There are many things that make Towellers Limited unique. For starters, the company is a rare example of a genuine bootstrap success story. Starting from humble origins in 1973, Towellers grew from a small unit of six terry looms to become one of the larger towel exporters in Pakistan’s already densely populated textile industry. On top of this the company is run by a quadfecta of sisters and its chairman and CEO are both women — another rarity in Pakistan.

But perhaps most significantly, the company seems to be incredibly modest. For the last three years Towellers has, almost miraculously, been doubling its profits every year, and yet it seems the least bit interested in publicising this information. In fact, if anything, they seem to want to keep this little tidbit of information that would be very interesting to potential investors, hush hush.

Most publicly listed companies would issue press releases about such achievements. Some company executives would even pay for media interviews and try to get publicity not just for their companies, but also for their personal profile building. But Towellers is operating on the other end of this spectrum. Not only have they not publicised their achievements, when Profit reached out to the company wanting to cover their success story, without a charge obviously, they asked that the interview be scheduled a full year later. A first for Profit.

So what gives? Quite possibly it is because in one particular way the company is not unique at all. In fact, it follows the blueprint of many other Seth-owned publicly listed companies in Pakistan: A complete and utter disregard for minority shareholders.

Why do we think so? The proof, as they say, is in the pudding. And in the case of Towellers it is in the recent trends in their financial results. For one, take a look at what happened to Towellers’ share price on the morning of Wednesday, September 27th, the day the company was announcing its annual results. At 10:00 AM, as the stock market commenced trading, the share price opened at Rs 169. By 12:30 noon, it had risen to almost Rs 178. In fact, for the last few days, the company’s stock was experiencing rapid appreciation in value in anticipation of good financial results.

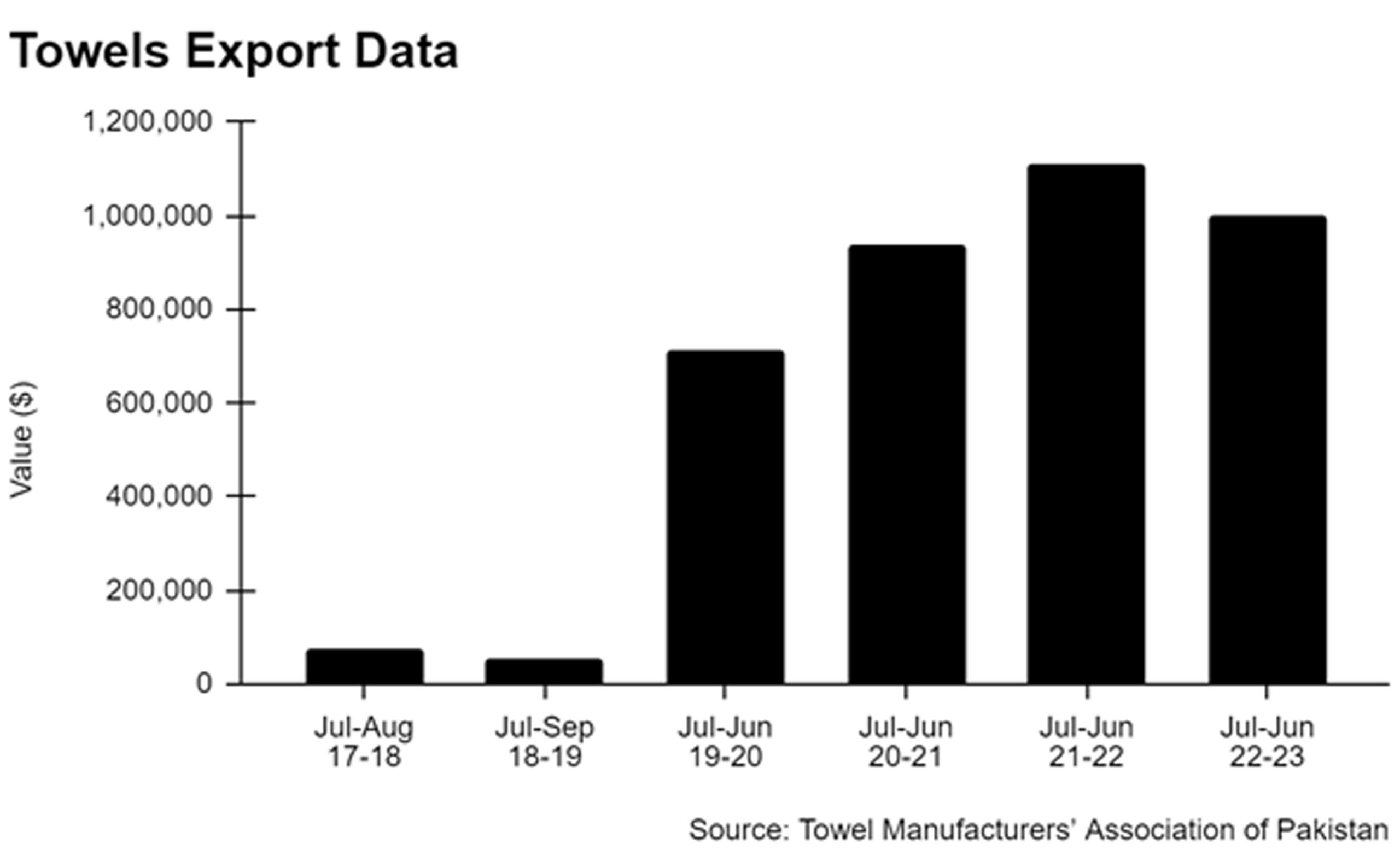

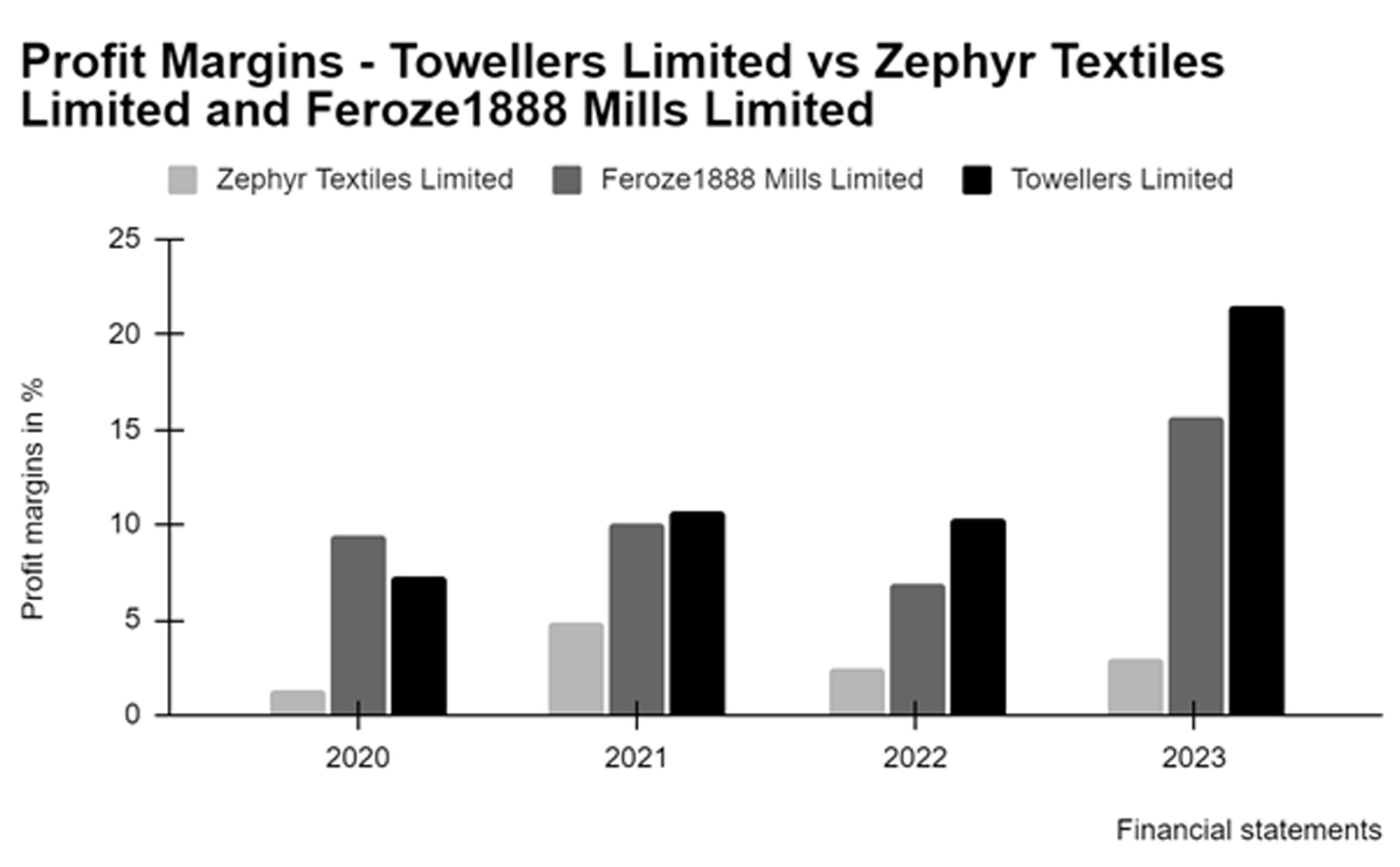

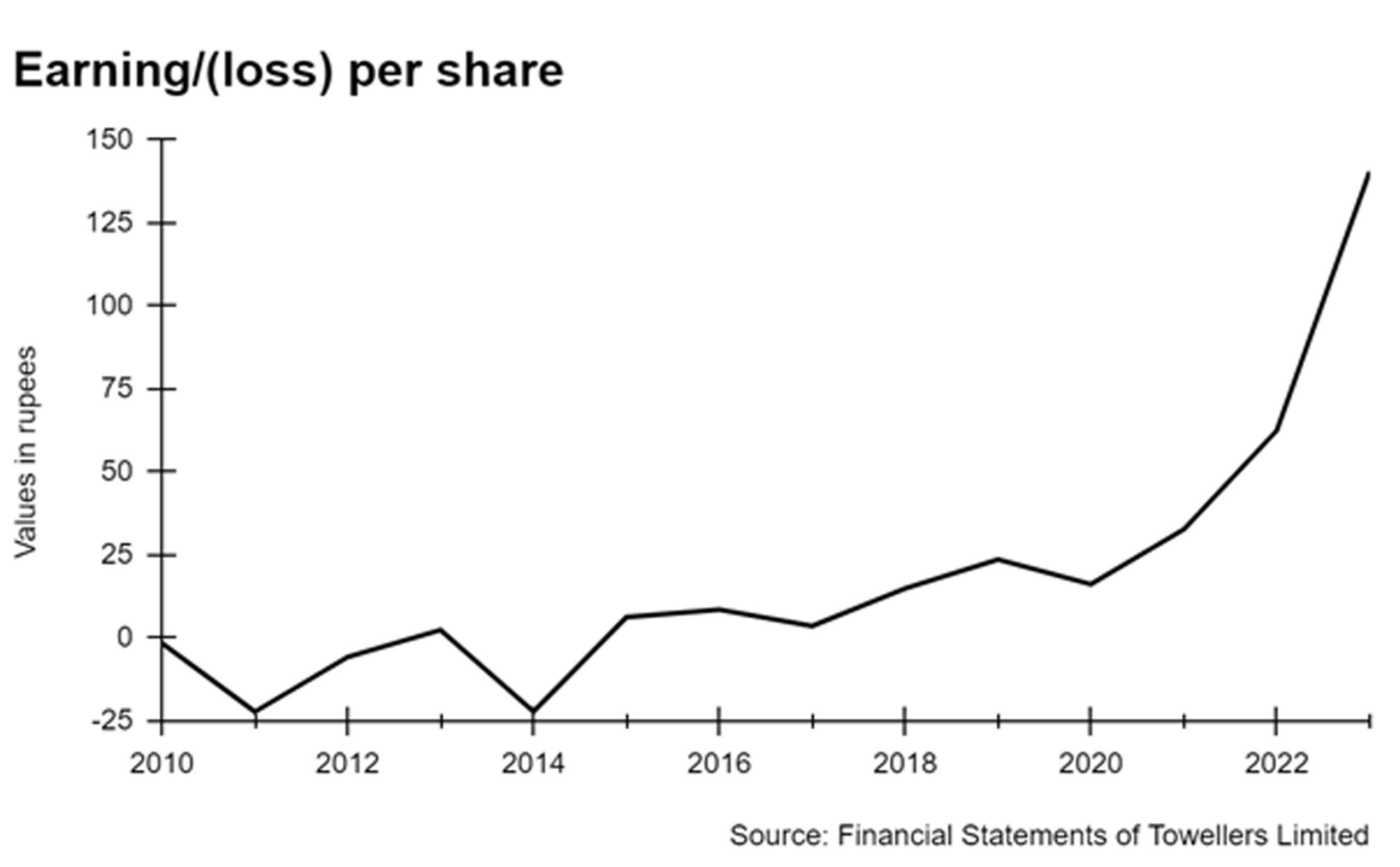

The results were released and showed that the company had more than doubled its profits, from Rs 1.1 billion in 2022 to Rs 2.4 billion In 2023. Similarly the earning per share (EPS), which is the profit attributable to each share of the company, rose from Rs 63 per share to Rs 140 per share. In some part this was because Towellers is an export oriented company that had made bank on the astronomical rise of the dollar. But the profitability of other Pakistani Towel exporters had not increased by as much. There is after all a slow down in the US economy, and hence a suppression in overall demand. Even in the case of Towellers, the sales volume contracted in 2023. But the company was able to double its profit margin from 10% to 20%. In simpler words, whereas other Pakistani towel exporters are making around 5 to 15 cents of profit on every dollar of sales, Towellers has managed to make 20 cents. Clearly the financial results of Towelllers were extraordinarily good.

Normally, you’d think this would be good news for the company’s shareholders, and as per the normal mechanics of the stock market, this would result in a rise in share prices of the company. Especially for a company which had an extremely low share price compared to its EPS.

Imagine, Towellers share was trading at Rs 120 on Pakistan Stock Exchange (PSX) in March 2020, the year when each share of Towellers earned only Rs 14. In 2023 EPS has increased tenfold to Rs 140, and yet the share price has increased only marginally to Rs 152. Had the ratio of share price to EPS remained constant, the price of one share of Towellers would have increased to a whopping Rs 1200 per share after the financial results were announced.

Except this didn’t happen. Not even close. Instead, as soon as the results were announced the company’s share price started going down, dropping from Rs 178 to Rs 169, which is where it had opened on the 20th of September. The main driver behind this disappointment was that despite having an EPS of Rs 140 per share, the company had only paid Rs 13 out of it in dividends per share, keeping the rest of the Rs 127 per share within the company. This is not necessarily a bad thing for share price. A company can retain profits, instead of paying dividends to shareholders, to invest in expansion, from which it can make an even bigger profit the next year, which should then result in even larger dividends for shareholders in future.

But then why, despite the company’s remarkable turnaround, are the investors not impressed? Do they feel they might never see these high dividends? Not even in the distant future? Is it because they have doubts about the company’s future profitability, or is it because they doubt the intentions of the majority owners that are running the company? What instead would the company do with this money then? Some of our answers might be found in the company’s impressive history.

The Towellers’ story

In 1973 Shaikh Obaid set up a small towel manufacturing unit comprising six Terry Looms. Without getting into the finer points of what a Terry Loom is or its output, suffice to say these were humble beginnings. Despite starting off as a small fry in the big, bad, and filthy rich world of textiles, Shaikh Obaid was by all accounts a natural salesman. Even his competitors acknowledge that he was a maestro when it came to marketing and selling his product, particularly to international clients.

Now, in the 1970s Pakistan’s textile industry was still very much a work in progress. This was the era when textile producers were bound by the Multi-Fiber Agreement. Under this agreement, Pakistan had a quota to export textiles to European and American markets. However, textiles could only be exported in limited quantities under this quota. This meant there was only room for a few manufacturers to export their product to these prized markets.

The quota was actually so highly sought that the Pakistan Export Promotion Bureau would auction the rights to it. But as one might expect, this quota was controlled by a select few people. Most of these were also not manufacturers themselves and outsourced their production but reaped the rewards from the European and American markets.

Shaikh Obaid on the other hand had his own production set up. By initially selling to the local market he continued to expand it with an eye on eventually becoming export oriented. Born in pre-partition India, his family had migrated to erstwhile East Pakistan at the time of partition and came back to the mainland after the 1971 Bangladesh War of Independence.

This is an important detail because under the quota agreement, since textiles could only be exported in limited quantities by each manufacturer from Pakistan, a lot of the remaining work was done from Bangladesh and Sri Lanka, where there was not a limit as to the export volumes to the US and European markets. With established connections in Bangladesh in particular, Shaikh continued to export through his second home.

For the next two decades Shaikh was flying high. His company grew exponentially and by 1985 the six Terry Looms had turned into an international network of textile factories. Towellers very quickly turned into a Big Kahuna in the world of textile. And despite converting into a public limited company in 1994, the company was still very much a private affair, run by Shaikh Obaid.

Shaikh Obaid had five daughters and one son. A progressive man who was passionate about the education of girls (what the Gen-Zs would call a “girl dad”) his children often accompanied him on business trips and were encouraged to learn about the family business, but were too young to get involved. His eldest daughter Sharmeen finished her undergraduate degree in arts in 2002.

{Editor’s note: Shaikh Obaid, who passed away in 2010, has left two legacies in Pakistan. The first of course is Towellers which is testament to his acumen as a businessman. The second is his daughter Sharmeen Obaid Chinoy — Pakistan’s first and only Oscar winner. Sharmeen is the only one of the Shaikh’s five daughters that has not been actively involved in their father’s business since his passing}

The turning point

For 32 years Towellers grew and the Obaid family grew with it. Then came 2005 which proved to be a pivotal year for Pakistan’s textile industry, which is when Pakistan saw its highest yield for cotton in history at 15 million bales and business was booming. It was also in this year that the quota system under the Multi-Fibre Agreement came to an end.

Insiders report that around this time the company was struggling financially. Some Industry sources say that one reason for the company’s troubles could be the lack of oversight on the company’s operations in Bangladesh. While others attribute it to Shaikh Obaids deteriorating health.

On top of this the textile business in Pakistan was about to hit a major point of implosion. Between 2007-08 Pakistan was hit by the global recession. The textile industry faced challenges due to high energy costs, rupee depreciation vis-à-vis the US dollar and other currencies, and a high cost of doing business. As a result, there was a reduction in the number of textile mills operating in the country from about 450 units in 2009 to 400 units in 2019.

Shaikh Obaid had generally shied away from diluting his shareholding and raising a lot of money from the public. Instead, the company went to the banks to seek both short term and long term loans. These were challenging times for the industry on a whole but were exacerbated for Towellers by the passing of their founding patriarch in 2010.

The children’s turn

Let us get back to the point with a small digression. What does it mean to be a publicly listed company? Essentially, it means that a certain percentage of ownership in the company is available for purchase by members of the public. People buy these shares in the company and the money is used by these companies to invest further. In return, the shareholders receive dividends if the company has excess cash — essentially their cut in the profit.

It is a pretty neat system. You invest in a company that makes big profits and you can expect dividends. This year, as we started this story off with, Towellers has made a bit of a killing. They also netted a big profit in the year prior, which is why perhaps shareholders were expecting to get a decent dividend according to the EPS value. Now, as already explained just because a company makes a profit does not mean they have to pay a dividend. Instead, the company’s management can decide to reinvest the money in the company, make an even bigger profit the next year, which would then result in even larger dividends.

The question of whether to pay dividends or reinvest is not one that has haunted Towellers for too long. The company has generally been caught up in the overall downturn of Pakistan’s textile economy. The downturn has mostly been witnessed by Shaikh Obaid’s daughters, who have been running the company since his passing in 2010. He was succeeded as CEO by his daughter Mehreen Obaid Agha in a year when the company was facing a loss. Currently, four out of the five sisters are running the company, with Mahjabeen Obaid serving as Chairperson, and Hadil Obaid and Sana Bilal serving as Directors (Board of Directors). Interestingly, their fifth sister, Sharmeen Obaid-Chinoy who is the eldest one and has international renown, is not visible in this company, not even as a shareholder. Profit attempted to ascertain Sharmeen’s stance on why she has distanced herself from the company’s affairs, and why she is the only sibling who is not a shareholder, but she too decided not to respond.

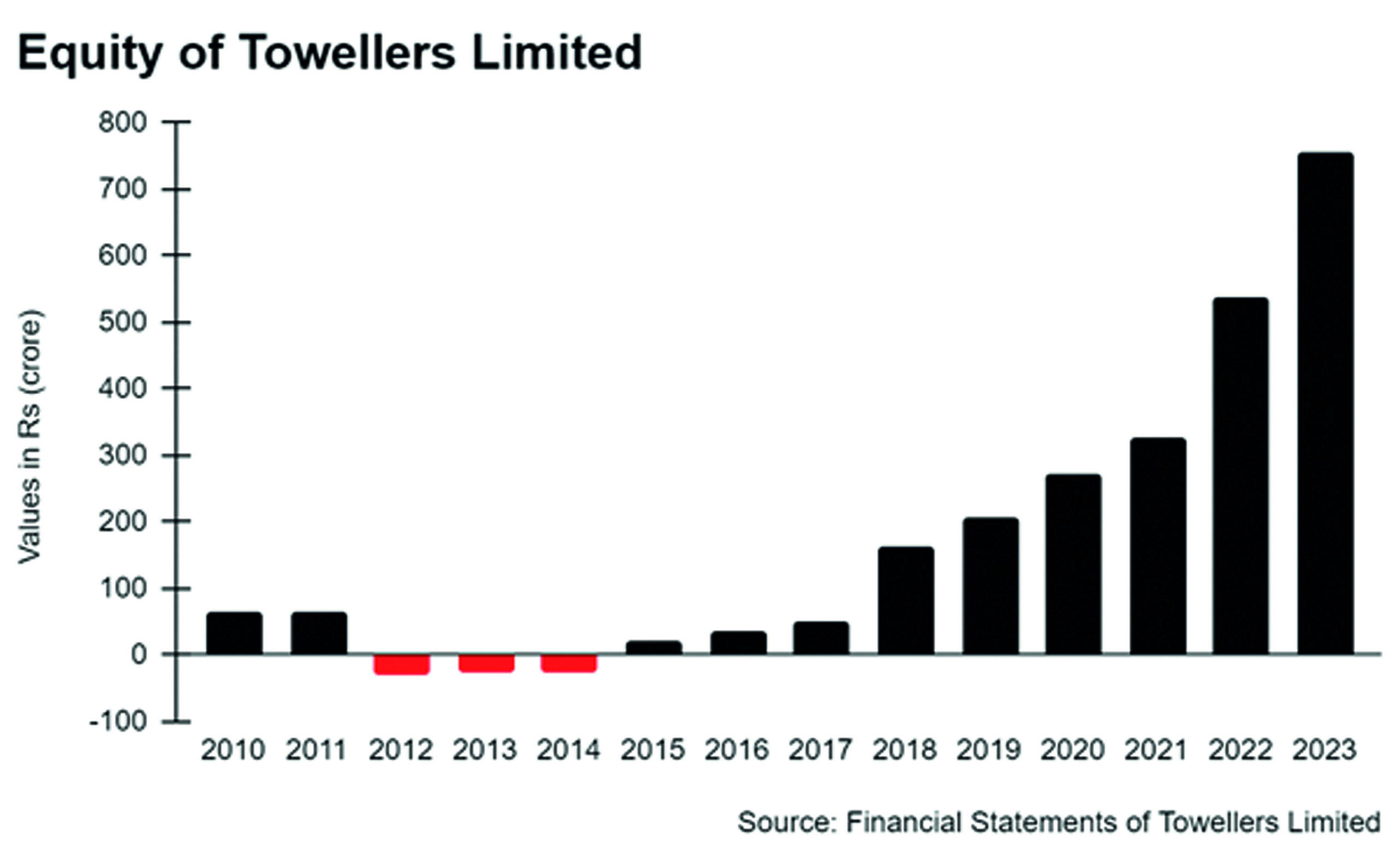

Even though the company was facing serious issues from 2010-14, consistently reporting annual losses, the most challenging year for the company was 2012 when, despite achieving a turnover of Rs. 2.1 billion, Towellers reported a loss of Rs 60 crores. More importantly due to the losses, the equity plummeted into negative territory, making the company insolvent. In simpler words, the company owed more money than it could raise even if it sold all of its assets, making it a crucial year of financial trouble. Similarly, 2014 also presented a complex financial scenario. Despite sales of Rs 3.4 billion, Towellers grappled with a significant loss of Rs 37 crores. Equity remained mired in the negative at Rs 27 crores underscoring the financial uncertainty surrounding the company.

In fact, the company remained insolvent for three full years (2012, 2013, and 2014), finding it difficult to pay its creditors and remain operational. During these years the company had to either default or restructure a lot of its banking facilities. Persistent losses and negative equity obviously meant that after 2009, for many many years the company was unable to pay any dividend to its shareholders.

However, after successfully negotiating terms with lenders, and at the same time focussing on the company’s operations, the sisters were able to improve the company’s financial performance significantly from 2015 onwards. This included shutting down unprofitable business units, a focus on bringing efficiency and getting some of the best international clientele on board. That year, Towellers reported sales of Rs 2.7 billion and achieved a profit of Rs 10.7 crores. This trend continued and going forward the company reported profits every single year, with the last three years being the most profitable. The first major profit came in 2021, when the company made Rs 55.6 crores.

Then came the real turn around. In 2022, Towellers Limited achieved a profit of a little more than Rs 1 billion, which meant that EPS was Rs 62.53 per share. Minority shareholders might have started feeling they were due a payout. You see Towellers is very much a family affair despite being a public company. They have a free float of only 20% on the stock exchange which means a maximum of 20% of its shares are available to the public to trade while the rest continue to be held by the Shaikh family. Also remember that while minority shareholders are waiting for dividends for more than a decade, the majority owners of the company that are also its managers pay themselves salaries, benefits, and extract other perks from the company’s earnings. So it would make sense that minority shareholders that had stuck by Towellers through their troubles would now want to get some money.

So why the low dividends?

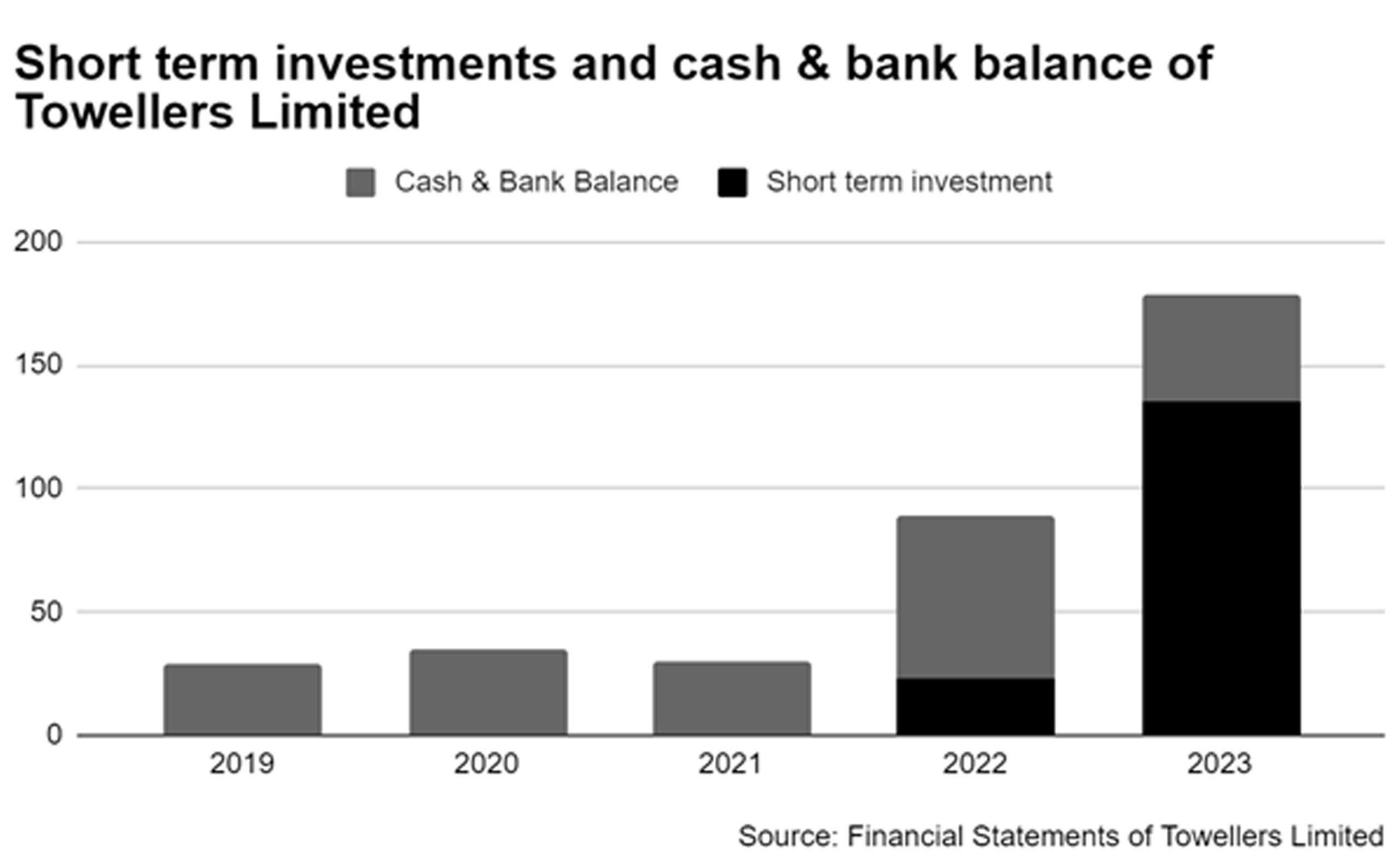

In the end, despite an EPS of Rs 62.53 in 2022, Towellers ended up announcing a dividend of Rs 10. Still, it was something. And the company had paid a dividend for the first time since 2009, after a gap of almost thirteen years. Perhaps they were looking to invest the profits and make even more earnings the next year? And the company did invest some of that money in expansion. However, a big part of it was invested in short term government securities, through mutual funds.

And then we come to this year. The year 2023 marked impressive growth for Towellers which hit a profit of close to Rs 2.4 billion resulting in an impressive EPS of Rs 140.49. Even more impressive was the increase in profit margin to 20%. This Towellers was able to achieve by attracting and retaining brands, as well as institutional customers like hotels, that were more quality conscious than price conscious. But this year again the company paid a dividend of only Rs 13 to its shareholders. The company chairperson, Mahjabeen Obaid seemed to think this should make the shareholders happy, “I am also pleased that the Board has decided to announce a healthy dividend for the second consecutive year. Members truly deserve the same for standing with the management and supporting the Company through all these years for which I am thankful to them. I wish and hope for the consistent growth and profitability of the company which would be mutually beneficial for all stakeholders.” she wrote in her message to shareholders.

With this rise in profits, which is what we started this story with, dividends might have been expected. So why is Towellers shying away from paying its shareholders the dividends they deserve? One answer could be that they are planning on holding on to these earnings so they can expand capacity and grow the business even further. And till that time they are building this pool by keeping the money in interest earning banks saving accounts and mutual funds. However, when Profit requested Mahjabeen Obaid to answer just this one question, as to what they plan to do with the retained profits, she directed us to the company’s Chief Financial Officer (CFO). Not surprisingly, the CFO did not respond to our phone calls, nor to our emailed question.

The other possible answer could be something more questionable, which is that the family that owns the majority of the company wants all of the dividends for themselves. And the only way to achieve that is through a massive share buyback. Could this be on the cards?

At least one senior analyst at a brokerage firm seems to think so. “You see, if the company starts giving dividends, the share price would grow. And if there is a plan to buy back the shares from the minority shareholders the company would obviously want to be able to purchase these shares at a low price, which explains why the company isn’t paying dividends. Once the company has purchased these shares from minority shareholders, it cancels them and even a bigger part of the company is owned by the sponsors”, he explains with a request not to attribute his comments.

This seems logical. That pool of money being built may well be used to do a share buy back at a slightly higher price than the prevailing share price of Rs 150. So instead of distributing Rs 140 of EPS as dividends to shareholders, for which the company does not get anything in return, the company can buy those shareholders out, once and for all by paying slightly more than one year’s EPS. This could also explain why the Obaid family do not want to advertise their recent success story to the media, as that could generate investor interest leading to an increase in the share price.

A question of mindset

Now this is where things get more complicated. Since 1973 the Obaid family has run Towellers and grown it to great heights. The company has seen highs and lows and throughout all of it they have maintained complete family control. The company currently offers only 20% shares on a free float on the stock market and is more than 80% owned by the Obaid family. Despite being listed (they went public in 1994) it is very much a family business. As such, the company’s owners might feel strangely about offering dividends to small shareholders and have largely been keeping the cash safe. After all they already own more than 80% of the company; their father built this company; they have been running this company without having to pay or answer to any minority shareholder, why would they not consider the company their own?

As we’ve discussed above, the company may very well want to keep the stock price low so they can buy back the few shares that are currently held by the public. They will possibly release the dividends after the buy-back which they will get themselves. Remember, when a company is owned by a family they can allocate some of the earnings for things such as salaries, but also perks to board members such as managing their day to day expenses. This then means that company earnings are more like assets for these family shareholders rather than income.

There are only really two possibilities. The first is that Towellers has plans to invest these profits further but its management doesn’t want to share its plans with its shareholders. The other possibility, as we’ve discussed, is that the Obaid family wants to initiate a buyback. This would give minority shareholders something to be happy about but might rob them of even higher returns.

In both cases, the Obaids are not doing anything illegal per se. But considering they have taken money from public shareholders, what they are is either overly secretive or greedy, both of which cannot possibly have good long-term consequences on a business that wants to be publicly listed and a long-term player in the market.

instead of focusing on the turnaround story, the only issue the writer decided to waste time and energy on was dividend…bhai agar dividend hi chahiyai tu govt bonds mei invest kar du

A very good story! I have been following this stock for a while but couldn’t find clues as the financial reports are not very nicely written.

Dear Shahab,

Thank you for sharing your article.

Your effort in covering the topic is sloppy, there are a few inaccuracies in the facts presented.

One of them being Towellers and/or any of the owners (existing or past) had any factory in Bangladesh.

I believe it is crucial to ensure that accurate information is shared to maintain the credibility of the piece. In order to provide your readers with the most reliable content, I would suggest fact-checking the information and making any necessary corrections.

Thank you for your understanding and dedication to producing high-quality content, in future.

Love

FK

@Fawad What a useless comment. Bhai if companies cant find avenues to invest their profits within business, they should pay them out as dividends. Instead, according to the author, the company is investing in bank and govt securities. Agar interest hee khaana tha tau business hee kyun kar raheen hain

No factory in Bangladesh

Faisal sahib, the aricle states that the company was exporting from Bangladesh. Nowhere does it state that they had a factory in Bagladesh. My understanding after reading the article is that they were probably outsourcing some of their orders to textile factories in Banglash.

Very conniving sisters – surely up to no good

Fraud family

Sana O… what’s the basis of your “fraud family” comment?

@NY…clearly you have little else to do but to make silly little comments.

@Sana, the story does not claim that they are a fraud in any way. That is a very strong word to use. Unless you are basing it on a personal experience.

Birkshire Hathaway, was originally a textile company. Ever since Warren Buffet bought it and jumped on the driving seat, it never distributed any dividends. Instead, he always held on to all of the profits and bought more profitable businesses. This made him the richest person in the world at one time. Still in top ten, and Birkshire’s original shareholders also became billionaires in process. A certain Bill Gates is also one of Birkshire’s shareholders.

Point being, the shareholders can earn from two ways, dividends and fundamental growth in the business that leads to growth in the share price. Keeping in view the recent growth and turnaround of Towellers the current shareholders should hold the shares and not sell or give in to any share buy back schemes. Growing company assets, grow the worth of the company. If you are not getting dividends, get benefit from the growth of the company.

My 2c.

It is the job of the board of directors to represent the shareholders. But if the family controls the board, then the shareholders are at the mercy of the family. The author did good for writing this story. But a more complete picture would be sharing the salaries and bonuses of the family executives and board members and compare them with other textile companies. That would instantly reveal whether this company exists for the benefit of its shareholders, or for the benefit of the family.

Contrary to what the article says, Why Not :

– Celebrate How Well a Women Led Textile Operation in Pakistan is doing and showing all the local seths how to run a lean operation.

– Talk about how they managed to turn around a business, in a male dominated industry.

– Talk about how they have grown with nearly zero debt, the profitability increase is directly linked with negligible debt, hence its prudent not to give out dividends.

– Talk about the fact – that all the owners are mothers with kids who despite there commitments are running an amazing operation.

– The article sadly is clickbait – and shouldve spoken about the exact opposite of what it captured.

Towellers Limited’s journey is truly remarkable and unique in many aspects. Founded in 1973, it started as a small textile unit with just six terry looms, but it has since grown into a prominent towel exporter in Pakistan. What sets Towellers apart is not just its success story but also its distinctive leadership – the company is managed by a quartet of sisters, and both the chairman and CEO are women, a rarity in Pakistan.

Shaikh family isn’t transparent at all. Greedy Like Mansha Family

Why dont you write an article?

You already knows what to write anyway.

Although any kind of positive criticism is an obvious right of everyone, I strongly believe that a few negative comments & criticism cannot down or discourage the Towellers LTD family & team at all.

In fact, it’s really difficult to deny the continued struggle & tremendous success of this wonderful organization.

I will also add that in this “male-dominated industry”, this amazing & talented bunch of sisters is managing and taking good care of their late father’s assets & ambitions very intelligently, not only taking good care but also doing their best & brave efforts to push the company up to the height of success & prosperity to fulfill the dreams of their father (Sheikh Obaid (Late).

great job by the sisters.

I think they should buy back their stock and delist from stock market. Best options for them and minority shareholders.

seth mind set…. earning for their own… these Seth companies can not be called corporate companies…. will never expend like multinationals…. will never spend on employees or share holders…. we are sure will never flourish and will die in due course of time

– Remarkable turn around

– Export oriented i.e maintaining quality standards

– Dividend, yes, it is not commensurate

– Business expansion…..taking away bulk of profit may appear good in a short term but true expansion is when u share. The more you give the more u get…

The cost of sales is increasing due to inflation and rising energy prices. profit margins will come down in future. The family appears prudent.