{Editor’s note: There are no women banking CEOs on this list. Unfortunately, there is a conspicuous lack of female bankers in top roles. Currently, UBL is the bank paying their CEO the most. The current CEO’s predecessor was a woman, Sima Kamil, who was not paid nearly as much as the bank is paying their CEO now. In fact, when she joined UBL Sima was paid Rs137 million per year, which was significantly reduced to Rs 94 million in 2019. Banks talk a big game about financial inclusion, a big part of which is bringing women into the fold of banking. However, it is disappointing to see that the barriers to entry for female executives continue to be high and mighty.}

How much does the highest paid banking professional in Pakistan take home every year? The figure comes out to Rs 34 crores 86 lakhs and 60 thousand. That is a salary of nearly Rs 3 crores a month. In that money you could reasonably (or actually very unreasonably) buy roughly 49 PTA approved iPhone 14 Pro Max 128 GBs in a month. Or you could instead buy a 1 kanal plot in DHA Phase 6 Lahore every month, or two Toyota Fortuners a month.

Yet the position of top-dog in Pakistan’s banking industry is a lonely one. The banking mountain is made out of 31 banks — five of which are public sector banks, 22 are private commercial banks, and four are foreign banks. Heading these banks are 31 CEOS or Presidents. All men. All professional bankers. All ridiculously well paid. And all constantly trying to edge each other out.

What some outside the industry may not know is that banking is one of those professions where being a ‘company-man’ is not a point of professional pride nor a good career move. After bankers hit a certain level in one organization, they regularly shift around, bouncing from one financial institution to another. In fact, most bankers aspire to head not one bank that they’ve worked at their entire lives but to have been part of multiple big banks and hopefully reach the top-slot in at least a couple.

But while the big-boys of banking splash around in the big-bucks that they are making, there are two big questions? How much money do all of these bank bosses make, and do they deliver the bang for the back that their employers spend on them? To determine this, Profit has ranked banking CEOs and Presidents in order of how much money they make but with a caveat — what is the return on investment that these high salaries give to the bank? That is why along with every Bank CEO’s salary, we have calculated the returns they generate – namely the return on assets and the return on average equity.

The methodology

There is no one way to measure which CEO delivers the most substance for the amount of money they are paid. For starters, this is a very subjective matter. No reasonable value of money can be paid on leadership for example. Then there is the fact that the key-performance-indicators (KPIs) that these CEOs are hired on the basis of are rarely public knowledge. For example, a CEO could be paid a lot because they are taking over a bank that is in trouble precisely to fix that bank’s workings. A CEO that has a stint for five years at a bank could see their work come to fruition years after they have left under the stewardship of a different CEO. At the same time, the CEO of a large bank will have a much tougher time having an immediate impact as the CEO of a small bank.

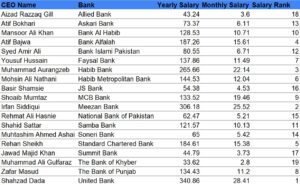

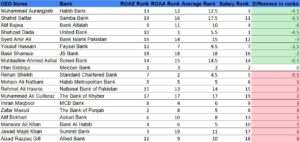

However there are some ways to rank them. The first one is the simple — who gets paid the most. That is the order in which we have listed these CEOs. Without taking into account travel, bonuses, and other such extravagances we have ranked them on the basis of their annual salary. After this, we have also included two other categories — return on average assets (ROA) and return on average equity (ROEE).

Return On Assets (ROA) is a profitability ratio that illustrates how much profit a company can generate from its assets. This ratio measures how efficient a company’s management is in earning profit from the economic resources or assets they have on their balance sheet. The higher the number, the more efficiently the assets are used by the management to generate profits.

Return on Average Equity (ROAE), is a profitability ratio that measures the amount of net income compared to the average shareholders’ equity of a company. The formula is used to assess the performance of the company based on how well it uses its shareholder’s investment to make a profit. We are not using the return on equity because ROAE offers a more accurate outlook on the general profitability of the business as there are changes in the percentage of owner’s equity throughout the year. This helps take into account any sharp changes in the equity and gives a fair review. Net income is divided by the average shareholder’s equity. The average equity is calculated by dividing the sum of beginning equity and ending equity by 2.

On all of these scales, the banking CEOs are ranked differently. To determine a final tally we have averaged out the ranks on both of these scales and compared them to how high the CEO in question is placed on the salary scale. So for example, if a bank CEO is ranked 4th on ROA and 2nd on ROAE their average rank comes out to 3rd. And if they are, for example, fourth on the list of highest paid CEOs it means they are possibly underpaid. This final calculation is not hard maths, but it is a bit of indulgence just to put things into perspective. There are also other limitations in this methodology, particularly since the size of the bank often skews the calculations. That is why the priority has been given to the ranking of who gets paid the most, and that is the order in which the names appear.

The final analysis of whether a bank CEO has been worth the money can only properly be determined after their tenure ends. But without further ado, these are the highest paid banking CEOs in Pakistan.

The top 10 (by salary)

Shahzad Dada – United Bank Limited (UBL)

Yearly salary: Rs 340.86 million

ROA Rank: 5

ROAE Rank: 10

Average Rank: 7

The highest paid banking CEO in 2021, he is currently the president and CEO of UBL. At the helm for the past two years, Dada took over the reins of UBL from Sima Kamil and joined the back with a significantly better package than his predecessor had. This is also not Dada’s first stint as CEO of a bank, but it is his first time heading a local bank. Before this, Dada served Standard Chartered Bank as CEO for over five years, and as CEO and Managing Director of Barclays Bank in Pakistan before that. He has also remained a director at Deutsche Bank. Dada is a graduate of the Wharton School of University of Pennsylvania.

Irfan Siddiqui – Meezan Bank

Yearly salary: Rs 306.18 million

ROA Rank: 1

ROAE Rank: 2

Average Rank: 1

Siddiqui is the founding president and CEO of Meezan Bank. He is also a member of the Information Technology Committee and of IFRS 9 Implementation Oversight Committee of the board. He has held several senior management positions including chief executive officer at Al Meezan Investment Bank Limited, general manager at Pakistan Kuwait Investment Company, advisor to the managing director at Kuwait Investment Authority, manager finance and operation at Abu Dhabi Investment Company, and senior business analyst at Exxon Chemical (Pakistan) Ltd. He has also served as the president of the Overseas Investors Chamber of Commerce and Industry.

Muhammad Aurangzeb – HBL

Yearly salary: Rs 265.66 million

ROA Rank: 13

ROAE Rank: 13

Average Rank: 14

You would think the HBL CEO would be the highest paid but he actually comes in at number three. Aurangzeb joined HBL in 2018 as the President & CEO. Prior to this responsibility at HBL, he was the CEO of JP Morgan’s Global Corporate Bank based in Asia, with experience in international banking spanning over 30 years in other senior management roles at ABN AMRO and RBS based in Amsterdam and Singapore. He is the only Pakistani to be invited to the exclusive membership of the Global CEO Council organised by the WSJ/DowJones group. He is also chairman of the Pakistan Banks Association, chairman of the Pakistan Business Council, and council member at the Institute of Bankers Pakistan.

A seasoned professional, Aurangzeb probably has one of the toughest jobs in Pakistan’s banking industry. Most banks have legacy which comes with both prestige and baggage, but none more so than HBL. For one of the toughest gigs in the industry, holding firm in it is testament to his skill.

Atif Bajwa – Bank Alfalah

Yearly salary: Rs 187.26 million

ROA Rank: 12

ROAE Rank: 9

Average Rank: 11

Bajwa is a veteran banker and his job at Bank Alfalah is not his first time as CEO, nor his first time being the CEO at Alfalah. He was the president of the bank for over five years before he resigned in 2017 for personal reasons. He has also previously worked as the president and CEO of MCB Bank and Soneri Bank. He was also the country manager for ABN Amro Bank and the chairman of the Pakistan Business Council.

Prior to rejoining Bank Alfalah in February 2020, Bajwa was appointed the president and CEO of the Bank of Punjab. He, however, excused himself from the position. He has long been a stalwart of the banking industry and is a favoured man for owners when they want to get their bank out of trouble.

Rehan Sheikh – Standard Chartered Pakistan

Yearly salary: Rs 184.61 million

ROA Rank: 1

ROAE Rank: 7

Average Rank: 3

On the top of our ROA calculations, Rehan Sheikh is one of the highest ranked CEOs on our list. With a career spanning over 38 years in banking, Sheikh has been serving as CEO of Standard Chartered Bank (SCB) in Pakistan since August 2020. Prior to joining, he was the CEO of SCB’s Islamic Banking Group, a position he held for over four years. Sheikh has previously been a senior vice president at Dubai Islamic Bank, head of corporate and institutional banking at SCB, and senior director and corporate banking head at American Express. Throughout his career, he has held positions in diversified roles including in corporate relationship management, risk management, remedial management, international trade finance and branch management.

Mohsin Ali Nathani – HabibMetro Bank

Yearly salary: Rs 144.53 million

ROA Rank: 4

ROAE Rank: 5

Average Rank: 4

Nathani is a seasoned corporate banker with more than two decades of experience and has been the CEO of Habib Metro Bank for the past four years. He started his career at CitiBank where he worked as a relationship manager for their corporate clients. He then spent the next seven years at ABN Amro working as Head of Asian Syndicated Loans business and Head of structured finance Asia. Nathani then went back to CitiBank and served as the regional head of Corporate Banking – Middle East. Here he served as CEO of Islamic Banking too. From CitiBank, Nathani moved to Barclays where he was country head and managing director for Pakistan. He then made his way to Standard Chartered as CEO where he served for five years.

Yousaf Hussain – Faysal Bank

Yearly salary: Rs 137.86 million

ROA Rank: 7

ROAE Rank: 12

Average Rank: 9

Hussain was appointed as the CEO and president of Faysal Bank in 2017. He has been with Faysal Bank Limited since August 2008. Hussain has over 22 years of multifaceted experience with prime local and multinational organisations, including multiple senior managerial and leadership positions within business and more recently within risk management function, primarily at ABN AMRO Bank and Faysal Bank Limited. His experience also includes a senior role with Samba Bank as the country head, global transaction services business and earlier assignments with Mashreq Bank and Mobilink.

Zafar Masood – Bank of Punjab

Yearly salary: Rs 134.43 million

ROA Rank: 8

ROAE Rank: 3

Average Rank: 6

The miracle man that survived a plane crash, Masood has not just defied odds in life but also been a lean, mean, banker that has hovered around the top of his industry. In May, 2020, Masood was approved by the Punjab government to head Bank of Punjab as its president. Masood’s career spans over 27 years during which he served at top positions for multinational banks in Pakistan and abroad. Masood has served as regional managing director and CEO for Barclays Bank Southern Africa. He has worked at senior positions at Citibank, American Express Bank and Dubai Islamic Bank. Masood was also appointed as the director general of National Savings by the Ministry of Finance, and he has been CEO (interim) of InfraZamin Pakistan – a DfID, UK driven initiative.

Imran Maqbool – MCB Bank

Yearly salary: Rs 133.52 million

ROA Rank: 3

ROAE Rank: 8

Average Rank: 5

Imran Maqbool served as President & Chief Executive Officer of MCB Bank Limited. He is a seasoned professional with over three decades of diverse banking experience. Before taking on the CEO position, he was Head of Commercial Branch Banking Group, where he managed the largest group of the Bank in terms of market diversity, size of workforce, number of branches on countrywide basis and diversified spectrum of products. In earlier roles, he worked as Head Wholesale Banking Group–North, remained Country Head of MCB Bank’s Sri Lanka Operations, spearheaded Islamic Banking and Special Asset Management Groups. Prior to joining MCB Bank in 2002, Maqbool was associated with local banking operations of Bank of America and CitiBank for more than seventeen years. He worked at various senior management level positions in respective banks.

Note:

Previously Profit had erroneously reported that Shoaib Mumtaz of MCB Bank was getting an annual remuneration of Rs233,519,000. In fact Shoaib Mumtaz took charge as acting president and CEO of MCB Bank on December 21, 2021. The annual salary which included a severance package, and performance analyzed related to Imran Maqbool who completed his term as president and CEO on December 20, 2021. The error is regretted.

I

Mansoor Ali Khan – Bank Al Habib

Yearly salary: Rs 128.53 million

ROA Rank: 6

ROAE Rank: 2

Average Rank: 2

Despite being the 10th highest paid CEO in Pakistan, Mansoor Ali Khan got some of the highest performance marks in our ranking coming in at an overall second place on the bang-for-buck scale. was appointed Chief Executive of the Bank on November 1, 2016. He had been with the Bank since 1994 in various positions, including Zonal Head, Group Head, and Chief Operating Officer. He is a nominee director on the Board of Habib Asset Management Limited and also serves as a Chairman/member of various Internal Committees of the Bank. Earlier, he served at various positions in Bank of Credit & Commerce International (Pakistan, Dubai-UAE, Yemen), from January 1985 to March 1992. Mr. Mansoor is a member of the Council of the Institute of Bankers Pakistan. He has attended many courses/trainings including Directors’ Training Program from the Institute of Business Administration (IBA), in January 2016. He holds a Master’s Degree in Business Administration (Banking & Finance) and has a vast experience in commercial banking.

Analysis of the rankings

So what does any of this mean? We started our ranking based on the absolute salary. Our winner is United Bank Limited’s (UBL) very own Shazad Dada. In 2021, Dada received Rs340.863 million in a year. The second highest-paid CEO is Irfan Siddiqui of Meezan Bank. This makes him the highest-paid CEO in the Islamic banking space in Pakistan. He makes Rs306.181 million which is roughly Rs25.515 million a month.

HBL’s CEO, Muhammad Aurangzeb is the third highest paid CEO in Pakistan raking in Rs265.663 million in 2021. With a monthly income of Rs22.138 million. As the size of the bank goes smaller, so does the CEO’s salary. The least paid CEO on the list is Bank of Khyber’s Muhammad Ali Gulfaraz who makes Rs33.616 million a year, and Rs2.8 million a month. But the bank’s legacy issues, deposit size, and coverage are also prime reasons. Since this is his first year at the bank and his first time as a bank CEO, it is likely that he will experience a rise in remuneration.

After all, once you’re on this list, you keep switching bank after bank until it is time for retirement; or you end up at the State Bank of Pakistan (looking at you Sima Kamil).However, looking at the salary as a standalone is simply not enough.Now that we’ve banked these individuals based on their incomes, we’re going to rank the banks based on the returns they generate – namely the return on assets and the return on average equity.

While Dada ranked number one in his salary, UBL’s ROA in 2021 was ranked number 5, Meezan at number 2, just like their CEO; and HBL at number 13. Standard Chartered Bank had the best ROA of 1.8%. This might also have to do with Standard Chartered cutting back on its physical presence in terms of branches and also its niche of clientele.

Based on Return on Equity (ROE), Meezan Bank clocks in at number 1, Bank Al Habib at number 2, and surprisingly, Bank of Punjab at number 3. In order to further our efforts at ranking the CEOs based on their performance, we’ve taken an average of the ROE ranking and the ROA ranking. The lower the ranking, the better the performance of the bank, and as a result of the CEO too.

Siddiqui of Meezan Bank ranks number one in terms of his score, followed by Mansoor Ali Khan of Bank Al Habib, and Rehan Shaikh of Standard Chartered at number 3. JS bank’s Basir Shamsie scores the lowest average score of 18 because JS Bank scored 18 in both its ROA and ROAE ranking across banks.

Pakistan’s highest paid CEO, Dada, Ranks at number 7 with an average score of 7.5, scoring the 5th rank in ROA, and the 10th in ROAE. However, to understand whether the average score rank is better if you’re paid better, we’ve looked at the differences in rank between the salary ranking and the score ranking.

Remaining profiles (in alphabetical order)

These are the bankers that are not in our top 10 in terms of annual salary. They are still all making a pretty penny, and their respective ranks on scales have been given in the attached graphs, but they are not in the top slots.

Aizid Razzaq Gill – Allied Bank Limited (ABL)

Gill was promoted from Chief Risk Officer at ABL to the bank’s CEO. He joined ABL in 2005 as regional corporate head where he also worked as head of commercial assets, group head of liabilities, head of commercial and retail risk, and head of operational risk. He was promoted to the position of CRO in 2017 and then finally CEO in 2021.

Atif Bokhari, Askari Bank

Bokhari is not new to the banking space or the CEO position. His career which spans 32 long years began at the Bank of America in Pakistan. Later he moved to HBL as Head of Corporate and Investment Banking. In 2004, Bokhari got his big break and joined the CEO club by taking charge of the President and CEO position at UBL where he stayed till 2014. He then served as President and CEO of NIB Bank which is a wholly-owned subsidiary of Fullerton Financial Holdings in Singapore. Bokhari then served as Minister of State and Chairman of the Board of Investment at the prime minister’s office in 2021. He then joined Askari Bank.

Basir Shamsie – JS Bank

Shamsie joined JSCL in 1994 as Director and Head of Fixed Income where he looked at the treasury and investment banking department, primarily debt capital markets. He then moved to JS bank as the Senior Executive Vice President and group head for treasury, investment banking, and financial institutions. In 2017 he was promoted and made deputy CEO. In 2018, he was appointed president and CEO of the bank.

Jawad Majid Khan – Summit Bank

Khan joined Summit Bank in 2021 as the president and CEO. Prior to this, he was a director at Emaan Islamic Banking at Silk Bank. He has also served as group head distribution for the Middle Markets and SMEs at Dubai Islamic Bank.

Muhammad Ali Gulfaraz, Bank of Khyber

Gulfaraz is a recent addition to the Pakistani bank CEOs joining in August 2021. He has banking experience of 25 years in global corporate and investment banking. He started his career with Bank of America in Pakistan and later moved to Bank of America, London. He then joined Mizuho Corporate Bank in London and rose to the position of Managing Director-Head of Corporate & Investment Banking for UK, Ireland & Nordic countries. Before joining the Bank of Khyber, he remained associated with Fauji Foundation as Member, Board of Directors.

Rehmat Ali Hasni – National Bank of Pakistan (NBP)

Hasni is currently serving as the acting president of the NBP, a position he assumed five months ago after Arif Usmani’s tenure ended. Hasni will continue in his position until the Government of Pakistan appoints someone else as the president of the bank after cabinet’s approval. Hasni has been affiliated with NBP for the last 12 years and has served as its senior executive vice president and group chief of various divisions.

Before NBP, Hasni was the chairman of Pakistan Mortgage Refinance Company (PMRC), non-executive chairman of First Credit Investment Bank Limited, executive vice president and head of corporate finance at IGI Investment Bank Limited and chief operating officer of Lahore Stock Exchange. He has also served as board member of various organisations.

Shahid Sattar – SAMBA Bank

Sattar joined SAMBA Bank in 2013 and is currently its president and CEO. With experience in retail banking, consumer finance, branch banking, cash management, remittance business and corporate and Islamic banking, Sattar’s career spans over 40 years. Prior to joining SAMBA in 2013, he worked at UBL where he headed various divisions. He has earlier worked at MCB Bank and CitiBank, with a stint at BCCI. Sattar has held directorships including at PICIC Asset Management, MNET Services Pvt Ltd, Bank Al-Bilad Investment Co and UBL Asset Management.

Syed Amir Ali – Bank Islami

Ali was appointed as the president and CEO of Bank Islami in October 2018. Before moving to Bank Islami, Ali headed the corporate and investment group of Meezan Bank. His expertise is in the fields of treasury, finance and investment and corporate banking. Besides affiliation with Meezan Bank and Bank Islami, Ali has worked at AF Ferguson Co as well as Shell.

Muhtashim Ahmad Ashai – Soneri Bank

Ashai joined Soneri Bank as its president and CEO on April 1, 2020. Before Soneri, he was the president and CEO of MCB Islamic Bank Ltd. Ashai has a diversified experience in banking with a career spanning 27 years working at domestic and international financial institutions. He started his career at Fidelity Investment Bank, followed by working at ABN Amro Bank, working in Pakistan, Japan and China for ABN Amro. He later joined MCB Bank where he was group head corporate and international banking for more than 11 years.

what about First women bank?? would be interested in why a man runs it ?

There are many talented woman bankers who will reach top positions in few years.

Nice analysis.

What about DFIs??? There are 8 DFIs operating in the country, all in the public sector as they are government owned, but we hardly see any news regarding them.

Good Analysis

UBL was run by a woman sima kamil and she did absolutely nothing for women education to job culture

Mann.. Thats huge salary.. For how long CEO remains on average in a bank..do they retire..

Not even top doctors earn this much

They do, it’s just undeclared because clinics earn in cash and underreport their earnings to evade taxes.

While gross salary numbers can be an indicative but to comment like buying a Kanal in DHA or iPhones etc, you should have taken the amount net of taxes. All these gentlemen pay 35% tax which is slightly more than 1/3rd.

very nice Analysis

Why wasn’t Silkbank included in this survey,???

I once again find myself personally spending way too much time both reading and leaving comments

사설 카지노

j9korea.com

Female need to work harder if they want to move up. It is not unfortunate.

Worth reading..!