In the last decade, we have addressed our power shortfall and blackout woes by doubling installed electricity from 22,813 MW in June 2013 to 41,557 MW in May 2022, according to the finance ministry’s economic survey.

In addition to this, the generation mix is being diversified by reducing dependence on residual fuel oil (RFO) by replacing it with regasified liquefied natural gas (RLNG). Similarly, cheap sources of energy, such as renewable energy and coal-based power, are synchronised to the national grids.

However, despite this, electricity prices are continuously growing. Average power tariffs have almost doubled in the same period.

The cost components

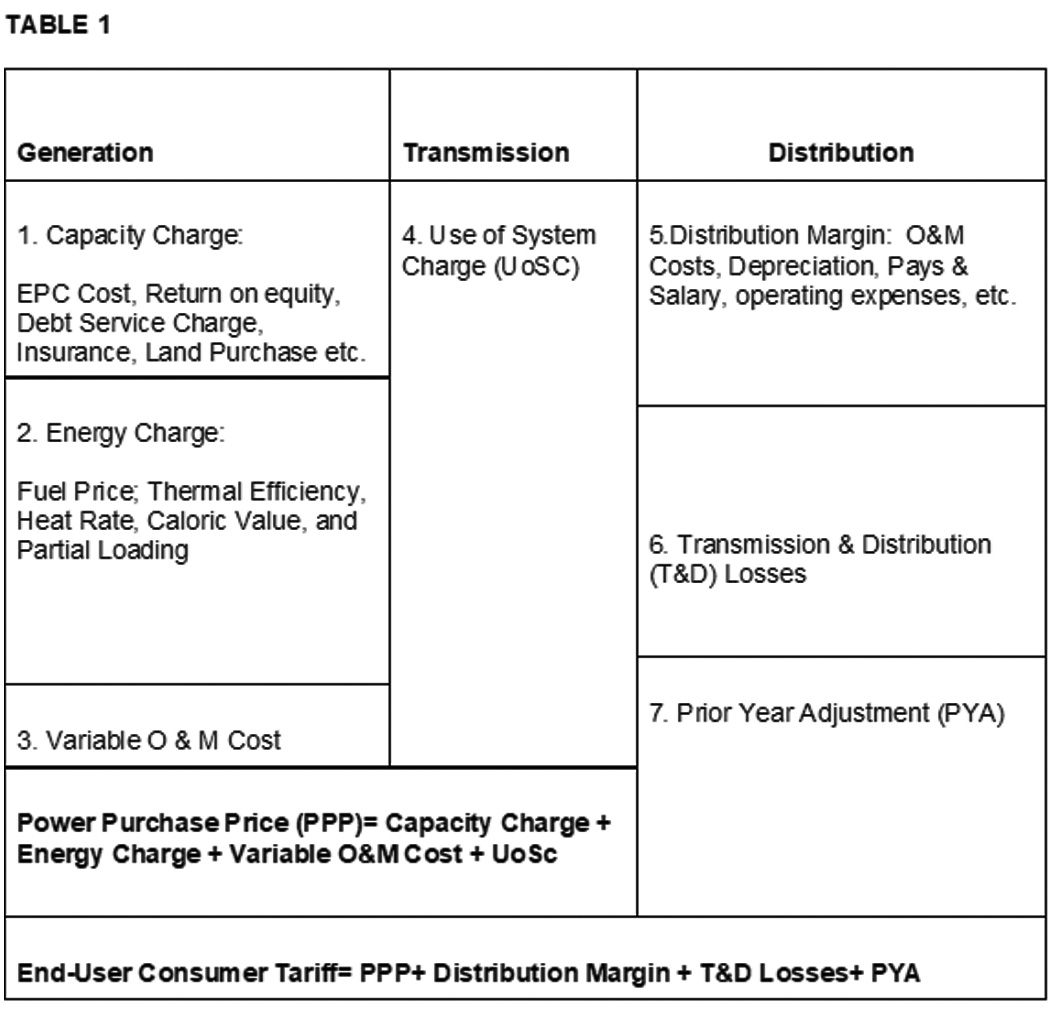

To understand why, one needs to understand the composition of the price – that is, the “end-user consumer tariff.” An illustration of this is provided in the table below with costs and charges incurred at different stages of the electricity supply chain, according to the National Electric Power Regulatory Authority (Nepra).

Now to understand the table’s components.

At the generation level, there are three components. The price of fuel as well as operation and maintenance (O&M) costs are variable components, which depend on fuel mix used for generation, for example gas, coal, RLNG, along with the amount of electricity produced and sold. On the other hand, the capacity charge component is a fixed cost, which is indexed quarterly or annually with multiple parameters, such as exchange rate, London Interbank Offered Rate (Libor), as well as local and U.S. consumer price index (CPI).

At the transmission level, National Transmission and Despatch Company (NTDC) imposes a Use of System Charge (UoSC) for providing a carrier between power producers and distribution companies (DISCOs). UoSc is applied by NTDC to cover its return on investment (ROI), repair and maintenance (R&M) costs, administration expenses, corporate taxes and debt servicing.

Finally, at the distribution level, there are three components. DISCOs are allowed distribution margins to cover R&M, pay and allowances, depreciation, and other expenses. Then there is the transmission and distribution loss component, as well as prior-year adjustment (PYA) component.

All of this is used to come to the end-user tariff.

Why the rise?

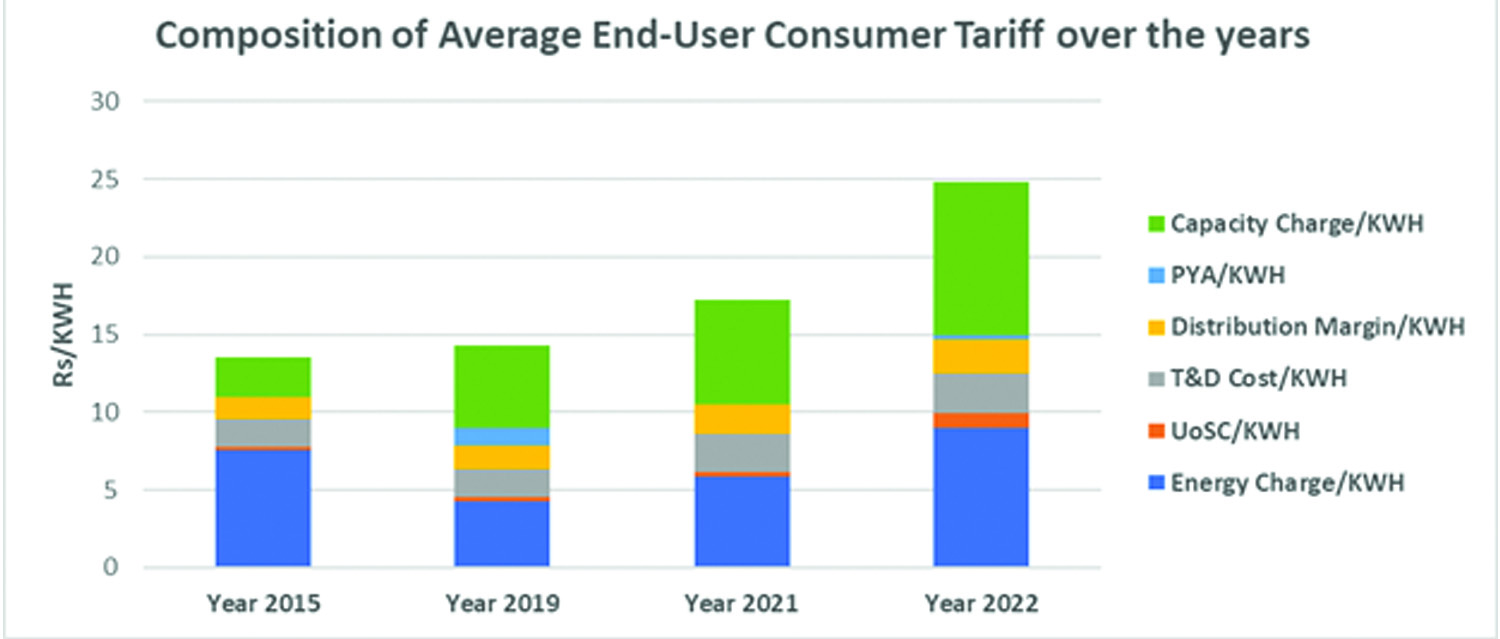

Now that we know the components, we’ll discuss the rise in costs, as reflected in the table below, using Nepra data, which shows the end-user consumer tariff has almost doubled in the last 10 years from an average price of Rs 13.50 per kilowatt hour (Rs/KWH) to Rs 24.82.

In 2015, variable costs of fuel and O&M constituted almost 56%, that is Rs 7.53, of the cost. The capacity charge share was a meagre Rs 2.49, almost 18%. However, the capacity charge has quadrupled to Rs 9.77 and is the main contributor to the exorbitant tariff rate of 24.82 Rs/KWH. Importantly, capacity charges, which stood at almost Rs 188 billion in 2013, have ballooned to a whopping Rs 1,250 billion at a compound annual growth rate (CAGR) of 23.43%.

The shares of variable fuel, O&M, distribution margin and T&D are almost stagnant over the same period. This also bursts the myth that T&D losses are the main drivers for increasing power rates. Data suggests that the contribution of T&D losses to tariff is stagnant if not declining.

Understanding capacity payments is also important. Over the years, we have developed a capacity market to ensure sufficient capacity to meet peak demand at all times. In turn, investors are incentivised by paying them capacity payments to install base load power plants with plant factors exceeding 85%.

The flip side of the capacity plants is that the capacity charge is a fixed cost which is charged in consumer bills even if not a single unit is produced. Similarly, depreciation of the rupee to the dollar increases the capacity payments as it is indexed to the dollar due to debt servicing, ROE, insurance costs etc.

Currently, we are facing a double jeopardy situation because the efficient base load power plants recently added to the national grids use imported fuel for generation. Due to higher fuel costs, these plants are underutilised and consequently unable to recover their capacity costs and the country is facing acute power shortages despite availability of capacity to produce.

Going forward, we must learn from the current precarious situation and correct our policy decision making for future electricity generation. Foremost, base load plants should have local fuel – that is, indigenous coal, hydro, nuclear, and long-term contract RLNG. By doing so, the energy purchase price (EPP) will be reduced substantially, and subsequently capacity purchase price (CPP) will be recovered, henceforth not contributing power tariff hikes. Secondly, the overall purchase price (EPP+CPP) should be used for determining the Economic Merit Order (EMO). Thirdly, investment in the transmission network is required to remove bottlenecks so that the EMO is not violated. Moreover, preferential addition of renewable energy in the national grid be made to reduce overall average tariff. With a major policy shift, we can make the electricity sector more affordable for end consumers and increase power consumption per capita.

Excellent Analysis……

Capacity payments means rental capacity but you still need to provide fuel ⛽

Informative

Very informative brother

A typical residential home uses alternating current (AC) electricity. AC is normally delivered via electricity transmission lines, which run along roads and highways, and is transmitted to local substations. These substations convert the electricity into direct current (DC), the type used to power household devices. The electricity produced at substations ranges from 120 VAC/240 VAC to 277VAC/500 VAC depending on the locale.

Electricity is created by connecting a generator to a motor and sending it through a series of gears. The gears create a constant motion, which in turn creates a continuous flow of electrons — the electricity. The electricity travels from the generator to the motor through wires called conductors. The number of conductors inside a wire varies based on the size of the current being delivered. Smaller amounts require fewer conductors than larger amounts.

The speed at which the generator turns determines the frequency at which the electrons oscillate. Higher frequencies mean lower voltages. Lower voltages mean higher voltages. Voltage is measured in units of Volts. Most commonly, 110 VAC is used in North America, 115 VAC is used in Europe and 240 VAC is used in Australia. Frequency is measured in hertz and ranges from 50Hz to 60Hz.

A three phase system consists of three separate circuits, each with a different frequency. Each circuit is separated by two magnetic poles of opposite polarity (like north and south). Three-phase systems have been used since the 18th century to generate electricity because they allow for much greater efficiency.

Three-phase power is often preferred by companies for its stability and reliability. However, most small scale applications do not require this level of control due to the relatively large cost involved in installing the equipment. Instead, a single line can serve many smaller loads without any problems.

One disadvantage of three-phase power is that it produces less torque than single-line power. Another disadvantage is that if one phase fails, it affects other phases. Additionally, three-phase power is more expensive to install and maintain.

hi

whats up bro

Welcome to Versatile Coupons, the final location for getting a versatile deal on your internet-based buys. Our central goal is to assist customers with enjoying you find the best arrangements and limits on the items you love. We comprehend that setting aside cash can be intense, particularly while shopping on the web. That is the reason we’ve made it our objective to present to you the best-in-class coupons and markdown codes from top retailers. Whether you’re looking for garments, gadgets, or home merchandise, we take care of you.