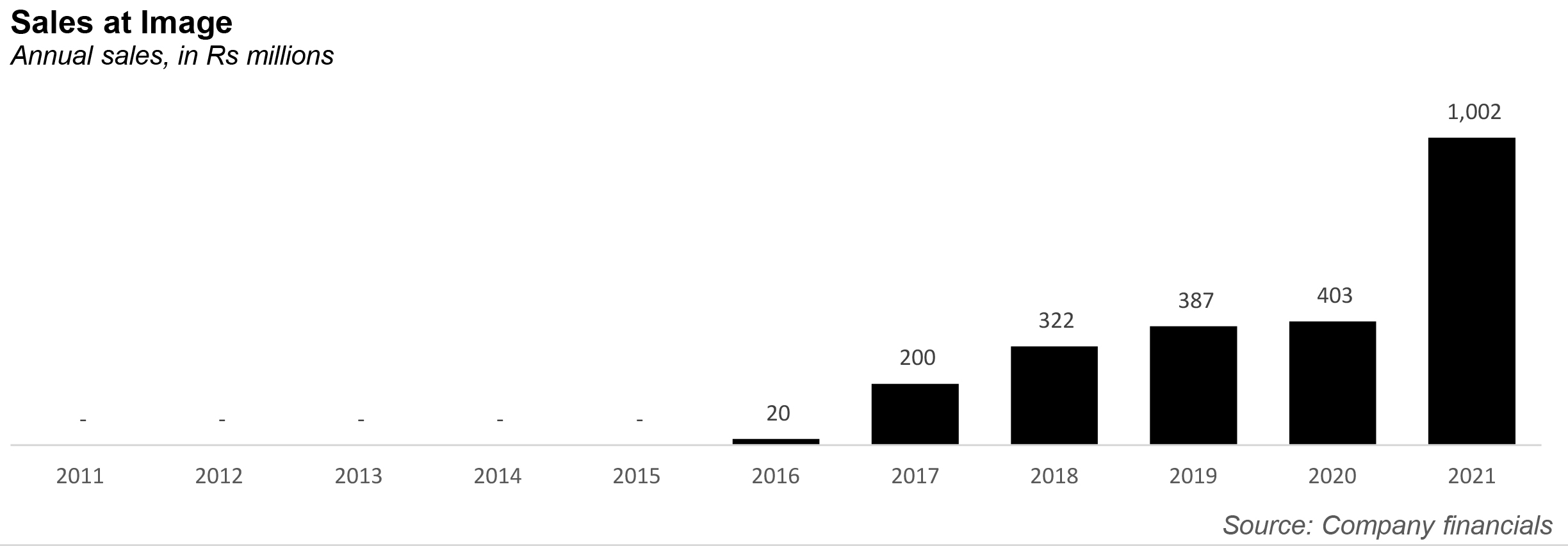

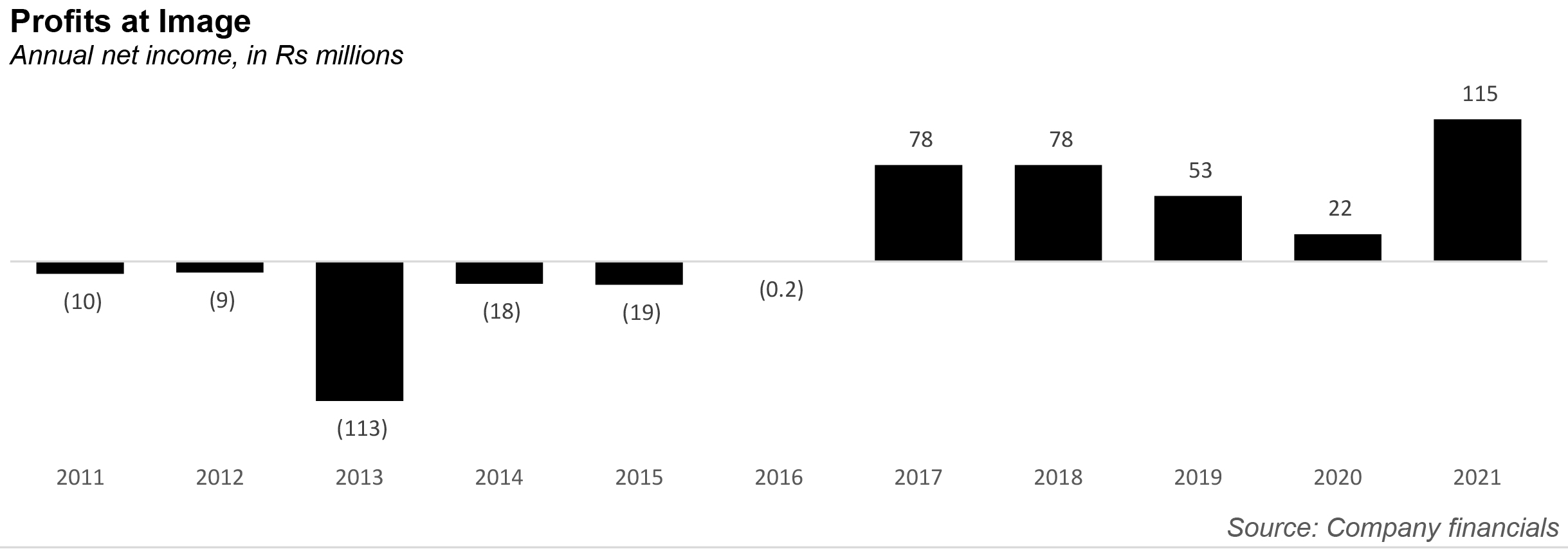

As this magazine has previously covered, Image Pakistan has done exceptionally well in the last few years, essentially rising out of the ashes of the now defunct Tri-Star Polyester Ltd. But then, in 2021, Image Pakistan not only did well – it hit the ball out of the park, as it were. Last year, it had sales of Rs403 million, and net income of Rs22 million; this year, its sales more than doubled, crossing Rs1 billion, and net income of Rs115 million.

It’s such an exceptional set of results that it made people sit up who otherwise do not pay attention to embroidered lawn. Take, for instance, the research department at AKD Securities, an investment bank. More prone to sending its clients analysis of oil and banks, it instead flagged Image Pakistan as one to watch out for, in a note sent to clients on October 21.

“Image Pakistan Limited (IMAGE) is poised to be a prime beneficiary of the improving consumer demand, led by the rebound in economic growth,” the report read. It further noted that the company’s sales has grown with a compound annual growth rate of 61% in the last two years, to Rs1 billion, while net income has had a CAGR of 48%, and gross margin has averaged at around 50% for the last three years.

Its impressive for a company that just in 2013 had made a loss of Rs113 million (as large as this year’s net income). To recap: Image Pakistan Limited, formerly Tri-Star Polyester Limited, was incorporated in Pakistan as a public limited company in November 1990. The principal activity of the company is manufacturing and sale of polyester filament yarn and embroidered fabric. And the shalwar kameez line was started in 1993. It was the era of intelligent brands picking up ont he fact that more and more women were beginning to buy ready-made clothes.

And yet Tri-Star Polyester did not fare so well, especially in the late 2000s. Between 2011 and 2015, the company did not sell any clothes at all. In fact, in those years, the company made losses, including a particularly bad year in 2013, where the company made a loss of Rs113 million. The company was most probably negatively affected by the textile crisis of the early and mid 2010s, where the industry lost close to half a million jobs over two years. The year 2016 is also when the company decided, enough was enough. First, it decided to ignore the polyester fabric aspect of its business, and go all in on its embroidered fabric business. In 2016, Tri-Star Polyester decided to invest in a Rs1.8 billion air looms project at its existing plant in SITE, Karachi. Then in 2017, it started operations to produce embroidered fabric for Image for stitched and unstitched fabric. In 2018, it took a Rs138 million loan from Al-Baraka bank (payable in 2022).

And Image took off. The brand pivoted towards a floral and pastel aesthetic, and invested in their separate pants section, which proved popular among young women. In the last five years, sales have shot up from Rs20 million, to Rs200 million in 2017, to Rs403 million in 2020. Similarly, the company has managed to make a profit every year since 2016.

But what explains the phenomenal year of 2021? Two words: online sales. That represent the second big shot in the company’s strategy. The company’s annual report notes: “As we took multiple steps to improve online operating performance, we were able to capitalize on the change in customer shopping patterns and saw a progressive increase in online sales throughout the year.This was a result of strong traffic, active customer growth, improving frequency and lower returns,”

This is something AKD Securities also noted, saying “The company boasts of a strong presence online which had helped it grow immensely during COVID-19 with online sales witnessing an increase of 6 times, contributing 65% to the topline.”

Image Pakistan went on to add that, “The dramatic increase in the move to online shift, the use of technology to connect suppliers and customers, and the demise of many high street brands are trends which will never reverse.” This explains why it decided to become Pakistan’s first approved seller on Amazon in June 2021, which AKD thinks will contribute to revenue for sure.

Plus, it also helps to focus a little on physical stores as well. According to AKD, the company recently concluded a right share issue of Rs640 million in order to contribute towards capital expenditure for the upcoming stores. Three stores in Rawalpindi, Peshawar and Lahore are expected to open by December 2021, with the total of 10 expected for fiscal year 2022. The company is also expanding into perfumes and Halal cosmetics.

That is why both the company and AKD believe that sales for fiscal year 2022 will stand at an astonishing Rs2 billion – wo would have thought?