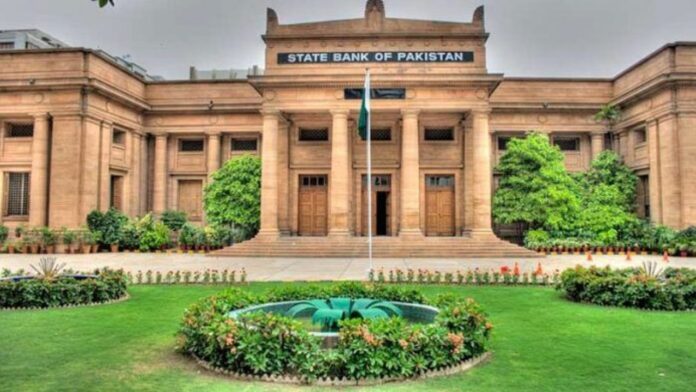

Islamabad: The National Assembly’s Standing Committee on Finance met yesterday to express concern over the slow pace of inquiry by the State Bank of Pakistan (SBP) into the commercial banks’ dollar manipulation and making windfall profits. It has sought the final implementation report to be ready by December 15, 2022 but the SBP has assured the committee that the inquiry will be completed by November 30, 2022.

The committee was chaired by MNA Qaisar Ahmad Sheikh. The bank informed the panel present that action would be taken against the banks allegedly involved in overcharging the importers in the opening of their letters of credit (LCs).

Deputy Governor, SBP Inayat Hussain assured the committee that the process is in the closing stages, and various banks have been charged, and also that written replies have been received from them. Furthermore, the SBP has tightened its monitoring and no further complaints regarding manipulation are coming to them.

Earlier in September, the SBP had issued a show-cause notice to eight banks over currency speculation allegations. It was looking to investigate banks that had opened letters of credit (LCs) at higher rates than the spot rate. The banks have autonomy over how and when they issue their LCs, but since the SBP regulates them they get to determine the rate of exchange at which these LCs work.

“While banks are not required to run losses, they are regulated by the SBP and have to follow banking regulations. If you’re manipulating the market, action should be taken – even PM Sharif has asked for strong action,” said Miftah Ismail at the time of the show-cause notices. For context, at that point the rupee had shed 60% of its value.

The Committee reiterated that it expects strict punishment and fines will be meted out to accuse Banks.

During June-July 2022, some of the commercial banks that have been identified and had made unjust exorbitant profits exploiting the rupee fluctuation against the dollar and huge spread between the open market and interbank rates. The central bank official, however, said that since August, there has been no such case reported.

As per chapter 2 of the FE Manual issued by the SBP, banks are barred from charging more than a defined margin set by the SBP. In point number 11 of chapter 2, the SBP states the Authorised Rates of Foreign Exchange. If you explore the manual further or have industry experts comment on it, they will tell you that Section 4(2) of the Act states that unless otherwise directed by the SBP, authorised dealers, authorised money changers and exchange companies are free to determine exchange rates for the conversion of Pakistani currency into any foreign currency or vice versa.

The SBP has granted general permission to authorised dealers which enables them to determine their own rates of exchange, both for ready and forward transactions for the public. This, however, is subject to the condition that the margin between the buying and selling rates should not exceed 50 paisas per US dollar or its equivalent in other currencies.

The chairman of the committee stated that banks have been making huge profits due to the spread but everyone is in darkness as to what action the SBP is taking against the banks.

Deputy governor SBP said that the banks were issued show-cause notices saying, “We have asked the banks to give a written reply and then we will hold a final meeting with them.” He also said that customers had given in written complaints in the months of June and July but there have been no complaints from them in the recent month primarily because of ongoing action.

The current account deficit (CAD) is US$2.3 billion which is half compared to last year. The accumulation rate of monthly CAD has been reduced from earlier $1.5 billion to 0.7 billion a month, the banks’ regulator said.

MNA Muhammad Barjees Tahir asked the deputy governor of SBP why there are around 15 rupees spread between the open market and interbank rates of the dollar. He asked what action was taken against those eight banks that had rocked the economy.

The chairman committee said, “today I need dollars, but the banks do not have them. The State Bank governor should come and address these questions of the committee as it is the representative of over 22 million Pakistanis.”

The capital and financial flows have also reduced due to which there are issues of the non-availability of dollars. He said that the regulator would take enforcement action against banks this month after completing the inquiry, an SBP official said. Deputy governor SBP also said that “We have a market-based exchange rate”.

Tahir further said that if this time these banks were not punished, they will do the same unjust practices again to manipulate the market.

MNA Khalid Magsi also said that the economy is not heading in the right direction. In the nearly four-year tenure, Imran Khan was directionless and now after his ouster, this government too, is without direction. He further said that despite the fact that Ismail was removed from the seat of finance minister and Ishaq Dar was brought in, the situation remains the same.

Create your own customized Web3 financial service!