On the 13th of August this year, Shoaib Ahmed was in for a bit of a surprise. Early in the morning, agents from the Federal Board of Revenue (FBR) burst into his shop located at the Pak Centre on Teak Chan Odhadhas Road in Karachi’s Saddar.

The agents were looking for Muhammad Junaid, the owner of an unheard of company called Al-Junaid Impex. As the agents explained, little old Shop number 16-A was listed as the main address for Al-Junaid Impex. But as Shoaib Ahmed explained, he had never heard of a Muhammad Junaid or a company called Al-Junaid Impex. The shop the FBR had been led to was a small operation from where he printed cards on a commercial scale.

It was an understandably frustrating day for the FBR agents that found themselves at the wrong address. After all, they were trying to trace what could possibly be a tax evasion racket responsible for billions of rupees in revenue losses for the federal government. Following the sparse paper trail of Al-Junaid, the FBR went to another address listed for the company. This one, Offices No 404 (A&B) on the fourth floor of the New Challi Trade Centre on Shahra e Liaquat in Karachi, was another dead end. Muhammad Junaid was nowhere to be seen. The offices were occupied by Burhannudin Mukkaram, who was using them to run a sanitary products business. He too had never heard of Muhammad Junaid or Al-Junaid Impex.

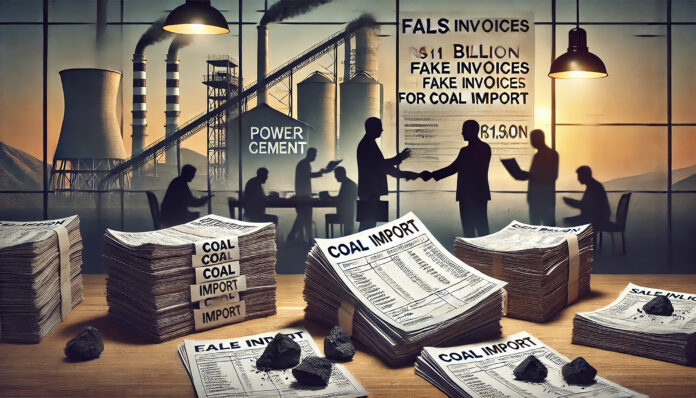

Who is Muhammad Junaid, and what does Al-Junaid Impex do? On paper it is a middle-man company that provides coal to different cement manufacturers. But according to allegations from an investigation by the FBR, it is actually a phony company set up to create fake invoices to help certain players in Pakistan’s cement industry. The FBR claims to have uncovered a network of phantom companies, created to issue fake invoices, allowing major players in the cement industry to evade taxes with shocking efficiency worth over Rs11 billion.

This investigation has led the board to Power Cement, a significant player in Pakistan’s cement industry that falls under the umbrella of the Arif Habib Group. But this might just be the tip of the iceberg. According to the FBR itself, they have only been able to trace tax evasion worth Rs32 crores by Power Cement and even that claim is up for litigation. What about the rest of the Rs11 billion evaded in taxes? Is it a case of the FBR not being able to prove more, or are there others that might have taken advantage of this? The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account. Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.To read the full article, subscribe and support independent business journalism in Pakistan