A few days ago, a reader suggested we come up with a list showing companies that give out the most dividends as a guide to explain what companies are the best to invest in. However, merely getting some dividends should not be your end goal if you are investing in the Pakistan Stock Exchange (PSX). The goal should be to maximize your returns.

Buying stocks of companies that pay pretty nice and steady dividends is one of the best ways to invest on the stock market, especially if you’re not someone that wants to watch their portfolio a couple of times during the day.

Before we get back to the list and explain the ratios we’re using and why one list is just not enough, let’s understand what dividend income really is.

What is dividend income?

Basically when a corporation that is publicly listed generates profits, it could either reinvest, retain and save, or share the returns with shareholders in the form of dividend payments. Unlike interest, dividend changes from year to year and companies can choose just not to give any.

For instance, let’s say a share is worth Rs 50 and the dividend for the year is announced as 5% that means the dividend you will get is Rs 2.5 per share. If you have 1000 shares, you will earn Rs 2500 in dividends.

For some investors, earning dividend income is their favorite way to grow and invest. While this is a good investment strategy, one should know that dividends are never guaranteed and companies have the right to decide not to announce dividends or announce less than expected dividends. We will later come around to how this happens more in some sectors and less in others.

What ratios should I look at before investing for a dividend?

This article isn’t targeted towards those investors that know their ratios well and understand market dynamics. This is a basic finance 101 for those that are new to investing on the stock market and are doing their research. We will look at the forwards and trailing dividend yield, the forward and trailing Price Earnings Ratio, and the trailing Price to book ratio.

“The market is forward looking so that is why we look at the forward ratios. However, when we want to look at historical performance and the track record for a scrip, we look at trailing ratios as well,” says Fahad Rauf, Head of Research at Ismail Iqbal Securities. For the purpose of this story, we will be using ratios derived from Bloomberg. “The estimates for the forward ratios are from Bloomberg. For instance, in the case of the forward dividend yield, Bloomberg takes estimates from various analysts and releases estimates in accordance. They can be right or off depending on whether everything goes as per analyst expectations or whether there is an exogenous shock,” Rauf explains.

Dividend yield

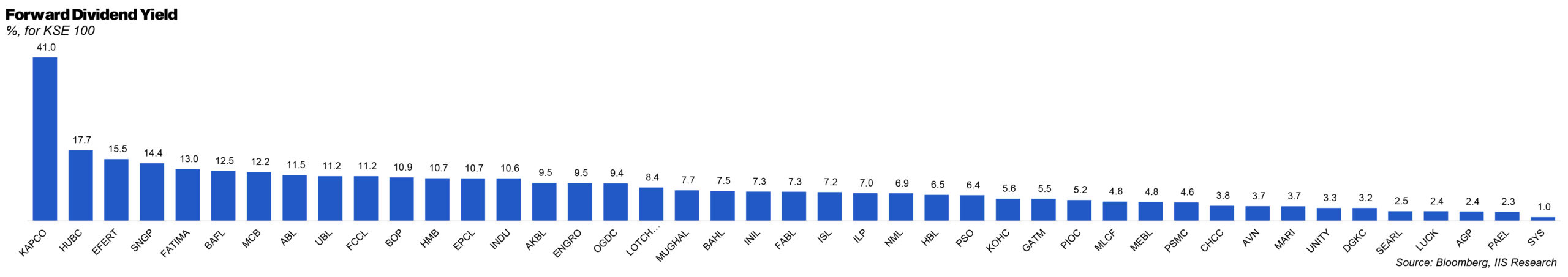

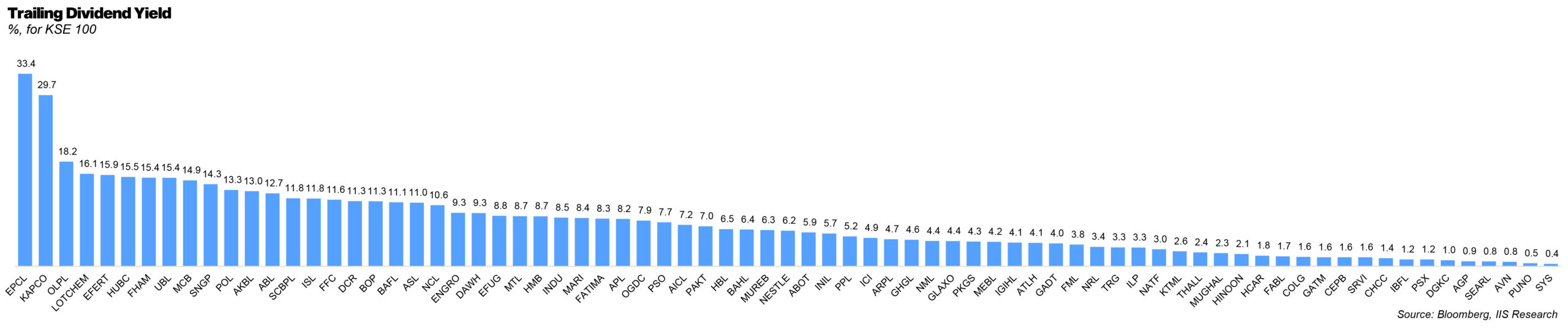

To understand what a forward and trailing dividend yield is, we need to understand what exactly is meant by a dividend yield. Dividend yield is a financial ratio calculated in the form of a percentage that shows how much a company pays out to shareholders in the form of dividends each year relative to its stock price. Because this ratio is based on the share price, it changes as the price of the share rises or falls. This means that the dividend yield will rise when the price of the stock falls, and fall when the price of the stock rises.

A forward dividend yield is calculated by estimating the year’s dividend as a percentage of the current stock price. By taking the most recent actual dividend payment and annualizing it, one can get an estimate of the expected dividend and use it to calculate the ratio by dividing the future dividend payments by a stock’s current share price.

The opposite of a forward dividend yield is a trailing dividend yield that is calculated based on the company’s actual dividend payments made relative to its share price over the previous 12 months. This is best used when it is difficult to predict future dividend yields.

Let’s take an example. Let’s say company ABC has a current share price of Rs 50 per share and paid Rs 2.5 in annual dividends. The dividend yield is 5%. Let’s say due to issues within the company there are some issues with performance which are reflected by a fall in the share price to Rs 25. The dividend yield will now go up to 10%. While the dividend yield did rise, the reason behind it was not one that would be encouraging to invest.

Similarly, if the same share had fallen to Rs 25 due to short term political instability that has no impact on the performance of the company and instead is just due to an exogenous shock, one would suggest buying the stock as likelihood of the share returning to its regular price would be expected, moreover, as an investor you bought a dividend yielding share at a price lower than what you’d normally get.

“Industries that have matured, such as fertilizer and power perform better when it comes to dividend yield. This is because these companies usually have little room to grow. They don’t need to hold on to their profits to reinvest them in expansion activities. They also tend to have stable cash flows. Therefore, they are more likely to announce dividends,” explains Rauf.

On the flip side, when we’re talking about dividend yields, on the other end of the ladder we have industries like cement which are continuously growing. “They have expansion cycles so you cannot exactly expect higher payouts. However, one can get some dividend and also make capital gains,” says Rauf.

Price to Earnings Ratio

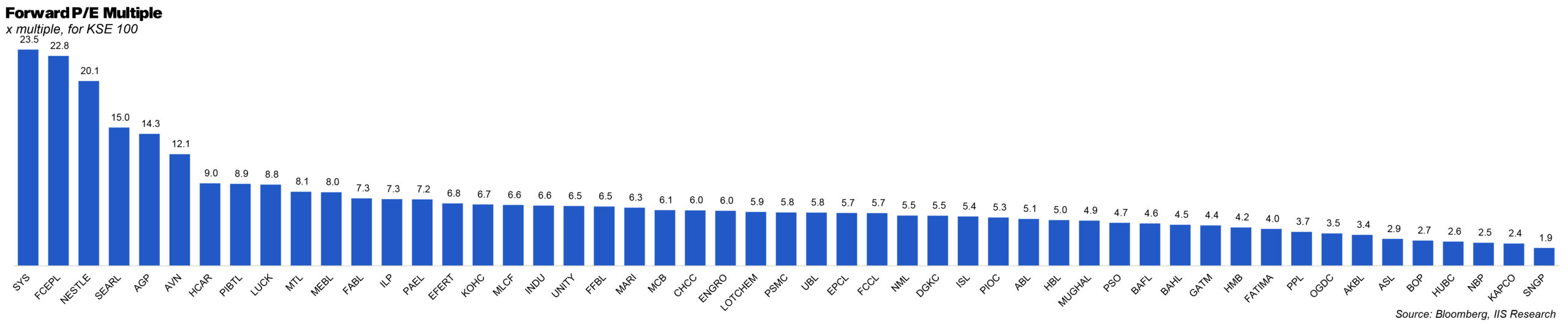

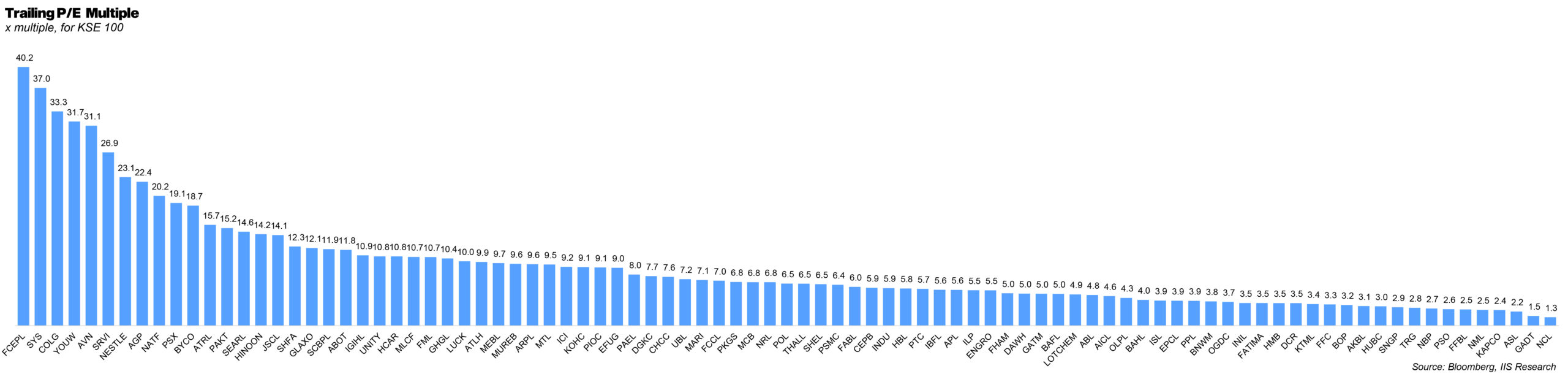

The next ratio we’re going to look at is the price to earnings ratio that is used to measure the current share price of a company against the earnings per share (EPS). The price to earning ratio is also called the price multiple of earnings multiples. It is calculated by dividing the market value per share by earnings per share.

A reason why this ratio is used is because it can be used to determine the relative value of a company’s share against its past record, against companies in the same sector, or sector aggregates over time.

A high price multiple could either mean that a company’s share is overvalued. It could also mean that investors are expecting it to achieve high growth rates in the future. The PE ratio can only be calculated for companies that earn. Companies that have no earnings or are losing money do not have PE ratios because the denominator cannot be zero.

The PE ratio is very important because it is most widely used to determine stock valuation. It is also used to determine whether a share is overvalued or undervalued in comparison to the sector or a benchmark or index.

Basically, the ratio gives you an expectation of how much return you can potentially “earn” off every rupee invested. It can also be perceived as how much an investor is willing to pay per rupee of earnings. For instance, if a company is currently trading at a PE multiple of 10x, that means that an investor is willing to pay Rs 10 for Rs 1 of current earnings.

One would assume that it is better to invest in a company with a lower PE multiple because you’re paying less for every rupee of earnings that you will receive. However, one needs to know the reasons behind the PE to make an informed investment. Chances are the share could be undervalued and the market hasn’t priced it correct yet. But it is also possible that the company has a low PE because its business model is headed towards saturation.

“For growth companies and sectors we look at the price earning multiple. The lower the better, keeping other things constant. However, one needs to factor and consider other ratios and the financial standing. For instance, look at the debt levels. Always look at the other factors,” explains Rauf.

The forward price earnings ratio uses the future earnings guidance. This is used to compare current earnings with future earnings. The trailing price to earnings ratio depends on past performance whereby the current share price is divided by the total EPS for the past one year. One downside of using the PE multiple as your only metric while investing on the PSX is that you can’t assess many stocks and sectors using it such as tech and consumer goods. “This is because, in the case of tech, earnings aren’t the focus. The objective is to achieve scale and then translate it into earnings,” states Rauf.

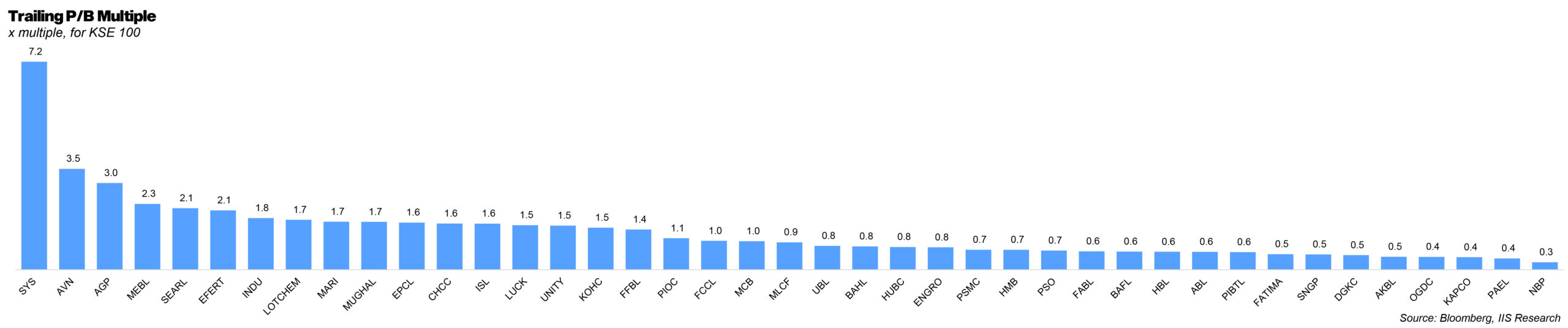

Price to book ratio

“In the case of banks, one should check out the price to book ratio,” says Rauf. The price to book ratio is the ratio of the market value of a company’s shares over its book value of equity. The book value of its equity means the value of the assets expressed in the statement of financial position. The book value is defined as the difference between the book value of assets and the book value of liabilities.

This ratio is primarily used to understand whether a share is valued properly. So if a stock is trading in line with the book value of the company, it’s fairly valued. If it has a low P/B ratio then it is undervalued, a high ratio means it is overvalued. The ratio is used for comparisons between companies in the same sector preferably companies with a similar asset and liabilities standing.

Tips for investors?

While these are definitely not all the ratios you need to be a finance whiz, these will get you going on your journey to investing. One tip, however, is to do your own research and consider all factors. Do not look at ratios as a standalone. Moreover, remember that all industries are different and so are their dynamics.

This is not an article meant to offer specific advice on what to invest in. In fact, unless you are being paid for the service, there is no point in offering investment advice. At best the person makes money off the person advising’s intuition, and at worst the person asking for the advice bad mouths the other person after losing money. The purpose is to help new investors understand that merely getting some dividend shouldn’t be the end goal of your investment journey. The goal should be to maximize your returns.