Just last month, Bank AL Habib decided to purchase a new high-rise building, Centrepoint, in Karachi. The swanky 28-story building (complete with rooftop swimming pool and coffee bar) located on Shaheed Millat Expressway, is a bit of a change for the bank. Its current head office is a significantly older and smaller building located on I.I. Chundrigar Road, in the shadow of other, much larger banks.

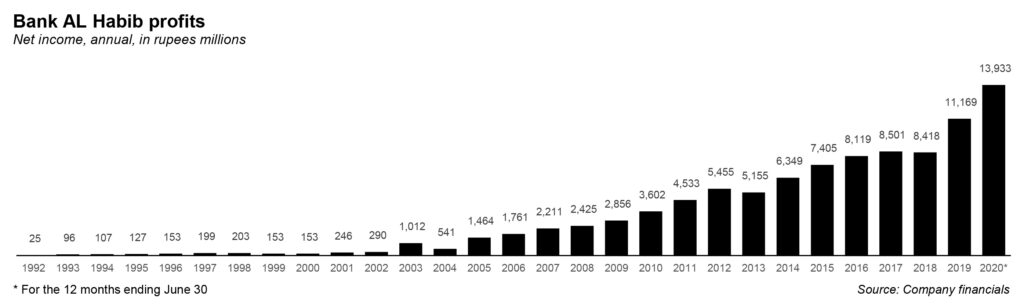

Are we searching for symbolism here? Yes, yes we are. That is because Bank AL Habib ambitions are matched by some solid performances in 2020. In fact, Fawad Basir, research analyst at Topline Securities, a securities brokerage firm, in a note issued to clients on September 8, went so far as to revise the earnings estimate for the bank by between 4% to 14% between 2020 and 2022.

In the second quarter of 2020, the bank showed ‘strong core performance’, with a 40% increase in the net interest income, compared to the first quarter. This was mostly driven by a 19% decline in interest expense on a quarterly basis. Additionally, Bank AL Habib’s interest earned increased by 2% on a quarterly basis, which is all the more impressive given that the sector’s interest earned as a whole witnessed a decline of 4% quarter-on-quarter.

Basir based his earnings revision on two major reasons.

First, the bank witnessed higher-than-expected deposit growth due to an expanding branch network. Since 2018, the bank has added 90 branches, with 56 of them coming in the first half of 2020 alone. According to Basir, this rapid growth is all the more impressive given that Pakistan has imposed a (varying) lockdown for four months starting in March 2020. Clearly, Bank AL Habib took the State Bank of Pakistan’s mandate to ‘stay functioning’ very seriously, and expanded accordingly.

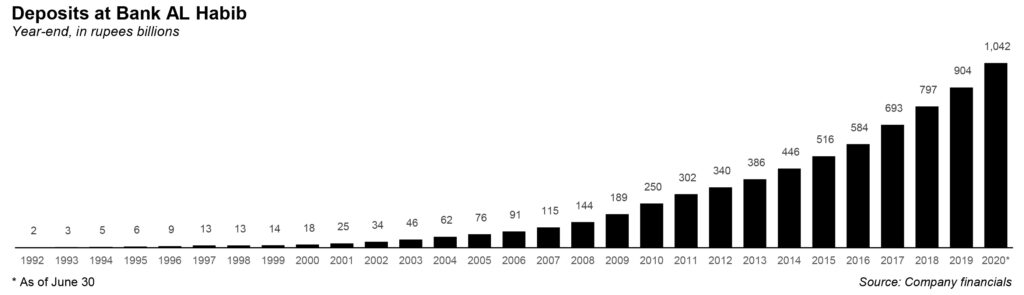

The result of this unexpected growth is that deposits have grown at 15% year to date, and 20% year-on-year. This is much better than the sector growth average of 11% year to date, and 12% year-on-year, respectively.

Much of this growth was led by growth in current accounts, which grew by 17.1% year-to-date, compared to the sector’s growth rate of 12%. Similarly, current account deposits account for 36% of all deposits – again, higher than the 32% ratio of the sector currently.

That being said, fixed accounts have remained stagnant on a quarterly basis, which has led to reduction in the deposit mix from 37% in the first quarter of 2020, to 35% in the second quarter.

“The focus on improving deposit mix is expected to bode well for the bank going forward, with a declining ratio of interest bearing deposits to ~61% versus sector’s 65%,” says Basir.

In fact, the deposit growth rate over the last five years has averaged at 15.2%. This year, Basir expects the growth rate in deposits to stand at 19%, based on the bank’s outstanding performance.

The second major reason for the bank’s success is the ‘timely’ building up of the bank’s investment book. The investment portfolio can theoretically include a wide variety of investments, including corporate bonds, equity investments (both public and private), but in practice is almost invariably dominated by government bonds. That may seem like a boring investment, but in Pakistan’s financial system, government bonds can be a lucrative business.

“The investment book of the bank has made some major inroads, with the [investments-to-deposits ratio] IDR improving to 76% in the second quarter of 2020, from 52% last year for the same period,” says Basir.

Government securities now constitute 97% of overall investments by the bank. According to Basir, the move towards the building up a Pakistan Investment Bond (PIBs), has been timely.

In fact, the revaluation surplus, which stood at a deficit of Rs2.5 billion in June 2019, is now standing at a surplus of Rs13.3 billion.

Basir also found it pertinent to mention that the bank has not recorded any capital gains to date, or the profit from the sale of an asset like bonds or stocks. “With the repricing on the asset side due, certain portion of the revaluation surplus may be recorded in order to provide buffer to the bottom line,” says Basir.

Bank AL Habib also does well on two other metrics. For instance, the average infection ratio of the bank for the last three years has hovered around 1.4%, which is much lower than the industry average. Meanwhile, the coverage of the bank stands at 143%, which is the highest in the industry.

And with bank branches popping up left and right this year, you would think that costs would increase. Yet, somehow, Bank AL Habib managed to keep operating expenses relatively ok. Despite the aggressive expansion, the cost to income ratio for the bank is expected to clock in at the 56% mark in 2020. The second quarter saw the cost to income ratio drop to 49%, due to the increase in revenue from the first quarter.

Did anything bother Bank AL Habib at all? Yes: the Covid-19 pandemic led to slight slowdown in economic activity, and some bank branches closed in the lockdown. The State Bank announced a relief measure to waive all transaction charges. This led to a 15% decline in the fee income, on a quarterly basis.

But, really, that is about it. Bank AL Habib should be feeling pretty good about themselves, especially, with the new view they now have.

Bank alhabib services are not good specialy online banking services

Assalamualaikum

Sir i will need

Alhamdulliah.By the grace of Almighty Allah. And Management’s work hard ripe fruit. We believe on further growth.

Alhumdulillah

Bank al Habib services are not good

I am client of bank Al Habib.

I never face any problem with

Services.keep growing bank Al Habib

Allah bless your entire team.

Pakistani banks are also getting deposits from freelancing, affilation, and Adsense dollars. Pakistani are doing great fetching dollars sitting at home even in panedemic. Bank Al Habib good work.