Of all the inane things said in Pakistani drawing rooms about Pakistani politics and the general state of our political economy, the most absurd is this: “The solutions to Pakistan’s problem exist, if only we had the political will to implement them.”

It writes off all of politics as some sort of congenitally corrupt enterprise rather than the art of getting people with varying interests to agree on a path forward together. If you do not have a political solution to a political problem, you do not have the solution, no matter how elegant the slides. (Yes, McKinsey consultants, we are talking about you.)

As Pakistan enters what is probably best characterised as at least its 13th year of a severe power crisis (the problem existed before 2008, but it started getting really bad around that time), the technocratic aspects of the problem are becoming clearer, even if the political challenge of getting the right stakeholders to agree looks as though it is as far off as ever.

As discussed in Profit’s cover story of last week, power generation companies have contracts that were perhaps a little too generous on allowed profit margins, but the bulk of the problem – over 81% according to our calculations – is caused by theft and defaults on electricity bills. (Of the total excess in electricity bills, Rs1 per kilowatt-hour is caused by power generation problems, but Rs4.52 per kWh is caused by theft and defaults, based on our estimates using data from the National Electric Power Regulatory Authority (NEPRA data.)

The K-Electric formula

The technocratic part of the solution has been emerging for some time now: a privatisation of the 10 state-owned electricity distribution companies, somewhat along the lines of K-Electric in Karachi, which is the only electric utility – or really any kind of utility in the country – that is privately owned.

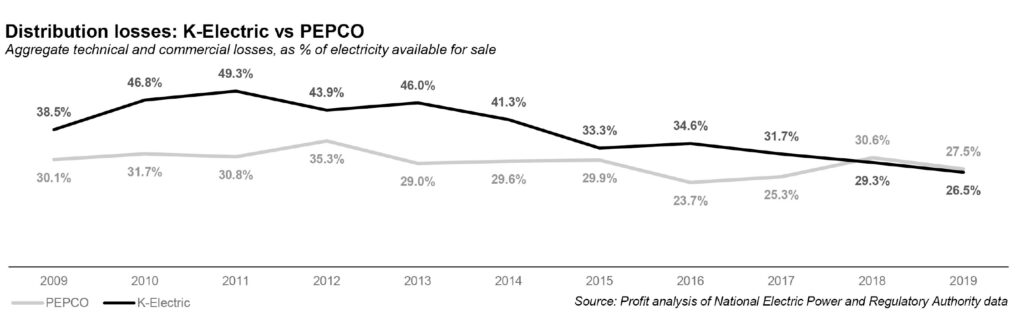

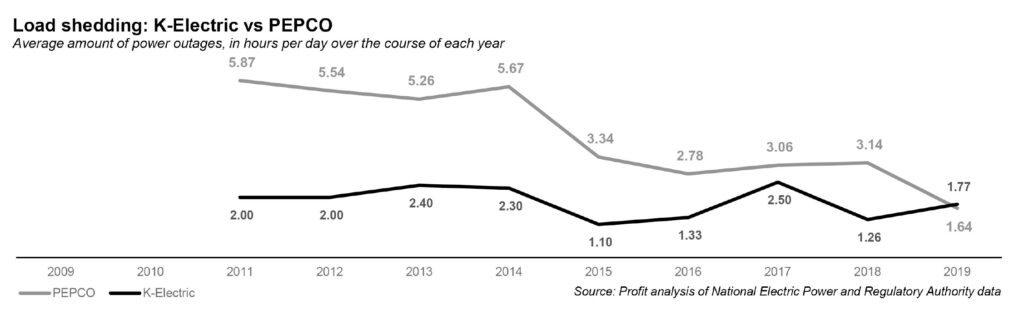

K-Electric’s infrastructure is far from where it needs to be, but aggregate technical and commercial (AT&C) losses – the industry’s favoured euphemism for the amount of revenue they lose to theft, bad infrastructure, as well as the portion of electricity loss that is inevitable due to the physics of electricity transmission – has gone down from a peak of 49.3% as of 2011 to 26.5% as of 2019, according to Profit’s analysis of NEPRA data. K-Electric started off much more inefficient than the state-owned companies in terms of cracking down on theft, but is now slightly more efficient that the state-owned utilities, which have an average AT&C loss ratio of 27.5% in 2019.

If the state-owned utility companies – particularly the five in Punjab, which are starting off from a much better operational efficiency basis than K-Electric was – can show the same kind of efficiency gains through a privatisation process, most of Pakistan would likely be served by electric utilities that can avoid load shedding power outages altogether.

jn But, of course, as with most policy questions, it is not simply a matter of putting together the technocratic solution. There is the small matter of getting all stakeholders on board, and as things stand in Pakistan right now, there is simply too much political opposition to outright privatisation of state-owned companies, and that opposition is especially strong when it comes to companies that directly provide services to consumers.

This is not strictly a matter of ideology: both left-wing and right-wing populists in Pakistan start screaming against the very idea of privatisation, almost regardless of the merits of the circumstances. And it is not just public opposition: even within the government, the federal civil service is almost unanimous in its opposition to any kind of privatisation.

The government’s plan: the PTCL approach

And despite all of the attempts by both the current Imran Khan administration led by the Pakistan Tehrik-e-Insaf (PTI), and the previous administration led by the Pakistan Muslim League Nawaz (PML-N), any solutions that keep both ownership and management control within the government have yet to make any kind of headway at all, despite the hiring of ‘professional’ CEOs and boards of directors that comprise independent energy experts. The weighted average of AT&C losses at the state-owned power distribution companies stood at 30.4% in fiscal year 2019, only slightly lower than the 32.8% AT&C losses in 2009, according to Profit’s analysis of NEPRA data.

So, what can the government do? Can it privatise the utilities completely, as was done in the case of K-Electric in 2005 under the Musharraf Administration? To successfully pull off a privatisation transaction, the government needs to ensure that it has the consent – however reluctant – of three entities: the public (as represented by politicians of various parties), the federal civil service, and the military.

To successfully privatise, the government does not need to appease all three. Only the military has an actual veto. The problem in the case of the state-owned electricity distribution companies is that, while the military is not opposed to such a transaction, both the public and the civil service are against it, making an outright privatisation impossible.

So what comes next? According to various media reports, the government is still contemplating some form of privatisation, and will be appointing the state-owned Pakistan Electric Power Company (PEPCO) as the ‘management agent’ for all of the state-owned distribution companies, and thus empowered to discuss the process of seeking ‘strategic alternatives’ for each of the 10 companies.

According to sources familiar with the matter, those strategic alternatives will most likely involve a transaction in which there will be a sale of a minority stake, with management control, to private-sector shareholders.

“Privatisation has become a dirty word in Pakistan, but public-private partnerships are still acceptable, especially within the ruling party,” said one source familiar with the government’s deliberations on the matter who declined to be identified because they were not authorised to speak publicly. “So the government might do something like selling 30-35% of its shares in each company, and hand over management control.”

“This arrangement is likely to allay some of the concerns against privatisation,” continued the source. “After all, the government made the investment in building these companies, but if it were to sell now, it would get too low a price for them [because of their losses]. So, it makes sense to have a private sector company come in and take management control which turns around the company, and then maybe sell the rest of the government’s shares after it has achieved profitability.”

That model – reportedly under active consideration by the government – would be similar to what the government did with the Pakistan Telecommunications Company Ltd (PTCL), in which the government sold a 26% stake in 2006 to Abu Dhabi-based Etisalat.

How the PTCL model worked

Until the early 1990s, short of military families – who had access to the military’s separate communications system – no Pakistani had access to any communications facilities that were not owned and operated by PTCL. And the younger ones among us may forget this now, but PTCL was an absolutely atrocious service provider.

As a government-owned monopoly, it had absolutely no incentive to care about its customers. Prices were high, service quality was poor, and – during the worse phase – getting a new telephone connection within one lifetime could sometimes require political connections to secure. The government publicly listed the company on the Karachi Stock Exchange in 1996, but retained complete management control.

That era can be described as the dark ages of telecommunications in Pakistan. Despite requiring a telephone line back then, PTCL did not bother introducing its own internet services until 1995, and realistically did not actively start marketing them until 2001. Most of the few Pakistani households that did have access to the internet relied on private sector internet service providers (ISPs).

Mobile telecommunications had entered Pakistan in 1992, but did not begin to take off until the late 1990s and early 2000s, which meant that most people remained dependent on a government-owned company for most of their telecommunications needs.

Then came the big move towards the government relinquishing control over the sector: in 2004, Pakistan got its third serious competitor in mobile telecoms (Telenor); in 2005, Warid started operations, and in 2006, PTCL was partially privatised with Etisalat gaining management control.

Since then, the intense private sector competition has meant that Pakistan has among the lowest costs of telecommunications – both telephony and mobile broadband internet data – in the world, expanding access to the point where, as of July 2020, 79% of the population has access to a cellular connection and 39% of the population has access to a broadband internet connection of some kind or another, according to data from the Pakistan Telecommunications Authority (PTA).

Could a similar model work for the electricity sector, where the government relinquishes its control and unleashes tremendous productivity? Maybe, the electricity and telecommunications sectors – while similar in some ways – have significant differences, both in terms of industry structures, as well as in terms of the level of opposition likely to be encountered by the government.

Why the civil service opposes privatisation

In this as in most other policy matters, the civil service’s collective stance can be determined with remarkable precision by examining their incentives.

The federal civil service does not extract direct monetary benefits from controlling almost the entirety of Pakistan’s electricity grid. Still, they do gain several other benefits, which they are likely to be reluctant to give up without the government pushing them to do so.

“It’s not direct cash, but there are a lot of indirect benefits,” one source familiar with the government’s energy policy told Profit. “They get access to cars, drivers, and domestic staff for their houses, they get the political power of being able to grant favours through giving people electricity connections, etc. They do not want to give that up, and those benefits drive a lot of decision-making within the civil service.”

That is difficult, but not an impossible hurdle to overcome, according to some experts who have studied the matter.

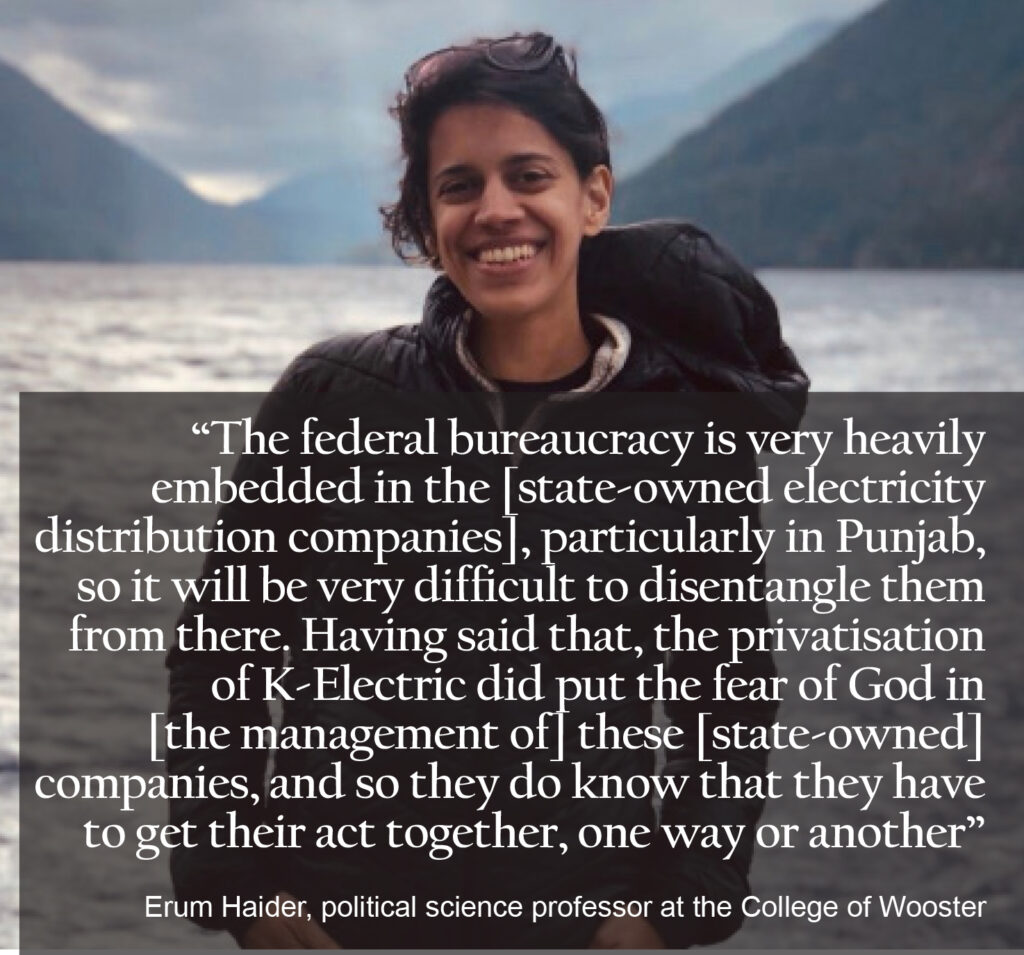

“The federal bureaucracy is very heavily embedded in the [state-owned electricity distribution companies], particularly in Punjab, so it will be very difficult to disentangle them from there,” said Erum Haider, a political science professor at the College of Wooster in the state of Ohio in the United States. “Having said that, the privatisation of K-Electric did put the fear of God in [the management of] these [state-owned] companies, and so they do know that they have to get their act together, one way or another.”

The privatisation of K-Electric was the focus of Haider’s doctoral dissertation at Washington DC-based Georgetown University, from where she received her PhD earlier this year.

That being said, if the current elected right-leaning populist government is able to garner political support for the idea of privatisation of electric utilities from the public – especially if the structure involves giving up management control – that could bode well for the country’s electricity sector. Nonetheless, the provision of electricity does have differences from that of telecommunications, and hence how the model works – and how it will be structured – will be crucially important.

How a privatised grid could work: electricity generation

One of the biggest benefits of privatising the grid would be that it would eliminate the government’s monopoly as the sole purchaser of electricity from power generation companies, which in turn would have the effect of lowering the cost of electricity production.

“Right now, because the government is the only buyer, the only way to get the private sector to invest in power generation is to offer them guarantees of buying electricity, which means that the government ends up paying tens of billions of rupees in capacity payments when it does not utilise that capacity,” said one source involved in the government’s energy policymaking process. “If there is no longer a monopoly buyer, the need to make capacity payments goes away almost immediately.”

That capacity payments issue is not nothing. According to the government’s own March 2020 “Report on the Power Sector”, compiled by the government’s Committee for Power Sector Audit, Circular Debt Resolution, & Future Roadmap, the state-owned Central Power Purchasing Agency (CPPA) is expected to spend an astonishing Rs900 billion on capacity payments to underutilised power plants in the fiscal year ending June 30, 2021.

Yes, almost a trillion rupees for power plants that are not being used.

All of that expense because the government made two critical mistakes: refused to give up its monopoly on electricity purchase from power companies, and then over-incentivised the power sector to increase power generation capacity from 23,825 megawatts of installed capacity in 2013 to 39,145 MW in 2019, an increase of 15,320 MW or 64% in just six years.

NEPRA estimates that about 30% of the country’s total installed capacity – about 11,884 MW, or about 78% of the new capacity added over the past six years – is not used even during peak hours, as of fiscal year 2019. That overcapacity is the direct result of the government making decisions by fiat rather than letting the market find the right balance.

“This is our problem with energy policy. We first face massive shortages for several years, then we go on a massive building spree and end up with overcapacity, then we overpay for several years, until we get to a shortage again, and the whole cycle repeats itself,” said the source involved in the government’s energy policy. “But if we had a private sector market, this would not even be an issue. The price and quantity signals in the market would take care of capacity on its own.”

But what would that grid look like? On the power generation and transmission side, the solution is obvious: several independent power generation companies – including newly privatised ones that are currently owned by the government – selling into a market that now includes 11 electric utility companies, rather than one single government purchaser (CPPA) and one private sector purchaser (K-Electric). No capacity payments, no long-term contracts: you only get to sell your electricity as a power generation company if you can offer the best price.

“That kind of competitive market is likely to find very few takers in Pakistan, given the fact that the industry has gotten used to these guaranteed returns,” suggests Haider.

That view – while likely true – may not capture the fact that some companies in Pakistan truly do have efficient power generation plants (such as Engro Powergen and Attock Power) and would gladly compete in a market where they can offer their plants as a baseload for any one – or even more than one – of the new buyers of electricity in the country.

In other words, the stronger players in Pakistan’s energy sector will welcome this transition while the less efficient ones will face a choice: either improve their operational efficiency, or else find themselves unable to sell electricity to anyone.

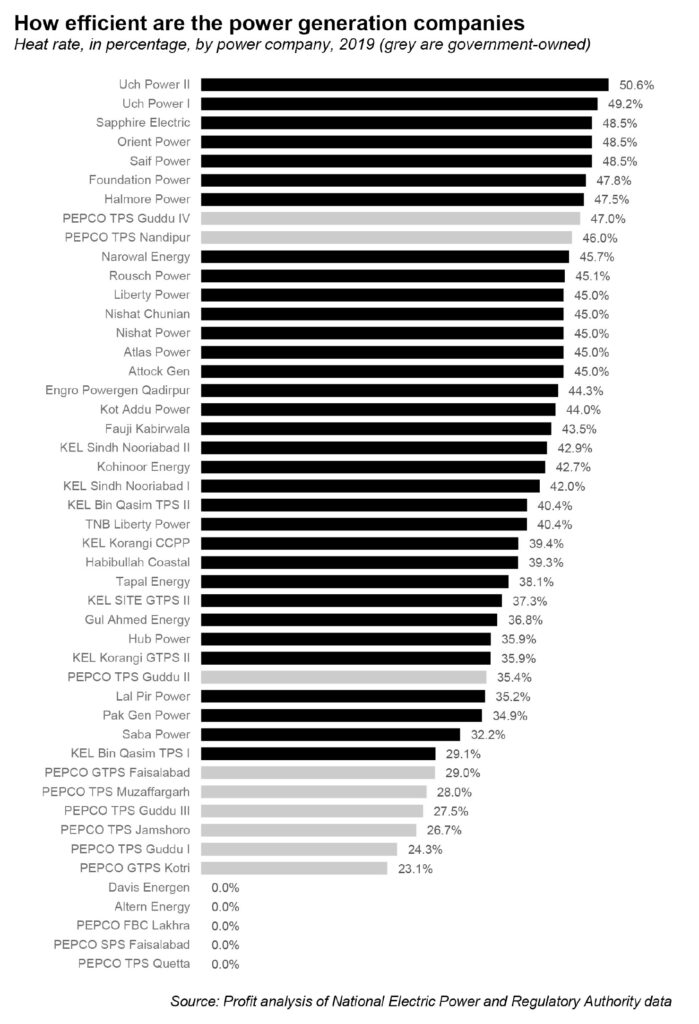

What constitutes efficient? The proportion of the heat generated from burning coal, oil, natural gas, or nuclear fission into electricity is called the heat rate of thermal power plants, and is generally accepted as the best measure of efficiency for such plants. (There are equivalent measures for both hydroelectric and renewable sources as well.) The laws of thermodynamics state that this efficiency can never be 100%, but getting as close to it as possible is the goal of energy efficiency.

For most hydrocarbon-fired thermal power plants, an efficiency rate above 38% is generally considered quite competitive. There are at least 19 independent power companies that claim to generate electricity above this threshold, according to data supplied to NEPRA, and would theoretically stand to gain from a conversion towards this system.

How a privatised grid could work: electricity distribution

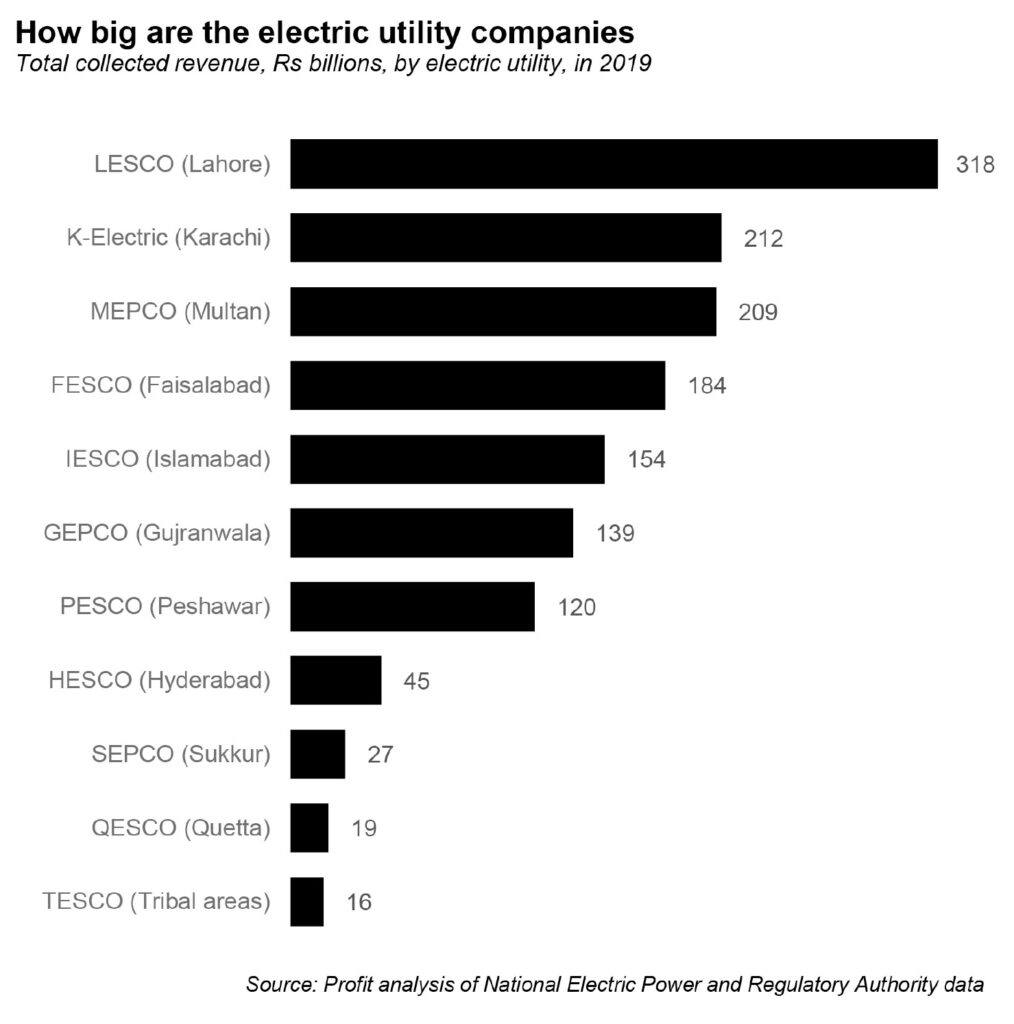

The harder problem is that of electricity distribution, where local monopolies will continue to exist. The Lahore Electric Supply Company (LESCO) and the Faisalabad Electric Supply Company (FESCO) may have to compete with each other for the cheapest electricity from power plants, but within Lahore, an ordinary consumer will still only be able to get electricity from LESCO, and in Faisalabad, their choice will only be FESCO.

Monopolies, natural or otherwise, have a tendency to offer less than stellar quality of service. And while many cities around the world – including Mumbai in India – have multiple utility companies, it is difficult to have more than one utility offering service to the same neighbourhood. Building more than one set of wires going to each home is just not practical.

One way this could be overcome: by modifying the business model of the distribution companies to be much more accommodating of distributed power generation, which is becoming increasingly more possible with the advent of rooftop solar power generation systems being marketed to urban middle class consumers, who tend to be the highest consumers of electricity and the best payers, among domestic users.

Solar power generation is becoming popular enough that it is being advertised on prime time television. And some banks are finally starting to finance these systems to help defray the high upfront cost.

The utility companies need to begin to see themselves as buyers of solar electricity from households during the day and sellers of thermal electricity to them at night, with surplus daytime solar being sold through the utility as an intermediary to industrial and commercial users. Ideally, the utilities could also build water-based electricity storage capacity for solar energy as well.

The biggest check on abuses of electricity distribution companies, however, may well come from who ends up buying these companies: if a Faisalabad-based conglomerate buys out FESCO, and a Lahore-based one buys LESCO, one imagines that their owners living in Faisalabad and Lahore respectively might prompt them to ensure high quality service to their customers, or else have the entirety of their social circle only ever talk to them about the problems they are facing with their electricity connections.

In short, the solution may come down to localising the problem: having people’s electricity needs being managed as close to their homes as possible rather than being managed by literally and figuratively distant bureaucrats in Islamabad, may be the solution that the country needs.

But the ultimate solution may simply be introducing the profit motive to the current regulatory structure. Yes, the electricity distribution companies are monopolies, but they are regulated monopolies, and the regulator actively tracks service quality, and even creates incentives for cracking down on theft, by not allowing them to pass on the full cost of the theft and line losses to paying consumers.

The reason why the current regulatory structure does no good is because the distribution companies remain state-owned: if they fail to meet financial targets, no civil servant will ever get fired, and if they meet all of their revenue targets, no civil servant will ever get a bonus. There is simply no incentive for them to change the status quo.

That, by the way, is why K-Electric has cut down on line losses and the state-owned companies have not, even though they both operate under the same regulatory system: K-Electric managers have financial incentives that have been aligned with reducing theft and improving quality, but the employees of the companies owned by the government do not.

To summarise: the current legal system would work to keep the monopoly power of these companies in check, so long as the employees who actually work at these companies face consequences for their actions. The government is great at making private companies do things it wants, but a lot less good at getting its own employees to act the way it needs them to.

Make LESCO’s employees private rather than civil servants, and you will stop having load shedding in Lahore.