It is one of those strange ironies. Most people that ask the question “what is a mutual fund” are usually the ones that need them the most. You see, for most working professionals not involved in the world of finance, terms such as mutual funds are often distant and confusing.

The reality is that mutual funds are investment instruments for individuals who feel that they lack the expertise on how to manage their own money.

Essentially, you put some of your savings in a mutual fund which is composed of a vast number of similar investors. So for example ten different people could put their money in the same mutual fund offered by a bank which would then use that aggregated money to invest in different projects. The profits on those investments would be returns on those mutual funds.

Pretty simple concept, right? Not exactly. The problem is that there are plenty of mutual funds out there. And since mutual funds are usually for people that don’t quite know how to invest their money, it isn’t always easy for these investors to pick the right mutual fund.

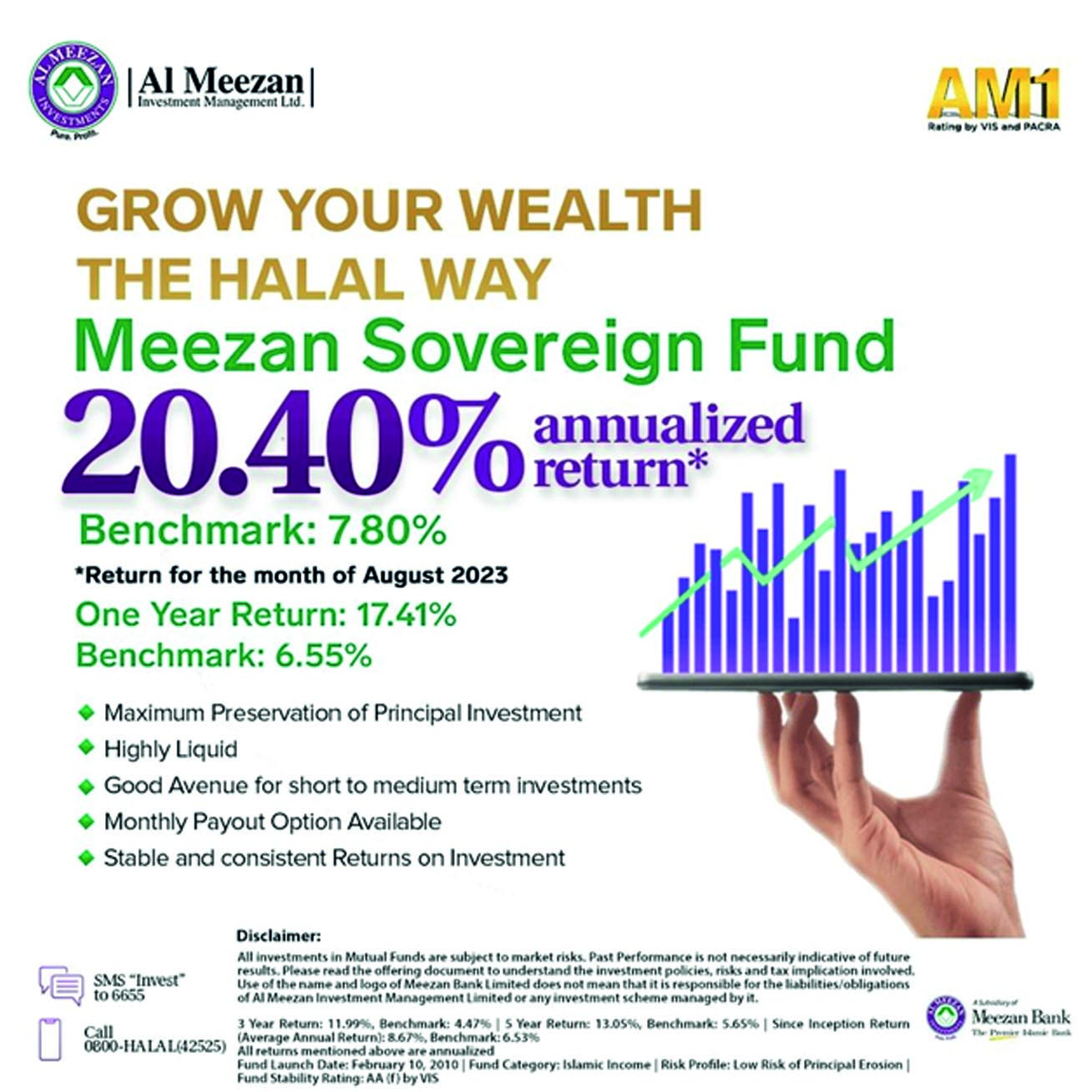

Take the example of Al Meezan Investments’ Meezan Sovereign Fund. On the 18th of September this fund introduced by the investment arm of Meezan Bank had earned an annualised return of 20.40% for the month of August. The investments that the fund had made in its assets gave them a return of 1.7% for the month alone. When these returns are annualised for the year, they translate to a return of 20.4 percent.

Compared to this, an average return on the market (what we would call benchmark — more on that later) at the same time in the market was around 7.8%. So how come Meezan’s Sovereign Fund is doing so well? And why are investors making a better return compared to other investments that can be made in the market.

The answer might not be quite as simple as it seems. But first, a bit about the basics.

Some background

Mutual funds are investment opportunities in which people hand their money over to an expert in the hope that they’ll be able to give them good returns. When many people go to the same expert, this money can be pooled into a ‘mutual’ fund. Different mutual funds can have different demographics in mind and have different levels of risk and other characteristics.

The benefits are that the mutual fund managers are responsible for the investments and actively look to maximise the returns of the investors. The clients benefit from the skills of the money managers and are able to invest in assets which might be difficult to understand or comprehend.

The cost of this management is that the experts take a fee for the service they are providing in return for managing the investments. The money managers feel that based on their ability, skill and expertise, they need to be compensated and they derive a certain percentage of assets under management as a fee. Consider it to be some of the cream off the top of the milk bowl.

Now, mutual funds are tailored to the needs of the clients. An 18 year old who is working a job will have different investment goals compared to a professional on the verge of retirement.

{Editor’s note: As things stand in today’s day and age, an 18 year old with a successful YouTube channel might have a lot more money to play with than say a career marketing professional entering their 60s}

One might want to invest in the stock market to get variable and high returns and can handle his investments making a loss from time to time. The retired man cannot see a fall in his income as he depends on the investment to supplement his income.

In essence, a stock market fund looks to invest in the stock market. It will own securities of companies that are listed and will look to earn a return that is far higher than compared to an income fund. At the core is risk that is involved. Stock market funds are risky as they can have no return or even negative return. In order to make it attractive, it can give a return that is higher than an income fund as well.

Similarly, an income fund invests in assets which provide risk free constant returns. There is little change that returns will fluctuate and investors who do not want to take too much risk will look to invest in it. The securities that this fund invests in are mostly bonds and interest yielding assets which are low in risk and provide a constant stream of income.

All the remaining investors fall in between these two extremes and can pick and choose a fund which provides them a steady return while having some investment in the stock market as well which can grow the value of their investment. There are many asset management companies (AMCs) which provide different types of mutual funds that suit their specific needs.

Benchmark battles

With many different asset and money managers being present in the market, it can be difficult to gauge the performance of one AMC to another. If one opens up the website of Mutual Fund Association of Pakistan (MUFAP), they can be inundated with a series of numbers that can confuse you further. MUFAP and SECP have developed a policy to use benchmarks in order to compare performances of mutual funds.

“(In Pakistan), benchmarks are not chosen by the funds but are set by the SECP and MUFAP on the fund themselves based on the categorisation of the fund” says Mustafa Pasha, Chief Investment Officer at Lakson Investment Limited. These benchmarks can help better understand the performance of a fund compared to the benchmark that has been designated for the specific investment objective of the fund.

Consider the example of Mutual Fund A which has an equity based fund. This means that such a fund can invest all of its funds into the stock market. This fund was able to earn a return of 4 percent while another fund was able to earn a return of 6 percent. Based on just numbers, it is evident that Mutual Fund B performed better.

When a third fund is added to the mix, we can say that it earned a return of 10 percent. This one shows that Fund C was able to perform the best as it has the highest return. What if the benchmark shows a return of 20 percent for the same period? This would mean that Mutual Fund C performed the best and that it gave a considerable return of 10 percent. However, the benchmark was able to outshine all the funds.

But before you get any smart ideas, it is important to remember that lagging the benchmark does not necessarily mean that the fund managers were wrong and that they failed. They did their best and that should count for something. A trend lower than benchmark returns would, however, mean that the fund is lagging the market and it would be better to invest in a fund which is able to equal or perform better than the benchmark. Dial away my friend.

Another aspect of benchmarks is that they need to measure an asset class which is close to the fund that is being measured against it. A stock fund will have the KSE-100 index which is being used as the benchmark while an income fund is compared to the risk free rate or discount rate prevailing in the economy. A benchmark makes sure that apples are compared to apples while oranges are compared to oranges related benchmarks.

Back to the Meezan Fund

Now back to the sovereign fund at hand. A glance over the promotional material that Meezan has shared reveals that Meezan Sovereign Fund (MSF) was able to earn an annualised return of 20.40 percent while the benchmark was 7.8 percent. It is vital to understand here that MSF is an income fund which means that it is low risk and an Islamic Banking approved method to earn a considerable profit.

Such a large return is not an extraordinary occurrence. It is pertinent to note here that there are conventional banks which are providing annualised returns even higher than 20.4 percent. Go to term deposits or saving accounts of some conventional banks and they are much higher than the one being provided by MSF. Fund Managers Report (FMR) of Faysal Funds (AMC under Faysal Bank) shows that its Sovereign Islamic Fund was able to earn an annualised return of 20.76 percent while the benchmark was 7.8 percent as well for the month of August 2023.

The problem is not with the return that is being advertised. There are other AMCs which have similar funds which are providing better returns and are higher in some cases as well. A return of more than 20 percent when the base discount rate is 22 percent is normal and expected to a certain respect. The angst that is seen in this regard is connected to the benchmark being used.

The unexpected return above benchmark

For equity based funds to outperform their benchmark is one thing. It can be expected that good managers will be able to select stocks and make investment decisions which will be able to beat the market or the KSE 100 index. Great managers will be able to do it consistently and they will advertise this feat as they have the knowledge to be able to beat the market on a consistent basis.

MSF is an income fund which is supposed to be consistent on a long term basis and is not expected to beat the market by a huge margin. As it is risk free, there should be little to no variability in terms of the return and the fund should not be beating the benchmark by such a large number.

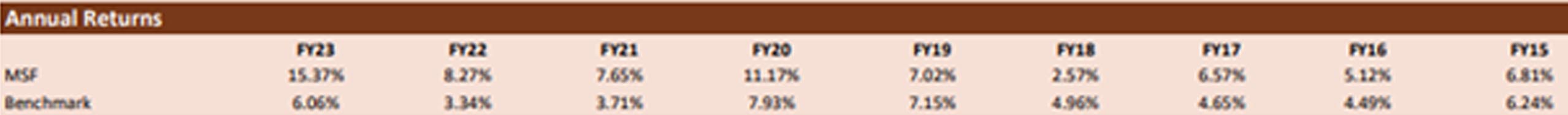

Even if we see the past performance of the fund itself, from FY15 till FY 22, it can be seen that the fund beat the benchmark by around 1 to 5 percent maximum. So what happened in FY 23 that MSF was able to outperform by such a huge margin of nearly 14 percent?

The devil is in the details

Alas, it can be seen that the real devil is in the details. Or, if it’s too Haram for a story on Al Meezan, then the essence is in the details. The benchmark that is used for sovereign funds is supposed to be PKISRV (Pakistan Islamic Revaluation Value).

This is a rate that is quoted by six brokerage firms that have been selected by the Financial Market Association of Pakistan. The Financial Market Association of Pakistan (FMA) selects six brokerage houses and asks them the price that is being quoted for conventional and Islamic bonds issued by the Pakistan Government.

The FMA averages these rates and based on these rates it decides what the PKRV (Pakistan Revaluation Value) and PKISRV rates are going to be. These rates are provided to the SBP (State Bank of Pakistan) and are released daily.

As the PKISRV is the closest proxy that is present for a sovereign fund, the SECP and MUFAP mandates that 6 month PKISRV needs to be used by the mutual funds when they have to release their performance data for income funds investing in sovereign debt. This is the best proxy that can be used in this case.

The plot thickens

The issue that was created in the benchmark rate of sixmonth PKISRV in recent times was that the Pakistan government did not issue a sukuk or ijarah in the last few months. As no such Islamic security issue was carried out, this created a gap in the market. There could be no comparable return or benchmark that could be used for the time being.

Usually what happens is that at the start of every month, just like there is an auction for treasury bills (T-bills) and Pakistan Investment Bonds (PIBs), the government also issues Sukuks and Ijarahs (Islamic bonds). This takes place every month which means that values derived from these bonds can be used in other fields.

When reached for comment, the management at Al Meezan stated that there was a dissonance in the markets as the government had not issued any Islamic bonds. Trying to use old or unrelated data to calculate benchmarks would not be advisable in such circumstances. This has been stated by the management at many of the other AMCs as well as they were told to change this benchmark. In such a case, the SECP asked the funds to change their benchmark to the deposit rate being offered by 3A or higher rated Islamic banks.

At this point, it is important to understand that Islamic and conventional banks differ from each other in one very important aspect. The Minimum Deposit Rate (MDR). SBP has mandated that conventional banks have to give a minimum deposit to their depositors which is in line with the discount rate.

There is no such mandate for Islamic banks and so Islamic banks can choose a deposit rate based on their own decision making. This means that Islamic banks and specially A- rated Islamic banks can provide a deposit rate which is much lower compared to their conventional counterparts.

“There is a stark difference between the benchmark rates being used for conventional funds and Islamic funds at least. When it comes to bank deposits, Islamic banks do not have any MDR making their rates much lower compared to conventional banks.” says Pasha elaborating on the gap that exists in the Islamic conventional banking.

Due to the special dispensation given by the SECP, it meant that rather than using PKISRV rates which would have been much higher, the benchmark fell to the rates which have been quoted by companies like Al Meezan.

To put things into perspective, it was seen that PKRV rates recently have hovered around 22 percent while PKISRV rates have not been available for the same period. As the SECP had allowed for exceptions to be made, the benchmark which was chosen was persisting around levels of 7 to 8%. This created a huge gap between the return of the fund and benchmark which has been seen in the advertising material.

Muhammad Ali Bhabha, Chief Investment Officer at HBL Asset Management states that the benchmark return is supposed to be 6 month PKISRV rate and “since no instruments were available in the market…..(it) was replaced with 6 month deposit rates of 3 A and above rated scheduled banks selected by MUFAP. Since 8th September…..GOP IS (Islamic) issue is available now.” Based on this issue, it is expected that the benchmark rates will be approved and converge around 20 percent.

Is there a case for a better benchmark?

At this juncture it can be stated that there needs to be a benchmark that should be able to represent the situation in a better manner. Most of the time, rates move in conjunction with each other and as there had been no fresh issue, the rates had become disjointed.

As the PKRV is hovering around 22 percent and the government is giving a return of more than 20 percent on its ijarah and sukuk bonds, the PKISRV can be revised accordingly and should be nearer to the PKRV rate. If the benchmark was around that rate, it would show that the actual return that the fund was able to earn was not that much greater than the benchmark and that the fund was tracking the benchmark as it should for an income fund.

Are Islamic funds misrepresenting the facts?

It is important to note here that Islamic AMCs are showing high returns in their sovereign funds while their benchmarks are low. This is a special case in the market which will be rectified when a fresh issue of sukuk or ijarah is carried out. As this month has seen an issue take place, the situation is expected to go back towards normality.

Still, trying to imply that the fund is beating the benchmark by such a large margin is a misrepresentation of facts as the fund returns have increased while the benchmark has been changed on a temporary basis.

Maybe it would be better if Al Meezan gave the complete picture and stated in the promotional material that the benchmark is lower than expected and this was a special case.

This misrepresentation led to anger being felt by many people on X who felt that it would have been better to state all the facts outright. It seems that Al Meezan has had an error of omission by not stating all the facts and should have made a disclaimer. This would have appeased some of the people as the true picture would have been represented in the mutual funds industry.

You all have too much time on your hands to make a mountain out of a molehill. I read all this to end up finding out that it was all done with the SECP consenting.

Seems like you could not blackmail Al Meezan into giving an ad! The benchmark you are referring to is used by most AMCs under approval from SECP and MUFAP, yet you single out one entity clearly shows Ur Mal intension. cheap journalism at its best!

What a lame article! You are saying that it is approved by regulator then why the whole shpeel with focus on 1 AMC only?

koi meray 10 minutes wapas Karo please! Kitna farigh time hai bhai. Is par to defamation law suit banta hai aap par. Bhai koi meezan wala is ko suuu Karo.

I have a question. If the returns are high, what is the issue?

You got to work on better stories. There is so much more to think and write about.

I often come across articles like this one which are just a one line statement but some how their content writers stretch it to 2000 words essay. Not sure why they want to loose their credibility

Please read the complete story before commenting. Just because SECP allowed it to happen doesnt make it right.

@Muniba Al Meezaz is advertising and misleading it. That is why it came into notice

@Tooba Al Meezan was advertising this fact

@Shah Al Meezan waloun sai comment bhi liya hai. They are doing something immoral

@Aqib Shah the misrepresentation is the problem

@Arif please suggest a story and I will work on it

@Owais there are people who do not understand the basics of mutual funds. People need to be told the background of the story or they will not want to read the magazine. The articles are written with the understanding of a layman to help everyone understand the basics of a story

perfectly okay story, a bit long but actually clears out the air on how such advert may deceive innocent investors!

Seriously Bhai, what is wrong? I believe All marketing correspondence are approved by SECP as per regular procedure. In case of any non-compliance, SECP asked to recall the post or information immediately.

Secondly, there is no Benchmark details available for Islamic Shariah Soverign Funds.

Industry need uniform benchmark for all and this is not the case only with Al Meezan. Everyone is doing the same thing because there is no benchmark available.

I have had investment for about seven years and ended in loss !

I’m surprised at the people who are downplaying it. Whosoever came up with this campaign was trying to mislead and hood wink general public.

The title of this “Inside the high returns of the Meezan Sovereign Fund” really doesnt go with the content. Serious clickbait. The article in no way shows any issues with the performance, but just rambles around the benchmark which was SECP approved. Not mentioning that the same benchmark is used by other funds in teh industry.

Looks like someone didnt get their ad money and now have gone into mainstream anchor mode.

honestly looks like the author and his supporters have zero clue about the business or journalistic ethics. Without getting a response from all AMCs and their regulators you went ahead with not just publishing an article but also a video. After stating multiple times that this is industry practice singling out one AMC clearly shows that there is a hidden malicious agenda. From your past reputation be it your take on Noman Dar, Jehangir Siddiqui, ARY, Sultana Apa and I can keep on listing the controversies your magazine has created to extort corporations. let’s see you do an article on that!

Chapter 7 Performance Benchmarks for Collective Investment Schemes (CIS), of SECP’s Master Circular 1 of 2023. Clause 7.1 which outlines Performance Benchmarks for all categories of CIS. The Benchmark for Shariah Compliant Sovereign Income Scheme is Six (6) months PKISRV rates.

GOPISV-08-03-2024 (variable) – 101.510 price giving 21.52% yield

GOPISF-08-03-2024 (fixed) – 100.230 price giving 19.91% yield

Average of above yields = 20.71%

Therefore, please note that the 6 Months PKISRV rate to be used as Benchmark is 20.71% for the Shariah Compliant Sovereign Income Scheme.

Meezan really be using bots to downplay the article