As we embark on a new year, the dynamics of the auto industry have been a subject of recent discussion and analysis. In a recent dialogue with a prominent journalist, I shared insights derived from my two decades of experience in the field. This conversation sparked interest, leading to the publication of an article highlighting my analysis, particularly emphasizing a potential surge in demand, estimated at 350,000 units every five years due to population growth. In response to inquiries from friends seeking more details on this forecast, I’ve decided to delve deeper into the subject in this article.

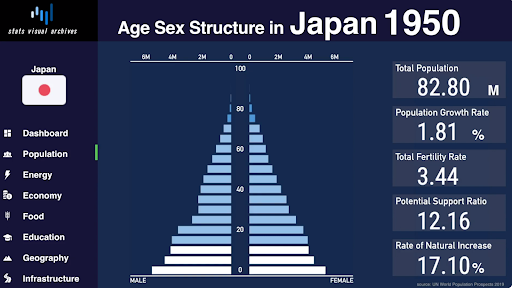

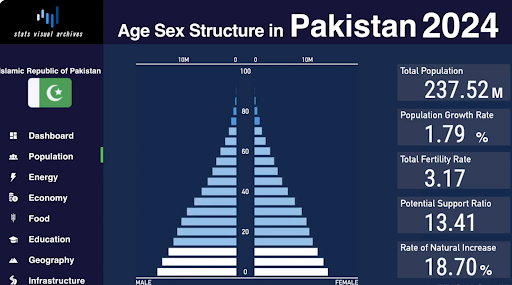

Population pyramid chart

Understanding the trajectory of population growth is crucial, especially when considering its profound impact on future demand. A population pyramid chart illustrates the distribution of people across age groups, serving as a predictive tool for assessing future needs. Take Japan, for instance; their upward triangle pyramid in 1950 set them on an economic superstar path, where a youthful population played a pivotal role. Fast forward to today, Pakistan has a promising upward triangle, rather better than Japan’s, meaning a lot of young blood. With some smart economic moves, we stand at the threshold of significant opportunities.

Relevant age group

The age group that makes car purchasing decisions typically ranges from 25 to 55 years, which is predominantly male. Though women also buy cars, for the ease of explanation I’m limiting to the dominant car buying gender.

It can be different for different industries: for example, for mobile phones, the relevant age group could start from as low as 15 years, both male and female.

Identifying the size of the target consumer universe

Let’s break down the numbers: Currently, 12.3 million young men fall within the 20–24 year old age bracket in Pakistan. Over the next five years, as they transition into the car-buying age group of 25-60 years, a substantial market emerges. Leveraging data from Ipsos Consumer Book 2022, we find that 7% of the national population belongs to the affluent SEC-A category, which includes educated employed or self-employed middle-top executives and small to large scale business owners.

Consequently, out of the 860,000 young men in the 25-30-year age range within SEC-A, a conservative estimate suggests that 40% may seek new cars for their need to showcase social status, travel over larger geographical stretches and avoid weak public transport systems in urban centers. This culminates in a projected demand of 350,000 units over the next five years. Extending this projection to a decade unveils an additional demand of 380,000 units, potentially surpassing a million units by 2035.

Recognize different buying behaviors

Understanding the psyche of Generation Z is paramount, as Gen-Z encompasses those in the age brackets of 15-20 year-olds and 20-24 year-olds. They have a very pragmatic approach to finances and an emphasis on product value, as opposed to intangible brand allure. They’re all about bang for their buck and are quite different from earlier generations. Recognizing these nuances in attitude and buying behavior is fundamental for crafting effective marketing strategies tailored to this demographic.

Expectations for 2024

The annual demand for cars reached a commendable figure of 320,000 units in recent years. The automotive sector’s performance is intricately tied to prevailing interest rates, not merely due to the facilitation of car financing but also owing to its impact on overall industrial growth resulting from low-interest rates. Forecasts indicate an anticipated reduction in policy rates to 15% in the year 2024. This reduction, coupled with the pent-up demand from the preceding year, leads us to anticipate a robust resurgence in car sales, likely three months after the implementation of reduced interest rates.

Another critical determinant influencing car demand is the fluctuation in PKR parity against USD. The projection for the coming year suggests a moderate devaluation of the rupee.

In conclusion, while the intricate dance of interest rates, currency valuations, and market forces shapes the trajectory of automotive demand, my outlook for the second half of 2024 is optimistic. As a stakeholder in the auto industry, I remain cautiously optimistic, navigating through economic nuances and demographic shifts that paint a promising picture for the year ahead.

pakistan’s future is dull and author is talking about bright future of its auto industry.

This article is a great example of evidence-based optimism or ‘cautious optimism’ as the author put it. This article applies this framework to the auto-industry, but the same framework could be applied at both individual and societal levels to maximize our potential. A pessimistic outlook, as is common in our public discourse, does nothing but dig us deeper into despair.

why u r just focusing to sell the cars locally. kindly focus on export of cars. the export of cars will earn dollars on one hand and make cars effordable and durable on the other hand.

Which auto players, in your opinion, have the right attitude to benefit from this growth potential

when are you bringing Uni-T or Uni-K? Saw news about Oshan X5 two years ago. but even that was not launched.

So increased population means greater car demand ? The fact inflation is rampant, the literacy rate is going down;stunning conclusions

@Shida: That’s an objective assessment of future possibilities, however, possibility exists that the country’s future stays dull or otherwise.

@Muzaffar: Thank you! yes opportunities lie even in the darkest hours.

@Zaryab Khan: That’s a topic some other day.

@Salman Taufiq: I wont take the names, but in my opinion the brands whose parent companies have invested in Pakistan under joint venture do possess that “right attitude”. There are at least five companies in passenger car segment

@Atif: I won’t talk about any specific brand, but companies do import trial units for feasibility researches, sometimes it sees the light of day sometimes stays in the shadows.

@Fatima: Yes, objective analysis points in that direction. Actual result will take another five years to unfold. We have to wait 🙂

You are always a genius in your postings.