In 1844, English inventor John Fisher created a prototype of what would be the first sewing machine in the world. Fisher, however, incorrectly filed his application at the patent office, and six years later, Isaac Merritt Singer improved on the design and created what is now considered the first modern sewing machine in the world.

Singer was able to turn his invention into a lucrative business that quickly expanded all over the world. The invention and mass production of sewing machines meant that great changes were on the cards for the domestic lives of women. As more households began to own sewing machines, women, the ones who traditionally stayed home to do chores including making and repairing clothing, found themselves with more free time, making the sewing machine one of the most significant inventions of the 19th century.

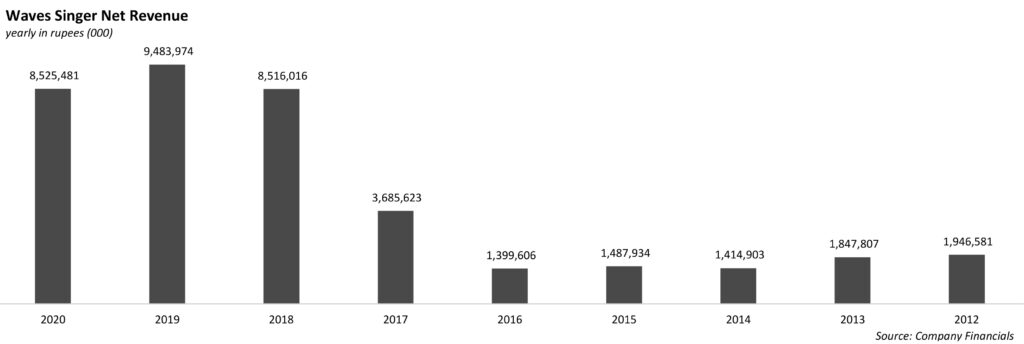

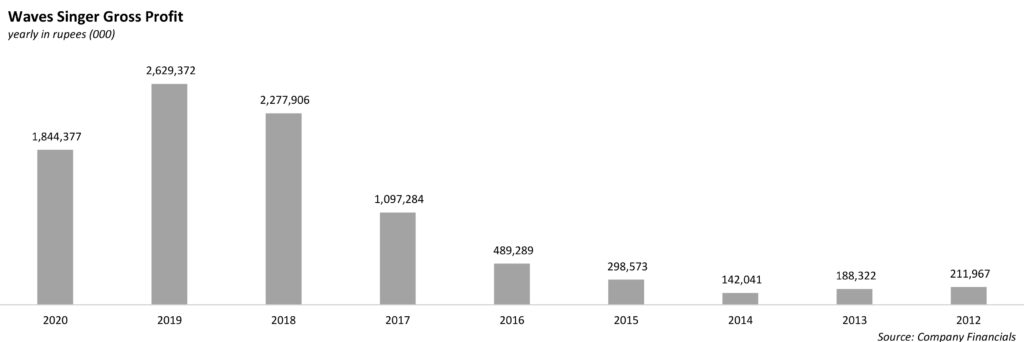

Fast forward to 2019, and Singer in Pakistan (now known as Waves Singer ever since its 2015 merger with Waves) was facing one of its worst years yet. The year 2019 was generally a tough one for the domestic appliance industry. A series of events that started with high policy rates, followed by the rapid devaluation of the rupee meant that finance and import costs skyrocketed. At the same time, the purchasing power of consumers was down in the dumps. So for Waves Singer, 2020 was a beacon of hope in which they planned to pull up their socks and correct their course from the less than ideal 2019 that they had.

Of course, with 2020 came the global coronavirus pandemic, and the entire country went into lockdown in March. While nearly all segments of the economy were badly hit, spending on consumer appliances came down to next to nothing, and companies like Waves Singer were left scrambling by the twin blows of the 2019 financial crunch and the 2020 global pandemic.

This was the result of extenuating circumstances and not direct negligence on the part of the companies. In fact, since the downwards patch of 2019-2020, Waves Singer is actually one of the companies that has done reasonably well, starting 2021 strong after securing corporate orders from the Coca Cola Corporation, doubling their revenue compared to last year.

The turnaround will be a relief for the company, which while it has been listed on the Karachi Stock Exchange (now PSX) since 1985, has been around in the subcontinent since the last quarter of the 19th century. While Singer originally emerged in the United States in the mid 1800s, their easy to use machines became extremely popular, and they were operational in British India by 1877. Following the partition of the subcontinent in 1947, Singer split between India and Pakistan and based itself in Lahore.

The company continued to produce its flagship sewing machines, other domestic consumer appliances, and assembling light engineering products. In 2015, the sponsors of Singer acquired Waves. The company operates under two brand names. The waves brand manufactures and sells deep freezers, refrigerators, air conditioners, washing machines, microwaves, and water dispensers. Singer brand makes refrigerators, air conditioners, washing machines, microwaves, water dispensers, sewing machines, water heaters, and cooking ranges.

So what has prompted the turnaround from the lows of 2019 and 2020? Well, two things really. The first was a strong recovery in the later half of 2020 when cases of the coronavirus went down and lockdown were eased all over the country. In a webinar hosted by BMA Capital in August 2020, CEO of Waves Singer, Haroon Khan, said that the appliance sector had been experiencing strong recovery after the easing of lockdown and improvement in economic dynamics. “We hope that the opening of remaining businesses such as marriage halls, restaurants, and hotels will further boost the momentum,” he said back then.

However, as lockdowns begin again with the third wave of the coronavirus pandemic, the thing that Waves Singer will be looking towards is the second reason why they have been able to do well over the past few months. Singer signed corporate orders with Coca Cola to provide branded deep freezers and visi-coolers. These are the coolers and freezers that you will see at departmental stores all over the country, branded with Coca Cola’s livery that they provide to these stores.

The order for the deep freezers and visi-coolers is worth Rs 975 million, which means that the company has brought in revenue of Rs 2 billion from corporate sales alone, as compared to Rs 1 billion in the previous year. Corporate sales are roughly worth 23% of the total revenue earned this year.

According to a report by BMA Research last year, Waves Singer Company held a market share of 31% for the deep freezer and 7% for refrigerators, and was expecting a higher increase in demand for the latter as it has significant potential to post growth going forward. While the deep freezer segment is operating at its full capacity, the refrigerator segment is utilizing around 70% to 75% of its overall capacity.

However, the name that is more well known in the commercial refrigerators market is Caravell, which holds the major market share. The orders from Coca Cola places to Waves Singer means that competition is getting tougher, especially since Caravell is a foreign brand and domestically assembled products are easier to brand or white label. The hope at Waves Singer will be that now that they have managed to bag a big client like Coca Cola, they may be able to lure in more corporate clients.

One possible reason why Coca Cola has struck a deal with Waves Singer could also be the fact that both Coca Cola and Waves Singer are based in Lahore, and the immediate result of the dealt will be that we will see a greater number of CocaCola branded visi coolers and refrigerators concentrated in the Punjab. Coca Cola’s distribution in Sindh remains limited, especially in Karachi, once again because Coca Cola is based in Lahore. However, another reason behind the deal could be that compared to 2019, Waves Singer also increased its marketing, selling and distribution expenses by approximately 60%. This could suggest that Waves Singer is not out to play and is heavily spending in acquiring new customers and branching out customers to drive sales.