Pakistan’s Islamic banking industry witnessed substantial growth, increasing by nearly 22% in the third quarter of 2023, reaching a record high of Rs8.417 trillion.

The State Bank of Pakistan’s Islamic Banking Bulletin revealed that Islamic banking sector deposits surpassed the six trillion rupees mark, reaching Rs6.160 trillion by the end of September, compared to Rs5.021 trillion in the same period last year.

The market share of assets and deposits of the Islamic banking industry in the overall banking sector stood at 19.6% and 22.5%, respectively, during July-September 2023.

The quarterly surge in assets was primarily driven by a rise in net investments, increasing by Rs456 billion and reaching Rs3.928 trillion by the end of September 2023, as per the SBP’s report.

On the other hand, net financing for the Islamic banking industry was recorded at Rs3.026 trillion. The share of net investments and net financing in the total assets of the Islamic banking industry was recorded at 46.7% and 35.9%, respectively.

The growth in net investments was attributed to the Islamic banking industry’s investments in the Government of Pakistan’s domestic Ijarah Sukuk (GIS).

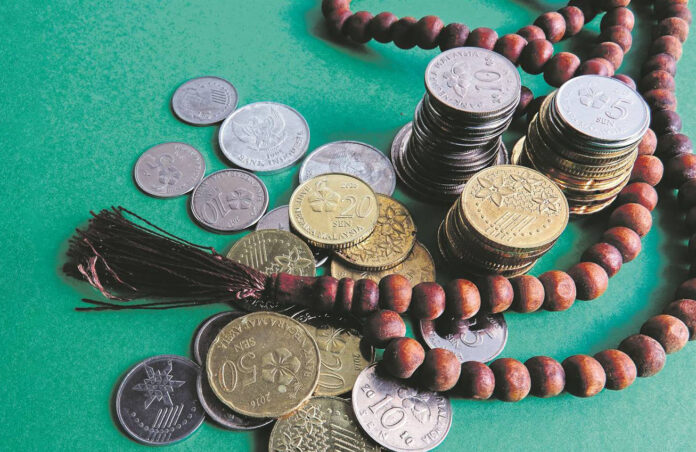

Pakistan, with the world’s fifth-largest population and the second-largest Muslim population, is witnessing increased demand for Shariah-compliant banking services. A recent study by the SBP in collaboration with the Department for International Development (DFID) revealed that religious beliefs contribute 23% to the demand for Islamic banking, with a higher demand observed among households (retail) than businesses.

The SBP aims to convert current conventional banks into Islamic financial institutions, aligning with its strategic vision for 2023–2028. This involves creating a roadmap for the transition to Islamic banking and coordinating with banks for the conversion.

The Federal Shariat Court’s historic ruling, mandating compliance with Shariah in Pakistan’s banking sector by 2027, has set a significant milestone for the Islamic banking sector.

From my experience, I guess the best way to avoid online scam is by having a very thorough investigation about the subject matter. If i had this advice i would probably have not gone through the ordeal i went through some months past. Binary Options is a blessing to some and curse to many, it almost ruined me. Gracefully, i got in contact with a certified recovery specialist ( Mr WALLINCE ) who helped me with refunds. I can’t say for any other recovery expert but this ( MR WALLINCE ) came to my rescue and I RECOMMEND ONLY his service.

Contact hes support team for further assistance:

COINSRECOVERYWORLDWIDE at G M A I L dot C O M