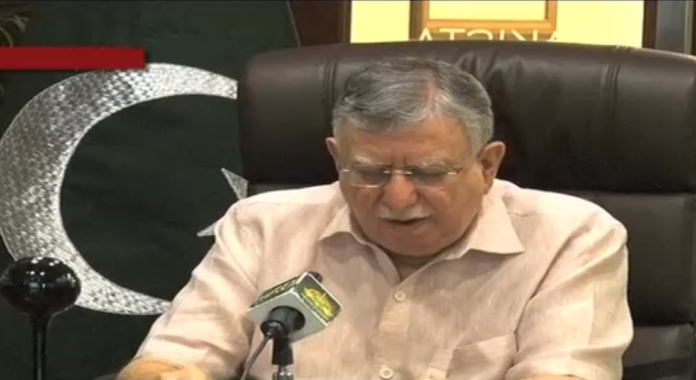

ISLAMABAD: Finance Minister Shaukat Tarin has said that the Rs4.8 trillion revenue collection this year would be the highest in the country’s history whereas the government is hopeful to collect around Rs5.8 trillion during the next fiscal year 2021-2022 (FY22).

Addressing a webinar titled, “Budget 2020: Balancing Stability and Growth” organised by Institute of Policy Reforms (IPR), the minister while stressing the need to focus on economic growth said the government had already constituted Economic Advisory Council (EAC) to evolve development strategies with the help of experts to ensure sustainable growth of about 12 different sectors.

He said that since the government lacked resources to invest in the growth of all sectors, it had decided to focus on 12 major areas, which would put the country on the road to “inclusive and sustainable growth” whereas the EAC has been directed to identify factors that hampered long-term economic growth in Pakistan.

“What we want is inclusive and sustainable growth over a long period of time,” he said, regretting that Pakistan had never seen a long period of sustainable growth except in the 60s.

Tarin regretted that currently the revenue collection was less than 10 per cent of the Gross Domestic Product (GDP).

“Because our exports are not keeping pace with our overall growth, we fall short of dollars. Never have we gone for a tailspin for any other reason than the balance of payments,” said Tarin, referring to the constant balance of payments crisis that pushes Pakistan to knock at the doors of the International Monetary Fund (IMF).

The federal finance minister said that the government is going to incentivise productive sectors including agriculture, services and industry.

“There is a need to make the industry more efficient so that exports can be enhanced. Pakistan, unfortunately, was converted from a food-exporting to a food-importing country; so, the government’s focus would be on reversing this trend.” he informed.

Tarin said there was also need to focus on all agriculture chains, adding that a progressive plan was being put in place with a number of incentives for agriculture reforms.

He said that there was also a need to control food inflation by adopting a mechanism to curb the practice of taking huge margins by playing middle man. “Administrative control will be strengthened, but more importantly, the government will have to consider bringing back price magistrates, which had been removed during the former military ruler Gen (r) Pervez Musharraf.

The finance minister said that a “bottoms up approach” would prove successful in eradicating poverty.

“We will also incentivise services sector such as housing and e-commerce and value-addition, and explore new areas of exports including motor parts, three-wheelers, motorcycles in the next budget. This has to be done to ensure exports grow.”

“Similarly, we want to incentivise the IT sector. I have a meeting, and we will look to put an end to FBR’s harassment of the IT sector,” he said, adding that he looked forward to seeing IT exports increase from the current $2 billion to $8 billion by 2023.

Regarding the Public Sector Development Programme (PSDP), the finance minister said the government planned to spend Rs650 billion on it this year, while he aimed to increase the spending to Rs900bn next year.

“But it will have to be efficient and since the planning commission has started public-private partnership initiatives, Rs900bn will have a greater impact on the ground,” he added.

However, stressing the need for bringing stability in the power sector, he said that certain incentives would be withdrawn in the upcoming budget.

“We are not going to introduce new taxes, but only remove incentives being given to people we believe have been receiving the incentives for no rhyme or reason,” he said.

What are the hurdles in enforcing Point of Sales policy? There are BIG names in every single city that bring in millions per day in cash. And God knows how much tax is paid on that. Just visit one or two top clinics in big cities and any tax auditor can easily see how much revenue is being generated there.