KARACHI: During the annual post-budget press conference on Saturday, the Adviser to the Prime Minister on Finance, Dr Hafeez Shaikh avoided a question regarding the individual that lobbied for a tax exemption to LUMS University, considering the significant fee it charges from students.

The aversion to the question demonstrated by the government has added to the rumors.

Sources allege that the university has been exempted from any documentary requirements needed to maintain its Non-Profit Organization (NPO) status.

Sources further alleged that Razzak Dawood, being the ProChancellor of LUMS and an adviser to the Prime Minister (PM) Imran Khan has had some influence over the decision.

Considering LUMS’s NPO status, the university enjoys certain tax exemptions as per the Income Tax Ordinance, 2001. As per the ordinance, an NPO “shall be allowed a tax credit equal to one hundred percent of the tax payable, including minimum tax and final taxes payable under any of the provisions of this Ordinance”

However, this is subject to certain conditions that require thorough documentation periodically.

As per the Income Tax Ordinance, “income of a university or other educational institution being run by a non-profit organization existing solely for educational purposes and not for purposes of profit;” are eligible for the tax credit.

The decision, however, of granting NPO status lies with the commissioner Inland Revenue as per Section 2(36) of the Income Tax Ordinance, 2001.

This means that the decision lies strictly within the hands of the Federal Board of Revenue and is between the board and the NPO in question.

Sources alleged that Razzaq Dawood exercised his influence on FBR officials to get the LUMS NPO status approved.

However, it is pertinent to note that the ordinance does not grant an NPO a permanent tax exemption.

Instead, it is for a specific time as per clause 36(c) which states that the NPO status is “approved by the commissioner for a specified period, on an application made by such a person in the prescribed form and manner, accompanied by the prescribed documents and, on requisition, such as other documents as may be required by the commissioner.”

Hence, as long as LUMS remains an educational institution it is entitled to a tax exemption given it meets the periodical requirements mentioned in section 100c of the ordinance.

While questions have been raised about whether LUMS can be given an NPO status given the fee it charges, the application of clause 66(2) from the Income Tax Ordinance on LUMS will further add to the regulations in light of the exemption.

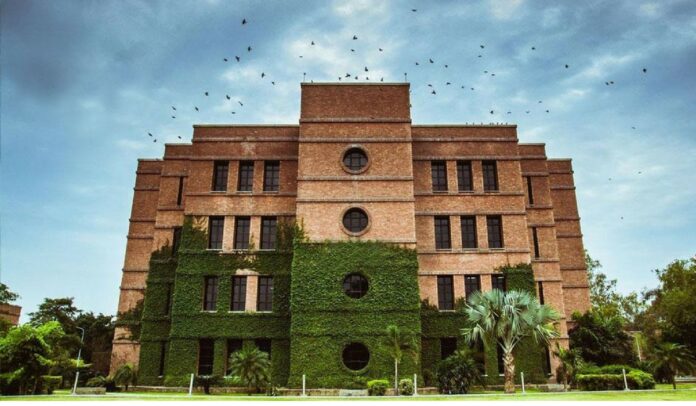

Earlier, the LUMS administration had also been criticised for increasing the tuition fee up to 41 percent over last year for certain students, with students and parents raising questions on the legitimacy of its NPO status.

I am puzzled by the point made in this article. Perhaps the author would like to clarify: Charging a fee for education and being a non-profit organization do not seem mutually exclusive, once you take into account the fact that providing an education is an expensive endeavor. Is there anything in LUMS expenditures, public disclosures or private financial data, that suggests impropriety that you are aware of? If not, making an argument that there is something fishy going on seems typical of the mudslinging we see elsewhere in Pakistani media.

This tax exemption has long been given to LUMS as a not-for-profit. The government may take it away but then LUMS will reduce its massive scholarship fund which is around 1 billion a year.