The heat is on and it’s between two unlikely rivals: Alibaba-owed Daraz vs the ARY Digital Network, representing conventional media and digital media respectively, including representing TV screens and mobile screens respectively.

This week advertisers and agencies sat down to debate the merits and demerits of two vastly different sponsorship proposals around the upcoming 2021 ICC Men’s T20 World Cup, which is a week away.

As reported by Profit, the first proposal floated in the market came from the ARY Digital Network, and the value of all six packages within the said proposal is Rs. 617.5 million ($3.625 million). The second proposal floated in the market came from Alibaba-owned Daraz and the value of 13 sponsorship slots – across three categories of presenting, main, and co-sponsor – is valued at Rs. 340.8 million ($2 million).

On the one hand, the ARY Digital Network proposal for the 2021 ICC Men’s T20 World Cup offers brand placement on two highly coveted channels: Ten Sports and A Sports.

But since Ten Sports has been in a landing rights limbo, across the country, media agency executives tell their clients the following: it is neither legal nor illegal to work with Ten Sports as the decision as to whether the channel is a national security risk is still pending. Unlikely as it may be, should you desire your ads on this channel, and should the ad spend be wasted because the channel is deemed illegal at some point, the fault and fallback are not on us. So clearly, there is a risk-reward decision to be made.

The second channel offered by the ARY Digital Network proposal is its own sports channel known as “A Sports”, which is owned by Horizon Communications, a business with clear ties to the ARY Digital Network proposal, as exposed by Profit.

This is a new channel and thus has no MediaLogic rating data to show. Some industry insiders allege that the recent rating spike for the ARY Digital Network proposal is an indication that the localities with PeopleMeters have been found, and could be exploited to spike ratings for A Sports on a level that took Ten Sports years to achieve. So clearly, a channel without ratings is offer number two in the same proposal.

Yes, advertisers in this country will be forking out money at a proposal that offers one channel in a legal limbo and another that has no ratings to show, for now.

As reported by Profit, numerous times, these two red flags will be conveniently ignored in the highly corrupt media industry of Pakistan, where rebates and kickbacks rule media planning decisions rather than data. For highly audited advertiser accounts, these red flags will matter but not for advertisers led by executives that use company resources for their own pissing contests.

Keeping in mind that most of the final decision-makers are boomer uncles, sources at ARY are confident that they will secure the lion’s share of allocated sponsorship budgets for the 2021 ICC Men’s T20 World Cup arguing that Ten Sports and A Sport will be watched by households with an average of five inhabitants, whereas any digital streaming service will only reach one set of eyeballs.

We’ll take “what is a smart TV?” for $999, Alex.

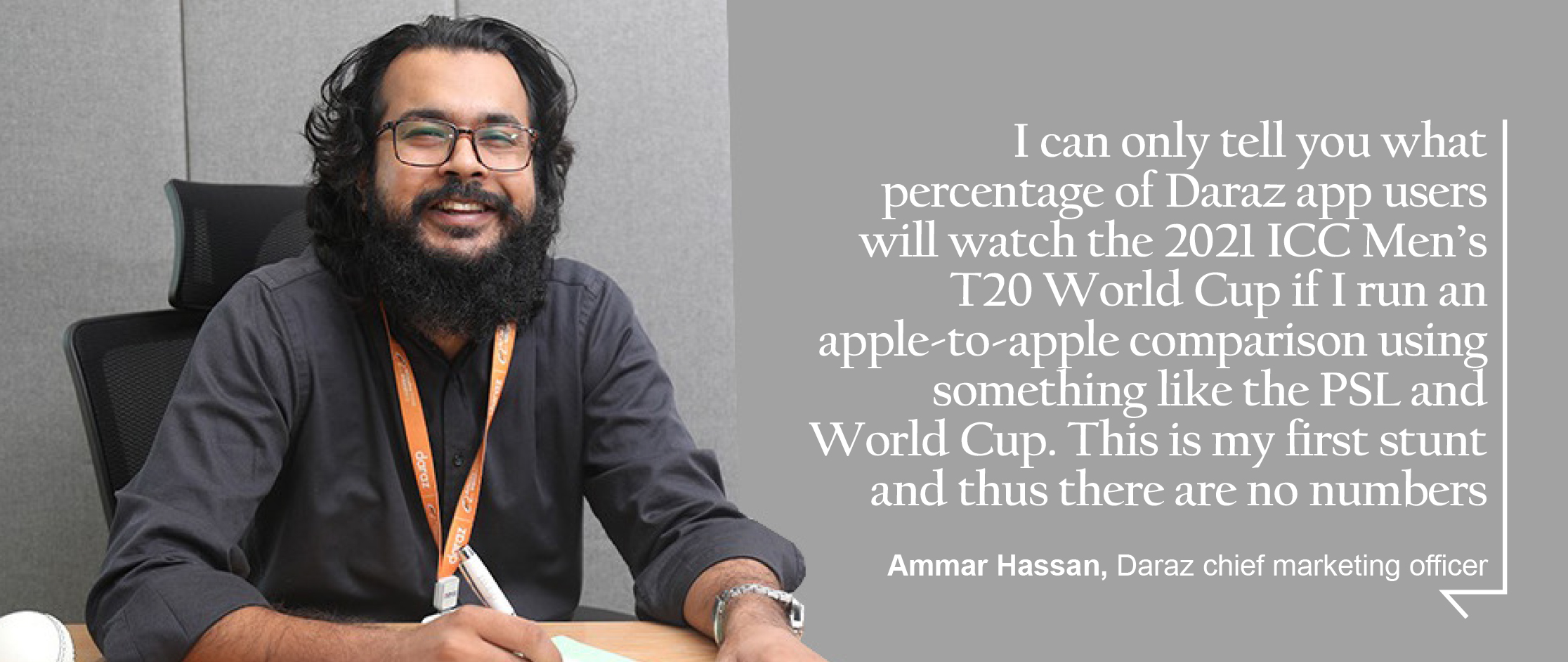

The second highly debated proposal in the market is from Daraz, which Profit feels is a relatively better deal than the one from ARY Digital Network, with a few red flags of its own. Daraz chief marketing officer Ammar Hassan spoke to Profit about the red flags identified and shared his points of view, documented below.

While Daraz is undoubtedly the market leader in Pakistan when it comes to gross merchandise value turned, the proposal makes a few tall claims that have nothing to do with each other. The proposal starts off by telling advertisers and agencies that the main reason to sponsor the 2021 ICC Men’s T20 World Cup on the Daraz app is that the game will be free to watch for whomever has the app while throwing subtle shade at bSports.

Daraz chief marketing officer Ammar Hassan told Profit that the total monthly active users (MAU) of Daraz is 15 million, of which seven million are attributed to the app while the remaining eight million are attributable to the website. Sources told Profit that the daily active users (DAU) are 1.5 million. Both these numbers are missing from the proposal and are shared in 1-on-1 meetings with media planners.

Industry sources shared that Daraz paid GroupM Pakistan roughly $1.5 million for the digital streaming rights of the 2021 ICC Men’s T20 World Cup and amid this proposal, will see a gross margin in excess of 30%. The production costs associated with managing the live programming, along with the labor costs associated with flagging cable operators and private groups that steal the broadcast feed – robbing Daraz of an audience it deserves – means the company has approached this investment with the same lens as Tmall by the Alibaba Group.

As reported by Profit, Daraz launched DarazMall and Daraz League to disrupt the influencer marketing industry by creating a solution that is at the bottom of the marketing funnel. The only other influencer ecosystem solution in Pakistan with a capability at the bottom of the funnel or a tracking mechanism around sales is INCA and Walee.

The following claims, however, need examination:

Red flag 1 – using website traffic to imply that mobile app traffic is related

The proposal uses Alexa data to demonstrate that Daraz is ranked in the 8th place for Pakistan with regards to high-traffic websites (which are web apps, not mobile apps) and compares itself to Tapmad, CricinGif, and bSports which rank in either the top 1,500 to top 100,000. The proposal says the 2021 ICC Men’s T20 World Cup will be streamed on the app, not the website.

Daraz ought to have included attribution modeling data which shows what percentage of website visitors tend to become app users, in order to justifiably cite website traffic numbers. This is a slide that belongs in the proposal around advertising on Daraz, and maybe not for making the case why the Daraz app is superior overall.

Furthermore, this section of the proposal implies that its shopping audience is comparable to a web and mobile-first cricket watching audience, with Daraz offering no data on what percentage of its website visitors make purchases that implicate them as cricket enthusiasts, which could have possibly been used to infer that this audience will be retargeted for consuming the 2021 ICC Men’s T20 World Cup on the app itself.

Speaking with Profit, Daraz chief marketing officer Ammar Hassan said that he disagrees with this point being a red flag, stating that regardless of shopping behaviors or purchasing habits, an app user or a site visitor from Pakistan will be a fan of cricket, adding that not all cricket fans purchase the merchandise.

“Advertisers don’t care what percentage of a cricket-related audience is viewing their advertisement, they only care about the reach of the platform,” said Hassan. “I can only tell you what percentage of Daraz app users will watch the 2021 ICC Men’s T20 World Cup if I run an apple-to-apple comparison using something like the PSL and World Cup. This is my first stunt and thus there are no numbers.” Valid point.

He said that with data from bSports on the audience numbers for cricket content versus noncricket content, he may have been able to derive an answer to this question, but cannot due to the data being inaccessible to him.

Red flag 2 – butchering causation and correlation

The proposal then says that since the annual 11/11 shopping festival by Daraz – which offers steep discounts for purchases made within the app – leads to a surge in traffic and app downloads, the company expects a similar “unprecedented” surge this year as well.

By the time 11/11 rolls around, there will only be three matches of note – the first (10th November) and second semi-final (11th November), and the final match (14th November). Across round 1 fixtures starting on the 17th October to group 1 of Super 12 on the 23rd October, and group 2 of Super 12 on the 24th of October, the lion’s share of matches will happen before the 11/11 shopping event from Daraz.

“When we become the number one app on the App Store, it doesn’t just happen on 11/11,” said Hassan. “We start marketing from the 15th of October – that is when our Google, Facebook, performance marketing, influencer marketing, TV advertising, out of home, will commence. Once we start pumping in the money, app downloads and users spike. What we meant to infer to advertisers is that the largest eCommerce shopping event and the most important sporting event in Pakistan will take place on the same app.”

As reported by Profit, one of the factors creating hesitation for advertisers around the 2021 ICC Men’s T20 World Cup was the poor performance of the Pakistan Cricket Team on the field, coupled with data from both MediaLogic and Cricingif that shows that matches, where the Pakistan Cricket Team are playing, have higher views and ratings compared to matches where they are not present at all.

Advertisers will more so be betting on a good athletic performance than they will be that somehow a discount and deal-hunting shopper might delay deleting an app just to watch a cricket match.

Red flag 3 – failing to define audience size

The written proposal fails to mention the exact DAU and MAU, while also failing to disclose what percentage of its own audience falls into the “youth” segment it so confidently touts as a reason to buy these packages.

Yes, 65% of Pakistan is under a certain age. Yes, this segment predominantly gravitates towards a mobile-first content consumption habit. Yes, they are “on the go” as they put it. None of this answers in a definite manner how many of said demographic is using your site or your app, or is even projected to do so.

“After the 14th of November 2021, I will disclose what percentage of the MAUs gravitated towards watching the 2021 ICC Men’s T20 World Cup on Daraz Live,” said Hassan. “Right now, I don’t have any guesstimate, we are as naive as a person is with a new product. Citing the locations within the KLI cities where purchase orders come from, I have explained to advertisers and agencies that the audience of Daraz isn’t in the niche but rather the masses, which means Daraz is used by digital immigrants and digital natives that are everyday people which means that they have content consumption habits geared towards cricket.”

The pro’s

The good news is that this proposal gives us a glimpse into the Prime mirroring strategy of the Alibaba Group and of Daraz. One of the highlights of this proposal is the revelation that those watching the game will be served contextual ads for relevant products, as speculated last week by Profit.

For all its red flags, a sponsorship channel that allows advertisers to activate their online shops – most likely only those that are on Daraz – coupled with sponsorship pricing that is 50% less than that of the ARY proposal, is what is making this eCommerce leader proposal win over results-driven marketers across the country.

The ugly

While this will be the first experience for Daraz in live streaming a major sporting event such as the 2021 ICC Men’s T20 World Cup, it must expect to face off against white-collar criminals that seek to devalue the platform by robbing it of an audience and ergo, value for advertisers.

Sources that spoke to Profit shared that bSports generated over 6.7 million views through its website for PSL 6 from the 1st to the 14th of March 2021. After the COVID-19 pandemic delayed the games and due to the issues created by former PCB chairman Ehsan Mani, the 15th to 34th matches generated a combined viewership of slightly more than 40 million through both Facebook and the website.

The platform had committed to achieving 70 million views across both Facebook and its website, failing to do so due to a number of factors including – but not limited to – the absence of conditional access systems (CAS) encryption, which was avoided in favor of a Basic Interoperable Scrambling System (BISS) key. This would have prevented cable head-ends, fiber optic internet, and black-market direct-to-home operators from stealing clean feed due to a lack of up-linking that protects the feed.

During the 6th season of PSL, a new frequency on PAKSAT called 3840V lacked a BISS Key which meant that anyone – whether it be an individual or a cable television headend – could see an advertising-free feed from the PSL production tea. The PCB also found that Optix, Transworld, and Stormfiber were distributing an ad-free clean feed to digital boxes by downlinking directly from PAKSAT. Speaking with Profit, a representative of Optix denied allegations of the PCB that it distributed or showed ad-free content on digital boxes.

This could have been avoided by protecting the uplink feed but since prevention isn’t part of the common sense curriculum for Pakistan, this possibility that a nation of thieves would go about thieving was never even brought up. By using a proper CAS encryption system and an integrated receiver decoder, PCB could have authorized downlinks.

In this way, the clean feed is never stolen and the fingerprinting in CAS allows it to pinpoint the IRD it was stolen from. Given that PCB failed to inform NETSAT and Tower Sports to protect the stream, millions of households received it directly and thus advertisers lost potential eyeballs for branding and recall goals.

Given that Daraz views itself digitally streaming the 2021 ICC Men’s T20 World Cup as branding and recall exercise for advertisers across the country, the reality of stolen feeds and lost viewership including advertiser value is a reality they will need to accept.