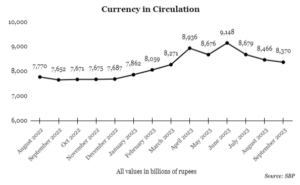

As the world continues to move towards digitalisation in all things, including monetary transactions, cash remains the king in Pakistan. Over the years, the country’s currency in circulation — the amount of notes and coins issued by the State Bank of Pakistan (SBP) that are out of the banking system — has continued to grow, reaching Rs 7.68 trillion by December 31, 2023.

Given the trend, it appeared that this year would be no different. That is, until data shared by the SBP showed the currency in circulation (CIC) declined by 9% quarter-on-quarter in September (according to data analysed till September 22). According to a report by brokerage house JS Global Capital, this pace of decline has not been seen in many decades. After all, in the last quarter — April to June — CIC grew 11%, a pace that was last recorded 23 quarters ago. And the average historical quarterly growth is 3%.

One reason for the decline in currency in circulation is the increase in deposit mobilisation (excluding interbank deposits, deposits of government and foreign constituents). According to SBP data, deposit mobilisation in 2023’s third quarter was up 1.7% compared to the April-June period. The biggest contribution to this increase was by individuals (personal segment), which accounted for 60% of the total new deposits, followed by non-banking financial institutions at 11%, the power sector at 10%, and non-financial public sector enterprises at 8%. For context, almost half of Pakistan’s total deposits in commercial banks are of the personal segment, which include salaried and self-employed individuals, according to the JS Global Capital report.

In its report, JS Global Capital said higher savings rates following the central bank’s decision to hike the policy rate by 100 basis points to 22% in June could be among the key reasons for the shift from cash to deposits. It added that other possible factors such as the ongoing crackdown on various segments of the economy, and relative stability in the USD-PKR exchange rate cannot be ruled out.

Law enforcement agencies had launched a crackdown on illegal foreign exchange trading and smuggling in various sectors of the economy in early September after the rupee fell to record lows of Rs 307.09 and Rs 334 per dollar in the interbank and open markets, respectively. This was followed by structural reforms for exchange companies, which have been directed by the SBP to consolidate into a single category by December this year. Resultantly, the rupee has been recovering steadily — from Sep 6 to 28, the rupee gained Rs 19.24 per dollar or 6.26% in the interbank market and Rs 24 per dollar or 7.69% in the open market.

Faizan Kamran Khan, CEO of FRIM Ventures, also said the CIC decline can be attributed to the operation against smuggling and foreign currency hoarding by law enforcement agencies that led to the rupee’s sharp appreciation. “Speculators rushed to sell off their dollars and bring their funds back into the banking system to be safe from investigations into their informal wealth,” he elaborated.

Meanwhile, Ahfaz Mustafa, CEO of Ismail Iqbal Securities, said currency in circulation decreased because people regained confidence in the markets and “probably opted to come back into the system and take advantage of higher rates”.

“As things improve and fear of bankruptcy subsides, we see people coming and deploying money in the formal sector and taking advantage of higher interest rates,” Mustafa added. After the government managed to sign an agreement with the International Monetary Fund in June, fears of a potential default were finally put to rest, and foreign exchange reserves nearly doubled to over $8 billion after funds were received from the IMF, Saudi Arabia and the United Arab Emirates.

Mustafa said the decline in CIC was a positive development as it signalled public confidence in economic recovery, and could eventually lead to lower inflation. When the currency in circulation is high, it fuels demand, which in turn leads to higher inflation. Pakistan is an import-dependent country, so when demand rises, imports also rise, putting pressure on the foreign exchange reserves. One of the ways that the SBP, or any central bank, seeks to reduce inflation is by increasing the interest rate. This makes it more profitable for people to deposit money in bank accounts and earn interest compared to spending it or investing elsewhere; this way demand is suppressed and currency in circulation reduces, leading to lower inflation.

Will CIC continue to decline?

According to Khan, it depends on whether the rupee continues to appreciate. If that happens, speculators may see greater returns in rupee-denominated assets, he said. “If this is corroborated with decline in commodity prices such as sugar wheat etc. then this trend may well continue.”

He added, “I still think the crackdown by law enforcement agencies will continue to be the major factor behind bringing wealth back into the formal system and hence, put pressure on CiC. But long term reforms to formalise the economy are needed to bring a sustainable decline in CiC.”

Mustafa said as long as the economy — which was plagued by uncertainty and fears of default for at least half this year — continued to improve, more people would move their cash into assets and money would move to the banking system.