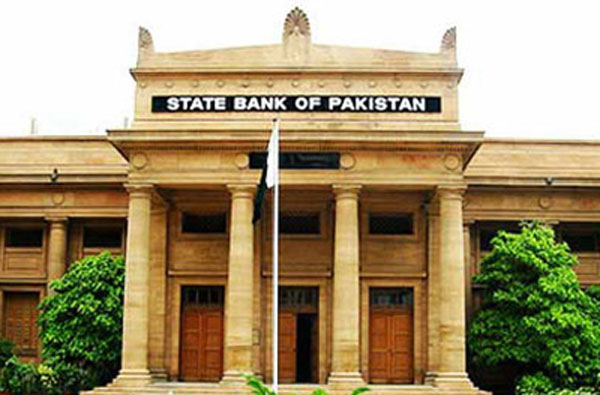

KARACHI: The State Bank of Pakistan (SBP) on Wednesday introduced new measures to reduce the need to visit bank branches or ATMs, and to promote digital payment services such as internet banking and mobile phone banking, in the light of the coronavirus outbreak.

According to a news statement, the central bank has decided to take these measures after consulting banks.

All banks must now waive all charges on fund transfers through online banking channels such as Inter Bank Fund Transfer (IBFT) and SBP’s Real Time Gross Settlement System for customers, the statement further says.

That way, people can transfer money through mobile phones or internet banking, and avoid the need to visit a bank branch or an ATM.

Customers will also not incur any cost for transferring large amounts of cash when using ATMs or visiting bank branches, thereby avoiding the use of cash.

Banks have been advised to facilitate their customers in using online banking, while taking all necessary precautions to ensure the safety and security of customer’s funds. Banks’ call centres and helplines are available 24/7 for instant customer support.

The financial industry has also been instructed to immediately facilitate education fee and loan repayments through internet banking or mobile devices.

Financial institutions will run awareness campaigns to educate customers to use internet banking or mobile phones, limit the use of currency notes, and restrict branch visits.

Anticipating any frauds in the wake of digital transactions, SBP has asked banks to be more vigilant about digital channels, and monitor cyber threats.

“COVID19 has challenged human life globally and all the countries are struggling to find out solutions; the key approach, so far, has been to take precautionary measures. SBP is working with stakeholders to continuously assessing the situation and will take every possible measure to improve the safety of public,” the statement said.

This is not the only action the central bank is taking regarding the COVID-19 outbreak as the State Bank, in its monetary policy announcement on Tuesday, had announced Rs5 billion Refinance Facility for Combating COVID-19.

“This is not the first step. We are ready to take action if more things happen. This is not the final scheme,” the release quoted State Bank’s Governor Reza Baqir as having said.

[…] SBP had earlier on March 18 waived all fees or charges on online bank transfers. It reiterated this, along with the need for bank branches to stay open, on March […]

[…] SBP had earlier on March 18 waived all fees or charges on online bank transfers. It reiterated this, along with the need for bank branches to stay open, on March […]