What would you do if you had been born to run one of the largest corporations in Pakistan? If from the moment of your birth, you had access to incredible wealth and a thriving business waiting for you to take over?

It is a question a person might ask themselves through the course of their life: “Agar abba ki steel/sugar mill hoti toh zindagi mai ayashi karta.” The desire to sit on the board of a family company and enjoy the rewards makes sense. And there are plenty of third and fourth-generation scions of major business families that do exactly that.

But there are some rare occasions where those born and bred to run these large fortunes aren’t just there for the ride.

Take the example of “The diversification drive was initiated to reduce dependence on the company’s traditional products (soaps and blades) and to explore new revenue streams. The management recognized that relying solely on existing products could limit the company’s growth potential,” says Sheharyar.

Born into perhaps the most influential and renowned business family in Pakistan, Sheharyar was the heir to Pakistan’s largest shaving blade manufacturer, Treet, which controls nearly 85% of the overall market share in the country and has been the market leader for decades. In the 2000s, he officially joined the family business and after cutting his teeth, he took up the mantle of executive director under the guidance of his father.

It would have been very easy for him to sit back and let the ship run as it was. After all, why fix something that isn’t broken? Because in the last decade or so, it started to become very clear that even though Treet might be the market leader, the razor blade business wasn’t what it once was. Why do we say so? We’ll get into the details of the numbers later on, but take a look around you. Men don’t shave the way they once used to. Beards are no longer frowned upon in the workplace and shaving everyday, come what may, is no longer a thing for most.

It was something Sheharyar noticed and was eager to fix. So what do you do when the decades-old family business that has made you your fortune is a victim to changing times? Easy, you look for other avenues to make money. And as far as finding avenues is concerned, he has done a commendable job.

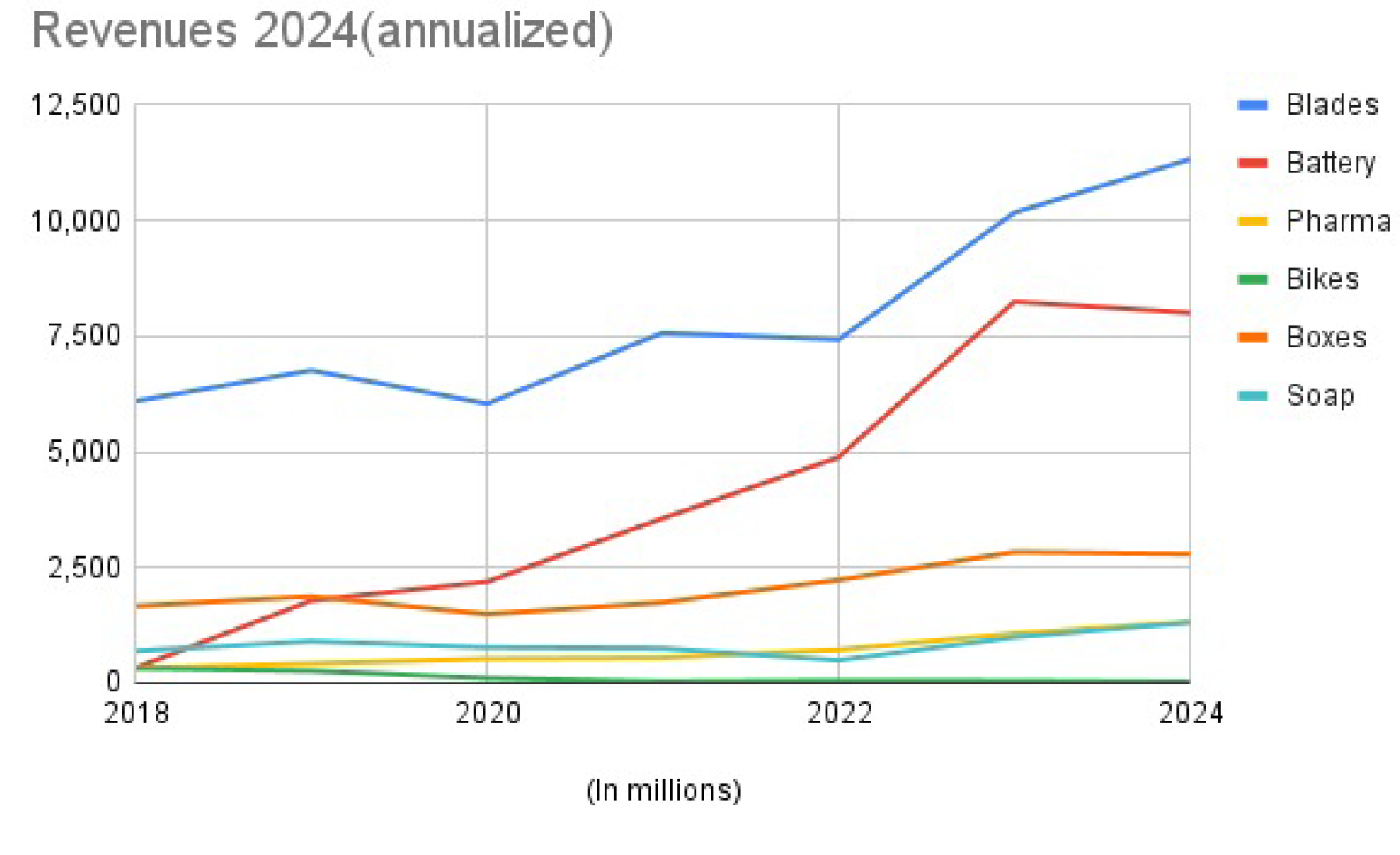

Since 2006, Treet has been diversifying in big and small ways. They have set up the manufacturing of corrugated boxes, an assembly line for two and three-wheeler motorcycles, a pharmaceutical business, a battery manufacturing business, as well as diversification within their original blade business. One has to hand it to the Treet Corporation: Whatever else may be, they have not been sitting around doing nothing.

But that, unfortunately, has been the extent of it.

Despite what are clearly numerous efforts, Treet’s diversification has garnered largely disappointing results. And all this while the blades business has continued to face a challenge it cannot possibly hope to counter: fashion and human nature.

A brief history of diversification

Treet is a storied Pakistani company and has the same roots as Packages. The family’s history begins with Syed Wazir Ali, who set up Wazir Industries by serving British troops in pre-colonial India. His son, Syed Maratib Ali, would go on to grow this business by supplying goods to the Raj. After partition, his two sons, Syed Babar Ali and Syed Wajid Ali, would take over their father’s business. Over time, Babar Ali would go on to hold most of the Packages Group while his brother Wajid Ali took control of the Treet Group.

Initially, Treet was the sole assembler of cars for the Ford Car Company in South Asia. The company then went on to manufacture oil and vegetable ghee under the name of Khopra Oil Mills and Wazir Ali Industries. But they really struck gold with carbon steel blades, which they began to produce in 1954 in a Hyderabad plant. This was a time when the clean shaven look was not just in fashion but a professional requirement. People needed to shave, and the safety razor (invented in 1904) was not common in Pakistan yet. In fact, most of the English would have their own shaving supplies that weren’t locally produced.

Treet made a fortune by providing high quality and cleanly packaged blades to every corner store barber, hotel saloons, and even those sitting under trees with a chair and a mirror offering shaving services. The blade business was a success, and for a very long time it stayed that way. In 1984, they started producing stainless steel blades at a plant in Lahore. In 1986, as consumer trends caught up and disposable razors became more common, they began to produce those too.

The upward trajectory of its success can be gauged by the fact that by 1996 Treet had started to export blades and razors. By the year 2000, they were able to launch industrial blades for all kinds of machinery and hard tools.

This was around the same time Sheharyar entered the business. From the very beginning, he played a key role in diversifying the business from beyond razor blades. According to Sheharyar, the company started to diversify in order to reduce its dependence on the company’s traditional products. The goal was to find new revenue streams by capitalizing on the strong brand name and financial position of the company. This was going to serve as the launch pad which would ensure long term growth and stability to the company.

This drive saw the company setting up a corrugated packaging plant in 2006. This was actually one of Sheharyar’s first efforts in diversifying his family’s business. For four years before this, he had worked at his uncle Babar Ali’s company Packages. Here he had learned the ropes of the packaging business, and wanted to set up a similar business for his own immediate family’s corporate interests.

In 2008, they again diversified and started assembling two and three wheeler bikes The packaging plant was incorporated under the First Treet Manufacturing Modaraba while the motorcycle assembly plant is registered under the name of Global Econo Trade (Private) Limited. This was the first big putsch on their behalf. It was starting to become clear that the razor business was perhaps not what it once was.

The razor business hits a snag

Clearly the seeds of wanting to diversify were there in the Treet management ever since the 2000s. But the need to expand became much more serious around 2010. This was the time that a strange trend started to grip the world: beards.

People who had never imagined keeping a beard were sporting a long beard with a mustache to match. Since then, different fashions have come and gone. Recalling the man bun or skin tight jeans as two which took off initially but it seems beards have had a sticking power as it has outlived both of these.

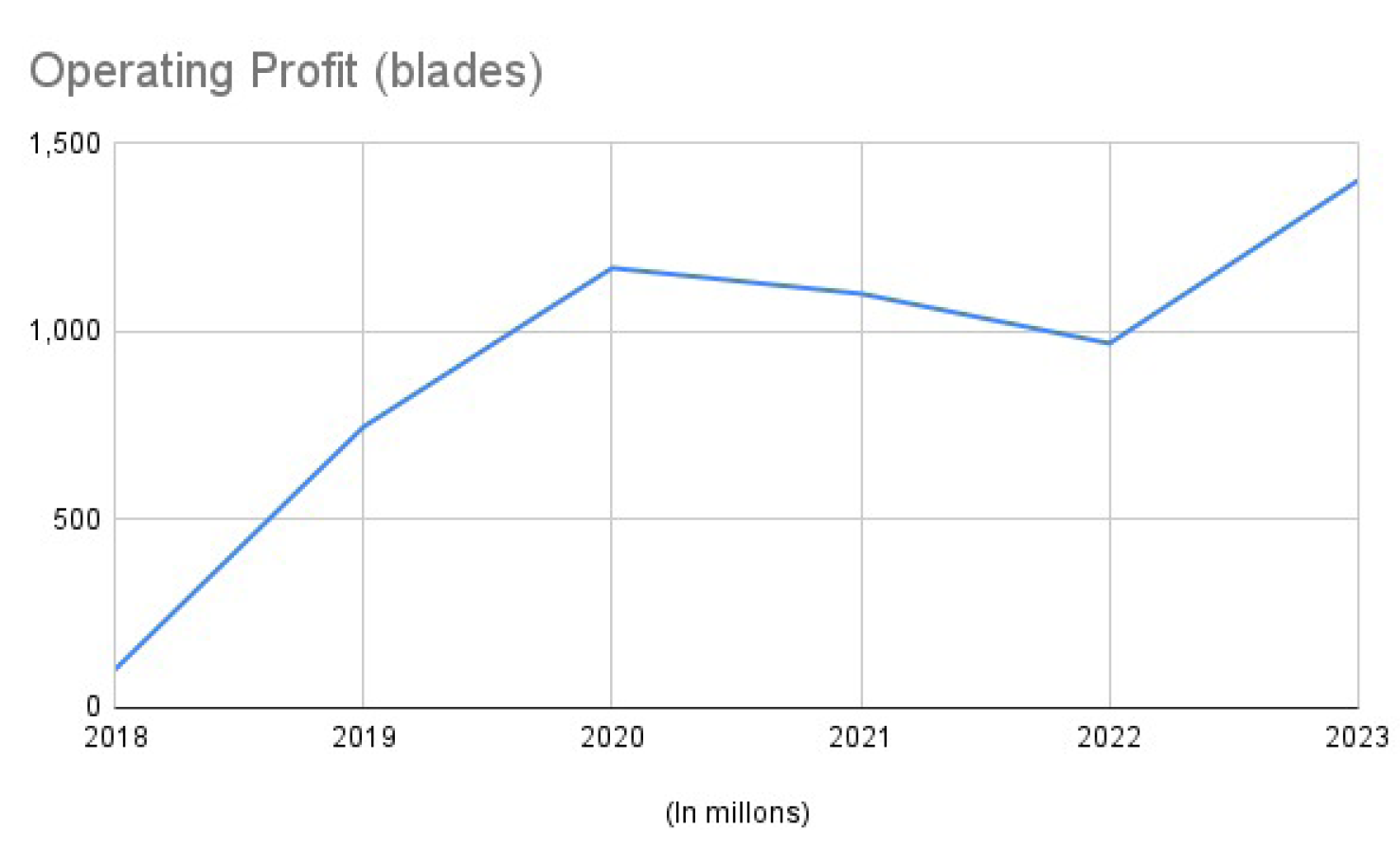

Just take a look at the changing fortunes of Treet Blades through the numbers. On the surface, it seems the company has continued to grow with nothing stopping its way.

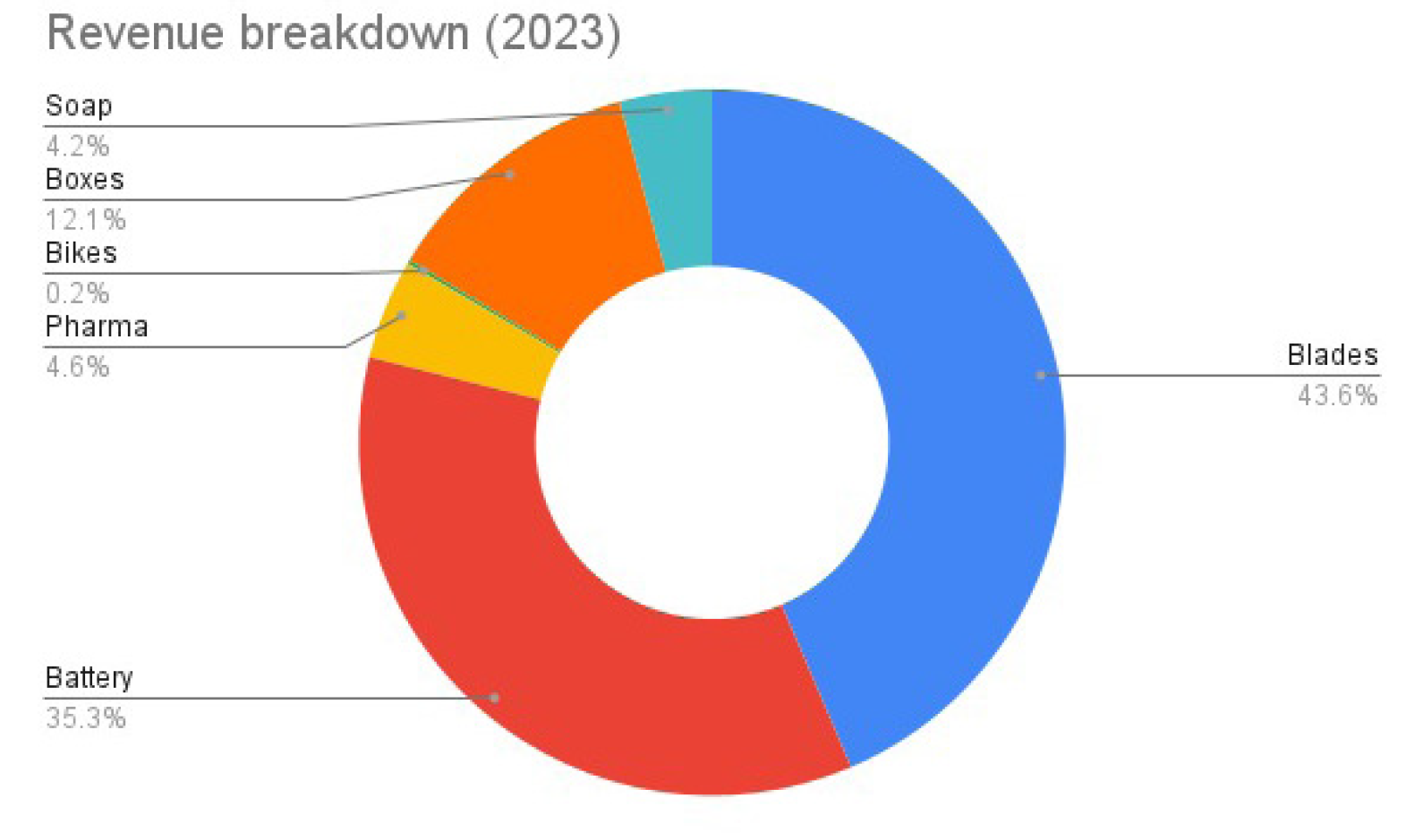

In 2023, the company earned a total revenue of Rs 23 billion from which Rs 10 billion or 43% was from blades and razor segment alone. Blades have a substantial demand locally and the company is also exporting to more than 45 countries spanning six continents of the globe.

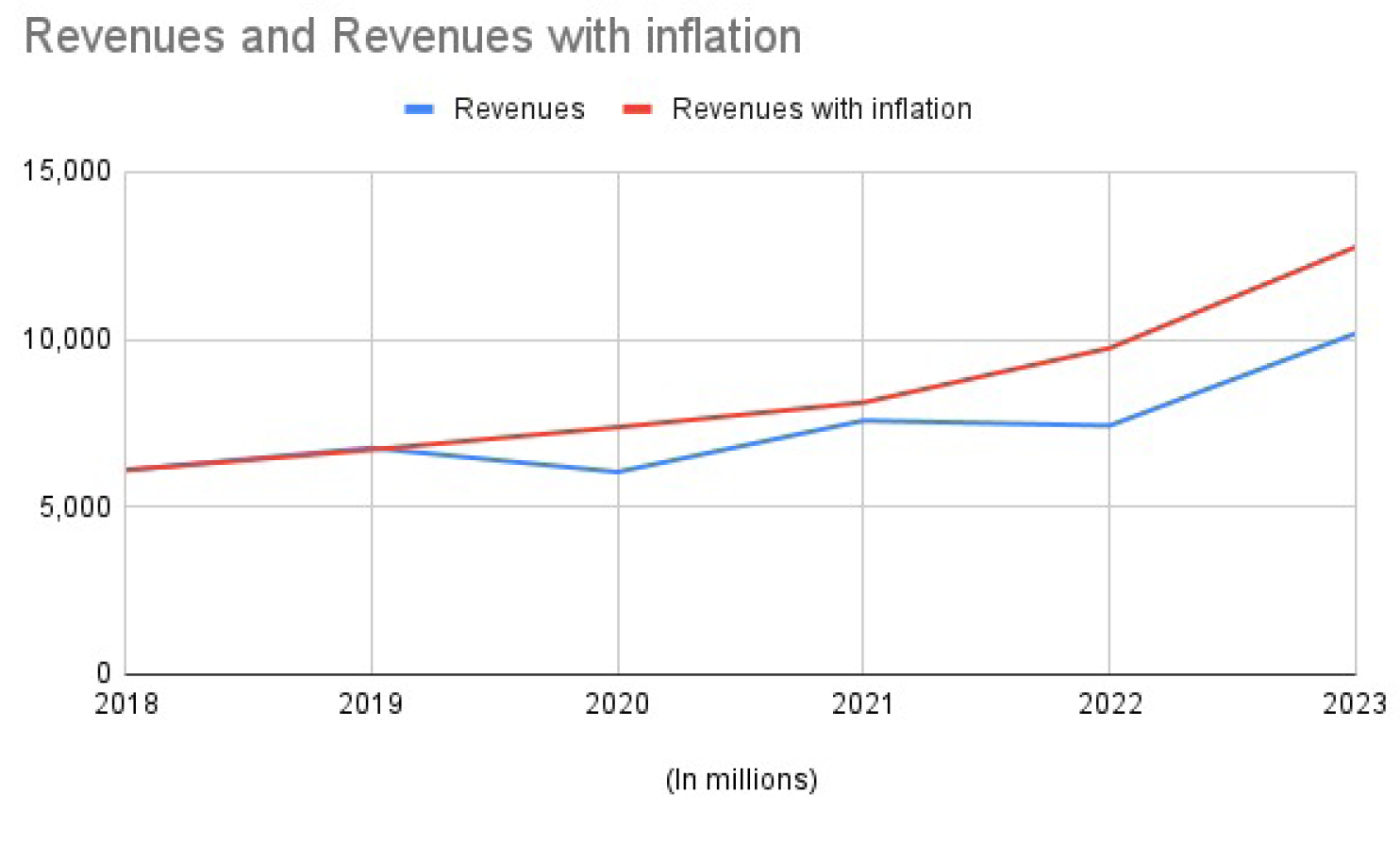

In 2018, Treet earned revenues of Rs 6 billion from their razor and blades division which increased to Rs 10 billion in 2023. This would be an encouraging sign showing that sales had actually increased by 66%. However, in the same period, inflation for the 5 years was compounded to be around 70%. Once the price is corrected for inflation, it can be seen that the company actually sold less blades.

Sales increase when either the volume of sales increases or the price of the goods being sold increases. Consider a blade which was selling for Rs 10 in 2010. Now the same blade is selling for Rs 100. The revenues would show that the sales have grown 10 times even though the same number of goods have been sold.

This can also be seen in the fact that in 2018, the company produced a total of 2 billion blades for the year while its revenues only came to around Rs 6 billion. In 2023, the company produced 1.7 billion blades and ended up earning a revenue of Rs 10 billion.

Essentially, Treet was making more money but selling fewer blades. The higher revenues were just because of inflationary pressure, and the amounts weren’t catching up with the rate of inflation. At the same time, Treet had also made the decision to expand their capacity. The capacity, which stood at 1.275 billion blades in 2009, went up to around 2.23 billion blades in 2023. Up until 2019, the company was seeing that the company was operating at 90% of its capacity. If the trend had continued, the company would have seen sales of around 2 billion in 2023. The trend was bucked in 2020 due to the pandemic which saw the operating capacity of the company fall from 96% in 2019 to 70% in 2020. Even though production rebounded to an extent in 2021 and registered around 2 billion blades, the last two years have been lackluster.

All of this created the perfect storm. Blades were simply not in demand anymore and Treet had increased their production capacity. As a result of this, Treet had the ability to make more blades but people just weren’t buying.

Sheharyar states that the company has recently changed its philosophy which could provide some insight into this change as well. “We have changed our philosophy from High Volume, low profitability to high profitability and low volumes. While the number of units are less, the value of the topline will be higher,” explains Sheharyar.

Blades, batteries, and much more

When it became clear what was happening, Treet did not sit back and watch. They had already tried diversifying with bike assembly and corrugated boxes, but this was time to go big. So the big gambles Sheharyar decided to take were on batteries and the pharma sector.

“The diversification drive was initiated to reduce dependence on the company’s traditional products (soaps and blades) and to explore new revenue streams. The management recognized that relying solely on existing products could limit the company’s growth potential,” says Sheharyar.

The first one, in 2017, was the acquisition of Renacon Pharma Limited. The second, in 2018, was the establishment of a batteries business under the brand name Daewoo Batteries, which they launched on a 40 acre facility in Faisalabad with an investment of over Rs 6.25 billion. Both businesses took off with a bang. Even though their main business was hurting, Treet was now involved in multiple businesses.

So how did they perform?

Over the last six years, Sheharyar feels that the results of the ventures have been mixed. Renacon Pharma has performed very well while the motorcycle company did not meet the potential the group had first gauged from it. In fact, the Treet Corporation has been suffering losses in many of its divisions, and as we’ve mentioned the company’s core business of blades seems to be suffering as sales volumes have declined in recent years. Sheharyar’s explanation for this is that performance has been impacted by the economic conditions of the country.

To understand the breakdown of each of these divisions, it can be seen that, in terms of revenues, Treet Blades leads with 43% of sales made by the whole Corporation. The second highest revenue generator is the battery division which yields 35% of the revenues. Corrugation, pharmaceutical and soaps add 13%, 5% and 4% respectively. This gives some sense of the fact that though blades are considered the primary business of the company, they make up less than half of the revenues. The battery division, which initially seemed to be one of the better decisions, has been (almost consistently unprofitable, while motorcycle sales are non-existent.

The following is a company wise distribution of the corporation and its performance:

Treet’s Daewoo Battery

This is the big one. The company invested Rs 6.25 billion to develop a 40 acre facility in Faisalabad for car batteries. The plant was set up in partnership with South Korean company Daewoo to manufacture maintenance-free batteries.

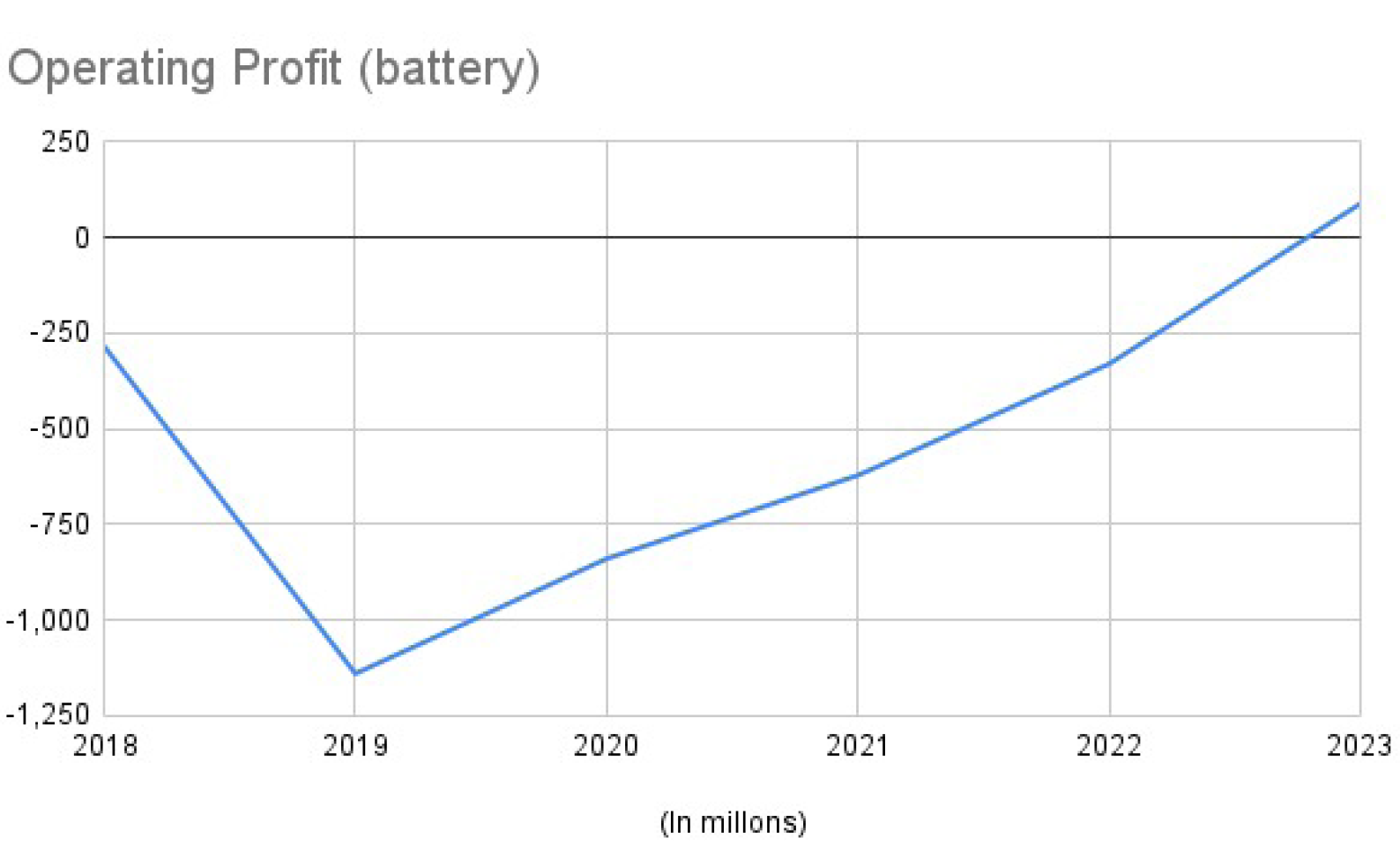

Ever since the plant started operating in 2018, the battery division saw its sales grow from Rs 1.8 billion in 2019 to Rs 8.2 billion in 2023. Since inception, the company has seen losses. 2023 was the best year where the company saw sales almost double and this was reflected in the profitability of the company. Out of 8 billion of revenues, the company only retained 58 million in profits. 2024 saw much of the same with 9 month results showing losses again.

Why? Once again the effort was struck down by timing. In 2019, getting into the batteries game was a good gig. People needed batteries for their UPS connections as well as in cars. Daewoo Batteries actually struck deals with Hyundai and KIA car manufacturers. There were a lot of cars being sold and car assemblers were producing more cars than ever.

But as inflation hit and markets slowed down, all of this would change. One of the big hits was the downturn of car sales which got cut by half in the past couple of years. The other big one was a significant drop in electricity outages and this a need for batteries for UPS installations. Suddenly the market for batteries was shrinking and Treet had poured a lot of money into this.

This was the time when solarisation was also on the rise, and battery manufacturers including Treet were hoping to get a new avenue for their battery sales. But people were getting solar connections and choosing to go for net metering rather than buying batteries and going off-grid. All of this culminated in the overall battery market slowing down significantly.

According to Sheharyar, however, even though the automotive sector faced challenges and reduced large-scale manufacturing meant a negative impact on the sale of car and UPS batteries, the company has still been able to beat the odds and see resilient sales. Inconsistent tax collection in the battery supply chain did limit growth but the trend is now changing. With the rise in solarization around the country, the company is poised to take advantage of the situation.

“The battery business experienced exponential topline growth and enhanced bottom line efficiency in 2023 following new senior management’s appointment and a comprehensive turnaround strategy. Revenue growth and profitability were balanced, focusing on operational profits despite high policy rates and macroeconomic turmoil,” explains Sheharyar.

The turnaround in its profitability was also evident in the stock market where the company saw its price shoot from Rs 11 at the time of listing in December last year to Rs 60 in January 2024. Since then, the hype has dissipated to some extent as the price is now hovering around Rs 25. However even at this price the share is trading at 25 times its book value. Compare this to the share of another bigger and profitable battery manufacturer AGS, which is trading at only 1.2 times its book value.

But the realities of UPS and car demand falling are still very real. In the face of such challenges, how has Treet seen an increase in sales? Sadly, the inflation rather than sales volume seems to be playing its part again, combined with the low base effect.

Since June end, the company has been marred by high financial costs which have eaten into the profitability of the company. The last three quarters have shown little profit or even losses. This was despite the fact that the company showed operating profits. The highly leverage position and record high interest rates are impacting the company and its bottom line.

“Inconsistent tax collection in the battery industry’s value chain disrupted fair competition, but recent governmental focus on this issue is promising. TBL upholds the highest ethical standards and transparent business practices,” Sheharyar explains.

”Despite a volume drop in the first nine months of this year, cost reduction and efficiency improvements led to better margins and profits. With the rise in domestic solarization due to increased grid tariffs, TBL’s superior products are well-positioned for future growth. This is supported by our investment in a state-of-the-art Korean technology plant and high-quality products in both automotive and backup storage segments.”

One of the market claims has been that Treet initially produced very high quality batteries but in recent times its product has suffered. Sheryar counters this claim by pointing out that Daewoo batteries has not received any complaints. “Our commitment to quality remains unwavering. Despite the recent concerns, we maintain a very low in-house rejection rate of 0.17%, which represents a 50% reduction over the past three years. This improvement is a result of implementing strict online quality controls through automatic inspection machines and QC systems. We have made significant investments in online inspection controls to ensure the highest standards of quality,” he says.

They are also the exclusive OEM suppliers to major automotive manufacturers such as KIA, Hyundai, Changan, Proton, and Isuzu, and as such they adhere to stringent quality standards. The manufacturing process and quality controls are identical across all brands they supply.

“Our quality is continually monitored by our OEM partners to ensure consistency and reliability. We are proud to have been recognized in the Best Supplier Quality category by Nishat Hyundai in 2023, which underscores our commitment to delivering top-quality products.”

Recently, Treet also announced that they were looking to divest 11.33% of its shareholding in the company. Treet Corporation owned 97% of shareholding in Treet Battery and it was decided by the company to sell some of this shareholding on 5th of March 2024. The company had decided to sell some of its shareholding. The total shares which were intended to be sold were around 100 million shares out of the total 882 million shares of the company. From 4th April to 17th May, the company has sold a total of 10.5 million shares valued at around Rs 303 million.

Sheharyar justifies this divestment by saying that they will use these funds to pay off some of its debt which will improve profitability and will provide some operating leverage which can be invested in capital expenditure going forward.

“The funds raised from divesting 11.3% of shares in Treet Battery, valued at approximately Rs 2 billion, are to be used for strategic purposes such as reducing debt. Paying off debt would improve the company’s financial health and will provide more operational and financial flexibility to invest in CAPEX.”

Recent financial results of Treet show that even though the company is earning operating profits, these are being hampered by the high interest costs. The recent results for blades show that even though the company earned 13% operating margin, it fell to 1% after interest cost was taken into account. With interest rates at an all time high, it would be beneficial to pay off any loans for the time period. This will show better profits going forward.

Another aspect that needs to be considered is the fact that Treet battery was recently listed on the stock market. The shares saw price go from Rs 10 to Rs 60 in a matter of weeks. It can be that the management at Treet feels that they can sell these shares at a time when price is higher. Once the price goes back to levels where the company sees them, they might enter the market and buy these shares back making a profit. This can be confirmed once the shares price levels out and buying interest is seen. Since January till now, the share price has fallen from Rs 60 to Rs 23.

Pharmaceutical division

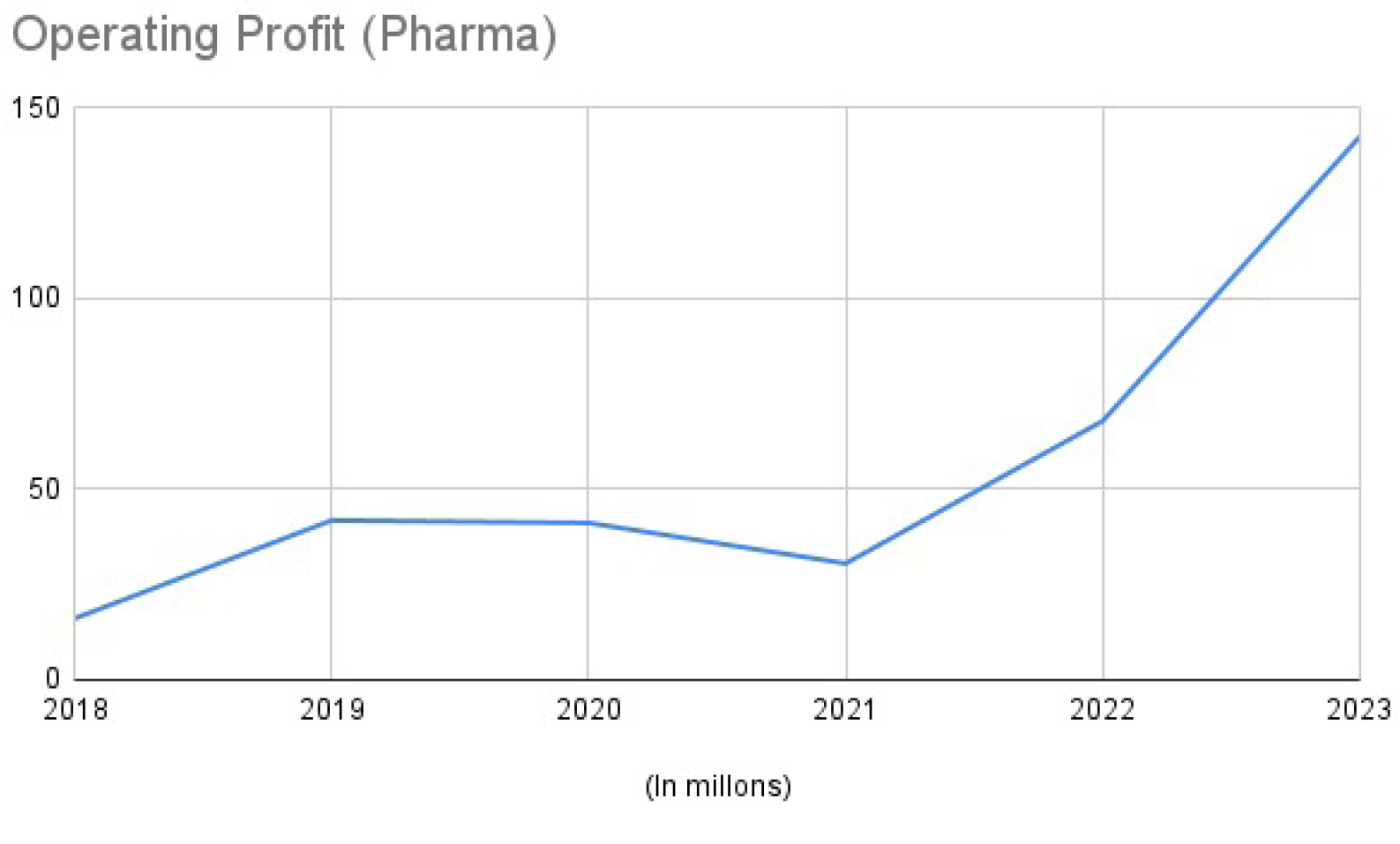

Treet Corporation has also invested in Renacon Pharma Limited by buying 58% shares in the company. The company is involved in formulation of Hemodialysis concentrates which are used in removal of waste from the bloodstream while also looking to purify kidneys. The pharmaceutical division was made part of Treet Corporation in 2016.

This is one of the divisions of the company which is performing well and has improved their performance time. In its initial years, the company was earning revenues of Rs 145 million which came to Rs 1 billion in 2023. The company has been able to maintain a high amount of gross profit due to the nature of the product that it sells. The company has been churning profits for the corporation and it seems that it can keep on track for the foreseeable future. It seems that Treet has struck the sweet spot in its investment in Renacon as the company is currently operating at full capacity and has potential to be expanded as well. With the backing of stable profits, this is one investment which has worked out for the company.

Even though Treet has a winner on its hands, it seems it might squander the opportunity in relation to the company. The Treet Corporation had plans to list the company on the stock exchange back in April 2018 but it seems that this never came to fruition. When the company had an opportunity to capitalize on the success of the company, it backed out of carrying out an IPO when it seems feasible. “The Renacon IPO plan is intact, however, it has been held back due to delay in the commissioning of the new facility. The new facility is functional and we expect that towards the end of FY 2024/25, we will initiate the process of the IPO.” says Sheharyar.

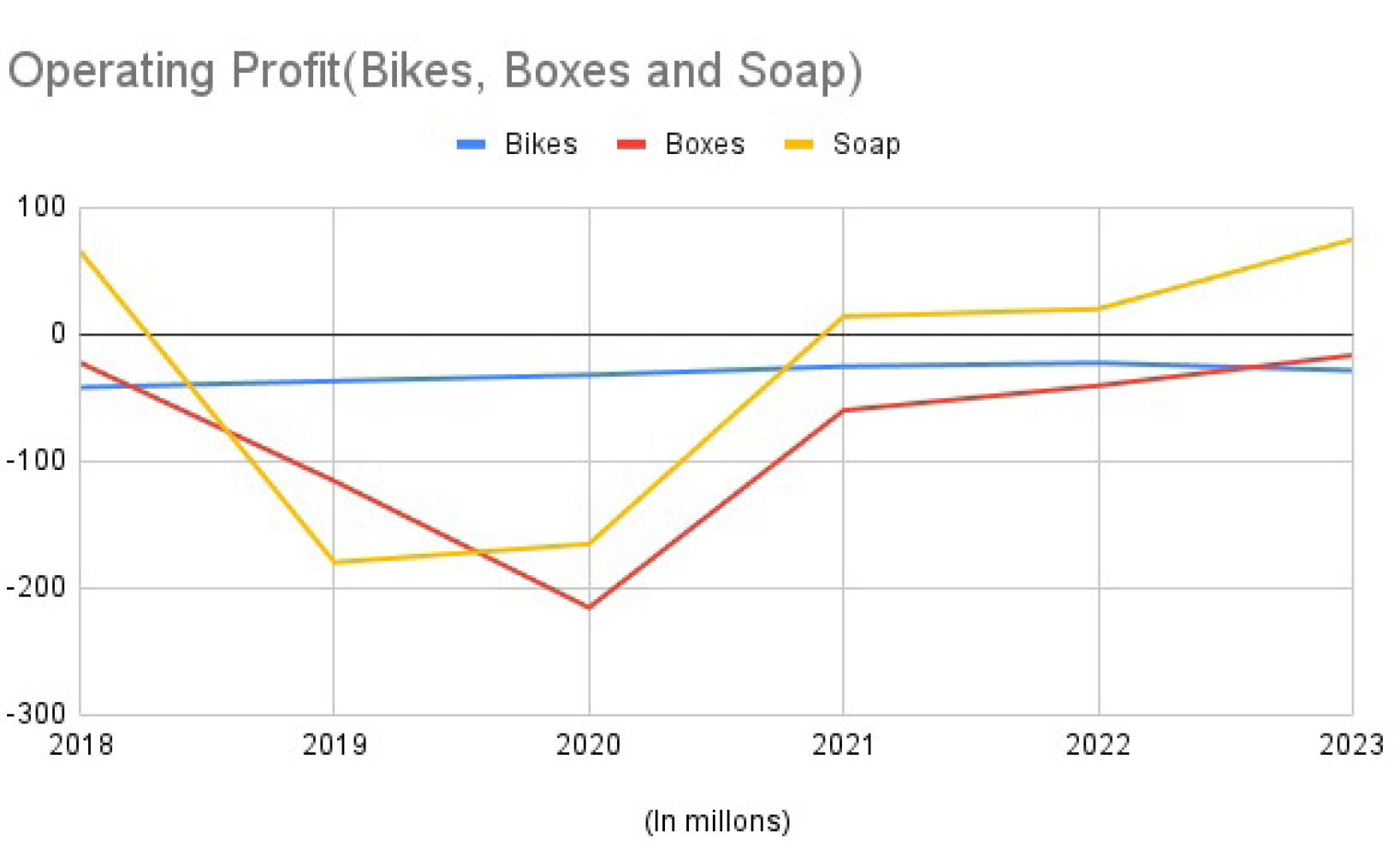

Soap

Then there is the soap business which was established by the company in the 90s. The product being produced by the company follows the philosophy of mass market and reaching a wider audience. The soap business does seem to be profitable for the company over an extended period of time. The company made sales of Rs 500 million in 2009 which have grown to Rs 1 billion in 2023. Even though this might not seem ground breaking, the company has earned a consistent gross profit of 15% and operating profit of 10% on these sales. Even though the numbers are lower in size compared to the other divisions, this is the only business which is giving a sustainable value to the company.

Treet Corporation also invested in higher education by setting up the Institute for Art and Culture in 2018. The Institute was set up as an institute with a focus on liberal arts education. This venture has now been sold off as a strategic move and the proceeds from the sale were used to pay off the debt which was on Treet’s balance sheet.

The misses

Motorcycle assembly

This did not seem like a very good idea at the outset as the country already had Honda, United, Road Prince, Yamaha and Suzuki. It was going to be a hard fought battle trying to beat these market pioneers who had years of experience behind them. This in a market where Honda dominated the market hands down. Maybe Sheharyar could have taken a cue from the fact that when there is a company dominating the market, it might not be wise to enter into it a la Treet.

Still Sheharyar thought he could buck the trend. What do the numbers tell us?

Initially the plant was able to see a steady rise in sales but going up against the big boys was always going to be challenging. Since its inception, the company saw operating losses and in some cases wasn’t even able to cover direct costs of production. This meant that the company was always under pressure to perform. Latest accounts show the company only earning revenues of Rs 45 million and making operating losses of Rs 29 million. Meaning for each rupee it earned by selling a bike, the company made a loss of 64 paisas.

The company initially had a capacity to produce 12,000 bikes per year and expanded it to make 18,000 bikes per year. Their ambition and goal could not be matched by the marketing ability of the company. The production capacity exceeded the actual production and demand for the company. The performance was so lackluster that the last 5 years of the company saw production of 13,000 bikes for all the five years combined. The last nail in the coffin was the fact that the company only produced 470 bikes in 2023 which was less than 3% of the total capacity of the plant.

Sheharyar sees this differently. He feels that his competitors have the ability and the finances to offer credit in the market and have billions in credit to their customers and retailers. Treet has always believed in cash sales due to which they lagged behind the market. Reviving the division would require a strategy which addresses production efficiency, market demand and competitive positioning which is something that the company has decided not to do at this moment in time.

“This is a completely credit market with our competitors giving billions in credit. At Treet we believe in cash sales and this was the core reason for this segment not performing. Reviving the motorcycle business would require a comprehensive strategy addressing production efficiency, market demand, and competitive positioning which is something the company has decided not to do at this moment in time.”

Corrugated boxes

In 2006, Treet Corporation got involved in the manufacturing of corrugated boxes. This was aptly the first venture that was started by Sheharyar as he had experience in packaging from having worked at Packages and gotten priceless experience in this regard. In terms of sales, this was a great decision as the investment into the company meant that the company could grow and expand. In 2009, sales for the boxes came to around Rs 700 million which have recently clocked in at around Rs 2.8 billion. With sales almost quadrupling, it can be seen that the company has been able to grow its sales.

This segment of the company seems to be sensitive to direct costs as the gross profit margin of the company was around 32% in 2012. This became negative for the first time in 2020 and a recent figure of 2.58% suggests that the company is still recovering from the pandemic era. The situation seems to get worse when it is seen that the company has not been able to control its direct costs which have impacted its operating profits as well. It seems after 2017, there is a lack of consideration being put into the company which would have allowed it to maintain its profitability. Sheharyar feels that the slump in this division is due to higher raw material costs, competition and a pressure on demand which are hurting the profitability.

There could also be other factors. For a very long time, the Treet Corporation and Packages worked well with each other. Syed Babar Ali and his Packages group was always thought to be fully backing his nephew’s company. But there are reports that this relationship has not remained the same over the past few years. Sources point towards that due to personal family matters of Shahid Ali, sale of IGI shares by Treet corporation to outsiders and the opening up of a corrugated boxes business by Treet, in competition to Packages, has led to some distance being created.

Sheharyar disregards these rumors and says that there is no truth to these reports.

“The corrugation business was set up by me. At that time my grandfather, Syed Wajid Ali, was chairman of both Treet and Packages. The corrugation business was set up initially to tap the industry using imported paper which Packages doesn’t use. Unfortunately with time reliance on imports became less and we had to shift to local. Even now Treet boxes and Daewoo boxes come from Package still and not our own corrugation. As for the selling of shares that was done with (Syed Babar Ali’s) blessing as Treet had issued right shares and needed the funds. Till today my father sits on the board of Package and IGi both so (the) family is still as close.”

Where to from here?

So where does the Treet Corporation go from here? According to their CEO, they are going to continue diversifying but within their existing businesses. For example, they are planning on launching new kinds of disposable blades to compete with Gillette as well as introducing their own shaving cream.

Treet Corporation, like other battery manufacturers, is hopeful that the government’s recent reconsideration of the solar net metering policy will encourage more people to adopt hybrid or off-grid solutions. This shift could boost demand for their batteries, providing a much-needed positive outlook for an otherwise challenging future for the industry.

Over the years, Treet’s diversification has been a hit and a miss. That is good. It shows that the corporation is willing to take risks and they are keeping an eye out on the future. But up until now they haven’t quite been able to figure out the trick. As their original business dips, Treet will continue to look for new avenues and business opportunities. What direction that will take, only time will tell.

Treet group has done a serious damage at corporate level despite an old company and historic values. They have lack of focus on their flagship area. While they have entered in new ventures, they forgot to hire and retain top talent so that they could synergize their value. With right team work approach, this group can do wonders

جب تک معاملات ان کے بڑوں کے پاس تھے تب تک ٹریٹ کارپوریشن وزیر علی ا نڈسٹری (تلو گھی) اور ذوالفقار انڈسری (کپری سوپ) منافع بخش ادارے تھے ان کے بڑورں کا اپنا مقدر تھا اور دوسرا وہ لوگ غریب پرور تھے اپنے ملازمین کو بوجھ نہیں سمجھتے تھے بلکہ بہت زہادہ خیال کرتے تھے خاص طور پر پرانے ملازمین کا جنہوں نے اپنا لڑکپن اور جوانی ان لوگوں کے کاروبار کو دیا ۔اور اب صورتحال یہ ہے کی جو پرانے لوگ ان کے ملازم تھے وہ چلے گئے اور ساتھ میں اپنا رزق بھی لے گئے ۔اب ان اداروں کی حالت پہلے جیسی نہیں ہے ۔ہماری دعا ہے کہ اللہ اس خاندان کو مزید ترقی عطا فرمائے اور انکی نسلوں کو برکت اور کشادگی اور فراوانی ڈے رزق کی مال اور دولت کی اور دلی قلبی سکون دے اور ایمان سے نوازے۔

Couldn’t read the full article. But the choice of topic is excellent.

Wish all the best to Treet Corp

The quality of treat blades has drastically declined. I used to use it but not anymore after recent horrendous experience. All sales, profits etc. depend on quality of the product. Marketing and sales can’t do much if quality is compromised.

Valuable insights

My man literally photoshopped pubic hair on building, depicting the literal meaning to the business? Wow!