In October 2020, one man decided to lock horns with one of the largest business groups in Pakistan. Tired of what he thought was consistent mismanagement and a complete lack of disregard for minority shareholders, Ahmed Manaf banded together with his fellow shareholders to try and force Merit Packaging, owned by the Lakson Group, to listen to them.

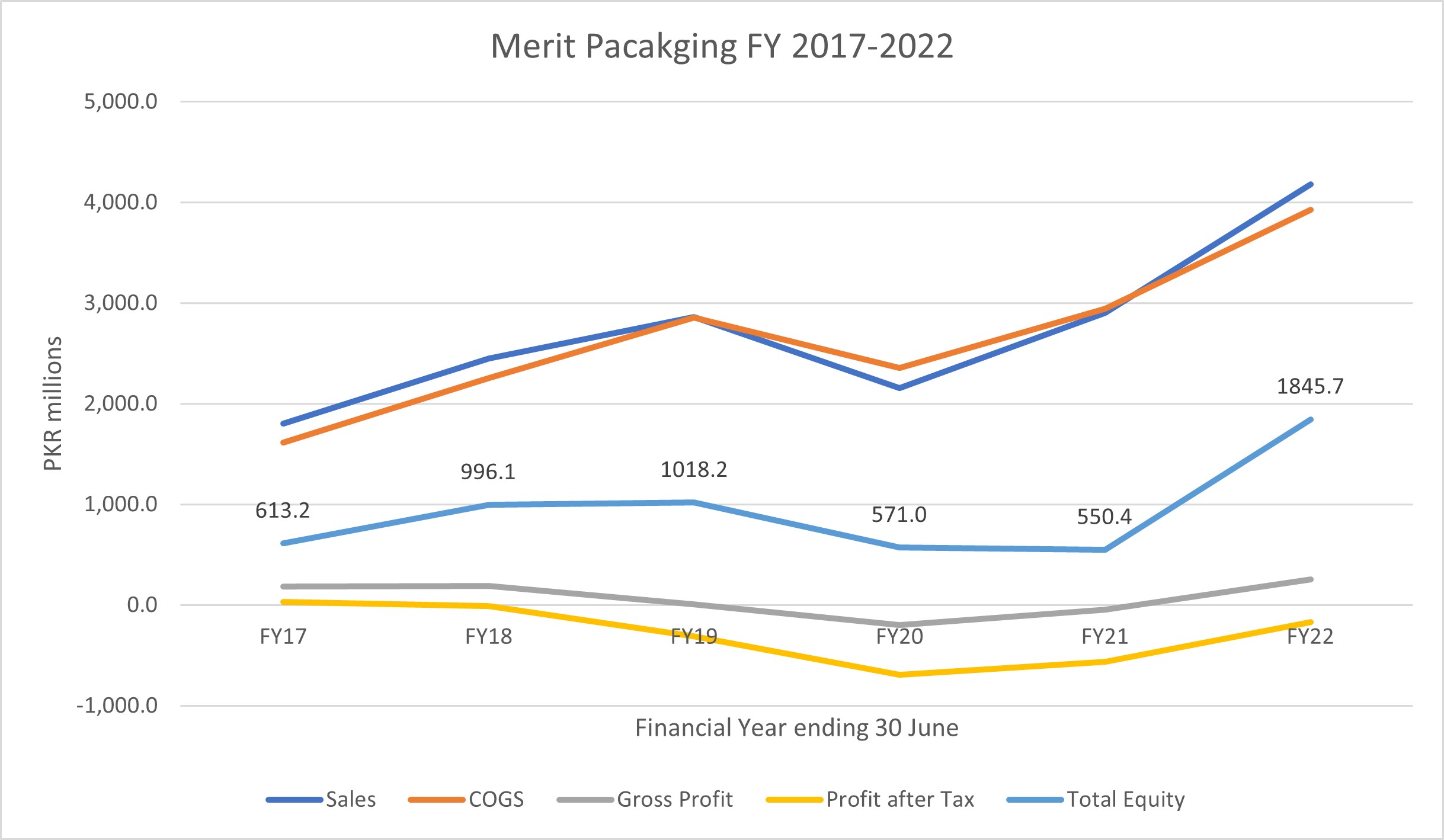

It worked. The shakeup in management that had followed the shareholder activism resulted in belt-tightening and a push to fully utilize the company’s resources. In its recently published financial results for the year, Merit had a turnover of PKR 4.1 billion and turned a positive gross profit of PKR 252 million for the first time in almost three years. This is a year-on-year sales growth of 44%. And even though the company shows a negative profit after tax of 168 million, it is only due to the financial charges that it owes to the sponsor because its core operating profit has already become positive again for the first time in three years.

Back when Manaf made his first putsch, many were skeptical about whether or not it would work. In a country like Pakistan where big companies are often kept and controlled within the family, minority shareholder activism is not usually successful. This is even more starkly true when the big fish are involved. Take the Lakson Group for example. It is one of the leading business groups in Pakistan with total assets exceeding $1 billion and employing over 17,000 people. It owns and runs companies in sectors such as agri-business, call centers, consumer non-durables, fast food, financial services, media, paper and board, printing and packaging, surgical instruments, technology (data-networking, BPO and software) and travel. Some of the well-known companies Lakson owns include Express News, Colgate-Palmolive, McDonald’s Pakistan, and StormFiber.

Merit Packaging is only one of the four publicly listed companies the Lakson group owns. It was incorporated in 1982 as a publicly listed company in the Pakistan stock exchange. Its clientele includes names such as Unilever, Nestlé, Tapal, National Food Ltd., Vital, EBM, Continental Biscuits, Philip Morris, Colgate Palmolive, etc. With a market capitalization of around $9 million, Merit Packaging owns a paltry position in the billion-dollar Lakson group of companies. That the sponsors would pay heed to the demands of the minority shareholders’ of Merit is telling of how Lakson conducts its business. But how did it all play out?

The play-by-play

As Profit previously reported, in October 2020, Mr. Ahmed Munaf, on behalf of a group of minority shareholders owning in excess of 17% shares of Merit Packaging (PSX symbol: MERIT), wrote to the board of directors asking them to explain their poor performance in the years prior, which included financial losses, lack of sales growth despite expansion, role of independent directors, and even the possibility of a merger with Century Paper & Board Mills Limited (another Lakson Group company). Since the minority shareholders owned in excess of 10% of shares, they were able to move a special resolution and force the board to discuss their grievances in the next AGM. Sure enough, the minority shareholders had their first success when the board removed the then CEO Mr. Shahid Ahmed Khan by year end.

This is where the turn-around started. The most important change in Merit was made when the board appointed Mr. Amir Ahmed Chapra as the new CEO in March of 2021. Coming in with nearly three decades of experience in the packaging industry, Chapra brought with him experience and knowledge of the packaging business not just in Pakistan but also in Africa, Middle East, Southeast Asia, and Turkey. His own company, Metatex, was at one time the largest packaging production company in Pakistan. When Chapra came in, the first thing he had to do was stabilize the bleeding company which had generated a combined loss of over PKR 1.5 billion in the last two years alone. According to his own assessment, the company was not doing well when he came in. The basics of the business were wrong because the company was selling below the cost of goods sold (as can be seen from the graph above).

Since Merit had been in the market for over three decades, it had all the big customers but was not the primary supplier to any one of them. And the volume it was getting did not matter because it was selling below margins. The new CEO took the company by the horns and micromanaged everything: he got rid of the customers who were buying below margins, increased the prices, removed the inefficient management without hiring any new senior people, and tried to improve the operational efficiency of the machines.

In Chapra’s own words, “Our volumes didn’t go up until the end of the first quarter. And only after stabilizing the company we made a strategy for marketing and added value. Then our volumes grew based on reliability and price. For example, when I came in, we were doing only 25 tonnes of business with Philip Morris, which is a premium customer for any printer. Now we are doing 250 tonnes with them, and we provide 80% of Phillip Morris’s supply.”

Merit Packaging also had two factories, one in Lahore and the other major in Karachi. Under the new management’s leadership, a feasibility study of the Lahore operations was made after which it was decided to shift from Lahore to Karachi in September 2021. This also affected the company’s performance because of under-utilization of machinery during the shifting process. But this move made sense from a financial point of view because aside from PepsiCo and Nestle (who were based in Lahore), all the major customers of Merit had their operations in Karachi.

According to Mr. Suleman Maniya, Head of Advisory at Vector Securities, “The company has improved margins and it is getting all the big clients now. This is all due to the shareholder activism at the company. And since the company has accumulated losses, it means that there will be no tax on the company for the next 2-3 years which will give it space to become a strong company.”

A hostile takeover on the cards?

Shortly after Chapra became the new CEO, Ahmed Munaf, the shareholder activist whose letters prompted this change, saw a vacancy on the board of Merit Packaging and went for it. As the representative of the minority shareholders holding over 17% shares at the time, this was the natural next step for Munaf. In the EGM on May 04, 2021, there were 7 openings on the board of MERIT and 9 candidates were running for the election. Each candidate needed at least 14% of the votes to get elected. Ahmed Munaf, Hossain Aga, and Raziuddin Monem, three candidates, had votes as such that either two of them could get together and beat the third. Unfortunately, this was going to be Mr. Monem, who lost by a small margin because Munaf and Aga got together and pooled their votes.

For some background, Ahmed Munaf is an importer of polyester yarn, a philanthropist, and an activist investor, among other things. After getting on the board, one would expect that the next step for Munaf would be to force a hostile takeover of Merit Packaging. But when Profit approached Munaf previously, he said he had no such plans. He said he was only trying to become a voice for the minority shareholders who felt that the company could be run better.

In December 2021, the company issued 119,330,029 right shares at PKR 12.50 per share to raise PKR 1.4 billion. This brought the total tally of issued shares of the company to 199,958,427, whereas the total authorized shares of the company are 200,000,000. There are two implications for this.

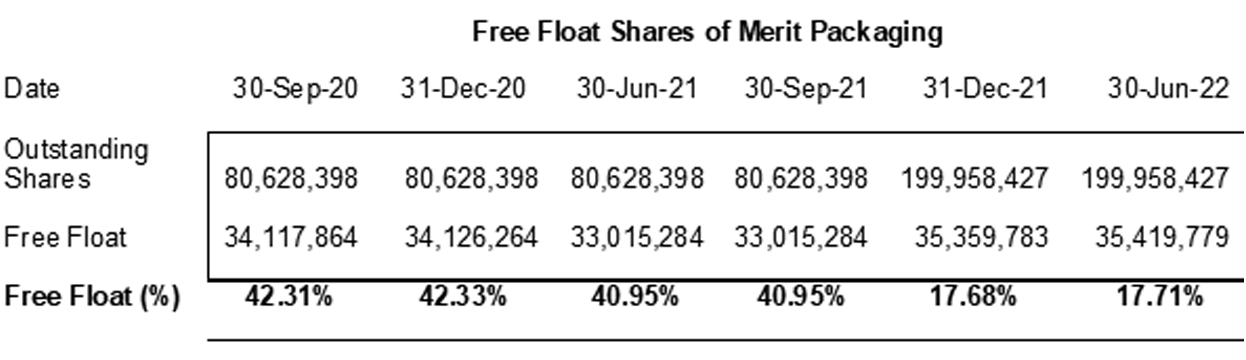

First, even if Munaf was intending a takeover of the company initially, that option has now ceased to exist. At the time of his election to the board in May 2021, the free float shares of Merit Packaging were 40%. As of June 2022, after the December rights shares, the percentage of free float shares has come down to 17%. This means that the sponsors have not simply shaken up the company to appease the minority shareholders, they have also solidified their own control of the company as well, and if ever Merit Packaging was going to be a case study of shareholder activism leading to a hostile takeover in Pakistan, that is no longer the case.

Secondly, although Merit has shown growth in its last financial year ending June 2022, its accumulated losses are still PKR 1.8 billion. If the company needs to raise more capital in the future, the board will have to increase the limit of the authorized shares. When Profit talked to Amir Chapra about this, he said that the company will not be looking to expand in the next 2 years because the board first needs to be shown that their last annual performance can be replicated. However, given the high rates of bank borrowing in Pakistan currently, if Merit does have to raise capital, issuing new shares remains a likely possibility.

Packaging Industry and the Future Outlook of Merit

In FY 2021, the company had exports of PKR 9 million but in FY 2022, exports were zero. It looks bad at first glance but when Profit talked to Chapra about this, he pointed out that the government needs to make an export policy for the packaging industry. He says, “Pakistan primarily does textile exports and when we go to the FBR or Customs, they don’t understand the makeup of our product, and making them understand can take years. The government also needs to give incentive on power costs and other inputs without which we cannot compete against countries in the Middle East, Africa, and China. And then comes the part of trying to convince the world to buy Pakistani packaging, which will predicate on developing trust, and this can take 2-3 years. We will target these beyond 2023-24 because at the moment we need to build capacity and bring in good people.”

According to Chapra, the packaging industry which covers cartons, boxes, plastic, and bottles, etc. will be a $ trillion industry in three years with a cumulative average growth of 3.5% per year. At the moment, packaging is $300 bn and Merit Packaging is nothing in it. For Chapra, exports are necessary for growth in the future because while volumes are always guaranteed in Pakistan due to the huge population, margins cannot be as easily increased because consumption of packaging material is directly linked to the buying power of the consumers, which is not much.

The Packaging industry is not for everyone. It is curious to note that there is not a single multinational in the packaging industry and about 55% of the packaging industry is unorganized and saturated with small players. While barriers to entry are low in this industry, sustainability is the real challenge. It requires high initial capital investment, a know-how of the packaging business model, and technically skilled human resource to operate the European machinery where one machine can cost upwards of 1 million euros.

“During COVID when there was a dip in the economy, many small players entered the packaging industry who charged low prices and took loans on credit,” says Sulaiman Manya. “They drove price competition and brought the margins down for everyone. Eventually, these small businesses went bankrupt. When such price competition ends, margins increase. And the big FMCGs who were previously benefiting from the low prices are now giving their business to reliable companies in packaging like Merit because they want good quality.”

Chapra agrees with this but says that such small players have always been there and a lot of them entered the market 10 years ago as well when they were supported by multinationals like Unilever who wanted to gain an advantage from lower pricing. This mushroom growth of smaller players was created by the big companies who later suffered themselves because they were not getting quality packaging from these smaller players.

For a shareholder, it seems to be a good time to invest in Merit Packaging because all the stakeholders of the company are on the same page on taking the company forward. In 2007, the company’s share price was trading at its highest around PKR 115. At the moment in 2022, it is only around PKR 11-12 per share. If the company keeps on improving linearly as it has in the past year, it can provide good returns to the shareholders.

Starting November, the company will start providing packaging to McDonald’s Pakistan. It already has the machines to produce the packaging for Happy Meals and french fries, which comprise the largest sales revenue for the fast food giant. Then in 2023, they also aim to invest in more machinery to cover the packaging for the rest of McDonald’s products. Merit also aims to increase its offset packaging production capacity by another 200 tons which will give over PKR 100 million sales revenue by the third quarter of FY23.

The financial performance of the company in the most recent results of the first quarter for FY23 prove that the company is finally giving a return. Net sales posted a growth of 60% at 1.39 billion PKR compared to the same quarter last year and gross profit posted a growth of 173% to PKR 136 million. Similarly, operating profit posted a growth of 473% from PKR 16 million to PKR 93 million. Finally, net profit after financial charges and taxation for the quarter turned a positive PKR 3 million against a loss of PKR 57 million in the same quarter of last year. This is the first time in over 20 quarters that the company has turned a positive profit after tax. If this isn’t a sign of the company’s reversal of fortunes, we don’t know what is.

Chapra credits the turnaround of the company to the sponsors who are fully backing it. “It’s a great time for companies like Merit because this is the first time in the last 10 years that it’s being run properly. The sponsors and the management are on the same page and at the right time. Despite the economic and political instability of the country, I think we are doing good because we are well backed by the Lakson group, we do have the facility to produce goods, and we have good machines and good people. Our aim is to make the best out of this situation.”

Awesome Post I like it !

Fantastic article. I hope we are able to get business journalism like this and Pakistan will improve by leaps and bounds. Well done.

Brilliant story. Hope Merit can return back to their good old days.

A very insightful article to highlight a much valid point, however I would have appreciated if some recommendations for the solution were also presented here.

사설 카지노

j9korea.com