On January 8th, Treet Battery Limited received a notice from the Pakistan Stock Exchange (PSX) in relation to its stock price movement. This is a routine inquiry to companies when their share price or volume sees unusual movement which needs to be explained.

The aim of this practice is to oblige the companies to disseminate all information pertaining to unusual stock movements. This ensures that market participants are not at a disadvantage due to some having access to preferred or insider information.

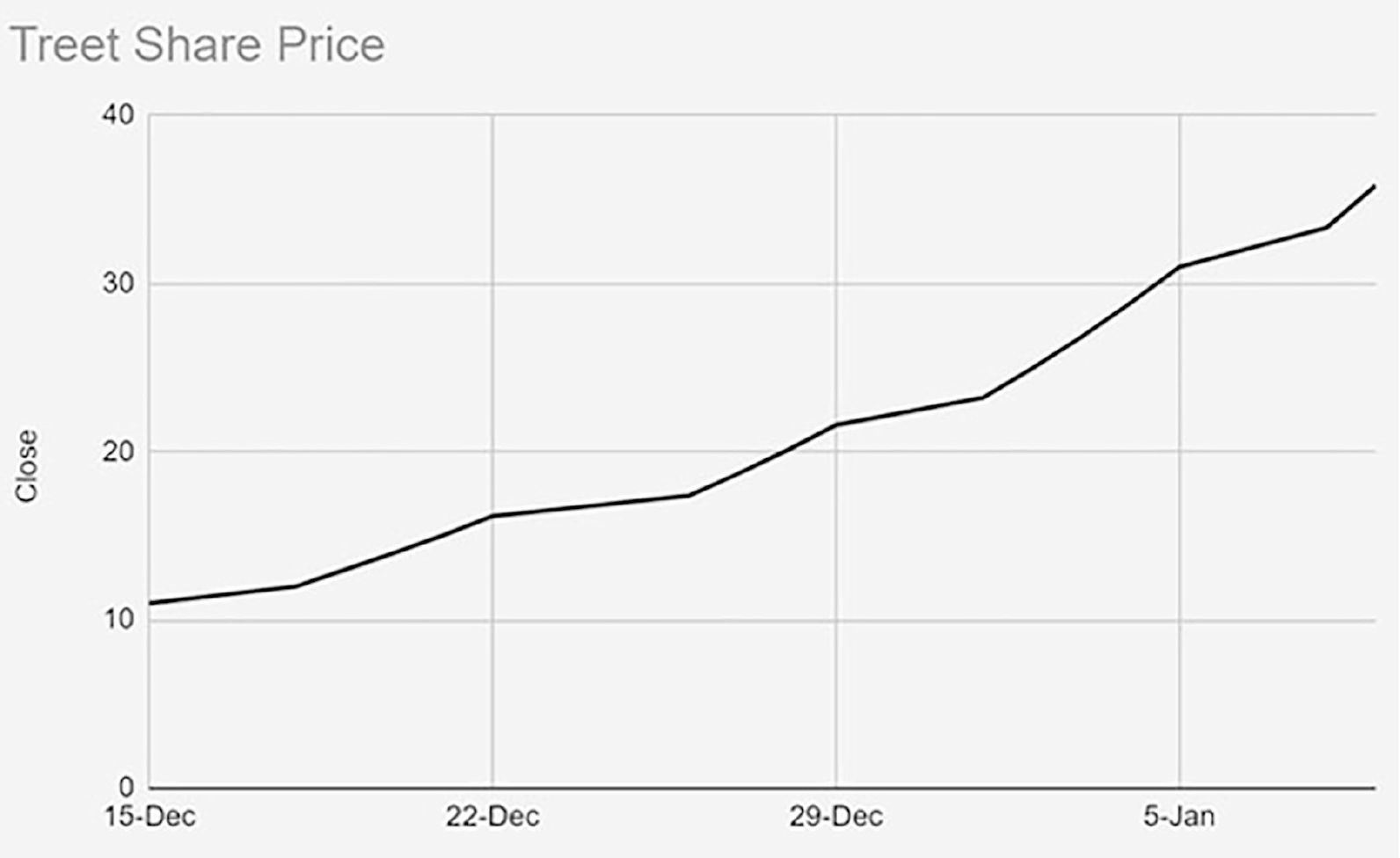

In the notice itself, the PSX acknowledges the fact that the annual accounts of the company were made available on the 27th of November 2023 but the price movement that has been seen in the share since 15th December 2023 was concerning and a clarification was sought from the company itself.

Can there be something deeper behind the increase in the share price?

What is Treet Battery?

Before we delve into the notice and the share price performance itself, let’s take a step back and start from the beginning. Treet Battery was formerly a part of the First Treet Manufacturing Modaraba which was manufacturing soap, corrugated boxes and batteries. The Modaraba was set up in 2005 and was managed by Treet Holdings Limited which was its parent company.

In simple terms, a modaraba is a financial contract between an investor and a manager who is supposed to share the profits or losses of the investment between the investor and the manager based on the agreement. In this case, a manufacturing modaraba is using those funds to manufacture products and then giving back a return to the investors.

The Modarba set up the commercial production of batteries in February of 2018 and the Modarba has been in active efforts to demerge the battery division from the company itself since its inception.

The batteries division of the company was involved in manufacturing of Daewoo batteries which is an established Korean brand. The project was carried out under the guidance of Korean experts and the product has been able to carve up a market share of itself in the battery market. The company prides itself for being the only one manufacturing maintenance free sealed batteries (MFSB) which do not require any form of maintenance from the customers.

In terms of the performance, the company saw losses in its initial years due to high training costs that had to be carried out for the staff. The Korean staff was hired to train the local workforce in order to work in the manufacturing of batteries. In addition to that, raw materials had to be imported in order to carry out production in the initial stages. The company earned gross losses from 2018 to 2021 while the net profits of the company remained in the red from 2018 to 2022.

A turn in fortunes

The company has seen a renaissance of sorts at the helm in recent years. Initially, they had to hire Korean experts as part of their workforce which was having an impact on the costs faced by the company. As time has gone on, it has seen that the administrative costs have decreased as the trained workforce is taking over more responsibilities which has allowed some of the foreign staff to be gradually replaced.

Additionally, increased plant efficiency, cost pass-on to consumers due to inelastic demand, and increased localization have elevated the company’s performance.

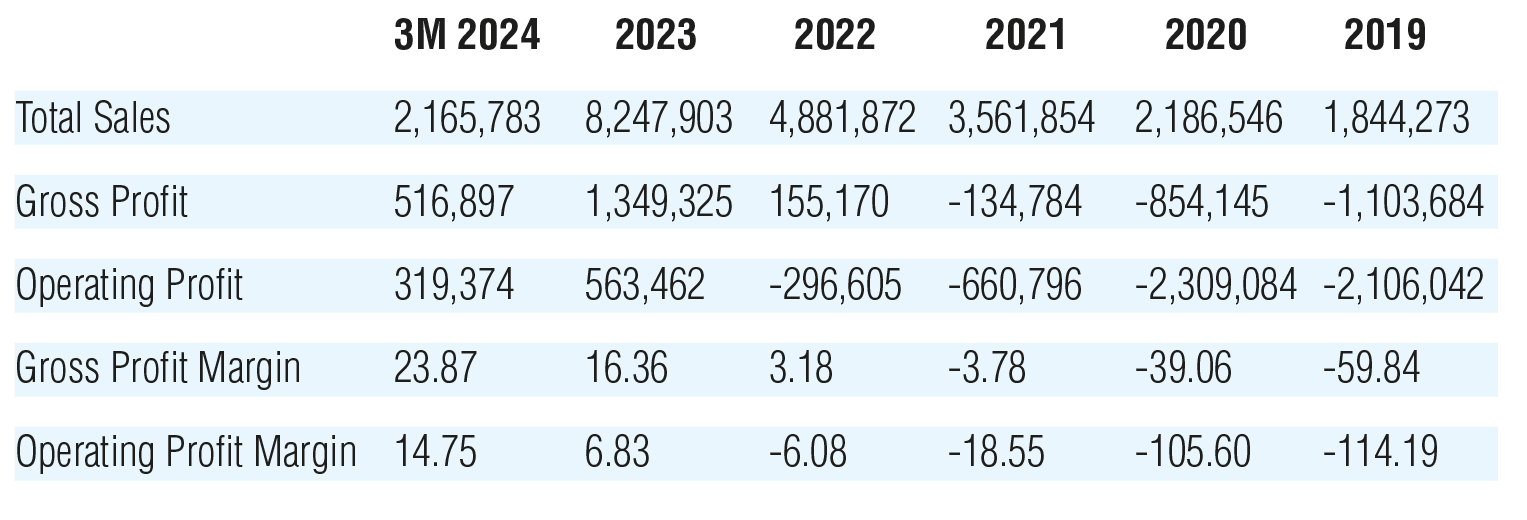

The implementation of these measures resulted in a significant turnaround for the company’s financial performance. Sales increased from Rs. 1.8 billion in 2019 to Rs. 8.2 billion in 2023. The profitability of the company also improved, with gross losses of Rs. -1.1 billion in 2019 turning into gross profits of Rs. 1.3 billion in 2023. Additionally, operating losses of Rs. -2.1 billion in 2019 were transformed into operating profits of Rs. 0.6 billion in 2023.

Similarly, the gross profit margin has gone from -60 percent to 16% in the same period while the operating margin has gone from -114 percent to 6.9 percent.

Syed Shehryar Ali, CEO of Treet Battery stated that “the executive team at Treet Battery Limited is highly optimistic about the future prospects of our business. We firmly believe in the potential and premium quality of our products. Furthermore, we are excited to announce that the launch of new battery SKUs is underway, which we anticipate will significantly contribute to our growth and market presence.”

These factors point towards the fact that this upturn in performance is expected to continue. Ali also points towards the fact that “at Treet Battery Limited, we are constantly exploring innovative ways of product development.”

“Our focus is on leveraging technology to stay ahead in the market. While we are examining the potential advantages of MFSB technology, we will keep the market informed about any definitive developments in this area,” he added.

Demerger of Battery Segment

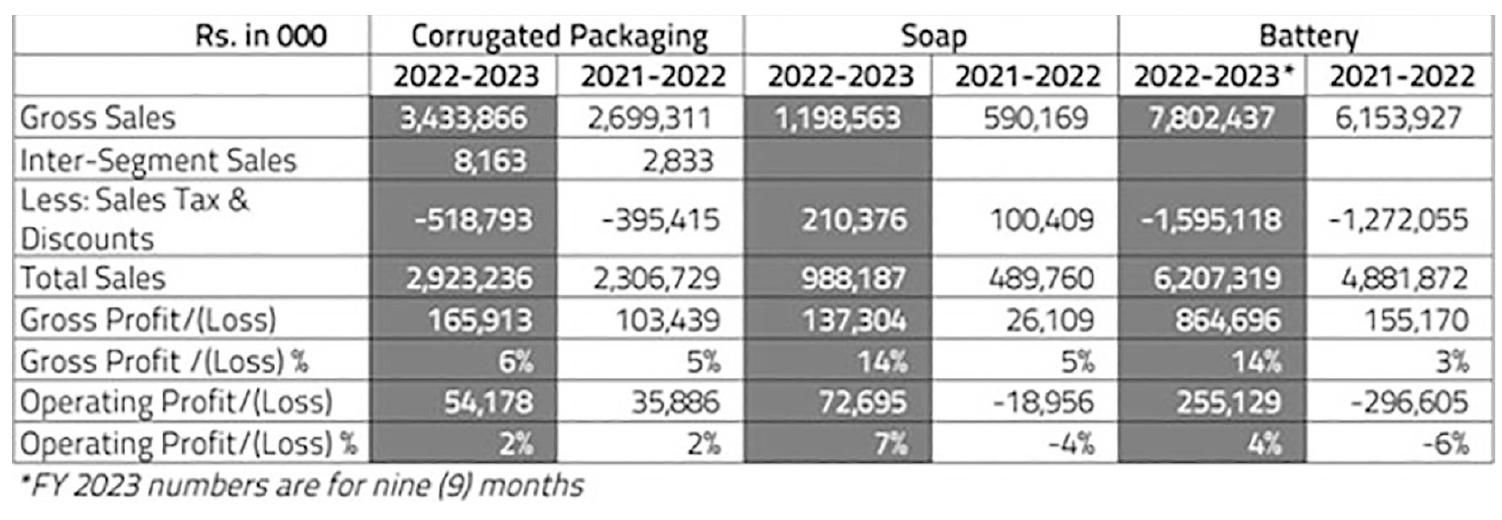

Ever since the battery plant was set up, the company was looking to demerge it from the Modarba company. After the legal and regulatory requirements were met, the company was finally able to demerge the battery segment on 1st of April 2023. After the demerger was carried out, the battery segment has been able to post results for two of its quarters ending in June and September respectively. These results also show that the company is going strong and its results are going from strength to strength.

After the demerger took place, the shareholders of the Modarba were given the shares of the demerged battery company in proportion to their shareholding in the Modaraba. Before the demerger, Treet Corporation and Treet Holdings owned 99.3 percent of the shares in the Modaraba and after the demerger, they own 99.3 percent of the shares in Treet Battery.

The demerger meant that the assets and liabilities of the battery company were separated from the Modarba and its stand alone accounts have been reported by the company which were references in the PSX notice mentioned earlier. Since 1st April 2023, it is understood that Treet Battery Limited is a separate company now and their financial performance and statements are going to be released as a separate entity from the Modarba itself.

The listing and share price performance

After the demerger took place, Treet Holdings decided to list Treet Battery Limited as a separate scrip on the Pakistan Stock Exchange. The shares were listed and trading started on 15th of December 2023 from an initial price of Rs. 10 per share. Since then, 17 trading sessions have taken place and in every session, the share price has reached its upper lock. This is the highest price the share can reach in a day and the company has been able to see its share price increase to the maximum limit each and every day.

| Open | Close | Change | % Change | |

| 15-Dec | 10 | 11 | 1.00 | 10.00 |

| 18-Dec | 11 | 12 | 1.00 | 9.09 |

| 19-Dec | 12 | 13 | 1.00 | 8.33 |

| 20-Dec | 13 | 14 | 1.00 | 7.69 |

| 21-Dec | 14 | 15.05 | 1.05 | 7.50 |

| 22-Dec | 15.05 | 16.18 | 1.13 | 7.51 |

| 26-Dec | 16.18 | 17.39 | 1.21 | 7.48 |

| 27-Dec | 17.39 | 18.69 | 1.30 | 7.48 |

| 28-Dec | 18.69 | 20.09 | 1.40 | 7.49 |

| 29-Dec | 20.09 | 21.6 | 1.51 | 7.52 |

| 1-Jan | 21.6 | 23.22 | 1.62 | 7.50 |

| 2-Jan | 23.22 | 24.96 | 1.74 | 7.49 |

| 3-Jan | 24.96 | 26.83 | 1.87 | 7.49 |

| 4-Jan | 26.83 | 28.84 | 2.01 | 7.49 |

| 5-Jan | 28.84 | 31 | 2.16 | 7.49 |

| 8-Jan | 31 | 33.33 | 2.33 | 7.52 |

| 9-Jan | 33.33 | 35.83 | 2.50 | 7.50 |

Is the share price increase justified?

It is a given fact that when the share price of a company is seeing returns of 358.3 percent in a period of less than a month, eyebrows will be raised which has taken place in this situation. However, it can be seen that some of the price increase can be justified. The market seems to be optimistic that the performance of the company is going in an upwards trajectory and, just like the share price, the actual results of the company will follow the same trend.

The financial performance of the company does warrant some of this increase in share price. Now that the burden of corrugated boxes and soap segments will not dilute the results of the battery company, the battery company by itself will be able to post better results going forward. The results from first quarter ended September 2023 show that operating profits were Rs. 319 million while the soap and corrugated division earned Rs. 87 million of operating profits for the same period.

In addition to that, the asset base of the battery division is primarily made up of plant, property and equipment while the Modaraba has 70 percent of its total assets locked in loans, prepayments and trade debts. As a whole, the battery division would have been adversely impacted by this burden. As the demerger has taken place, it has unloaded much of this weight off its shoulders.

The benefits of having local suppliers for raw materials, local trained workforce and increased efficiency will be better for the profitability of the company.

Ali also points towards the fact that the company is looking to change the current debt structure as it is costly and is squeezing the profit potential of the company. The company has borrowed heavily from Treet Corporation and the company is looking to bring its debt down to sustainable levels.

Is it all rosy and peachy?

But hold your horses folks.

Even though some of the increase can be justified, the increase of more than 3 times share price in a span of a month is more than justifiable. There are other battery companies which are listed in the stock exchange like Exide and Atlas Battery. Both these companies are well established in their field and are providing good returns in the form of earnings to their shareholders. “Performance has improved significantly over the last year with margins for Atlas and Exide also up” Yousuf Farooq, Director Research at Chase Securities opines.

But this needs to come with a caveat. The fact is that these are companies which are established and have been giving out dividends on a consistent basis. Comparing Treet Battery to these juggernauts will be premature. Both of these companies are earning profits on a sustained basis.

Some skeptics say that the earnings do not justify the increase in price and there is no comparison between Treet and either of these two companies. To put things into perspective, “Atlas and Exide are trading roughly at a multiple of 8 times their earnings while Treet is trading at 14966 times,” states Yousuf Saeed, Head of Research at Darson Securities.

Even if these two companies are used as a benchmark, these companies have earned a return of less than 100 percent over the last year while Treet Battery has earned more than 3 times its listed price which comes to around 36 times on annualized basis. Treet Battery declared an earning per share of 0.07 for its recent financial year which shows that the company still needs to increase its returns and profits to be considered a competitor to Exide and Atlas. Exide earned an EPS of Rs 97 per share while Atlas earned Rs 62 per share.

One bright spot for Treet Battery is that it experienced a net profit margin of 2.84 percent while Exide had a net profit margin of 3.22 percent and 5.25 percent for Atlas Battery. So it is showing signs of a recovery after becoming profitable but the quantum of sales seen by Treet was Rs 2 billion compared to Exide which earned revenues of Rs. 23 billion and Atlas of Rs. 42 billion. There is still a long way to go.

Therefore, the numbers do present Treet as an outlier, and it remains to be seen whether market forces or other factors are responsible for this trend.

Can the price be manipulated?

Usually what happens in certain shares is that due to the low free float available in the market, market participants can look to increase the market price as there are not many buyers and sellers trading in the market. In case of Treet Battery, more than 99 percent of the shares are held by the Treet Group. First of all, Treet is not manipulating the shares. In case they trade even a single share, they have to disclose this information in the market as they are mandated to do so. So let’s get that fact out of the way.

An illiquid share which barely has a free float of 1 percent is ripe for manipulation as a buyer can easily increase the prie with little to no volume being traded on a daily basis. This is one thing that is a reality in the Pakistan Stock Exchange as lack of participation allows for this form of trade manipulation to be carried out. With a free float of 8 million shares available to the market, there is an opportunity to increase the price with little trade activity.

when will holder’s of treet modarba certificate get shares certificates of treet battery ?

or will they get it at all ?

when will holders of shares certificates of treet modarba will get share certificates of treet battery Ltd.

MY PERSONAL EXPERIENCE ON LOST CRYPTO RECOVERY!

I read so many stories about bitcoin loss to scams. I will like to start by saying the agencies responsible for bitcoin security has really done nothing to help locate stolen or lost coins. In my situation my MacBook was hacked by someone that had access to my emails, i immediately contacted blockchain and they only wasted my time, after which i worked towards getting help else where, i was referred to consult a bitcoin expert who helped track and retrieved my 3.3 btc, for an agreed fee. I was more than grateful and willing to pay more after the job was done. Thankful i didn’t fall victim and would like to recommend ( MORRIS GRAY 830 @ G maiL . COM )

what is the book value of tbl. the journey of uper locks have been ended with lower locks series.

on 19th jan 2024, the first lower lock of rs 55 posted with tradding of 1.09 million shares traded and more than 1.5 million shares were in que of selling.

what stregity we investor apply .

regards

I m not an expert on subject , but feel there will be atleat another 6 to 8 lower locks..