China’s financial regulators have invited some of the world’s biggest investors to a rare symposium next week, three sources said, seeking to encourage foreigners to keep investing in the world’s second-largest economy despite its recent weakness and rising geopolitical tensions.

The meeting in Beijing next Friday will focus on the current conditions of U.S. dollar-denominated investment firms in China and the main challenges facing them, according to the sources who have direct knowledge of the matter and invitation documents reviewed by Reuters.

Such a meeting, with a clear agenda to discuss challenges facing global fund managers investing in China, is rare, the three sources said, and reflected Beijing’s keenness to shore up confidence among foreign investors.

They also will be encouraged to provide suggestions to help address challenges facing their businesses in China and share their outlook on the economy, according to the sources and documents.

All three sources spoke on condition of anonymity as they were not authorized to speak with the media.

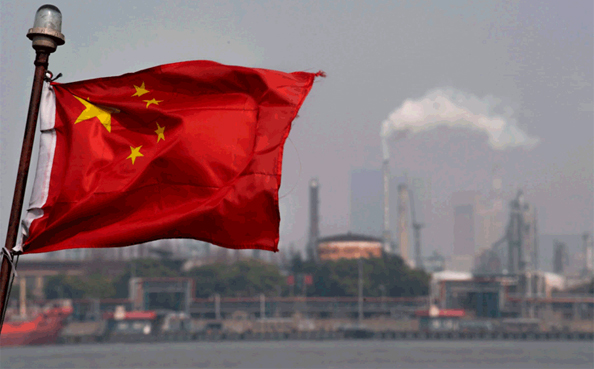

Weighed down by strict COVID measures, China’s economy grew just 3% in 2022, one of its worst showings in decades. Activity rebounded early this year after the curbs were abruptly lifted, but momentum has faded sharply since, while policy uncertainty and tensions between China, the U.S. and other Western powers have heightened.

The meeting also comes as some PE firms and their investors have been rethinking their China strategies after a years-long, bruising crackdown on private enterprises such as tech companies, which has cast a long shadow over PE investors’ return prospects and narrowed investment opportunities, separate sources have told Reuters.

Canada’s No. 3 pension fund – Ontario Teachers’ Pension Plan (OTPP) said in January it was pausing future direct investments in private assets in China.

Fang Xinghai, vice chairman of the China Securities Regulatory Commission (CSRC), the country’s securities regulator, will address the attendees, according to two of the sources.

The CSRC did not immediately reply to Reuters’ queries on Friday.

The meeting is organized by China’s fund regulator Asset Management Association of China (AMAC). The AMAC didn’t immediately reply to Reuters’ questions.

Months of disappointing economic data has MSCI’s China share index down 2% on the year, against a 15% gain for world stocks, while the yuan is hovering at 8-month lows, pushing some investors to close up their China strategies.

U.S. dollar-denominated fundraising by China-focused venture capital and PE firms this year also had its weakest first half year in the past decade, data from industry tracker Preqin showed.

China-focused GPs only raised $5.5 billion in U.S. dollar-denominated funding in the first half of the year, Preqin data showed, a far cry from its peak of $27.6 billion raised in the same period in 2021.

China’s policies including security crackdowns, its harsh regulation of the tech industry and close monitoring of foreigners are convincing many global companies to steer clear of the country, said Andrew Collier, managing director at Hong Kong-based Orient Capital Research.

“Now that the economy is drastically slowing there is a new charm offensive to convince foreigners to come back,” he said, adding the measures might come “too little, too late”.

The symposium also follows signals from authorities last week that a crackdown which began in late 2020 on the technology sector had ended with fines on Ant Group and Tencent.

In another strong signal that the crackdown is over, Premier Li Qiang on Wednesday met firms such as Alibaba’s cloud unit and Meituan, and urged them to do more to support China’s economy.

I find this quite fascinating and it should be included in my collection. Goodjob! I am very impressed. We appreciate that keep writing more content.

Good job.. Thanks

Investment is one of the best ways to achieve financial freedom. For a beginner there are so many challenges you face. It’s hard to know how to get started. Trading the Crypto market has really been a life changer for me. I almost gave up on crypto currency at some point not until I got a proficient trader Bernie Doran, he gave me all the information required to succeed in trading. I made more profit than I could ever imagine. I’m not here to converse much but to share my testimony, I invested $5000.00 and got back $50,500.00 within 5 days of investment. His strategies and signals are the best and I have gained more knowledge.

If you are new to cryptocurrency. You can reach to him on Telegram: @BERNIE_FX ,through Gmail :BERNIEDORANSIGNALS@GMAIL.COM or his WhatsApp : +1424(285)0682

I was scammed by an Instagram person faking a celebrity I talked with this scammer 8 months via WhatsApp and I sent money to them via Bitcoin then I was cohered to give my banking login and from there they hustled me out of my 20k from the unemployment money they said oh I routed cash to your account and never gave me time to verify that was my unemployment money. They were really patient with me and waited 8 months for my payment then I exposed them…by video on WhatsApp. They asked me to Bitcoin the money via atm. But for the timely intervention of Mr. Wizard Brixton, who just in kick-off on time got back my $20,000. He is really good at what he does, I have recommended him to friends and co-workers who all became satisfied customers. He has helped me a lot in the trading industry, you can reach him at WIZARDBRIXTON AT GMAIL DOT COM for Everything. Hacking and Funds Recovering He is the best and has different skills in fund recovering and exposing scammers. I am glad and happy to recover back my money (WIZARDBRIXTON)AT GMAIL DOT COM

China has emerged as a global economic force in recent decades, experiencing unprecedented growth and transforming its economy from a centrally planned to a market-driven one. With a focus on manufacturing, exports and a growing middle class, the country has made impressive progress. However, it faces challenges such as debt, inequality and the transition towards an economy more focused on domestic consumption. The Chinese economy continues to be a topic of interest and debate at the international level