MCB Bank and United Bank (UBL) command a presence in Pakistan, or so they think. MCB is as old as the country, founded in 1947 by the Adamjee Group. Its majority stake is held by the Nishat Group, run by Mian Muhammad Mansha, possibly Pakistan’s richest man, who is also the chairman of both the group and the bank. Meanwhile, UBL was founded in 1959 by Agha Hassan Abedi (of BCCI fame), and is currently owned by Sir Anwar Pervez, the richest Pakistan-born Briton in the UK. Together, the two banks are part of the ‘big five’ banks of the country.

So it is good to know where banks like MCB and UBL stand when compared to other banks on the frontier market, including in countries like Ghana, Rwanda, Kenya, Vietnam and Sri Lanka.

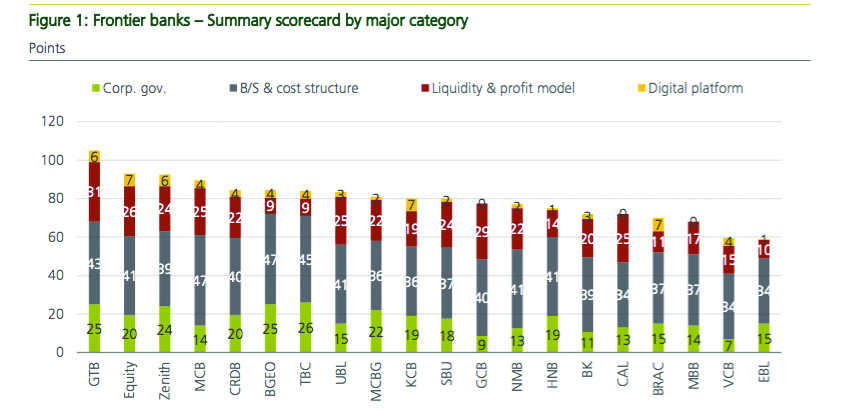

Analysts Kato Mukuro, Murad Ansari, Ronal Gadhia and Muammar Ismaily at EFG Hermes reviewed 20 banks able to withstand Covid shocks in different frontier markets, in a report issued to clients on June 1. The consensus? MCB ranked in the top quartile of all banks, and was the top pick for Pakistan, with analysts highlighting its strong deposit franchise and conservative lending style. UBL was not far behind, ranking eight out of the 20 banks reviewed.

The analysts were on the lookout for what they called ‘Bank Frankenstein’, or ‘an unbreakable monster, built with the best operating characteristics of the banks in our universe.’ The 20 banks were reviewed on the basis of four criteria: corporate governance (the brain and soul of a bank); balance sheet structure (the bank’s torso); liquidity and profit profile (the bank’s circulatory system); and digital platform (the real limbs of a bank).

Bizarre literary analogies aside, both banks from Pakistan did very well. Both were well positive when it came to balance sheet penetration, and cost structure. Both also came out on top of the list when it comes to liquidity.

In the specific category of corporate governance, both MCB and UBL scored highly on the level of disclosure (publishing reports and financial statements). There was some mismatch when it came to audit payments, with the authors of the report noting that MCB’s 2019 audit cost around 42% ($287,000) of UBL’s audit ($687,000), despite its 2019 balance sheet being 80% of UBL’s. (However, the report noted a lack of standardisation in payments, despite all 20 banks around the world being reviewed by the same big four auditors).

The report’s author’s scored banks highly if they limited government ownership, (so full points to both MCB and UBL). However, in the interest of whether the controlling shareholder was aligned with minority shareholders or not, the report noted: “In Pakistan, although the Chairmen of both MCB and UBL are controlling shareholders, they have also built extensive non-financial conglomerates that may take precedence over their banks.”

In this regard, UBL fared poorly. UBL has only one chairman, features a high board of directors’ ownership at 11%, and has limited executive representation on the board of directors (only one of nine members).

Not surprisingly, Pakistani banks scored poorly on diversity, with MCB placing second to last in percentage of female employees, and UBL not bothering to even provide that information. The report also noted unfavourably that Pakistani banks’ average CEO compensation was also quite high, at $673,000, more than double that of bank CEOs in Bangladesh ($249,000).

Both UBL and MCB scored very high on asset penetration, with net loans at 34% of total assets for both banks, and investment securities at 43% and 47% of total assets respectively.

MCB had a slightly more diversified loan mix, with 18% to SMEs, while UBL was mostly concentrated in corporate loans (84%): both banks scored poorly in this regard.

On the bright side, UBL and MCB scored high points for controlling cost-to-total asset ratios. Both banks were also able to keep the cost per branch to below $300,000 (two of three banks in the entire survey that could do so). Both banks’ cost per employee was also less than $25,000. MCB had a cost per customer of less than $40, while UBL’s was a little higher, at $54.

MCB was better at controlling the cost of the benefits paid to employees. In fact, UBL scored no points for its benefit expenses totalling more than 50% of personnel expenses.

“In our opinion, a bank with structurally high levels of payments in kind (benefits) is far less flexible in its ability to manage its headcount,” said the authors.

On the liquidity front, UBL scored better than MCB on its lower than net loans to deposits ratio. MCB also scored maximum points for being able to re-price 87% of its loans within three months (UBL could reprice 64%). Both banks scored maximum points for having a ratio of net interbank positions-to-total assets of between -2% and +2%.

MCB also had a high proportion of low-cost deposits with its CASA ratio – the proportion of its deposits that consists of current accounts and savings accounts – at 89%, while UBL’s was 74%. According to the report: “banks that have a higher mix of CASA and retail deposits will be best positioned to withstand the expected economic shock post these lockdowns, because these deposits are not only cheaper, but also stickier.”

Finally, the authors stressed on digital platforms. Both banks did poorly, with MCB falling somewhere in the middle, and UBL on the lower end. To be fair, they were not alone: most banks had done poorly in reporting their newfound digital capabilities with their stakeholders.

As the authors pointed out: “If a bank does not think it is important to share the number of mobile users, volumes/ value of mobile money transactions, POS terminal, ATMs and agents with its stakeholders in its annual report or corporate presentations, how is anybody supposed to trust in their ability to build an effective digital platform?”

Now one thing is important that in Pakistan Banks are investing in Public debt issued by GOP, which means they are not doing their business as laid down world over to balance with private sector for minimizing risk which may cause downgrade in rating from rating companies.

I don’t know how foreign investors consider MCB as better choice, but I do know there service is so deteriorated during last few years in all respect for public in general in Pakistan as compared to other banks in Pakistan

My MCB account is over 30 years now but the newer accounts with SCBL and HBL are much better, specially wrt customer services

I am just maintaining MCB account for my long association.

I have left MCB due to charges,where other banks do not charge.

The typical ‘Saith’ approach.

Many other banks work better than MCB.

If Gallop survey conducts on this matter,other renowned banks will lead.

In terms of customer service, I can say with absolute confidence that both MCB and UBL come at the very last place with MCB definitely taking the last place and UBL, Askari or BOP taking the second last spot.

MCB is better for foreign investors (who are only interested in stock performance) just because Mian Mansha runs that bank just like a Saith company and controls all costs as it goes out of his pockets. That’s why it has the highest RoE as the employees have the lowest salary in the industry, costs are reduced to minimal levels and profits are maximized. MCB would never give loans to SME or Agriculture sector that have potential to develop the whoole industry as it just focuses on risk free profits available on investments.

ku ky sub kala paisa yahi ata hai white hony dono hi chorron ky bank hn MCB or UBL ek Sindh ka chor dusra Punjab ka….

please tell me about jobs . i need job

plz guide me about job

Comments are closed.