Lahore-based Zarya, which positions itself as a digital wholesaler for online sellers, today said in a statement that their startup had raised $1.7 million in pre-seed funding from international and local venture capital firms.

The round was led by Saudi Arabia-based Raed Ventures with participation from Fatima Gobi Ventures, US-based Class 5 Global, Global Founders Capital. Egyptian social commerce startup Taager, whose model Zarya is replicating in Pakistan, also invested in the round.

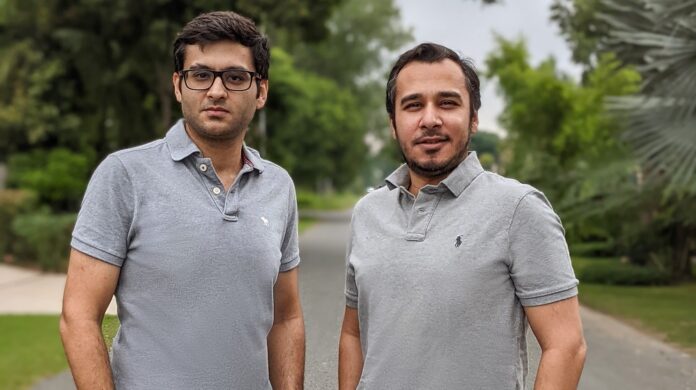

Founded in June this year by brothers and co-founders Faisal and Saad Zahid, Zarya claims to have set out to make the sale process easier for sellers by allowing them to source products from the Zarya app, followed by delivering the products to customers, collecting payments and disbursing profit to the seller.

The startup is banking on the increasing social media usage of 100 million YouTube and 45 million Facebook users in Pakistan and leverage it for social eCommerce. Amid the COVID-19 crisis, the global market for social commerce is estimated at $89 billion in the year 2020, and is projected to reach a revised size of US$604.5 Billion by 2027, growing at a compounded annual growth rate of 31.4%.

Social commerce is expected to pick up in Pakistan as well with the size of eCommerce expanding as more sellers move to digital channels for sales. Zarya positions itself as a digital wholesaler within the broader eCommerce whereby sellers, primarily online, and offline, can directly source products from the Zarya application and sell them to people in their network.

Quite simply, anyone, existing sellers or someone who wants to be a seller without any investment, can simply choose a product on the Zarya app, add commission on top of the sale price which is significantly lower than the market retail price for a few products scouted by Profit and compared online, share the product with people in her/his network on Facebook, on an Instagram store, or even through a WhatsApp message to friends and family, and earn the commission from Zarya for simply marketing the Zarya product.

The startup ships the product to customers anywhere in Pakistan at a standard shipping rate of Rs200 paid by the customer. The commission for the seller is currently restricted to 50% on the Zarya app.

“The primary market Zarya intends to serve is digital because the idea is to sell digital. Offline sellers, however, are not shunned either,” says Faisal Zahid, co-founder at Zarya. “Supplying online sellers’ products at wholesale rate makes more sense because it’s not easy for online sellers to go and pick products up from the wholesale market and then sell them online. It can become expensive which can mess up their unit economics,” Faisal adds.

Zarya’s conundrum which has arisen from this arrangement, however, is that while it positions itself as a platform for sellers only, direct-to-customer sales are not restricted on the app, and Zarya, perhaps inadvertently, taps the B2C market as well where the end customer can also buy products at wholesale rates.

Effectively, this cannibalises Zarya’s B2B model of enabling online sellers to sell more seamlessly but Faisal seemed less concerned. “At the end of the day, it is the wholesale rate that matters. We have designed the product as wholesalers. There would be people who would be B2C but our emphasis and our strategy is B2B and we are expecting most of it to be B2B,” he says.

The B2B and B2C distinction is tricky in the grocery delivery industry too. Startups like Airlift, pandamart, and Cheetay seem to be designed for end customers but deliver groceries to convenience stores as well. In contrast, B2B startups like Bazaar, which Zarya also likens itself to minus the groceries part, have restrictions in place that end consumers can not buy from Bazaar app on which it has listed products on wholesale rates.

Effectively, Zarya also becomes a competitor to the very well-funded Daraz which has a wide range of products available at discounted rates for customers. But it is contingent upon Zarya remaining primarily B2B rather than B2C but Faisal remains assertive that their primary model is different from Daraz: they are majorly focused on making inventory available for sellers whereas Daraz is a platform where these sellers can sell their products.

Perhaps, sellers can benefit from the price arbitrage by purchasing from Zarya at a lower rate and then selling on Daraz. Popular retail brands in Pakistan like Sapphire and Gul Ahmed list on DarazMall but have lines of products available to wholesalers who then sell to consumers through offline channels.

These wholesalers, or new ones, can make these products available on Daraz for online sales after purchasing these products at wholesale rates from Zarya.

“Our operating model is B2B and most of our customers are sellers. Nonetheless, we expect some volume of sales coming directly from customers because we have wholesale rates,” Faisal says.

Zarya says that their app currently has over 3,000 items listed on the application including clothing for women and children, and footwear, with aims to add new product categories. According to Faisal, their ambitions for Zarya are not restricted to Pakistan only and soon they will be launching in international markets like in the Middle-East.