On the first of August, the month Pakistan celebrates a landmark of 75 years of independence from British colonial rule, came the end of an era that predated the country’s existence.

One of the last active vestiges of global imperial rule is set to disappear as Imperial Chemical Industries (ICI), one of the best known brands in corporate Pakistan, and indeed for many years around the world, announced their intention to change their name.

To be sure, ICI Pakistan was no longer run by the imperial colonisers of old, but the name had been retained because of its brand value even under new local ownership.

It was bittersweet for the company, with the name change being announced alongside solid results for financial year 2022 that saw a greater than 50% growth in revenue and a 70% increase in operating profits.

The company announced that it intended to rename ICI Pakistan to Lucky Core Industries Limited. The change, if implemented, would mark the end of the ICI name in Pakistan, which was the last territory in the world to still hold on to the name that once spanned across the world during the colonial era.

If anyone has been following the recent developments at the Pakistan Stock Exchange (PSX), they are likely to have come across a few significant updates including making decisions regarding expansion, disinvestments, investments.

ICI Pakistan

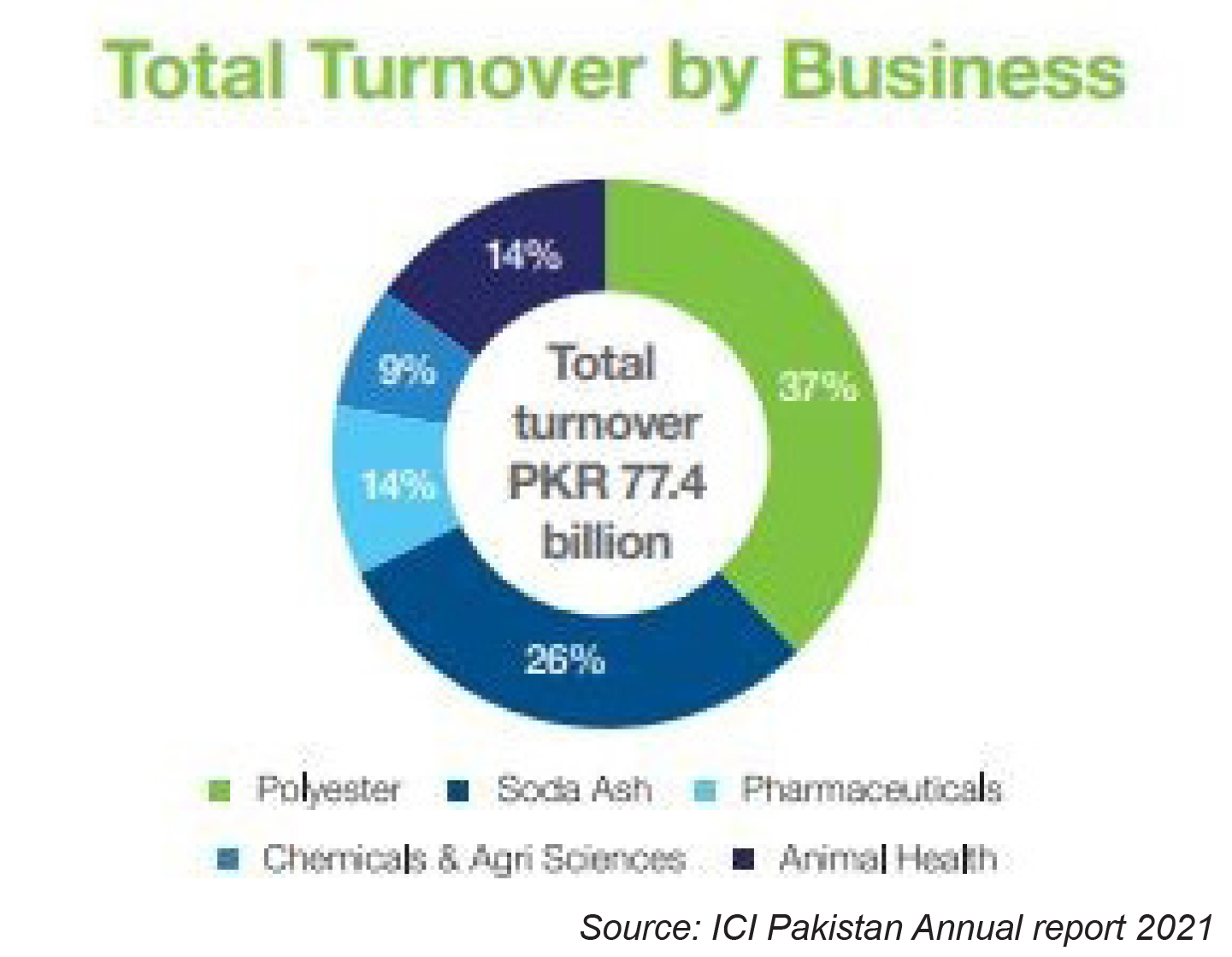

ICI Pakistan Limited is a manufacturing and trading company whose primary business segments are Polyester, Soda Ash, Chemicals, Pharmaceuticals, and Animal Health.

The company also has two subsidiaries, NutriCo Morinaga (Private) Limited, which is a joint venture with Japanese Morinaga Milk Industry Co, which manufactures Morinaga infant formula, and a wholly-owned subsidiary, ICI Pakistan PowerGen Limited, that was set up in 1991 to supply power for the consumption of the company’s Sheikhupura based polyester plant.

ICI’s history is rich, and reads almost like a story.

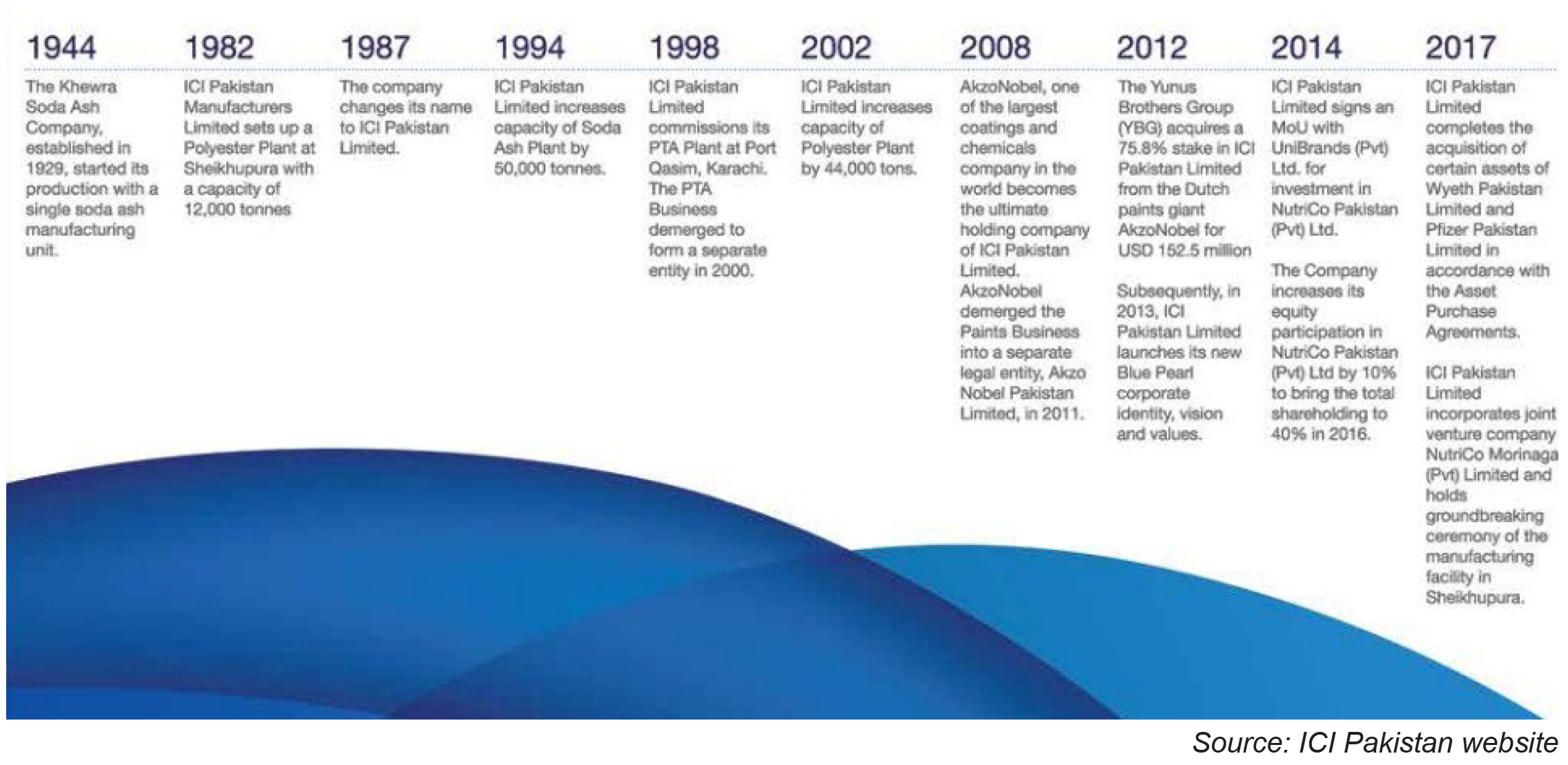

This story begins before Partition, in 1944, in Khewra, district Jhelum. It is when the company started the production of soda ash, a precursor to several industrial chemicals. After 1947, ICI incorporated its Pakistan assets under Khewra Soda Ash Company Ltd, which was set up in 1952, and in 1966 the company was renamed ICI Pakistan. At least one ICI subsidiary has been listed on the Karachi Stock Exchange since July 1957.

The post-Nationalisation era under Bhutto was fraught with fears. Many Pakistani businesses shifted focus to trading as investors lost confidence to set up manufacturing facilities in the country. However, ICI continued to thrive with the backing of its international parent. Also, for those who grew up in the 80 and 90s especially, it will be remembered that ICI was the main source of human capital development. Alongside CitiBank, ICI was the employer of choice for educated Pakistanis. Asif Jooma, CEO of ICI, while addressing the Leaders at LUMS conference in 2018 stated, “ICI was a significant leader feeder for the economy and it continues to be. If you do a quick scan of the corporate landscape of Pakistan, you would invariably find people that have in some shape or form been associated with ICI during their careers.”

The company did so well during those years that back in 1995, its international parent, ICI PLC, made its largest ever overseas investment in Pakistan, to set up a manufacturing facility of Pure Tperethalic Acid (PTA) at Port Qasim.

However, In 2008, the global parent of ICI was bought out by Dutch paints and chemicals giant AkzoNobel, following which ICI Pakistan became part of AkzoNobel worldwide. The global acquisition marked an end to a multinational British giant and an icon from the era of industrialisation.

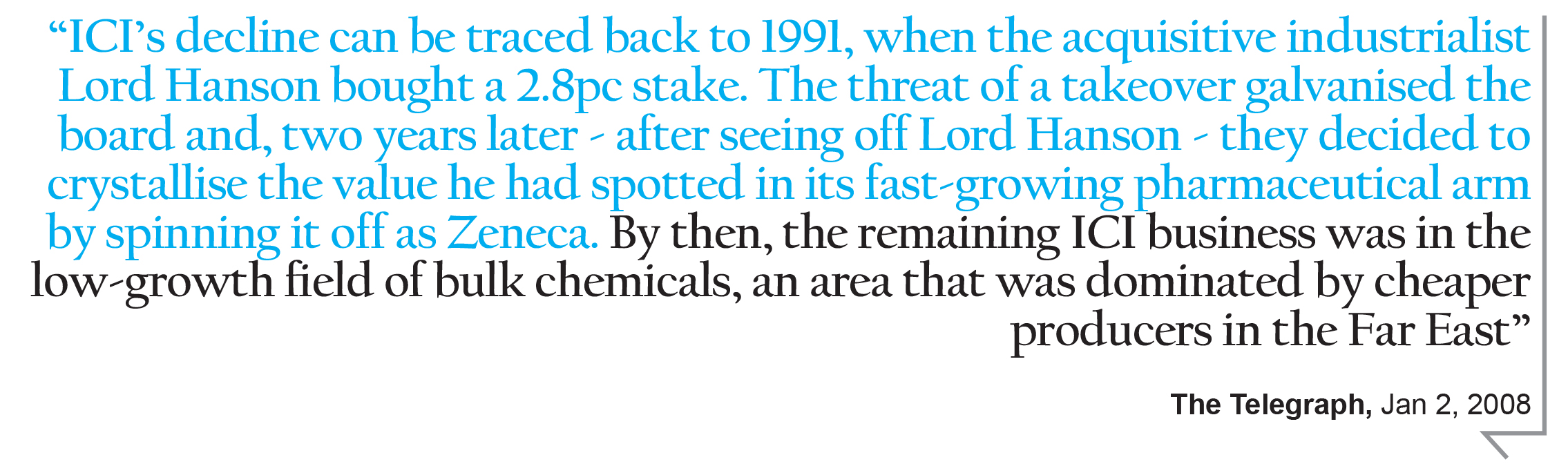

ICI by the time it was acquired, was struggling to live up to its legacy. There were several reasons for this. Some considered the spin-off of its pharmaceutical and agrochemical businesses in 1993 to be the starting point for its downfall.

According to an article published in Telegraph on January 2, 2008, “ICI’s decline can be traced back to 1991, when the acquisitive industrialist Lord Hanson bought a 2.8pc stake. The threat of a takeover galvanised the board and, two years later – after seeing off Lord Hanson – they decided to crystallise the value he had spotted in its fast-growing pharmaceutical arm by spinning it off as Zeneca. By then, the remaining ICI business was in the low-growth field of bulk chemicals, an area that was dominated by cheaper producers in the Far East.”

For others, multiple factors, including a risk-averse strategy, internal management rifts, and bad investments, were the architects of ICI’s downfall.

Further, challenges faced by ICI Plc at the global level were creating constraints for its Pakistani subsidiary. One such step was the disinvestment of the soda ash and fiber business at the international level which, for the Pakistani subsidiary, was a major revenue driver. Thus, the Pakistani soda ash and fibre business became more of a regional concern rather than a global strategic priority.

Back in 2012, Jooma wrote an article for Business Recorder, stating, “Investment by ICI PLC as a strategic imperative became short and scarce as it struggled with its own repositioning and consequent debt and its newly acquired portfolio from Unilever had no significant potential in the Pakistani market. This was particularly detrimental to the regional businesses’ soda ash/polyester fibre, which required regular investment to maintain market position and cost competitiveness by expanding the scale of operation. This imperative became even more critical in this period as protective tariffs began to be lowered which unleashed vicious Asian competition wishing to dump products to fill up their huge expensive capacities. This phenomenon continued from time to time into the new millennium as well.”

In 2010, AkzoNobel international decided to focus on the paints business, its global specialty, and spin off chemicals business. The spin-off, labeled a “demerger”, was completed in May 2012, creating two separate companies in Pakistan: AkzoNobel Pakistan and ICI Pakistan, though, at the time, both were owned by the global AkzoNobel. The process to find a buyer for ICI Pakistan began in June 2012 and ended with the Yunus Brothers Group (YBG) – the industrial conglomerate that owns Lucky Cement, KIA Lucky Motors, and Yunus Textiles among others – winning the bid to buy out the industrial chemicals business that was the new ICI Pakistan.

The foundation stone for YBG was laid back in 1962, as a company trading in textiles, rice, and other commodities. In 1981, the group first ventured into the manufacturing space by setting up a textile mill, Lucky Textile Mills. Leaping from success to success, it established multiple textile units across the country before diversifying in 1994 to cement manufacturing creating Lucky Cement. Next, the company diversified by acquiring ICI in 2012, as mentioned earlier, and entered the automobile business by setting up KIA Lucky Motors, a Joint venture with Korean automobile Manufacturer, KIA.

The company held on to the ICI brand name as it believed that there was significant brand equity to be taken advantage of. This was the same reason why AkzoNobel retained the ICI name in Pakistan while dissolving it globally. According to an article published in 2008 in the Telegraph, “In Britain, where Akzo is already established and ICI’s client problems five years ago ultimately led to its unravelling, an unsentimental break from the past is likely. Elsewhere, the ICI name still carries valuable currency – particularly in the former Asian colonies where Akzo has no notable presence.”

Financial Performance

Financial Performance

ICI is the second largest chemical manufacturer listed on the PSX. While its group company, Lucky Cement is the 10th largest company on the stock market in terms of market capitalisation.

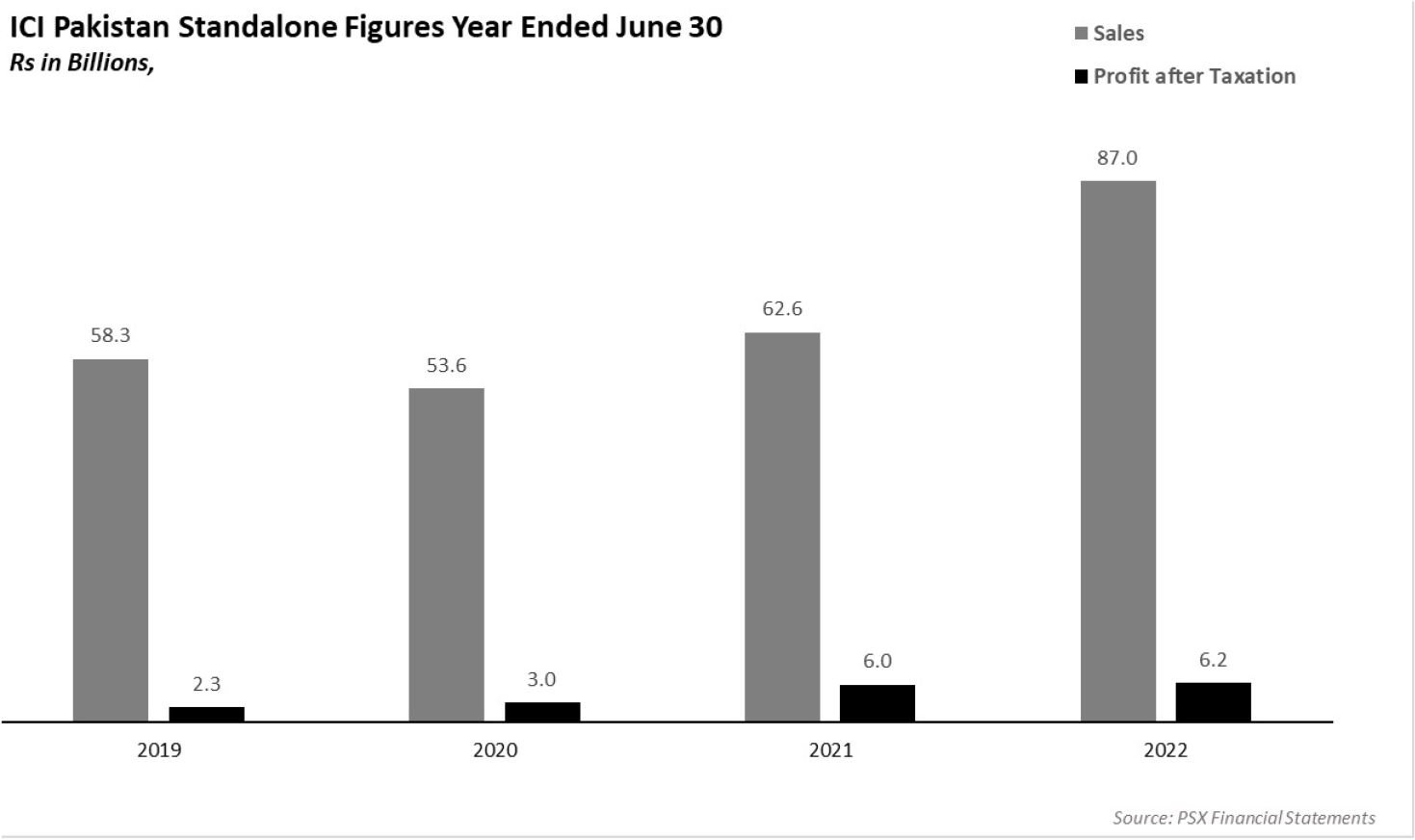

The company filed its financial results for the year ended 30 June 2022 in the first week of August. It clocked in net revenue of around PKR 100 billion, which was 52% higher compared to the preceding year. Operating profits also grew by 72% to PKR 13.8 billion. As a result, the consolidated net earnings increased by PKR 3.66 billion to PKR 8.86 billion.

The majority of the revenues were earned by the group holding company, ICI Pakistan Limited, whose standalone figure was around 87% of the total turnover.

The company benefited from recovering demand and was able to post impressive figures despite the one-off super tax (the primary reason for the fall in net profit margin in 2022). Furthermore, the company declared PKR 15 dividend per share even after announcing its intention to acquire Lotte Chemicals which indicates a strong cash flow position.

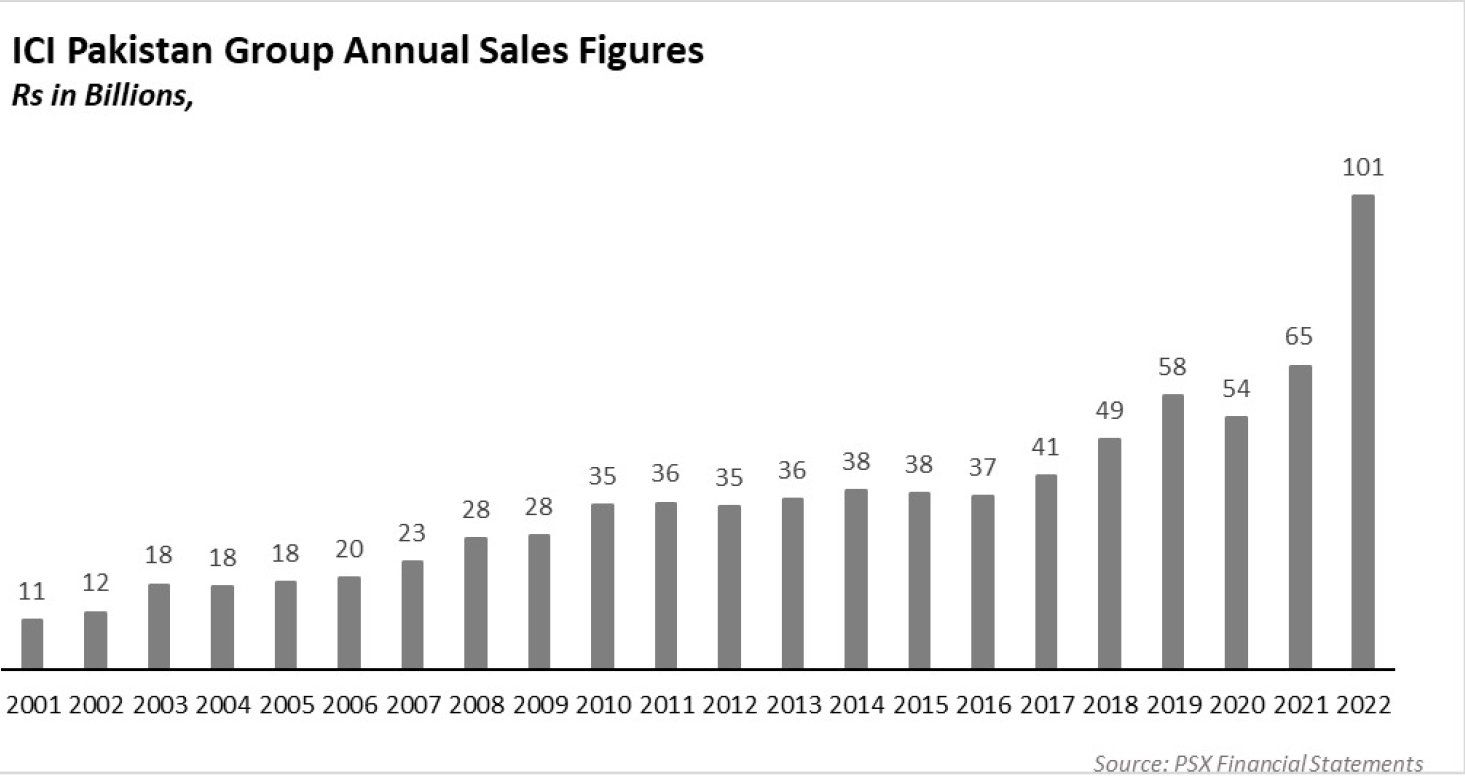

Historically, ICI Pakistan has shown decent growth in terms of revenue. Between 2001 to 2011, the company was part of multinational groups and grew by 11.65% per year, on average. The growth rate slowed a bit under YBG as the company was only able to expand its revenues by around 10.19% on an annual basis between 2012 to 2022. However, under the control of local owners, the group’s efficiency increased on the back of a better understanding of the Pakistani market. The gross profit margin went from 16% in 2011 to 21% in 2022. While the operating margins increased from 7% to 14% during the same period.

Recent events

In August last year, the company acquired an additional 11% stake in NutriCo Morinaga Pakistan, bringing it under the umbrella of the ICI Pakistan group as a subsidiary, due the total stake of the manufacturing giant increasing to 51%.

However, a few months later, in July this year, the joint venture partner in the infant dairy business, the Japanese partner, Morinaga Milk, sent a conditional offer to buy one-third of the share capital from other partners against consideration of $56.6 million. ICI’s board has approved the sale of 26.5% shares (out of the 51% holding) in the subsidiary for $45 million. This translates into a payment of $2.07 per share. The transaction is subject to shareholders’ approval that would be sought in the company’s upcoming annual general meeting scheduled to take place on the 27th of September.

However, the restructuring didn’t stop here. A week after the initial announcement to sell off a partial stake in NutriCo Morinaga Pakistan, the company was again in the market, but this time to buy something.

It filed a notification with the stock exchange announcing its intention, as per the letter, “to acquire approximately 75.01% shareholding comprising 1.135 billion shares of Lotte Chemical Pakistan.” Lotte is another prominent player in Pakistan’s chemical industry, and buying a controlling stake in the company would allow ICI to cement its position in the market.

The way forward

As ICI’s board has resolved to change its name from “ICI Pakistan Limited” to “Lucky Core Industries Limited,” it seems that the brand equity of the once global giant has diminished. Pretty much, like the size of the ICI logo on the Dulux paint (The brand name of the paint manufacturing division of ICI that was retained by AkzoNobel).

“This change will align the company’s name with its holding company, Lucky Cement Limited, which is a part of the Yunus Brothers Group (YBG). The proposed name draws on the strength of the Lucky brand, a leading, progressive, and diversified conglomerate.” (Read the announcement letter.)

Profit reached out to corporate law experts to understand the rationale behind this step and the regulatory procedure to be followed for materialising the change of name. The response was that it was a routine transaction, and companies prefer having a similar name for their subsidiaries to fortify the group’s goodwill. Case in point, First Microfinance Bank renamed itself HBL Microfinance Bank, at the beginning of this calendar year, to benefit from the goodwill of its patron, HBL.

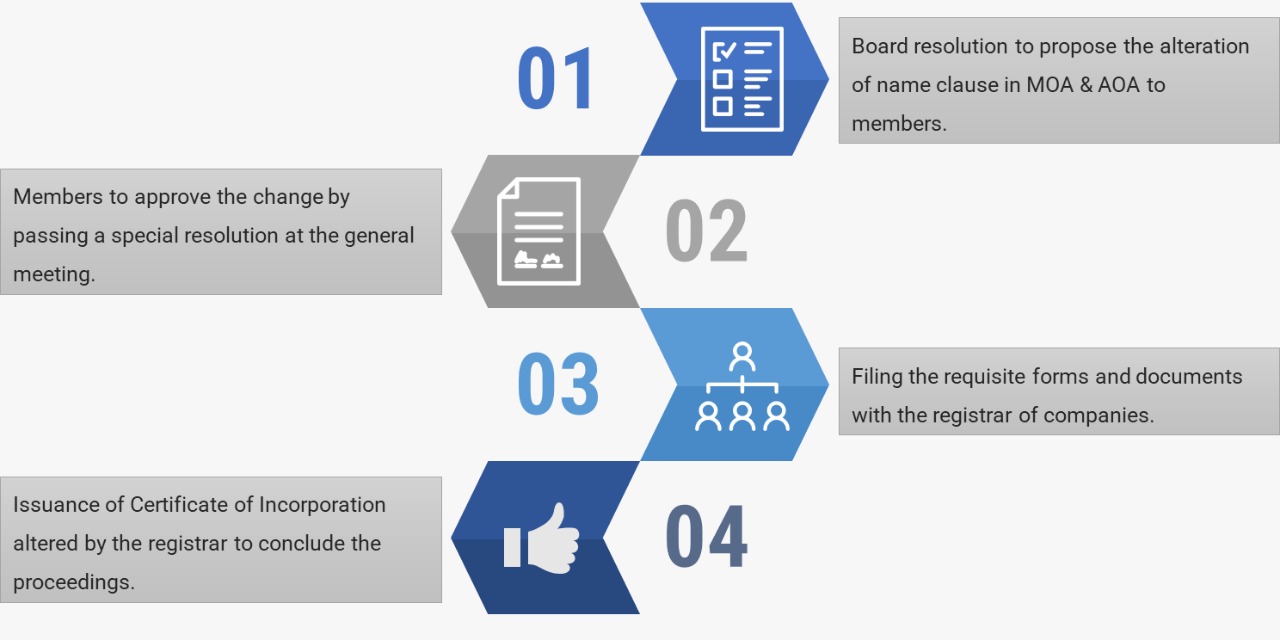

As per the Companies Act 2017, “A company may, by special resolution and with approval of the registrar signified in writing, change its name.”

A special resolution is a tool used to get the approval of members in a general meeting on any matter except for the consideration of financial statements and the reports of the board and auditors, the declaration of any dividend, the election and appointment of directors in place of those retiring and the appointment of the auditors and fixation of their remuneration.

Once members have approved the new name, ICI Pakistan must file the special resolution and amended company documents with the registrar.

The law states, “Where a company changes its name, the registrar shall enter the new name on the register in place of the former name, and shall issue a certificate of incorporation altered to meet the circumstances of the case and, on the issue of such a certificate, the change of name shall be complete.”

“Where a company changes its name, it shall, for a period of ninety days from the date of issue of a certificate by the registrar under sub-section (1), continue to mention its former name along with its new name on the outside of every office or place in which its business is carried on and in every document or notice referred to in section 22,” the law further adds.

However, the name change does not affect the rights and obligations of the company’s creditors, debtors, or any other stakeholder. Moreover, it has no implications on any ongoing legal proceedings against the company.

As per ICI, the final curtain on the name change will be drawn at the end of the calendar year 2022, contingent on receiving the requisite approvals.

I have perused every one of your posts and all are exceptionally enlightening. Gratitude for sharing and keep it up like this.

사설 카지노

j9korea.com