Last year, there was a flurry of speculation regarding Telenor’s departure from Pakistan. However, the rumour mill was finally laid to rest in December 2023 when the Norwegian telecom company officially announced its exit from the Pakistani market. Telenor had reached an agreement to sell its operations to the government-backed Pakistan Telecommunications Limited (PTCL).

The deal is expected to have a significant impact on Pakistan’s telecom sector, bringing about a major redistribution of subscribers and telecom infrastructure.

Read: Telenor finally packs up shop from Pakistan, what all will change?

However, the focus of this story is not on that. The often overlooked aspect of this transaction is the potential impact that Telenor Pakistan’s sale to PTCL could have on Telenor Microfinance Bank (Telenor Bank) and its flagship service, Easypaisa, which is one of the largest digital wallets in Pakistan.

Despite being distinct entities, Telenor Bank and Telenor Pakistan worked in tandem on various fronts, including the provision of services through the flagship digital financial services app Easypaisa.

As the telecom company goes through the formalities for its exit, there is a possibility that the bank might lose the synergistic benefits it has enjoyed for more than a decade. However, the question remains: how significant will the impact actually be?

History of Telenor Bank

Telenor Microfinance Bank commenced its journey as Tameer Bank in September 2005. It was founded by Nadeem Hussain, a former Citi Banker, at a time when the microfinance industry was still in its nascent stages. Hussain aimed to bring the discipline of 27 years of Citi Group experience, including consumer banking, into the microfinance industry to bring some new discipline, learn the business and scale it.

In 2005, the bank commenced operations and had an exceptional year with zero delinquency. Speaking at the first merger and acquisition conference organised by TerraBiz on December 7, 2016, Hussain said that in the first year, Tameer Bank had 20,000 customers and 15 branches – all in Karachi. With such a stellar performance, the bank anticipated that it would break even in its third year of operations instead of what we had projected earlier.

However, in the subsequent year, reality set in as the delinquency ratio went up to 25% due to the low recovery of loans. Hence, the bank suffered a double cash burn – on one side the bank had to pay operational costs like salaries, rent, etc. and on the other side it was bleeding cash on defaulted loans.

Hussain and the other sponsors were compelled to reassess their approach and develop a new strategy as the bank faced challenges in maintaining its financial stability. To address these issues, the sponsors injected an additional million dollars and embarked on exploring opportunities for expanding the bank’s operations beyond Karachi into other parts of Pakistan. To scale sustainably and minimize lending risks, Tameer Bank started providing loans to farmers and individuals, this time securing them against gold collateral. This approach allowed the bank to build its loan portfolio without jeopardising its equity.

However, the sponsors soon realised that relying on traditional brick-and-mortar operations would impede their ability to achieve scalability. As a result, Hussain turned to the uncharted territory of branchless banking, where he found the solutions he was seeking.

Fortunately, for Hussain and his sponsors, the State Bank of Pakistan (SBP) and Pakistan Telecommunication Authority (PTA) were also looking to create branchless banking regulations.

After much deliberation, the SBP issued branchless banking regulations in 2008. These regulations also led to the telcos’ adventure into the microfinance sector as it presented an opportunity for the telcos to collaborate with banks to launch mobile financial service products in the country.

In the same year, which was the third year of operations for Tameer Bank, the bank had its first negotiations with Telenor Pakistan. “Telenor had some branchless banking dealings outside Pakistan and had a vision of what they wanted to do. They didn’t trust us completely. However, they were looking at the licence play – (acquiring a stake in an already established microfinance bank) rather than creating their microfinance bank and applying for their licence”, said Hussain while addressing the conference on mergers and acquisitions.

At that time, Tameer’s capital base had come down to minimum capital levels and the bank was experiencing some liquidity issues as cash burn was increasing while turnaround was taking longer. Therefore, the bank had to strike a deal within 3-6 months or go for another capital raise.

Similarly, the telco was facing its own challenges, as per Hussain, their Average Revenue Per User (ARPU) had come down from $15 to $2. Telenor Pakistan had invested $1-1.5 billion in infrastructure, merchant networks and licences, however, voice was not making them money so they had to come to financial services.

Negotiations went back & forth. Finally, Telenor put an offer on the table. A merger with Telenor was desired because it would not only give Tameer Bank capital but an earning stream as well. However, Telenor wanted a 75% stake in the bank which the SBP would not approve, so a deal was struck with the SBP to allow Telenor a 51% stake in Tameer Bank, subject to pricing, with an option to buy another 25% stake later.

A year later in 2009, Tameer Microfinance Bank and Telenor Pakistan jointly launched Easypaisa, Pakistan’s first branchless banking solution.

In 2016, Telenor acquired the remaining 49% stake in Tameer Microfinance Bank, making it a wholly-owned subsidiary of Telenor Pakistan B.V. This made Tameer Bank a wholly-owned subsidiary of the Norway-based telecommunications company.

While Easypaisa was launched as a joint venture between the telco and the bank in 2009, this changed on 7 March 2017 when Easypaisa parted ways from the mobile operator, Telenor Pakistan. The product and its operations were transferred to Tameer Bank.

Later on 27 March 2017, the Telenor Group acquired all regulatory approvals to rename Tameer Microfinance Bank to Telenor Microfinance Bank.

Telenor Bank found its ownership structure changing once again in November 2018 when Telenor Microfinance Bank entered into a strategic partnership with Ant Financial Service Group. The bank received capital injections from Ant Financial worth $184.5 million, through its investment arm Alipay resulting in Ant Financial holding a 45% share in Telenor Bank by the end of 2019 while Telenor Pakistan B.V. still holding the remaining 55% share. The investment by Ant Financials was considered one of the biggest in the fintech space of Pakistan.

Financial performance

Telenor Bank had an impressive record for almost a decade primarily due to the success of Easypaisa. However, competition picked up when Mobilink Microfinance Bank started to invest heavily in Jazzcash aiming for the market leader position in the mobile wallet space which it eventually got by the end of 2018 as per Karandaaz Data Portal.

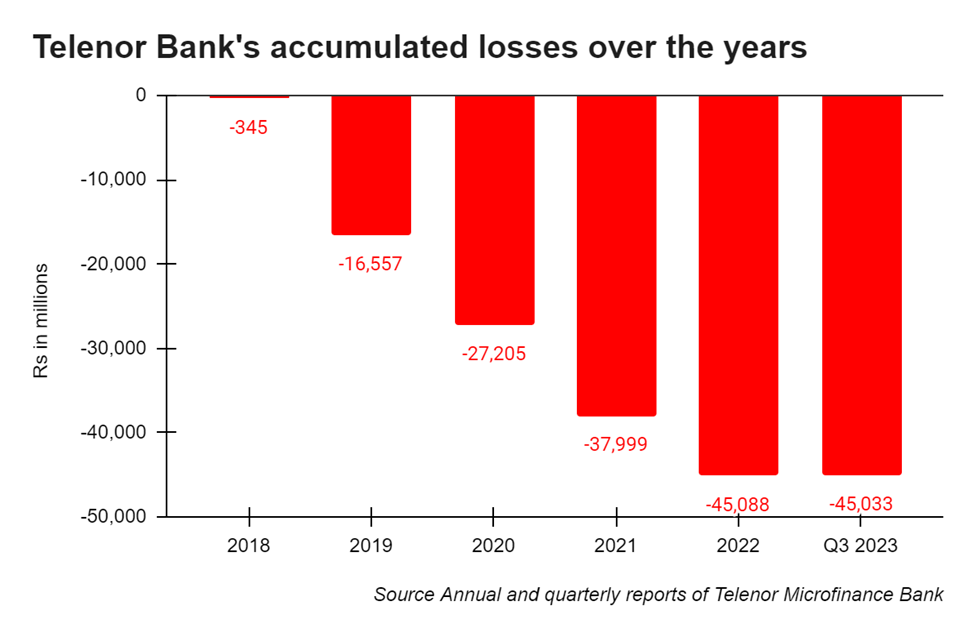

Things took a turn for the worse in 2019 when a massive employee fraud in Telenor Bank was unearthed resulting in heavy loan defaults. It also led to a lot of controversy for the microfinance bank. Apart from the controversy, the fraudulent loans resulted in huge losses. In 2019, Telenor Bank had accumulated losses of around Rs 16.6 billion

The accumulated loss surged to a whopping Rs 27 billion in 2020. Additionally, the advent of the pandemic in 2020 also took a toll on the bank’s loan portfolio as the industry-wide non-performing loans grew due to an economic slowdown. At the same time, the State Bank’s decision to abolish interbank fund transfer (IBFT) charges in 2020 also added to Telenor Bank’s woes as its main source of branchless income was affected.

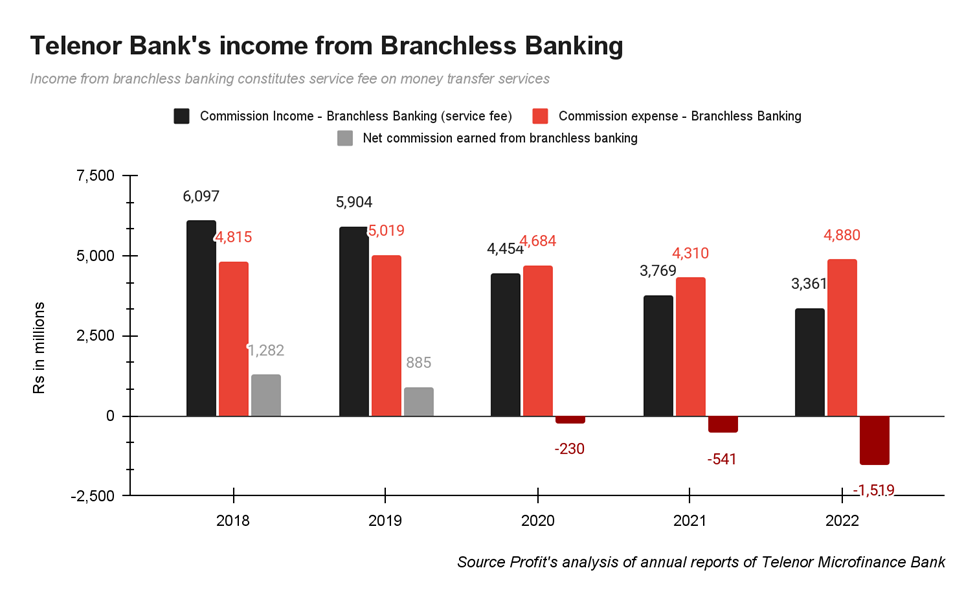

In 2020, the bank suffered a loss of Rs 230 million from branchless banking which more than doubled to Rs 541 million in the next year. In 2022, the loss increased to Rs1.5 billion.

Accumulated loss increased to around Rs 38 billion in 2021. The fraudulent loans contributed to more than half of the losses the bank experienced between 2019 and 2021.

To counter this, Easypaisa restructured its books. The bank cleaned up its lending portfolio, wrote off loans, and exited the agriculture bullet lending business where a majority of fraud had occurred. Apart from restructuring loans, Telenor Bank’s sponsors injected more equity into the business. $45 million were injected in 2020, followed by a $70 million injection in 2021.

The bank eventually moved the business to a new strategy of the digital-first bank. “We embedded both businesses into one business and made the entire bank on a digital-first strategy. And in that process, we had to take an impairment charge on the lending portfolio of roughly Rs14-15 billion” said Mudassar Aqil in a previous conversation with Profit

Telenor Group and Ant Financials, funded the impairment loss which gave the bank a clean slate to establish the business once again.

In 2022, a further $37 million was injected to pursue a digital-first strategy as the bank also applied for a digital retail banking (DRB) licence. Telenor Microfinance Bank (Easypaisa) is one of the five recipients of the DRB licence. It was granted NOC in January 2023, followed by an in-principle approval in September 2023. The DRB licence would replace the existing microfinance bank licence.

Yet, according to a PACRA report, the aspiration for a sustainable consumer platform hinges on bolstering acquisition, retention, and transactional throughput within branchless banking wallet accounts. It also states that sponsor support through equity injections would help absorb substantial cash and accounting losses. The bank would receive an equity injection of $15 million in 2023.

Decision to sell

Given the increasing losses, finally, at the end of 2021, the Telenor Group had decided that it had had enough. In November 2021, the Telenor Group posted a statement on its website that said the company was considering a potential sale of its 55% ownership stake in Telenor Microfinance Bank in Pakistan, and that a process to evaluate interested partners has been initiated.

Similarly, the Telenor Group was also looking for merger opportunities for its telecom business in Pakistan. In November 2021, news agency Reuters quoted the CEO of the Norwegian telecom operator as saying that the global entity “will continue to look for merger opportunities in Asia, including in Pakistan and on a regional basis”.

Read: Telenor finally packs up shop from Pakistan, what all will change?

In November 2021, MCB Bank expressed its interest in acquiring 55% shares in Telenor Microfinance Bank held by Telenor Pakistan BV. A few months later in February 2022, United Bank Limited (UBL) also expressed interest in acquiring a major stake in the bank.

While prominent banks have expressed interest in the bank, there has been no execution. “Telenor Global’s desire to exit has been hindered by its inability to find a buyer due to the bank’s history of significant losses, which resulted in the depletion of its equity. Consequently, despite efforts to sell, potential buyers are deterred by the bank’s poor asset quality (quality of its loan portfolio). Any prospective acquirer would have to incur losses on those loans as well, thus impeding the sale process,” said Ammar Habib Khan, an independent analyst.

However, on the telecom front, the Telenor Group sold 100% of its stake in Telenor Pakistan to the PTCL. This also implies that once the sale is executed, the acquirer may decide not to continue the partnership with the bank, which consequently would result in the dissolution of existing synergies.

But what are these synergies?

Synergies

The biggest synergy between the telco and Telenor bank was the distribution network of franchises and retailers.

In Pakistan, telcos sell their products through a few channels: digitally and through a retail distribution network of franchises and agents.

Digital platforms include the telcos’ applications. For example, Ufone has a ‘My Ufone’ application for its customers. One can transfer money from their bank account or wallet to these platforms to recharge their account and buy airtime.

Telenor Pakistan, like any other telco, operated through a network of franchise retail networks to extend their reach and services to consumers across the country. The franchises have a contractual relationship with the telco. Then there are retailers that sell various products apart from selling airtime. These retailers are connected to franchises who oversee them.

The role of retail networks is essential due to low penetration of smartphones in Pakistan, which stands at around 50% as per an industry source. However, when smartphone penetration increases in future, the need for this distribution network might decrease.

Concurrently, Telenor Bank has been following a digital-first strategy. They have been shutting down their branches and have transitioned to digital lending. As of December 2022, they had 61 branches down from 120 branches in 2019.

At the same time, Telenor Bank needs some sort of network that can provide cash-in (deposits) and cash-out services (withdrawals) for the bank. This is where Telenor Pakistan’s (telco) retail distribution network comes in. Telenor Pakistan acted as the primary agent for Telenor Bank’s branchless banking endeavours. The agent network provides people with the convenience of depositing and withdrawing money.

Essentially, it oversaw Easypaisa’s extensive agent network, which comprised hundreds of franchisees responsible for managing retailers selling airtime for the telco while also providing cash-in and cash-out services for Easypasia. In this capacity, Telenor Pakistan served as the intermediary for the bank’s mobile financial services. The Telenor Bank, in return, paid commissions on these transactions to retailers, and thus franchises.

Both entities mutually benefited from their collaboration: Telenor Pakistan granted Telenor Bank access to its vast network of franchises and agents. In return, Easypaisa’s network drove substantial foot traffic to these retailers. Notably, as per an industry source, nearly half of the revenue generated by retailers, and consequently franchises, is attributed to Easypaisa. When both entities synergize, it becomes a win-win scenario, particularly advantageous for the telco.

This symbiotic alliance not only benefited both parties but also enhanced the distribution network’s financial prospects which incentivised these agents to work more with both Easypaisa and Telenor Pakistan. This distribution network is the core synergy of both entities.

Moreover, Telenor Microfinance Bank enjoyed cross-marketing and other preferential pricing like the SMS costs for transaction prompts on USSD-supported Easypaisa accounts.

If these services are to be discontinued, it will increase costs for the bank. An industry source disclosed to Profit that the SMS costs have increased significantly, by as much as 2000%. “The SMS that used to cost Rs 5-6 is now at Rs 80”, the source expounded.

Additionally, Easypaisa wallet users can use their wallet to recharge. This would save the commission paid to retailers for the telco.

Impact on synergies

Until now, Telenor Bank and Telenor Pakistan (telco) have had a strategic preferred party relationship, granting each other discounts and leveraging each other’s services like EasyPaisa has been relying on Telenor Pakistan’s distribution network.

The sale of Telenor Pakistan could impact Easypaisa and Telenor Bank in two ways. Firstly, the value that was created through access to the retail network that served as branchless banking agents for the bank and EasyPaisa might get affected as Telenor Pakistan, now under PTCL, might be open to other financial services providers.

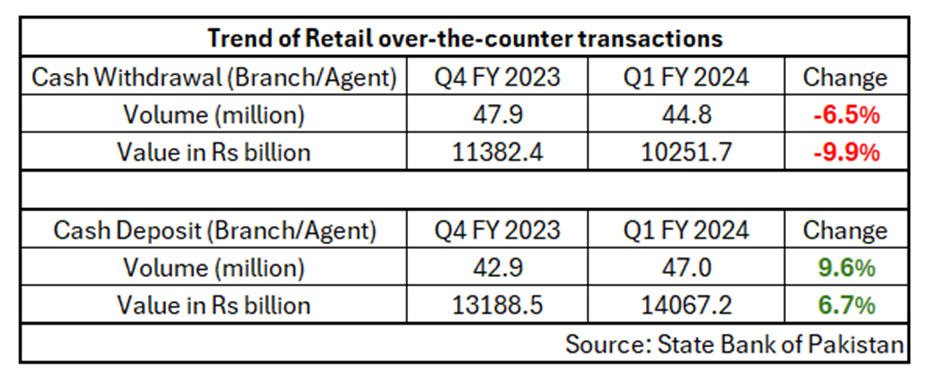

Profit spoke to another source affiliated with the industry who said that with this retail network gone, EasyPaisa will need some entity which can give access to the retail footprint. “EasyPaisa needs some entity that can give access to the retail network of agents for cash-in and cash-out transactions. The importance of agents increases as cash-in (deposits) is increasing, while cash-out (withdrawals) is declining due to new users preferring to convert physical credit to digital within their wallets.”

This claim is substantiated by statistics released by the SBP. According to SBP’s payment system review, in the first quarter of fiscal year 2024 (July 2023 to September 2023), over-the-counter cash withdrawals declined in both value and volume, whereas cash deposits have increased in both volumes and value.

“JazzCash and EasyPaisa are effectively the largest digital banks. JazzCash and Easypaisa move about 7-10% of GDP in payments”, remarked an industry source. This became possible because of the expansive retail distribution network from the telcos. “EasyPaisa and JazzCash became successful on the back of the agent distribution network of telecommunication because people trusted these agents,” the source added. This is not the case with other digital banks.

Moreover, the PTCL group has its digital wallet – Upaisa. Would PTCL prefer Upaisa, which is much smaller, over Easypaisa? For context, Easypaisa has more than 50 million downloads, as per Google Play Store whereas Upaisa has more than a million downloads only.

With retail distribution now under PTCL, the ball is in PTCL’s court, and there are two directions that they can take: they can either be strategic or they can be territorial.

In the first option, PTCL, instead of focusing on its wallet – Upaisa, can leverage its ongoing collaboration with Easypaisa. That is, it continues to offer its franchise and retailer network with Telenor Bank’s operations. By combining the franchise and retail networks of Telenor and Ufone, they might become more profitable because now there is a bigger base to do transactions. At the same time, more transactions would lead to higher commissions for the franchise network, which would be more motivated to sell the services.

In the other option, PTCL Group can assert detachment from the preferential commercial agreement. You see, Telenor Group which staunchly supported Easypaisa has a 55% stake in the bank. While the two entities i.e. Telenor Pakistan and Telenor Bank operated at an arm’s length, they were intertwined at commercial level which was beneficial for the Telenor Group.

The current quandary arises from the potential scenario where Telenor Bank flourishes. As PTCL does not have a stake in its success and thus any profits, it might dismiss the presence of any benefit of a commercial arrangement with Telenor Bank, despite the existence of underlying commercial advantages at an operational level. (PTCL on the other hand has a wholly owned subsidiary – U Microfinance Bank (UBank). While UBank is not a player in the digital space as it has a completely different strategy, it is still one of the biggest players in the microfinance sector.)

Telenor’s stance

Profit reached out to Telenor Bank to find out how the sale of the telco has impacted the synergy. “As far as Telenor Pakistan’s sale is concerned, our operations remain unaffected and are not part of this transaction in any way,” said Farhan Hassan, head of the Easypaisa wallet business.

Emphasising their status as an independent financial institution, licensed and regulated by the SBP, Hassan reassured that their journey towards becoming a digital retail bank, supported by shareholders Telenor B.V. and Ant Group, remains unaffected by Telenor Pakistan’s exit.

Profit also reached out to corporate communications personnel at Telenor Pakistan (the telco) to find the impact of the change of ownership on the synergy between the telco and the bank who stated that “it is still under process”.

As mentioned earlier, Telenor Group wants to exit Pakistan. As per an industry source, Telenor Group will continue to find buyers for their share of stake in Telenor Bank. “They’ve already offloaded their telecom business and officially attempted to sell Telenor Bank previously, albeit without success in striking a deal with any party. They’ll probably persist in pursuing a favourable deal to divest their stake in the coming years”.

However, amidst this backdrop, Easypaisa stands as one of the recipients of the DRB licence. As per an industry source, much of this development hinged on the technology and commitment of Ant Financials Group which prompted the SBP to grant the licence. The SBP might not support a sudden change in ownership post-issuance of the licence as that could reflect badly on the prospect of digital banking, which would mean that Telenor Bank will continue with its transition towards digital banking and then in a few years Telenor Group may sell its shareholding, contingent upon the terms of the deal and available partners.

good work

Thanks for updating

I’d personally advocate just effective together with honest truth, and for that reason realize its:

informative article.

Thorough research based article.

It was really nice to read your article. One more thing is that Telenor was not consistent in the work to keep users updated with the Network.

Also Jazz is providing their users best affordable and many other new updated offers that keep them high in market as their site mentions https://alljazzpackages.com.pk/jazz-internet-packages/