At first glance, it seemed like Bawany Air Products was not going to be acquired after all. Initially, Fossil Energy, a private company, had decided to acquire more than 50% of voting shares of Bawany Air Products, all the way back in December 2019 (a ‘Public Announcement on Intention;). The Securities and Exchange Commision of Pakistan (SECP) had granted an extension in the time to make a Public Announcement of Offer’ in June 2020 .

But in a notice issued to the Pakistan Stock Exchange (PSX) on September 14, Bawany said that they had received a ‘Withdrawal of Public Announcement of Intention’ from Fossil Energy. What happened? It turns out that there was an expiry date of September 12 that ended up being crossed. Apparently Fossil Energy “has not yet been able to make a decision regarding the making a Public Announcement of Offer on the basis that the due diligence from the acquirer’s end is still ongoing”.

Still, Fossil Energy was interested in Bawany, expiry dates and all. So it withdrew the intention, only to issue a fresh intention on September 22, for again, 50% of voting shares in Bawany Air Products.

Exactly who are these companies, and why should you care? Good question. Let’s start with Bawany Air Products. The company is just one of many companies started by the Bawany Group. That group was founded by Ahmed Ibrahim Bawany, who was from Rangoon in what is now Myanmar. He set up the Bawany Violin Textile Mills in Karachi soon after Pakistan’s independence. His son, Yahya Ahmed Bawany (who was born in 1925 in Rangoon) helped set up most of the group’s companies between 1953 and 1978. These included a spate of jute mills, textile mills, tea and coconut estates, brick fields, sugar mills, electricity components, and leather.

The last company he helped set up was Bawany Air Products, which was incorporated in in 1978. The company produces and trades oxygen gas, dissolved acetylene and nitrogen gas. Its manufacturing plant is located at Hub Industrial Estate, in Balochistan, and has an annual installed capacity of 4,629,000 cubic meters. The company has four main clients: the ‘industrial sector’ (including cable manufacturers, paper mills, some multinationals); the ship breaking industry at Gadani, Balochistan; steel re-rolling mills; and hospitals.

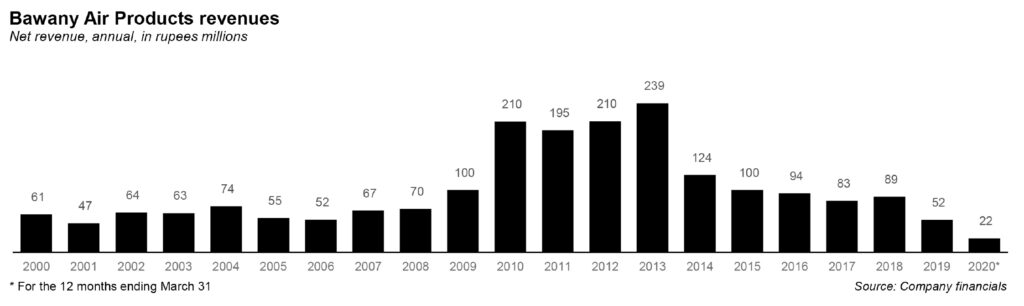

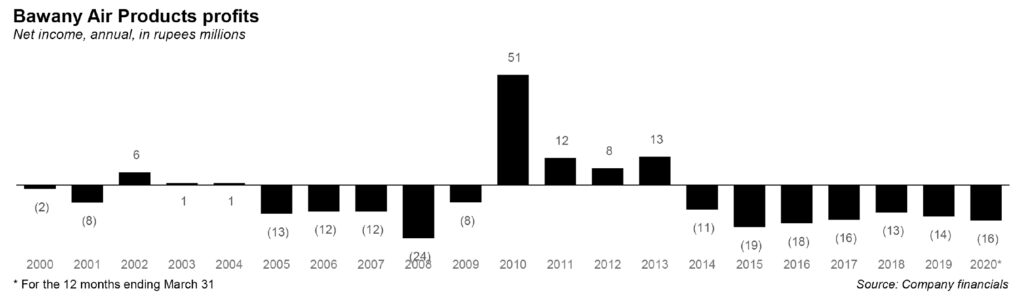

Now, on a whole, Bawany Air Products has done pretty poorly. Between 2000 and 2019, the company made a profit in only seven of those years (2002-04, and 2010-2013). For the last six years straight, it has made a loss after tax, with the most recent loss in 2019 at Rs14.5 million (which was not as bad as 2019, when it made a loss of Rs19.3 million). It is currently sitting on the PSX’s defaulters list.

In the 2019 annual report, the directors blame the devaluation of the rupee, which affected the ship breaking industry. “Uncertainty in the business community over the economic condition of the country… ship breakers are reluctant to invest in ships,” said Bawany.

Ship breaking in Pakistan is set to decline, as consumers move towards better quality and graded products. Pakistan used to have one of the largest ship-breaking industries in the world. That changed after 1973, when Pakistan Steel Mills started producing much higher quality steel and the country’s industries no longer needed to rely on the low-quality re-rolled steel from ships that were so old that they had to be discarded for scrap. In other words, the ship-breaking industry dying was a good thing for the Pakistani economy.

If Bawany Air Products is so heavily reliant on selling its product to a dying industry, that certainly does not bode well for the company’s future. It is also certainly not surprising that it has ended up on the defaulters’ list.

Bawany Air Products declined to comment on the acquisition, citing the fact that the due diligence was still ongoing. However, Profit spoke to Danyal Rizvi, an investment banking associate at Intermarket Securities, which is the investment bank and securities brokerage house that is the manager to the offer.

Fossil Energy is an oil marketing and storage company incorporated in 2013. Bawany Air Products would not be the first public limited company that it has a share in: Fossil already has an 83% share in Clover Pakistan, which is a publicly listed company that trades in food items, gantry equipment, car care products and lubricants.

According to Rizvi, the direction this potential acquisition could take is still up in the air, and depends very much on the due diligence. For instance, Fossil Energy could decide to merge Bawany Air Products into its fold, or alternatively do a reverse merger, in which a private company becomes a public company by acquiring it. That would depend entirely on the contents of the Public Announcement of Offer, which is still to be issued.

Why would Fossil Energy consider a reverse merger? Rizvi spoke on a general basis (though one can extrapolate), that it is often expensive and cumbersome for a private company to conduct an IPO to be listed. However, if a private company acquires a public company as an investment, it can convert itself into a public company.

In general, there are several companies listed on the PSX that are in effect ‘shell companies’ because they are on the defaulters list, and are not really operating [And if one recalls, Bawany Air Products is on the defaulters list]. Acquiring a non-operational listed company is often easier and less time consuming.

Still, Fossil Energy already has a holding in a listed company; perhaps instead, it sees an opportunity in acquiring the business operations of Bawany Air Products, expanding its range of business lines outside of Clover Pakistan.