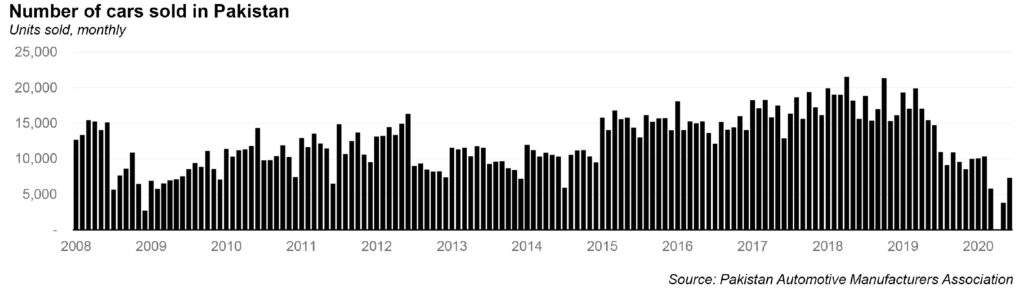

It seems like every month, this magazine devotes space to the ailments faced by the auto sector. And for good reason: as has been pointed out earlier, if there was any more proof that Pakistan is reliving a slump, it is that the total car sales in fiscal year 2020 are the lowest they have been since 2009. The low sales, along with the depletion of gross margins, means that earnings of auto assemblers are set to decline sharply in the fourth quarter of fiscal year 2020, according to Hammad Akram, analyst at Topline Securities, in a note issued to clients on July 22.

Akram looked at four auto assemblers – Indus Motors, Honda Atlas Cars, Pak Suzuki Motors, and Millat Tractors – as a metric to judge the auto industry by. Together, the total volumetric sales of the auto industry are down 70% year-on-year to 19,014 units in the fourth quarter of fiscal year 2020, compared to the 63,080 units recorded in the fourth quarter of 2019. This is also a 47% decline from the 36,028 units sold last quarter.

According to Akram, such a sharp decline is expected to reduce the gross margins of assemblers by between two to five percentage points. Gross margins refers to the net sales revenue minus the cost of goods. Since sales are decreasing, but the fixed costs are likely to stay the same, the fixed cost per unit is likely to substantially rise.

So, what happened? Well first, the most obvious culprit: the Covid-19 pandemic. The government imposed lockdowns throughout the country in March 2020, which continued until May 2020. Car assemblers were deeply affected, as Indus Motors and Honda Car did not operate for up to 60 days, while Pak Suzuki was only open for the last 15 days of the quarter.

The pandemic itself also impacted sales in the second half of the year. Turns out, the middle of a pandemic, and the fear of job security, is when people are least likely to buy a new car. No car sales were recorded by any of these companies in April 2020, and only 4,473 units in total were sold in May 2020.

Within this world, Indus Motors saw its unit sales decline the most, by 81% in this quarter, from 15,853 units in fiscal year 2019’s fourth quarter, to 3078 units in this quarter. Its gross margins declined from 7% to 9.3% in the fourth quarter as well. Consequently, Akram predicts Indus Motors to record an earnings per share of Rs7.6 this quarter, a decline of 78% from the previous quarter (Rs34.1) and a fall of 83% from 2019’s fourth quarter (Rs43.9).

However, there is a bright spot. First, Indus Motors finally started delivering its new sedan, the Yaris, which was launched in March 2020. There were high hopes for the Yaris: its average price is Rs2.7 million, which is significantly cheaper than the Corolla (at Rs3.7 million). So far, the model has recorded sales of 1,327 units in the fourth quarter – impressive, considering the general Covid-19 climate.

Indus Motors also maintained some short term investments of Rs31 billion in the fourth quarter, so ‘other income’ is expected to help out somewhat, accounting for Rs8.9 per share. Akram expects a cash payout of Rs2 per share this quarter, taking the total payout to Rs25 per share for fiscal year 2020.

Honda Cars saw its sales fall 72%, from 8,346 units in fiscal year 2019’s fourth quarter, to 2329 units in this quarter. Akram expects Honda’s earnings to break even in the first quarter of MY21. In the previous quarter, the company had recorded a loss of Rs0.2 per share, mostly due to very high finance costs, and a turnover tax rate of 105%.

“We expect sequential improvement due to normal effective tax rate and lower finance costs due to substitution of local currency loan with short term loan of USD14mn at a markup rate of 3.2% from Asian Honda Motor Co,” says Akram.

Pak Suzuki Motors sales fell 75%, from 30,433 units in the fourth quarter of fiscal year 2019, to 7512 units in the fourth quarter of fiscal year 2020. The gross margins are expected to come in at around 1% in the second quarter of calendar year 2020, and thus, the company expected to record a loss of Rs13.2 per share. Most of these losses can be attributed to the plant shutdowns, which severely impacted Pak Suzuki Motors. In addition, Akram noted that the company’s high finance costs would continue to affect profitability, as the company was highly leveraged, with a debt to assets ratio of 41%.

Finally, Millat Tractors was the least affected, and saw its sales fall by only 28%, from 8,468 units in the fourth quarter of fiscal year 2019, to 6,095 units in the fourth quarter of fiscal year 2020. In fact, on a quarterly basis, it actually saw its sales rise by 13%. The gross margins of the company also stayed stable at 18%, compared to 18.4% in the last quarter. That is why the company will record an earnings per share of Rs12.4, which though is a decline of 29% compared to the earnings per share in the fourth quarter of 2019 (Rs17.3), is still an improvement over the earnings per share of last quarter (Rs11.09). Akram expects a final cash payout of Rs20 per share, with the total payout of Rs40 per share in fiscal year 2020.

Millat Tractors numbers are indicative of the tractor industry in general, and will help in the recovery of the auto sector. During the lockdown, the government allowed agriculture activities to continue. This meant tractor industries were exempt from the shut down, and Millat Tractors resumed operations in mid April 2020. The government also allowed for a Rs2.5 billion tractor subsidy, which has helped farmers buy more tractors, and keep sales alive.

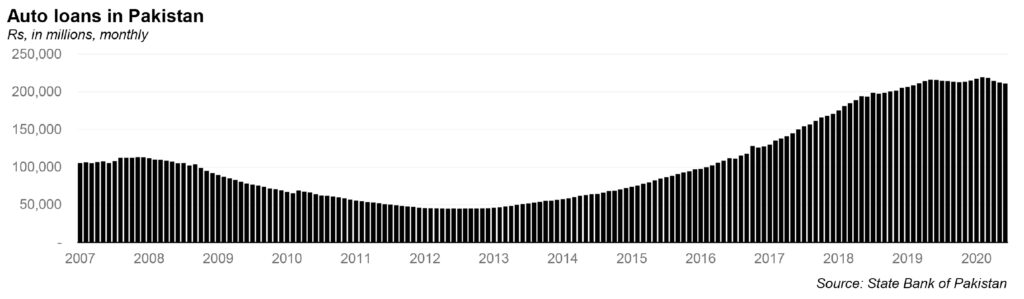

In addition, interest rates have been slashed from 13.25% in March to 7% in June. This will bode well for sales going forward. As noted previously, banks like Habib Bank and Bank Alfalah have started to offer discounted limited time promotions on auto loans. Granted, the loan space is still in its nascent stages: HBL’s scheme has attracted less than 1000 applicants. But the combination of low interest rates and favourable auto loans may mean that auto sales jump in the coming months.

Mr. Hammad Akram analyst Topline Securities in the note issued to clients, and shared by Profit Pakistan Today, valid/true.

Pakistan Auto Mobile sector supported/subsidized local transplants/assembled with local contents as General Tyre, Lubricants, Brake Fluids, seat polythene, foam rubber, carpet, hinges, paints, sheet metal plate from PASMIC, for body, doors, shell body, QC, gives the deletion/industrialisation chit for the FBR as product of Pakistan.

Pakistan auto buyer has no choice to study the life cycle of the car produced in Pakistan, Environmental emissions (for Climate Change) ACCIDENT AVOIDANCE with technology

available from OEM today worldwide.

TODAY is the era of Digitisation of Auto Industry, which is based on Digitisation of car that will sense from Sensors to avoid accident, at nominal cost.

Also important for auto industry is CEPEC which will not compromise on autos without safety parameters for life saving from accidents.l

The new mobility/transport is Digital, Accident avoidance by technology from OEM’s, and Pakistan may qualify for export of Autos to inernational markets besides domestic market with first thing to understand is Digitisation. The WCO may also not allow cars to import if they do are not compliant to Accident/Collission Free Digital and low priced.

Mobility/Transport as Buses of HinoPak should essentially comply to Road Safety Standards Digitisation. We should look to have the safety of transport as the lives of people of Japan. Safety of Human Live from Accident. Hino is selling EV buses in North America, Europe, why should we not ask Hino to build buses on international standards digitised.