There was a time when cooking wasn’t quite as easy as it is today. Just think about it. Before we had gas stoves, one had to cook with wood ovens. These were harder to control, more work to ignite, and likely to cause minor burns. Similarly, before refrigerators (which didn’t become common in the Western World until after the second world war) there was a limit on how much produce one could store and what kinds of food could be made.

It isn’t just a matter of tech. Access to ingredients has changed dramatically in the past fifty years alone. Perhaps nothing has symbolised this better than the rise of packaged “spice mixes” in the Indian Subcontinent. And the origin is not so long ago.

In India, for example, the first major spice mix company by the name of MDH was set up as a single factory in the Kirti Nagar neighbourhood of Delhi in 1959. In Pakistan, the pioneers of this concept was National Foods which set up shop as a spice company in 1970. The concept was simple enough. Back in the old days, kitchens had to have separate spices stored and ready to be ground and mixed for whatever recipe was on the menu. Over time, cooks realised this was time consuming and laborious work. Instead of making mixes every single time, they would pre-prepare the mixes, add some water and turn them into small spice “patties” that could be broken off and used whenever a common recipe was needed. This ensured that the taste was the same every time and saved precious time.

It wasn’t long before these spice mixes started to be sold in shops. And then matters were just a step away from industrial packaging and retail selling. For the first decade, National Foods in Pakistan was widely successful. In 1981, however, they would get their first taste of competition in the form of Shan Masala.

Originating as a small home based business, Shan Food established itself in 1981 and quickly became renowned for its convenient and high-quality spice mixes. Over the years the competition has been stiff.

On the one hand there is the corporately run and publicly listed National Foods. On the other there is the very-much-a-family-affair Shan Foods. Both companies have duked it out in Pakistan and beyond. The competition has been marked by the fact that while Shan’s spice blends are more popular, National manages to use its larger product portfolio of everything ranging from condiments to jams to perform better than its main competitor.

Throughout all of this, Shan has stuck by their line of spice products. That is until now. The company is introducing a product by the name of “Shan Cooking Sauces” to their portfolio of products. It is a really simple concept. With their spices, Shan would simply blend and make mixes that would be ready to put into the cooking pot. With these sauces they are going a step forward and taking out another step from the cooking process. The sauces Shan is making include the traditional tomatoes, onions, and whatnot that get added to these recipes.

This product, if it works and is adapted, will save precious time that would otherwise be wasted chopping, dicing, and generally preparing the base in which most Desi Food is cooked. The only question is, will people take the bait and should National Foods be scared?

Why a new product and why now?

Throughout this time Shan has stuck to its guns. The rise of this company and its modus operandi has been covered previously by this publication. But now, it seems, Shan is finally ready to give a new line of products a whirl.

Read more: Why Shan Foods should actively consider an IPO.

This marks a bold move for the company, as it becomes the first major spice brand to enter the burgeoning market for convenient cooking solutions in Pakistan. The preparation time for this format is zero, hence, the positioning has been set around the same; Pour, Cook, Serve. According to Shan Foods Co-Chairwoman Sammer Sultan, “Shan has tapped into a niche market segment that values convenience without compromising on authentic taste.” Although challenges exist in establishing a new product category and driving consumer acceptance, the potential for growth, particularly among working women, newly married couples, and students, is substantial.

It is clear that the company has managed to identify a gap in the market for convenient cooking solutions and introduced its line of cooking sauces. Although the product may not target the masses directly, ‘its potential is substantial, estimated at around 5% of Shan’s traditional recipe mixes offerings,” Sultan points out.

With the lack of existing competitors in the market, Shan Foods has the freedom to set the pricing standard for pre-made cooking sauces in this region. Sultan further explained the pricing strategy and said that the strategy reflects “the added value and convenience these sauces offer compared to traditional spice mixes”. The higher input costs associated with pre-mixed sauces are also a factor.

With no existing benchmark in the market, they’ve opted for a price point that balances competitiveness with healthy profit margins. This approach makes sense. It capitalises on the growing demand for convenience in the kitchen. Busy individuals willing to pay extra for convenience. A 350g jar of Shan’s cooking sauces costs around Rs 500, whereas the dry spice mix ranges from Rs 80 to Rs 250 per single packet depending on the size.

Competition

One can’t expect the competition to not notice of course. National Foods, a larger and faster-growing company, it is pertinent to mention that National Foods is not a direct substitute for Shan Foods as it has a much more diverse product portfolio. Although the brand has not introduced a similar product and is still selling dry spice mixes, Profit contacted National Foods multiple times for a comment on this story, but they did not respond at the time of publication. Thus, if they are planning to enter the market with such a product, it can be a challenge for Shan Foods, as the competitor being a publicly listed entity, National Foods enjoys advantages in terms of access to capital, transparency, and shareholder accountability. This allows them to invest aggressively in growth strategies and expand their product portfolio, giving them an edge in the international market.

More so, in 2023, National Foods exported Rs 2.4 billion worth of products whereas their local sales were at Rs 40 billion, this is because they also include the sales from their expanded business lines, such as A-1 packaging in Canada, as wholly-owned or majority-owned subsidiaries, enhancing the company’s overall strength. Similarly, Shan Foods exported Rs11.8 billion worth of products, which includes sales to Gourmet Foods FZC, Shan Foods UK and American Halal Foods, whereas their local sales were at Rs18.3 billion. This can be attributed to National Foods’ broader product range, encompassing condiments like ketchup and achaars, while Shan Foods focuses primarily on spice mixes and now the recently introduced cooking sauces.

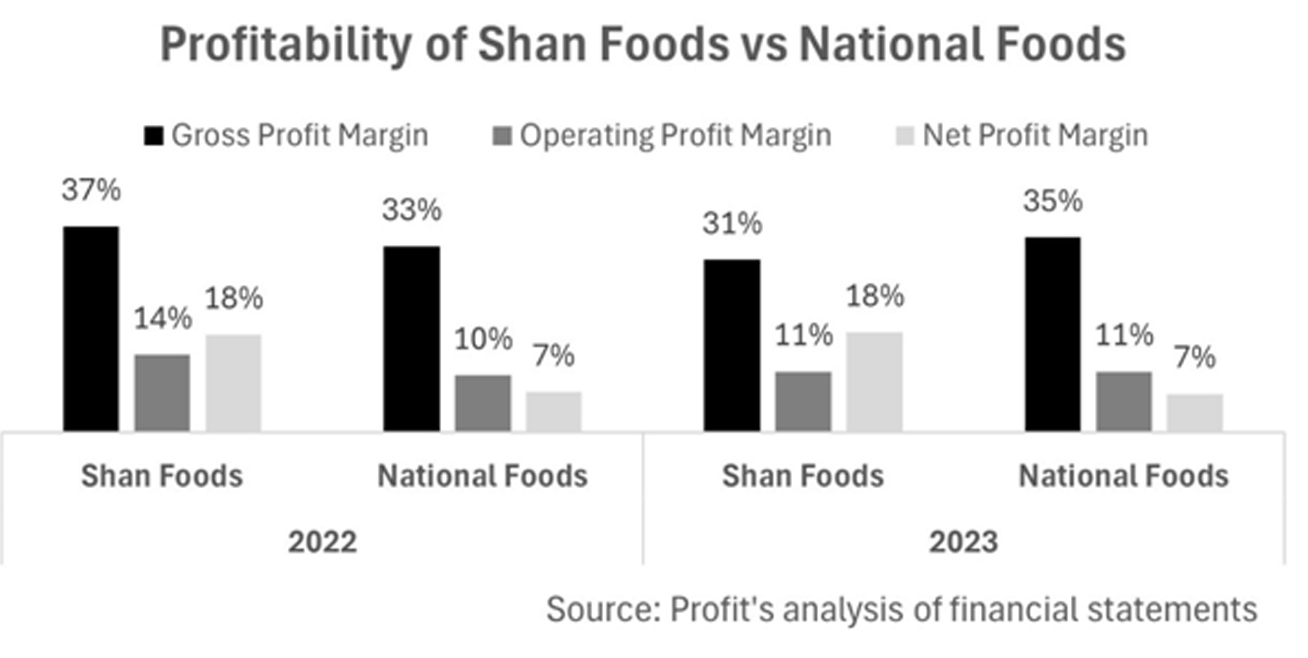

For Shan Foods sales increased in 2023 to Rs25 billion from Rs 22 billion in 2022, however the cost of sales increased by a higher ratio leading to gross profit actually decreasing. This shows that the gross profit margin decreased from 37% to 31% in 2023, this can be attributed to raw material cost which went up from Rs 8.2 billion in 2022 to Rs 12.7 billion in 2023. This is an increase of 55%.

In the same time period, National Foods saw an increase in sales from Rs 27 billion in 2022 to Rs 30 billion in 2023 and their cost of sales increased from Rs 18 billion in 2022 to Rs 19 billion this year. Their gross profit stood at Rs 10 billion in the recent year from Rs 9 billion in 2022. Their gross profit margin went up from 33.4% to 34.6%. Even though Shan has grown significantly over the last several decades and remains the market leader in masala mixes, it is not the biggest company in the overall market. That is National Foods, which is not only growing faster but evolving better with the market as compared to Shan.

Breaking down the sales figures for Shan Foods, exports made up 39% of the sales in 2023, while they were at 34.5% in 2022. In terms of the operating profit, the company saw similar figures of Rs 3 billion in 2022 which decreased to Rs 2.6 billion in 2023. This can be attributed to the increase in admin expenses from Rs 1.1 billion in 2022 to Rs 1.4 billion in 2023 – the impact of this can be seen on the operating profit margin which stands at 10.5% in 2023, whereas it was 14% in 2022. Similarly the operating profit margin for National Foods went from 10.3% in 2022 to 11.2% in 2023.

The saving grace for the company was the other income which doubled from Rs 1.1 billion in 2022 to Rs 2.3 billion in 2023. Major contributor in this regard for Shan Foods was the Exchange Gain, which went from Rs 0.9 billion 2022 to Rs 1.9 billion in 2023. This was due to the deprecating currency during the year.

Finally the net profit margin in 2022 was 17.6% which went up to 18.2% in 2023. This increase in net profit margin can be wholly attributed to other income even though the gross profit margin and operating profit margin was lower this year. Similarly, the net profit for National Foods in the same time period was Rs 2.2 billion which went up from Rs 1.9 billion in 2022 – the net profit margin did not see a major increase as it rose from 7.32% to 7.39%. According to their financials, the major contributor like Shan Foods was the other income and the exchange gain that went up this year to Rs 573 million.

The challenges

While the introduction of cooking sauces presents promising opportunities for Shan Foods, it also brings forth a set of challenges. The new cooking sauces can change the culinary landscape by creating a new category for convenient cooking solutions. However, carving out this space requires careful planning and execution.

Building brand awareness is crucial. Shan Foods must differentiate its sauces from existing offerings and educate consumers about their utility to drive acceptance within the target market. Further complicating matters is the current economic climate. With inflation on the rise, consumers are becoming increasingly price-conscious. Shan Foods needs to deliver compelling value propositions to attract these cost-conscious customers.

As Sultan, Shan Foods Co-Chairwoman, aptly noted, “While the opportunities are vast, tackling these challenges will be integral to unlocking the full potential of this new venture.”

How have they marketed it?

It didn’t come as a surprise when Profit asked housewives and other members of the society if they had heard about Shan’s new cooking sauces, to which they were left surprised. While Shan Foods utilizes TVCs and other mediums for established products, their cooking sauces haven’t received the same level of promotion. This strategic prioritization might be overlooking a potentially lucrative market segment. When compared to National Foods’ aggressive marketing tactics, particularly for new products, it showed that Shan has a more conservative financial approach as it is a family-run business.

Shan Foods prioritises cultural alignment in its cooking sauces, adapting flavours to suit diverse regional preferences, for example offering milder options in markets like KSA. Sultan further said that the company’s entry into Indian and Bangladeshi markets showcases its commitment to regional expansion, with positive initial responses indicating strong growth potential. Initial market activation efforts, particularly free sampling initiatives promoting its Biryani sauce, have been met with positive consumer response.

“Shan Foods is confident that continued investment and focused efforts will lead to long-term success in these new markets,” said Sultan.

On the other hand, National Foods, being publicly listed, is under constant pressure from shareholders to prioritise market share and growth. This translates into aggressive marketing strategies, exemplified by their doubling of spending on marketing and distribution between 2015-2018, even at the expense of short-term profits as mentioned in an earlier report by Profit. The company is able to control the advertising and marketing costs as the brand has established their identity and can utilise the budget smartly.

This difference in ownership structures goes beyond marketing. For instance, despite familial ties, Shan Foods maintains a distinct identity from Dipitt & restaurant Wingitt, allowing both brands to operate independently while exploring collaborative opportunities which include co-locating stalls at events like Gulffoods. These ventures were started by Shan Foods CEO Sikander Sultan’s daughter and son-in-law.

The separate identity of Dipitt highlights a potential disconnect within the family businesses. While Shan Foods prioritises traditional advertising for its core products, Dipitt, targeting a younger, digitally-savvy audience, focuses on digital marketing strategies.

Similarly, as stated earlier, National Foods has also expanded its business lines, such as A-1 packaging in Canada, as wholly-owned or majority-owned subsidiaries, enhancing the company’s overall strength. While both public and family-owned models have merits, they differ in perspective. National’s management prioritises the company’s interests, leveraging its public listing for growth. In contrast, the family-owned company balances business objectives with familial considerations, reflecting an additional layer of concern for family well-being and relationships.

Despite contrasting approaches, both companies have developed a loyal customer base, especially Dipitt, in such a short period, it has carved a niche for itself in the premium sauce market.

Looking ahead, the management at Shan Foods needs to focus on innovation and market adaptation by acknowledging the changing needs of consumers and adapting their marketing strategies accordingly. It also envisions expansion in the spice market and beyond, targeting both ethnic and non-ethnic consumers globally.

Headline seems a bit misleading: Shan had also ventured into noodles at a time when market were abuzz with Unilever takeover rumours and recently have also added the Korean noodles in their product portfolio with a younger generation being targeted – so it’s not only the dry spices

Wonderful read

Shan brand is the best and number one brand in its products.