When faced with the two bad options, the temptation for decision makers is always to pursue the one option that involves taking action, even if the option involving inaction causes less damage. That is the situation the government of Pakistan finds itself in right now (and generally every three to five years) with respect to the value of the rupee.

The situation is this: the government can either let the rupee fall – and not spend any money trying to prop up the value of the currency relative to the US dollar – and accept an uptick in inflation, or it can try to spend borrowed money to prop up the rupee for as long as possible, keep inflation temporarily low, but indebting the country for the long run, and ultimately causing a sharp spike in inflation when it runs out of money.

Historically, with one major exception, the government of Pakistan has always picked the latter option. Yet that one exception started under then, and now again, Finance Minister Shaukat Tarin, when he first assumed office in late 2008, and continued under his successor Abdul Hafeez Shaikh. This time, Tarin has succeeded Shaikh, but the result may be the same: an unwillingness of the finance ministry to expend scarce resources to try to prop up the value of the rupee.

We say this despite reporting from Shahbaz Rana at The Express Tribune that the government has already spent $1.2 billion in trying to prop up the value of the rupee. Rana is one of the most credible reporters on the finance ministry in Islamabad (disclosure: he is a former colleague of this author), but for reasons that we will outline later, we find that number difficult to ascertain.

In this story, we will lay out just how deep the roots of the “control the exchange rate” idea go in Islamabad, why the government tries to do this, the costs of doing so, and why this time the government may finally be willing to let the rupee go.

If we are correct in our hypothesis that the government is truly willing to let the rupee become a freely traded currency – and we will provide considerable evidence to suggest that this is the case – then this represents a clean break from a series of terrible decisions in the past, and would mean that the Imran Khan Administration would become that rare instance of a government in Pakistan that explicitly put the long term economic interests of the country ahead of short-term political pressures.

Of course, that probably means we are wrong.

A brief history of a terrible idea

On September 18, 1949, the Bank of England made a monumental decision that set off a series of events that has permanently reshaped the Pakistani economy.

On that day, the British government announced that it would be devaluing the pound sterling by 30%. In those days, while the US dollar had already taken over as the default currency of global commerce, most former British colonies still pegged their currencies to the British pound. As a result, when the British government decided to devalue the pound relative to the US dollar, the government of India decided to follow suit. Crucially, however, (and this, in hindsight, was a blunder of monumental proportions), Pakistan did not follow suit.

The government of Pakistan at the time felt that it did not want to devalue the rupee because it felt that Pakistan’s own macroeconomic indicators did not justify such a move. That decision, however, had a serious negative impact on the Pakistani economy.

At the time of Partition, well over 60% of Pakistan’s foreign trade was with India. This makes intuitive sense: until August 13, 1947, all of that trade had just been intra-country trade. After Partition, those economic linkages did not disappear overnight, and all that intra-country trade became international trade.

However, in 1949, when Indian devalued its currency and Pakistan did not, suddenly Pakistani goods became more expensive to produce relative to their Indian competitors, by a factor of 30% (both currencies had a pegged exchange rate of 1:1 at Partition, which continued for the next two years). This made Pakistani goods and services relatively uncompetitive, and Pakistan’s share of the Indian market started to fade over time.

This is important to remember: Pakistan lost its biggest export market not as the result of the 1965 war – which did result in more legal restrictions on trade between the two countries – but as the result of the much earlier decision not to maintain exchange rate parity with India. Given the fact that the two countries had been managed by the same central bank, and had effectively the same currency until just two years prior, it was not at all unjustifiable for Pakistan to keep the exchange rate parity.

By choosing to prioritise the absolute level of the exchange rate over the consequences for the rest of the economy, specifically the country’s nascent export industries, the government permanently altered Pakistan’s economic trajectory. Instead of integrated regional supply chains (which, by the way, survived the 1948 war just fine, suggesting that Pakistan and India can go to war and continue to trade at the same time), Pakistan is now mostly cut off from its regional markets and has set back the development of its export industries by decades.

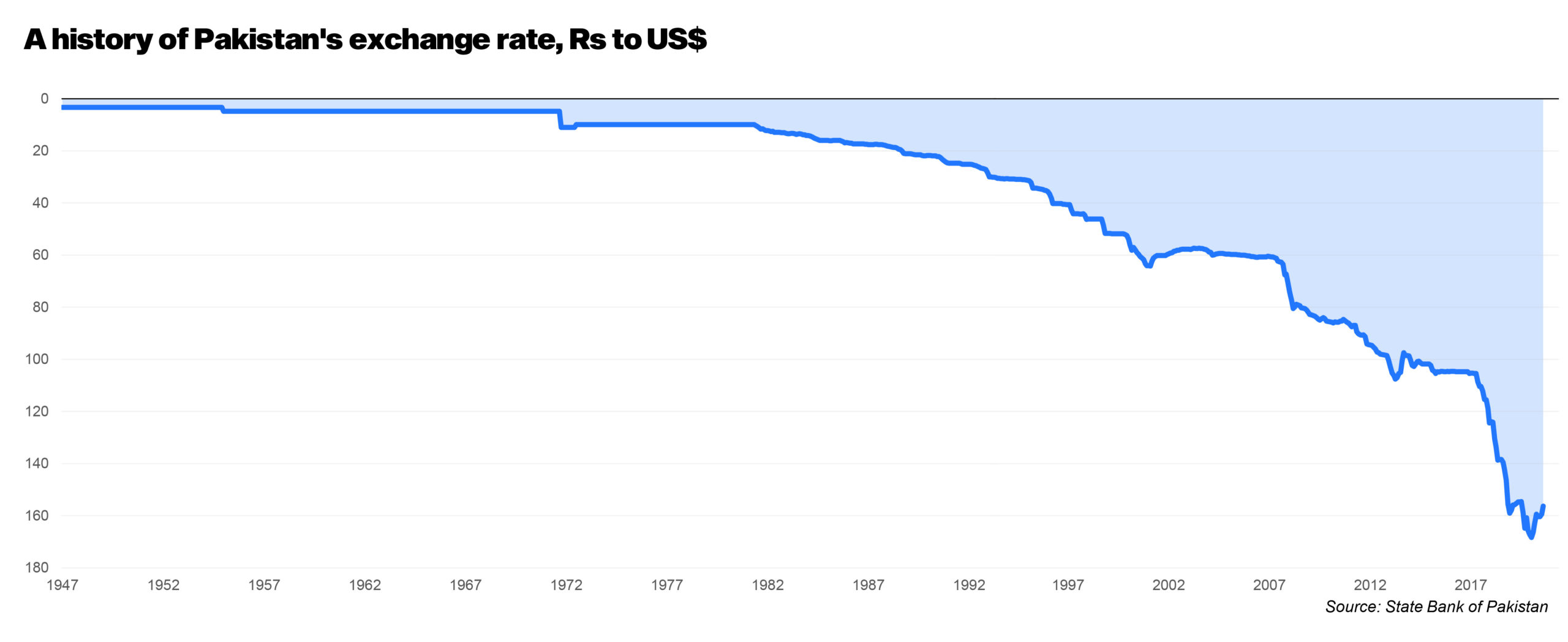

Here is where things get interesting: the government of Pakistan did ultimately have to devalue the Pakistani rupee. In August 1955, the rupee declined by 44.2% relative to the US dollar in just one day, more than it would have, had the government decided to retain its parity with the Indian rupee and maintain its exchange rates with its main trading partners.

The government was not able to “save” the value of the rupee and it lost out on economic competitiveness anyway. All the pain, and nothing to gain.

By that point, however, it was too late. The economic linkages that had existed before Partition were now permanently broken, and India and Pakistan went their separate ways with respect to global trade. The Pakistani rupee remained part of the Bretton Woods system of fixed exchange rates until that system broke down in August 1971 (largely due to imbalances that the United States had allowed to grow within its own economy, a story that is not directly relevant to that of Pakistan).

However, it took Pakistan more than a decade to fully convert over to the system of a “managed” floating exchange rate, a system which began on January 1, 1982 and has largely remained in place since then. The State Bank of Pakistan lets the rupee trade within a certain range, and intervenes by buying or selling dollars to keep it within the range the government of the day wants it to be.

Trying to control inflation through the exchange rate

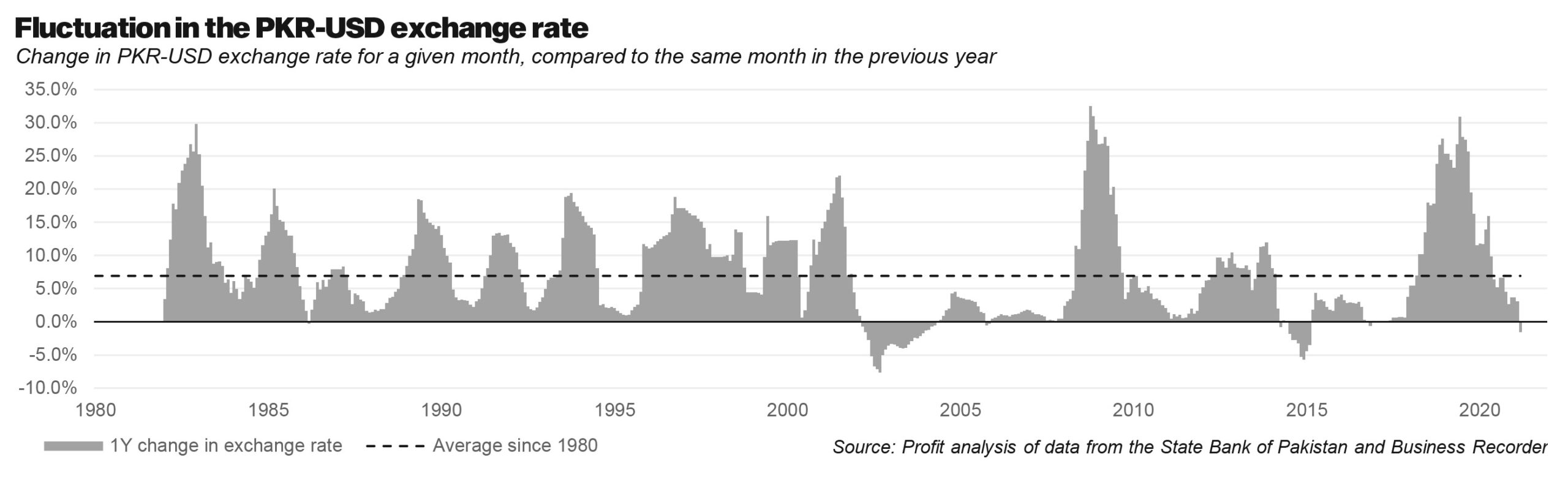

Since 1982, almost every single government (with only one exception) has tried to artificially control the price of the rupee as a means of keeping inflation lower than it naturally would be if the exchange rates were left alone.

Every time, the cycle is exactly the same: the government raises foreign debt as a means of securing more dollars, which is slowly sells over time so that it can create an artificially high supply of dollars in the economy and artificially high buying of the Pakistani rupee. This is obviously unsustainable, largely because the government is using borrowed money not to finance investment into future income opportunities for the economy but present consumption. Eventually, foreign lenders want their money back and are not willing to refinance, and hence the government’s ability to prop up the rupee ends, causing the currency to suddenly crash.

What makes this worse is that Pakistan ends up with more foreign debt and nothing to show for it. Instead of financing investments into future income – in the form of infrastructure that ultimately increases the productive economic activity of the country – the government is effectively financing the monthly electricity bills and automobile petrol costs for the urban middle class by using borrowed money to artificially deflate the cost of imported energy. A significant portion of Pakistan’s electricity generation relies on imported fuels.

The critical thing to remember is that this debt and inflation cycle is not something that is imposed on the government of Pakistan by an external lender. It is a policy choice made by the government itself, one that many international lenders – including the International Monetary Fund (IMF) – would like Pakistan to get out of.

But a look at the history of the country’s inflation and exchange rates reveals that this exercise only has the effect of creating unnecessary shocks. It does absolutely nothing to arrest inflation, or the exchange rate. A substantial proportion of the variation in exchange rates and inflation – including the size of the subsequent economic shocks – can be explained by just how much effort previous governments have put into trying to control both.

Since August 1947, the Pakistani rupee has depreciated at an average rate of 5.38% per year, according to data from the State Bank of Pakistan (SBP). The Pakistan Bureau of Statistics (PBS) does not make inflation data available for that same period of time, but since January 1958, the country’s inflation rate has averaged at around 7.55% per year.

Those averages hide significant variations. However, we are able to surmise at least one significant inference from the historical data: the longer the government uses artificial means to keep inflation below 5%, the worse the subsequent increase in inflation. Reversion to the mean, in the case of the Pakistani economy, is a mean, chaotic, highly disruptive process.

Could Pakistan break the cycle?

In finance, one should generally be wary of those who say: “this time is different”. So we will not suggest that the government of Pakistan will actually stop doing what it has done since almost all the way back to Partition. We will, however, lay out three reasons why we think the government appears to be trying to make a break from the pattern of the past, and how it might succeed if it kept trying.

The three reasons are:

- Shaukat Tarin is the finance minister.

- The government has entered into an IMF bailout program before an election.

- The State Bank is actively changing policies to make the Pakistani rupee into a fully convertible currency.

Let us take a look at each of these three factors, what they mean, and how together they might help the government break the cycle.

Tarin as finance minister

As we stated earlier, there is one exception to the pattern of pumping borrowed dollars into the currency market, and that is the period between 2008 and 2013, during the Zardari Administration, led by the Pakistan Peoples Party (PPP). The finance ministers then were Shaukat Tarin and Abdul Hafeez Shaikh, who made the active decision to not intervene in the currency markets.

And they both did so for a reason: they both managed to convince the rest of their cabinet colleagues that it was not worth spending those resources on pumping up the value of the rupee when it could be used on different, more productive uses.

Tarin is still that same person and there is no reason to believe that he has fundamentally changed his world view on what the government’s exchange rate policy should be. At the very least, we can be assured that the pressure to flood the currency market with borrowed dollars will not come from the finance minister himself.

Of course, this is a different cabinet than the one led by the PPP. The PPP’s constituency is far more rural and working class, and thus less attached to cheap petrol and electricity prices than the urban middle and upper middle class that are a large portion of the current ruling Pakistan Tehrik-e-Insaf’s (PTI) voter base. So Tarin may face pressure from his cabinet colleagues who want to have their neighbours in Lahore Cantt be able to continue buying Audi e-Trons.

Tarin, however, is known specifically for being more able to withstand pressure than any other person who has held the office of finance minister in Pakistani history. Indeed, he was brought in specifically because he is more impervious to pressure than the other candidates for the job. So, there is at least the possibility – admittedly far from certainty – that the Prime Minister will back Tarin in his decision.

Entering the IMF program before an election

For most of Pakistan’s relationship with the IMF, the government tends to enter into an IMF bailout program almost immediately after coming into office, uses the IMF money to drive down the price of the dollar, goes off on a populist pre-election spending spree right before the IMF bailout expires, and then promptly loses the next election, following which repaying the IMF is the next government’s problem. The next government then comes into office and uses a new IMF bailout to repay the old IMF bailout, plus any private sector foreign borrowing the government did, and the cycle restarts.

What is interesting this time around is that Pakistan is entering an IMF program before an election, which implies two things:

- Tarin wants to bind the government into not behaving recklessly before the 2023 election, by using the IMF’s money as the carrot and its opprobrium as a stick.

- The prime minister wants to plan for the possibility that he will win the next election, and thus is willing to at least go along with this risky new approach.

Of course, there are other possibilities, and it could just be that the government’s finances are more dire than they appear at first glance, but nevertheless, having the IMF have a big say in what the government can spend its dollar reserves on at least reduces the likelihood of them being used to prop up an artificially strong value of the rupee.

The State Bank is making the rupee fully convertible

This is perhaps the least noticed, but possibly the most significant policy initiative that the government of Pakistan is undertaking with respect to the country’s long-term economic stability: making rupee deposits much more flexible than they have ever been in the country’s history.

The Roshan Digital Accounts (RDA) have gotten a lot of coverage, but in reality, they are the most meaningless part of this policy. (Seriously, which Pakistani expat sends lots of money home but left without having a personal bank account in Pakistan of their own?)

But nonetheless, the government has established a principle: they want to make it extremely easy for both resident and non-resident Pakistanis to bring money into Pakistan (and buy rupees) as well as send money out (selling rupees in the process).

On that latter part, the policy that has not gotten a lot of news coverage is that every resident of Pakistan can now convert up to $25,000 worth of Pakistani rupees into foreign currencies to send abroad for the purpose of investing that money without requiring prior State Bank of Pakistan approval. The only condition is that the transfers can only take place from one designated bank account per individual, so the transaction limit in this rule cannot be evaded by sending money from multiple bank accounts.

This is big news, and represents a very important tectonic shift in the government’s policies. It means that they want to attract money into Pakistan in the long run, not just through short term tricks. By opening up Pakistani bank accounts to be able to send money out of the country, they are signaling to the population: “if you bring your money parked abroad back home, you will be able to take it out again.”

By rendering the rupee convertible, they have decided to trust the market and bear the short term volatility (assuming they do not back out of this policy) that will likely come with that. If you give people the assurance that they will be able to take their money out any time, they are more likely to bring it in. And the fact that the government has done this not just for expat Pakistanis but also resident Pakistanis indicates that it is aware that wealthy and upper middle class Pakistanis like to park a substantial portion of their wealth abroad, even while continuing to live within the country.

Is the change here to stay?

All the signs from the above three developments seem to indicate that the government will manage its resources more sensibly this time around, the noise around “currency speculators” notwithstanding. However, none of this will matter if the government loses its nerve and decides to backtrack on all of these changes – particularly the commitment to free-floating rupee and a convertible currency – at the last minute.

For any of these changes to mean anything, they have to survive not just one or two administrations, but also through times of economic duress. People have to have the assurance that the government will not simply go back on its word when the times get tough, which means sticking with these policies especially through a time like right now, when the rupee is losing value rapidly.

If we had to guess, we would reckon that the government will not be able to sustain these liberal economic policies. Because ultimately, the person who needs to know how to withstand political pressure is not Shaukat Tarin or Reza Baqir: it is Imran Khan. And the prime minister has demonstrated a penchant for giving in to pressure from a narrow section of his base of supporters, even when there was no obvious direct benefit to his electoral or political prospects from doing so.

Will we break the habit? Tarin and Baqir have gotten us to dare to dream. But we suspect this dream is about to rudely interrupted by political reality.