The start of this quarter has been the breath of fresh air the startup ecosystem in Pakistan desperately needed. A total of five startups announced successful rounds and even broke records, by collectively raising a total of over $15.6 million, restoring the industry’s faith in the country’s startup scene.

EduFi, a study-now-pay-later fintech announced a raise of $6.1 million earlier this month, with Zayn VC leading the pre-seed round, along with investment from Palm Drive Capital, Deem Ventures Ltd, Q Business, Abhi, Adalfi, Techlogix, and a few angel investors. Aleena Nadeem’s EduFi broke Krave Mart’s record of $6 million pre-seed round in December 2021. EduFi also broke Oraan’s record of the largest round by a female-founded startup in Pakistan.

In this quarter’s pre-seed rounds, three other startups announced million dollar rounds. Voyage Freight secured over a million dollars, with the aim of revolutionising global shipping and digitising logistics in the country. Meanwhile, home services tech company Helpp Technologies secured $ 1.1 million in a SAFE pre-seed round. Lastly, mobility startup BusCaro recently announced that it had raised $1.5 million in pre-seed financing.

As for this quarter’s seed rounds, online grocery company Krave Mart also closed a round of a little over $6 million, over the last year. They previously made history through a successful $6 million pre-seed round in 2021, raising a total of $12+ million in less than two years.

Looking back, it has been a tough year for startups globally, but a particularly bad one for Pakistan. Two prominent and seemingly successful startups went under in the second quarter of calendar year 2023: Medznmore announced their closure this summer, with Jugnu following suit.

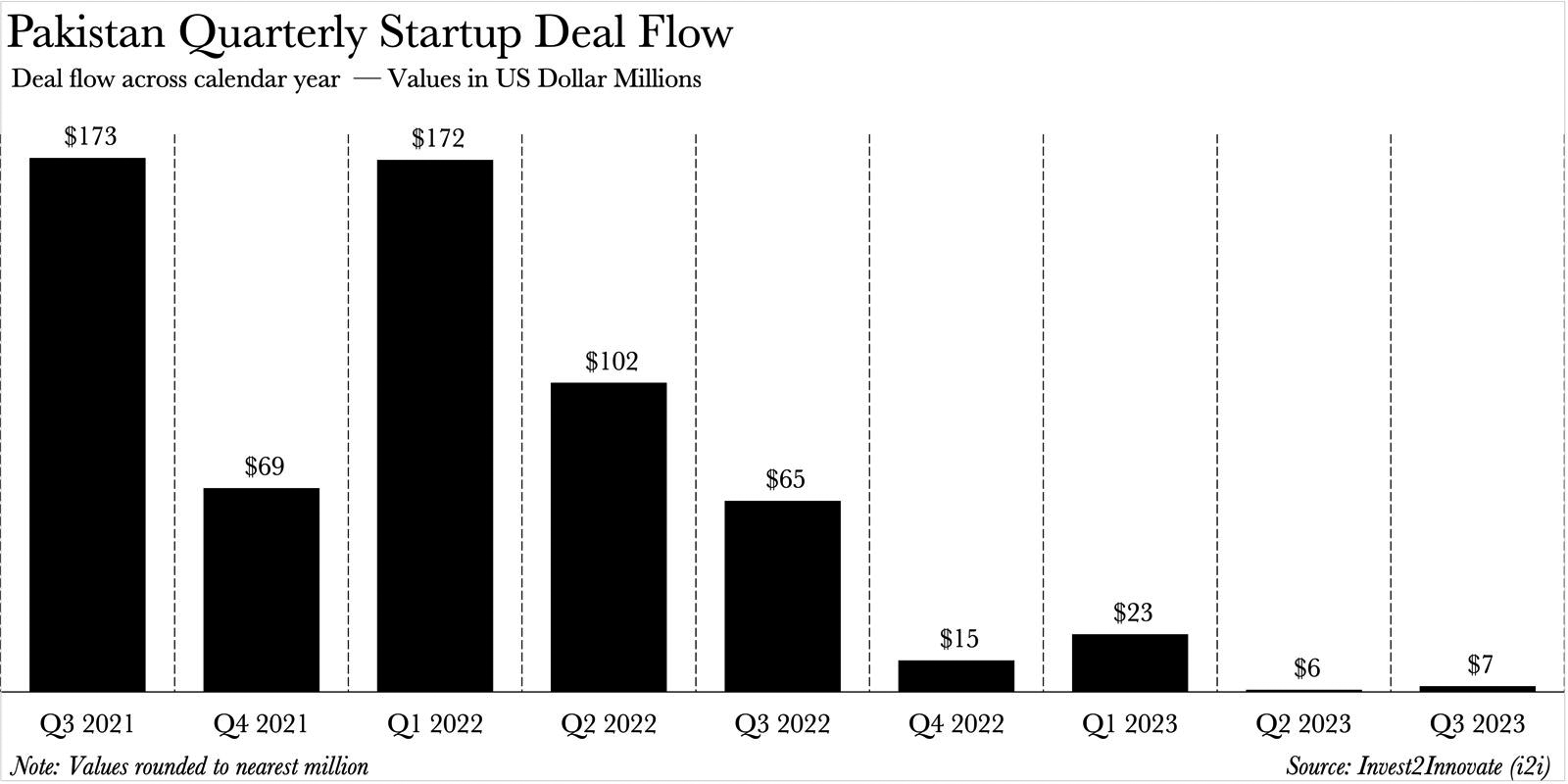

In fact, nine months into 2023 and the total investment in the industry was standing at a meagre $35.1 million. According to Data Darbar insights, this was an 89.4% drop compared to the first three quarters of 2022.

Let’s take a closer look at the harsh impact of international and domestic economics on Pakistan’s startup ecosystem before discussing the successful rounds closed in this quarter.

The funding drought

In October 2023, Data Darbar released a report on funding deals in the third quarter of 2023, highlighting a slump that recorded the lowest number of funding deals in the third quarter since 2018. The funding pullback of 2023 was not limited to Pakistan: in fact, it was a global trend.

According to Pitchbook-NVCA Venture Monitor, in the third quarter of 2023, global funding stood at $73 billion, a 10.2% quarter-on-quarter decrease compared to the previous quarter’s $81.4 billion. Moreover, compared to the same time last year, the decline was even more apparent, with a 31% decrease. To put things in perspective, the third quarter of this year marked the lowest funding value since the fourth quarter of 2017.

In volumetric terms, the global deal count had dropped to 7,434 deals. This was the first time in over six years for the total global deal flow to be below 8000, since the third quarter of 2016.

Meanwhile in Pakistan only five rounds were announced in the third quarter, signifying a 50% year-on-year reduction and a 37.5% drop from the previous quarter. This resulted in a substantial 70.5% year-on-year decrease in the average funding amount, which now stood at $1.36 million for the third quarter of 2023, down from $4.26 million.

Industry’s sentiments

The year 2023 started with an impending economic crash and looming threat of default in Pakistan. A few months in and the political instability made matters even worse, with a nationwide internet outage in May after former Prime Minister Imran Khan’s arrest.

Amidst all kinds of disheartening news, a funding ‘winter’ was the last thing the tech industry needed.

Profit reached out to startup founders and venture capitalists to understand the industry’s sentiments during such a trying time.

Kulsoom Lakhani, partner at i2i Ventures, told Profit how difficult it had been to navigate through the crises and explaining the current ecosystem to her limited partners (LP). She said, “If your investors were already in the door, it has been about explaining how we, as funds, are navigating this environment and demonstrating how our strategy is reflecting the realities. If you’re raising from new LPs, it’s been incredibly difficult. The word Pakistan itself shuts down conversations, given the current macro environment.”

Lakhani also shared how she worked around these challenges: “You lead with discussing the opportunity for early stage investment, how a fund’s life is not short-term, and how this is part of a longer cycle.”

Similarly, Robin Butler, partner and head of impact at Sturgeon Capital told Profit, “The reality is that 95% of LPs would never look at venture capital in emerging markets, due to the perceived risk level. This was true when the market was on the way up and is still true today. For those that are willing to look at emerging markets, the current environment means they are taking longer in their due diligence and preferring multi-country exposure to diversify country-specific risks. The long-term secular trend of digitalisation remains as true as it did before and this is what LPs find most compelling.”

When asked whether she had any hope of the situation improving in upcoming months, Lakhani’s response reflected concern yet optimism. “I feel that 2021 to 2022 were outlier funding years – 2021 was 5.5x of 2020, and most emerging markets saw that swell of international funding everywhere. I think we’ll see growth again next year, but I’m not sure whether it will be to the extent of the past two years.”

She continued, “This market does need growth stage capital, especially for companies that raised two years ago, and that gap will need to be plugged. I believe over the next few quarters, we’ll see this dip reflected before numbers start coming back up, hopefully, post the first quarter of 2024. I also think we’ll continue to see a lot more local M&A activity. With the scarcity of capital, some larger players will acquire smaller players, or merging of entities might occur.”

Butler had a slightly more optimistic response: “Winter is a season that by definition passes. Emerging markets go through cycles at an accelerated rate, typically every 3 to 4 years, compared to developed markets, which is every 10 years. The overexuberance of 2020 to 2021 won’t return, and this should not be the benchmark that people use to judge the seasons in emerging markets. The next 12 to 18 months will be challenging but good businesses will be able to raise at sensible valuations.”

Lo and behold, Butler’s assertion held true. Good businesses were indeed able to raise at sensible valuations, and that too in just a month.

When asked which sectors might be the best performing in a market like Pakistan’s, Butler predicted: “Lower cash burn business models that are solving key problems affecting the day to day lives of businesses and consumers will do well. Sturgeon remains focused on fintech, B2B software and marketplace opportunities that have large addressable markets and strong unit economics.”

While VCs remained focused and hopeful, Profit also spoke to Farooq Tirmizi, founder of Fintech startup Elphinstone that raised $1 million in a seed round last quarter. Tirmizi said, “A tiny $1 million deal in a seed round back in 2021 and 2022 would frankly not even be worth announcing, when companies were easily raising upwards of $10 million in seed rounds. You were starting to see some deal sizes roughly approaching what was considered normal in Silicon Valley pre 2019.”

This reflects how dismal the overall funding in the last quarter was.

Tirmizi also highlighted there tends to be a significant lag between when a deal is announced and when the money actually comes in. “We waited until the last check cleared before we announced it but that is not always the case.” So, there might be others who have raised capital but have not made an announcement. However, it is safe to say that this quarter has been a positive one, in terms of funding announcements.

Tirmizi said Pakistan is often overlooked compared to larger markets like India and faces reluctance from investors due to perceived risks. He emphasised on the need for companies in Pakistan to adopt a broader strategy, focusing on being “Pakistan first” rather than exclusively targeting the local market.

According to Tirmizi, the lack of funding taught startups some harsh but valuable lessons, such as being more disciplined in their spending. He recognised that some expenses previously considered necessary for the image of a successful company were, in fact, not essential for the business’s success. Tirmizi saw this as an opportunity for many to adopt more efficiency in resource utilisation, as opposed to the practices of startups with more freely available funding, especially back when money was often wasted on experimental and cosmetic endeavours.

The silver lining in the current market downturn is the opportunity for startups to learn frugality and develop a more sustainable business model. It is not an uncommon accusation for startups to burn through money, but Tirmizi emphasised the importance of wisely allocating funds to genuinely develop the business’s products that people want and are willing to pay for.

The quarter of golden opportunities?

Lakhani told Profit that VCs don’t just invest in a pitch deck, but also in the founders ability to materialise a good idea. And that is exactly what many witnessed this quarter. Despite prominent startups winding up operations, along with the growing scepticism of international VCs in the Pakistani market, some founders made ripples that have the potential to make waves in upcoming months.

Let’s start with EduFi. EduFi, short for education finance, is a fintech startup that enables financially strapped students to secure loans for their tuition fees.

Aleena Nadeem, a graduate of MIT with prior experience at Goldman Sachs and Ventura Capital, witnessed firsthand the financial challenges faced by many individuals striving for quality education while working at the Progressive Education Network (PEN) in Pakistan. PEN is a nonprofit organisation providing free and quality education to financially disadvantaged children.

Nadeem said, “I was thinking about what the biggest problems we currently face in Pakistan are and how we can use technology to solve them. It boiled down to poverty and illiteracy. While many children in Pakistan make it to high school, there is a significant decline in those who can pursue higher education. EduFi aims to bridge the financial gap between high school graduation and the first year of university admission.”

In Pakistan, approximately 40% of students opt for private schools due to the subpar quality of public schools, resulting in an annual expenditure of over $14 billion on education. Additionally, more than 50% of the adult population lacks access to essential financial services like bank accounts and insurance.

The two-year-old company has established partnerships with 15 universities, making the app accessible to approximately 200,000 students across Pakistan who need to pay fees for undergraduate, Master’s, and Ph.D. programs.

Most interestingly, this student loan fintech utilises AI tools to assist with credit scoring. “Our credit scoring model uses AI to ensure that we take education sector related statistics to have a low NPL (non-performing loan). So what do I mean by education sector related data? Basically, a very small example of that could be our dropout rates,” Nadeem said.

She continued, “If a student has a low attendance or a low academic record, his dropout rate is likely to be higher, and therefore he may not be eligible for a student loan or a size of a student loan that is the largest we can give, which is Rs 25 lakhs.”

Nadeem also explained that what they have built from a product perspective is really building a loan management system for their liquidity providers which allows for the loan’s fast dispersal. “The point of fintech in my opinion is to have fast 24 hour dispersal, like within 24 hours or five to six hours to actually disburse the loan, not to annoy the consumer with hassle. So, when a consumer applies, all they need is a bank statement and no additional collateral. So, if our model gives them a relatively good score, they are genuinely able to get the credit in their account within five hours, which is a massive feat for us.”

They also use AI for unsecured patterning. This entails clustering certain types of credit consumers into a bucket and predicting how these consumers will behave.

Currently, the company’s main target is medical and dental students. According to Nadeem, these students often have the highest tuition fees, and many promising students tend to drop out due to financing constraints.

EduFi loans are dispersed against the fee bill, rather than a large student loan for the entire four to five year program. On the loan repayment front, EduFi mainly offers a year’s time for payback, which can be broken down into monthly instalments. They also offer three and six month payback periods to students who can or wish to return the loan sooner. The interest rate on these loans is the lowest in the market currently, which is 29-30% annual percentage rate.

The company is domiciled in Singapore. Having one’s startup registered in Singapore is a growing phenomenon among both Pakistani and other tech and non-tech companies. This is because it is a strategic Southeast Asian region that not only offers greater access to major markets, but also attracts better investments.

According to Nadeem: “I based it out of Singapore because investors are more comfortable with the holding company being in Singapore, but we have an entity in Pakistan. Secondly, we do have plans to expand to southeast Asia.”

Voyage Freight, a digital freight forwarding startup, secured over $1 million in its pre-seed round, led by Indus Valley Capital. The startup aims to transform logistics for Pakistani exporters by providing a frictionless end-to-end global shipping solution.

The founders said their digital platform addresses challenges in traditional freight forwarding processes, offering exporters a user-friendly one-stop solution. Voyage’s platform consolidates shipping operations on a single dashboard, providing real-time visibility and control, reducing time and costs, and enhancing the competitiveness of Pakistani goods globally. To solve export related challenges in the country, Voyage aims to tackle the current account deficit and support the economy by streamlining logistics.

Profit asked Omar Mukhtar, the co-founder of Voyage, how his company will navigate export related challenges, such as ensuring the quality and volume of export goods, considering that exports have declined in the past months due to output limitations relating to electricity issues, raw material shortage from 2022 floods and the import ban from earlier this year.

Mukhtar said, “The current industry is extremely fragmented. It consists of over 1000 plus freight forwarders. Even in the midst of declining exports, we believe that by digitalisation, there is ample room for us to grow. If we are even able to cater to 5% of the total existing market, we could potentially become one of the largest logistics companies in Pakistan.”

He elaborated, “In regards to declining exports, we honestly believe that within the next few years, you will see an astounding growth in exports. Our devalued currency will be a boon for exporters, which, due to the current global decline in consumption, is hampering our country’s growth in the short term.”

In the service sector, Singapore-based home services app Helpp Technologies announced a $1.1 million pre-seed round closed this quarter. The round was backed by E Planet Global, You Ventures, Engie Saudi Arabia, J Holding Pakistan and other high net worth and business executives from the US, UK and Saudi Arabia.

The company has a business-to-business (B2B) arm, as well as a business-to-customer (B2C) arm, which together enables it to provide on-demand services in four main verticals, including at home salon, laundry, paint and air conditioning services in Karachi and Lahore. The B2B arm, through partnerships with big box chains and small and medium enterprises, aims to strategically make service provision easier through digitisation, while the B2C arm functions to revolutionise home services and improve customer satisfaction.

Mustafa Iqbal, founder and CEO of Helpp Technologies told Profit, “We believe that creating a social impact and making profits are not mutually exclusive. We wanted to build a budget brand to solve people’s household needs. A core part of our business, especially in the woman-led salon vertical, is to empower individuals and small businesses by giving them the platform to elevate their incomes. The increase in salon workers’ income after partnering with Helpp has been almost 5x.”

In the ride-hailing startup space, mobility startup BusCaro raised around $1.5 million in a pre-seed round. Founded by Maha Shahzad, who previously worked at a similar startup called SWVL that went under, BusCaro is the third attempt at solving the same problem.

Will BusCaro succeed where startups like Airlift and SWVL failed? Shahzad claims to consciously ensure that the business remains profitable and does not offer subsidies and discounts that would ultimately derail the company’s own profitability. Interestly, to combat the capacity utilisation issue, BusCaro currently uses a subscription-based B2B2C model and a B2B partnership model to acquire customers, instead of treading down the B2B route taken by Airlift and SWVL.

Kassim Shroff, Hammad Bawany, Haziq Ahmed, and Ahsan Kidwai’s Krave Mart also announced a successful $6+ million seed round this month. The capital was raised between 2022 and 2023, with the last deal closing in the fourth quarter of 2023. This startup had previously held the record of securing the highest pre-seed funding in Pakistan, a mantle recently taken over by Nadeem’s fintech EduFi.

The founders had previously worked within the industry, at companies such as Foodpanda, Daraz, and SWVL. In the same vein, Krave Mart seeks to provide a hassle-free grocery shopping experience.

Krave Mart entered a deal-by-deal syndicate fund with Japan-based platform PROTOCOL Capital. Interestingly, soccer star Keisuke Honda, known for playing for celebrated football clubs like AC Milan, is the lead LP in Krave Mart’s syndicate with PROTOCOL.

The founders refrained from confirming the current valuation of Krave Mart, stressing that numbers do not reflect the true success or potential of a company. They did, however, provide some other useful insights.

Profit asked Shroff how it has been operating a grocery business in the current high inflationary environment, where there has been belt-tightening across the board. He said, “Grocery is a necessity. You will eat three times a day, so roughly ninety times a month. However, in inflationary times you will first cut down on luxuries, like travelling and in the second stage you would try to reduce expenses, such as dining out but you still need to eat. What you end up doing is, you start switching between brands.”

This would mean you start buying a local chocolate and hazelnut spread instead of buying a big imported jar of nutella. But you will not stop grocery shopping altogether.

Shroff elaborated: “If grocery was 30% of your monthly spending, it might become 50% because you let go of other unimportant things. I wouldn’t say that our business was impacted too much and it has even grown, but yes trends show that people are buying cheaper items.”

These numbers might not be considered much in the global tech ecosystem but for an emerging market like Pakistan, these same numbers do offer some hope. Whether these startups can actually solve real life problems using technology as they claim to is a different problem altogether. But it looks like the funding ‘winter’ may just be over – for now.