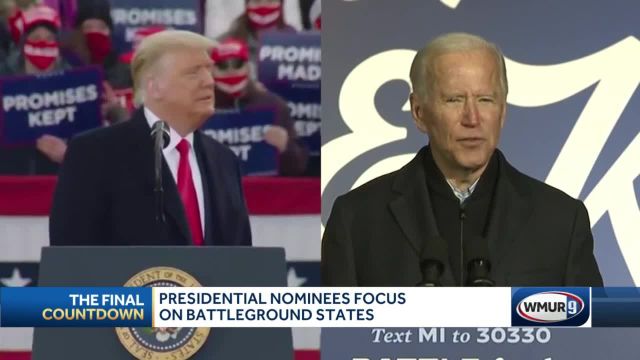

WASHINGTON: While the Republican incumbent has handed the financial industry huge tax breaks and deregulatory wins, his first term has also been marked by volatility and unpredictability, particularly in international trade.

Wall Street has been leaning left this election, with Democratic challenger Joe Biden outstripping Trump in financial industry fundraising.

While many executives said they did not support all Biden’s policies, they believed he would be more predictable and better for the country.

“There was a lot of trepidation for this election. There were people expecting violence. The White house was fenced up,” said David Bailin, chief investment officer of Citi’s private banking arm.

“Guess what? We now have something to worry about. Had there been a clear election outcome there would have been one day of activity. A prolonged struggle given the sort of tensions could be something uglier,” he said.

Global investors on Wednesday began reversing some Biden trades that had prompted a jump in Wall Street’s main indexes on Tuesday.

Share markets including U.S. equity futures gyrated wildly, as voting projections on some key states appeared to favor Trump.

European banks who had staffed trading floors overnight reported a long night of talking to nervous clients. Jim McCormick, global head of desk strategy at British investment bank NatWest Markets, said it would be “all hands on deck” with the outcome still so uncertain.

Analysts said it could be days before all votes in battleground states were counted, leaving investors and fund managers expecting a long wait before the result was assured.

For many, it was a far cry from Nov. 9, 2016, when, with no pandemic raging, New York city and other financial centres played host to countless informal watch parties in bars, and Trump’s victory was called at around 2.30 a.m.

This year, Mike Novogratz, chief executive of New York-based Galaxy Digital and a major Democratic donor and fundraiser tweeted about being at home with a bottle of wine, watching the results on television with his family.

In anticipation of possible protests, some buildings and stores were boarded up in cities such as Washington and New York.

While there were few signs of disruptions or violence at polling sites on Tuesday, some finance executives said it was too soon to rule out civil unrest.

“There are no problems right now but that’s only because there’s no answer right now,” said Billy Weber, CEO of Checkpoint Capital, a fixed-income platform.

‘PERFECT STORM’

The S&P 500 Index has risen 48.8% during Trump’s tenure, which he has frequently cited as a measure of success. But Trump has not been uniformly loved by the financial industry.

He has attacked corporate leaders, including JPMorgan Chase & Co CEO Jamie Dimon, and Wall Street chiefs have distanced themselves from Trump as he came under fire over his handling of the pandemic and racial justice protests.

But the U.S. financial industry is also worried about higher corporate taxes, a fresh enforcement crackdown and an emboldened consumer watchdog under Biden.

The former vice president has cast himself as someone who will unify the country and has aligned himself with progressives fiercely critical of Wall Street.

Regardless of the winner, a decisive outcome is key for the global financial community.

“If we get Biden victory and a split in terms of the Senate remaining with the Republicans and the Democrats in Congress, I think markets would take that probably worse,” said Devan Kaloo, global head of equities at Aberdeen Standard Investments.

Still, some young Republican finance executives said they were anticipating gathering to celebrate a Trump victory.

Charles Kolean, a 25-year-old investment industry worker who spent months raising cash to re-elect Trump, said he had reserved a chunk of a Dallas bar where he and some 100 friends planned to toast another four years for the president, albeit wearing masks.

“The perfect storm is coming together to make Donald Trump a two-term president.”