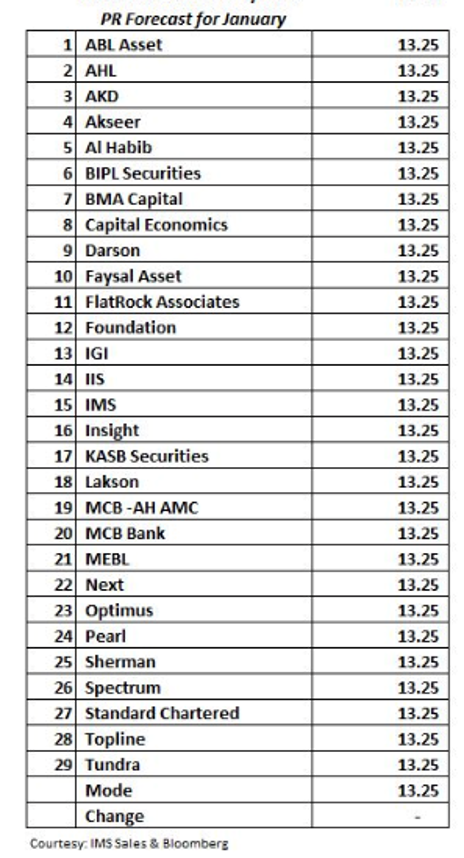

KARACHI: As the State Bank of Pakistan (SBP) is all set to announce its monetary policy tomorrow (Tuesday), almost all major brokerage and analysts have predicted that the policy rate will remain unchanged, at 13.25pc.

In fact, all 29 research houses surveyed on policy rate expectations predicted that the SBP would maintain the status quo on the policy rate.

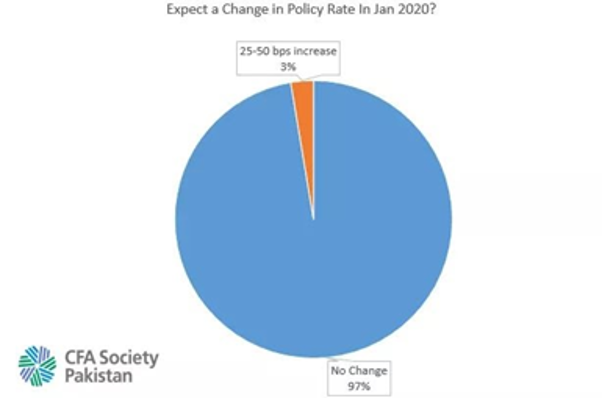

But some disagree, according to a recent survey by the CFA Society of Pakistan of CFA Charter holders (and not brokerage houses, as reported elsewhere). These are not house stances, but are instead individual stances, who may be associated with houses.

As many as 97pc of those surveyed believe no change will happen in the policy rate, while a small sliver (3pc) predicted that the rate will increase by 25 basis points, or even 50 basis points.

This would bring the interest rate up to 13.5pc, or 13.75pc.

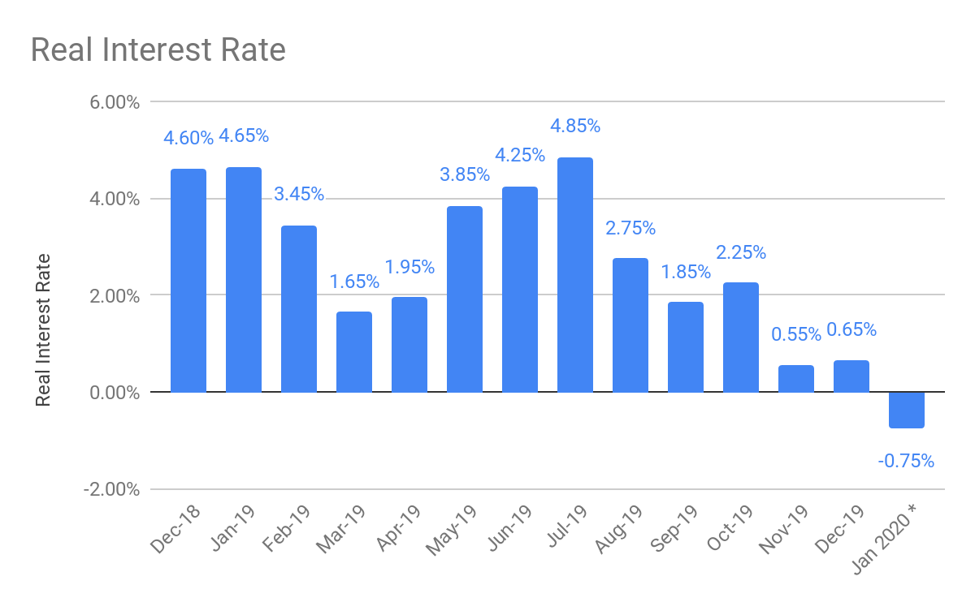

Why would a hike be on the cards? According to Adnaan Sheikh, AVP Research & Development at Pakistan Kuwait Investment Company, IMF clauses categorically state that the SBP must maintain positive interest rates.

“Inflation is expected to outweigh the policy rates for the month of January. The gas price hikes, along with supply shock inflation in food prices suggest that the upside risks outweigh the downside risks,” he said.

According to Profit analysis, this rising inflation means the real interest rate (or the interest rate minus inflation) is going into negative territory. Since tackling inflation head on has proved a challenge for the government, one immediate solution to keep the IMF happy is to hike the policy rate.

According to Sheikh, “The chances of a rate hike are higher than those of a rate cut as inflation is likely to persist for the coming months. Thereby giving the SBP the chance to take preemptive action.”

Even if a rate hike seems a little far-fetched, rising inflation still has affected the status quo predictions.

For instance, the list even includes BMA Capital, the outlier in the last monetary policy announcement, that had predicted 50 basis points cut to 12.75pc. This time around, they too, have toed the status quo line of 13.25pc.

According to Saad Hashmi, the Executive Director of research and business development at BMA Capital, BMA’s mainstream stance was because food inflation has been higher than expected. Though he disagrees with the idea of a rate hike, dismissing it as “going against the very directives of the central bank so far”, he added that “with inflation rising, it is difficult to expect central bank easing”.

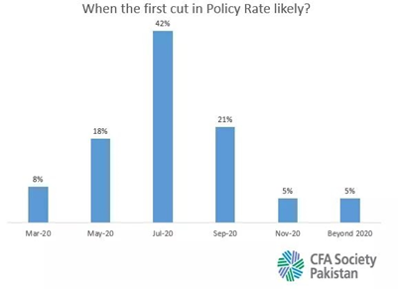

Even the date at which a predicted cut in the policy rate has also shifted. Many analysts at the start of 2020 predicted a rate cut any time between end-January to mid-March. But now, due to rising inflation in Pakistan, that predicted date has also shifted to July or September.

In a survey conducted by the CFA Society Pakistan, almost 42pc of people surveyed believe the rate cut will happen in July, and 21pc believe the cut will happen in September. Only 18pc believe the cut will happen in May, and a paltry 8pc believe the cut will happen in March.

The SBP had last changed the policy rate on July 16, 2019, to 13.25pc, a rise of 100 basis points. At the time, it cited increased potential inflation, owing to a rise in utility costs.

The central bank kept the policy rate unchanged in its review on September 16, 2019, and also in its review on November 2, 2019.

At the start of the year 2019, the policy rate was 10pc. Subsequent policy reviews – in January, March, May and July – increased the policy rate by a total of 325 basis points.

–With Additional Reporting By Ariba Shahid.