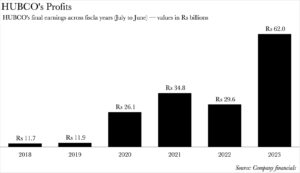

The Hub Power Company (HUBCO) recently unfurled its annual report for the culmination of the fiscal year 2023. The outcome? The company notched up its highest ever profit at a whopping Rs 62 billion, a meteoric rise of over 100% from the Rs 30 billion it amassed in the preceding year.

This financial windfall was propelled by a trifecta of factors. In addition to extraordinary incomes from its associated enterprises, HUBCO saw fresh revenue streams gushing from its two Thar-based power plants springing into operation. At the same time the depreciation of the Pakistani Rupee against the United States Dollar enabled the company to rake in a higher turnover from capacity payments. All this transpired while the company generated merely half the electricity it did in the previous year.

“Power companies have their tariffs pegged in USD terms. Consequently, when the Rs depreciates, the profits may remain steady in USD terms but they skyrocket in Rs terms,” expounds Yousuf Farooq, Director Research at Chase Securities.

While the assertion is correct, there is a larger context to this. HUBCO saw its earnings from capacity payments (CPP) skyrocket to an all-time high at Rs 62 billion. This offset the Rs 12 billion dip in revenues from energy sales to the Government of Pakistan (EPP), as HUBCO’s energy generation dwindled from 9,265 gigawatt hours (GWh) in 2022 to a mere 4,728 GWh.

| HUBCO’s Revenue Breakdown | ||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Capacity Purchase Price | Rs 25 | Rs 28 | Rs 34 | Rs 36 | Rs 36 | Rs 62 |

| Energy Purchase Price | Rs 80 | Rs 26 | Rs 7 | Rs 12 | Rs 60 | Rs 48 |

| Late Payment Interest | Rs 6 | Rs 7 | Rs 8 | Rs 8 | Rs 8 | Rs 10 |

| Startup Charges | Rs 0.3 | Rs 0.1 | Rs 0.03 | Rs 0.05 | Rs 0.4 | Rs 0.1 |

| Part Load Adjustment Charges | Rs 1 | Rs 1 | Rs 0.1 | Rs 0.2 | Rs 1 | Rs 1 |

| Pass Through Items | Rs 0.04 | Rs 0.05 | — | — | — | — |

| Sales Tax | -Rs 12 | -Rs 4 | -Rs 1 | -Rs 2 | -Rs 9 | -Rs 6 |

| Total | Rs 100 | Rs 58 | Rs 48 | Rs 55 | Rs 97 | Rs 114 |

| Units in Rs billions | ||||||

| Source: Company financials | ||||||

However, this doesn’t account for the additional Rs 32 billion that HUBCO pocketed.

The benefits of multiple income streams

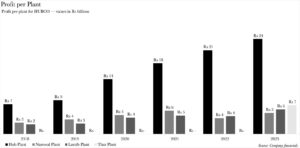

HUBCO’s Thar power plant, which commenced operations in October 2022, and its associated company ThalNova’s 330 MW plant, which became operational in February 2023, have significantly bolstered HUBCO’s financial performance. The former contributed an additional Rs 7 billion to HUBCO’s income, a revenue stream that did not exist previously, while the latter generated proceeds of Rs 1.9 billion for the first time since 2020.

The performance of the remaining plants in HUBCO’s portfolio, including its primary Hub plant and the ancillary Narowal and Laraib Energy plants, remained consistent with previous trends.

The substantial increase in earnings was primarily due to HUBCO receiving Rs 28 billion from its stakes in the China Power Hub Generation Company (CPHGC), and Prime International Oil and Gas (PIOGCL). Although HUBCO has not provided an explanation for this windfall — equivalent to almost three years’ worth of combined proceeds — it is likely attributable to the completion of CPHGC’s coal plant in Balochistan. This milestone freed HUBCO from its obligation to maintain a $150 million standby letter of credit for CPHGC. However, HUBCO has not provided further clarification on this matter.

As for PIOGCL, HUBCO attributes the proceeds to PIGOCL’s acquisition of ENI Pakistan’s upstream operations and renewable energy assets in November 2022.

| Profit from Associates and Joint Ventures | ||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| China Power Hub GenCo | -Rs 0.3 | -Rs 0.4 | Rs 13.7 | Rs 15.5 | Rs 9.1 | Rs 28.3 |

| ThalNova Power | — | Rs 0.014 | Rs 0.001 | -Rs 0.016 | -Rs 0.005 | Rs 1.9 |

| Prime International Oil and Gas | — | — | — | -Rs 0.013 | Rs 0.001 | Rs 3.9 |

| China Power Hub OpCo | — | — | — | — | Rs 0.1 | Rs 0.2 |

| Values in Rs billions | ||||||

| Source: Company financials | ||||||

HUBCO, however, has not been greedy with its luck for the year. The company dolled its highest dividend for shareholders ever at Rs 30 per share.

The company’s health in the year ahead

While it remains uncertain whether the company’s performance will surpass the fiscal results of 2023, it appears to be on a steady trajectory to prevent a collapse in the forthcoming year, at least for the time being. The Thar Energy plant, along with its associated Thal Nova plant, have consistently ranked in the top five of the National Electric Power Regulatory Authority’s merit order since their inception. The only exception was a brief two-week period in May when Thar Energy slipped to the sixth position.

This ranking provides a partial hedge for HUBCO against potential reductions in energy purchases by the Government of Pakistan from power companies, should demand decrease. Even a minimal demand for electricity ensures that HUBCO’s Thar Plant and ThalNova can sell electricity due to their favourable placement in the merit order.

Moreover, PIOGCL’s acquisition of ENI’s assets provides HUBCO with an opportunity to reap additional benefits from potential fuel exploration activities. HUBCO is also poised to profit from potential expansions in Thar Block-II through its 8% share in the mines.

However, the most significant benefits for the company could arise from developments entirely beyond its control.

“The power sector’s major issue has been the persistent problem of circular debt,” Farooq begins, “where payments to power generation companies are uncertain. While these companies may generate profits, they often struggle to receive cash payments, resulting in substantial receivables on their balance sheets.”

He continues, “The government appears to be taking steps to permanently address the circular debt problem by raising tariffs to align with the generation cost and implementing crackdowns on power theft as part of a long-term solution.” “Furthermore,” Farooq adds, “privatising distribution companies (discos) could potentially alleviate theft and efficiency-related issues within the power sector.”

The Pakistan Stock Exchange KSE-100 continues to display a robust and pleasantly surprising profitability. Hub came out of behind to be a jewel in it.

Good analysis. Thank you!

عوام کا خون چوس کر منافع کمانے والے ویمپائر۔

why everyone is against listed power cos if govt has capacity financial resources government of

Pakistan purchased listed co shares from stock exchange.

I’d want to express my gratitude for this fantastic read!! Everything about it appeals to me. I’ve got you bookmarking your site so you can keep up with what you’re doing.

What about the receivables?