What is going on with PIA-B? (B? We know the national carrier has seen better days, but B actually refers to a different class of shares, available to the public). On February 4, the Pakistan Stock Exchange (PSX) sent a letter to Pakistan International Airlines (PIA) inquiring about why there had been a sudden surge in the price of PIA ‘B’ class shares.

This story is interesting because one, it seeks to a larger story of unexpected surges in the last two months in various stocks on the stock exchange; and two, it is an interesting reveal into PIA’s structure.

So, on February 12, the company wrote back. First, PIA explained that according to its annual report of 2019, PIA has issued a total of 1.499 million ‘B’ class shares. Of those, 1.462 million shares are held by the federal government, and another 37,000 are floated in the market.

This, by the way, is separate from the ‘A’ class shares, which number 5,233 million. Of those, the federal government holds 4,791 million shares, while 173 million are held by individuals. All in all, the federal government holds a whopping 91.56% of PIA. Individuals hold just 3.3% of PIA. the ‘A’ class shares are issued at Rs10 each; the ‘B’ class shares are issued at Rs5 each.

The letter then explained that a substantial increase in price of PIA-B shares was observed in December 2020 and January 2021. Apparently, a transaction of 500 shares was carried out on December 10, at the rate of Rs19.79 per share. Then, just eight days later on December 18, another transaction of 500 shares was carried out, this time at a price of Rs27.24 per share. Thus, an increase of 37.64% was observed between the two transactions.

According to PIA, no transaction was recorded in the said shares during the month of December 2020 and January 2021, yet the closing price showed a consistent upward trend up until January 19, 2021. “Despite the consistent upward price trend, no major volumes were traded nor any transaction took place during the aforementioned period,” explained PIA.

Instead, PIA put the onus on the PSX for figuring out what the problem was. “As mentioned before, the number of free float PIA-B shares held by the general public is such that no manipulation could effectively be managed thereof. It is for the pSX to determine why such an activity of price movement is taking place despite the fact that no actual transaction is materializing. We will appreciate it if the factual position in this regard is shared with us.”

PIA is right: the number of shares held by the general are indeed far too small for manipulation to occur. But perhaps what is more interesting, is the spate of letters from the PSX demanding so and so company to explain why their stock is surging. This has been particularly acute for the months of December and January. Most of these rising stock prices and volumes which can be observed in many stocks,cannot be attributed to any reason. This magazine actually dedicates a whoe story in this issue, trying to parse the reasons behind the rally in the TRG stock. Similarly, on February 15, the telecommunications company WorldCall told the SECP that they were not aware of any material information which may result in unusual movement in the volume of World Call Telecom in the last few days.

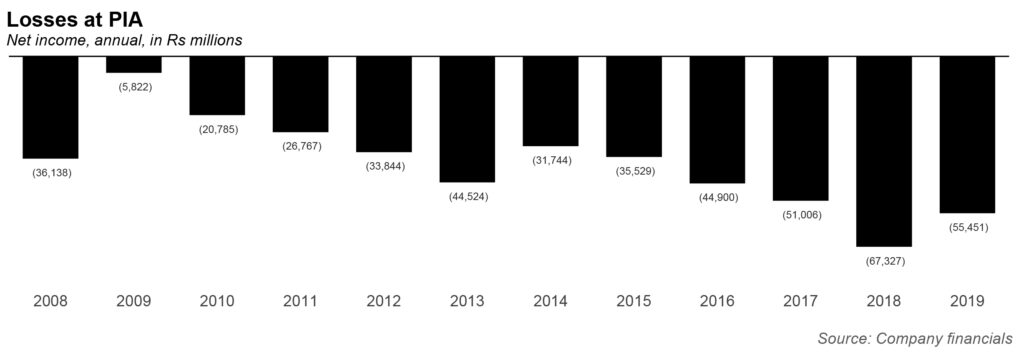

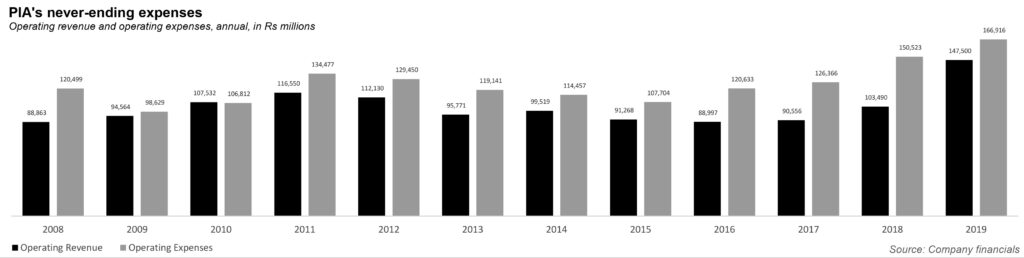

Is there something unique to PIA that has motivated this rally? Let us see. Historically speaking, between 2014 and 2019, the company’s operating revenue has gone from Rs99,519 million to Rs147,500 million. The revenue fell in the years between 2015 and 2017 to around the Rs90 million mark, before having an exceptionally good year in 2019. Still the expenses also climbed during that same period, from Rs114,457 million in 2014 to Rs166,91 million in 2019. And that is why the company’s losses have also deepened, from Rs 31,744 million in 2014, to Rs67,327 million in 2018, and finally to Rs55,451 million in 2019.

Did things improve in 2020? Not quite. According to the company’s half yearly report for the six month period ending June 2020, the company’s revenue stood at Rs51,471 million, compared to Rs65,924 million for the same six month period during 2019. Additionally, the company’s loss before taxation stood at Rs36,896 million, around the same as 2019’s Rs37,563 million.

Then, according to the company’s latest financials for the period ending September 2020, revenue had only climbed to Rs74,362 million, compared to 2019’s Rs107,339 million.

What happened? According to PIA, the outbreak of Covid-19 pandemic in 2020 resulted in a crushing blow to the airline industry. The company’s core passenger and cargo revenue fell by 44% because of reduced passenger capacity. The charter revenue of the company increased by 98.7 % due to special cargo planes. On the bright side, because of reduced capacity, fuel costs fell by 52.9%, mostly due to the lack of flights. Similarly, direct expenses by 34.1%.

It is really saying something that the worst year in aviation history simply looks like a normal year when it comes to PIA’s financials. There is nothing to see in PIA’s financials which would warrant a surge in share price.