[EDITOR’S NOTE: We normally try not to publish the perspectives of Pakistan’s various lobbying groups, owing to the fact that the vast majority of them want to tell a sob story with no real value to our readers. We made an exception in this particular case because the head of Pakistan’s banking association wanted to say something discrete, and back it up with data, in a manner that we felt would serve our readers.]

Pakistan’s banking sector is now the largest taxpayer. We finance almost 100% of the government’s budget deficit. We are one of the country’s largest employers, with over 200,000 people employed. And we are more inclusive employers than most other sectors in the economy.

Despite this, we face a lot of criticism, that we are rent-seekers, or that we do not function as adequate financial intermediaries for the economy. Some concerns raised by people outside our industry are valid. Others perhaps require some additional context. All deserve to be addressed.

I believe in taking criticism on the chin, and in this article, I hope to address some of the most important criticisms leveled towards the Pakistani banking sector. I do so in my capacity as the chairman of the Pakistan Banks Association, the group meant to represent the industry’s interests before the government, industry, and the public. What follows below is a modified version of a speech I delivered at the first Pakistan Banking Summit, which took place in Karachi on February 23, 2025.

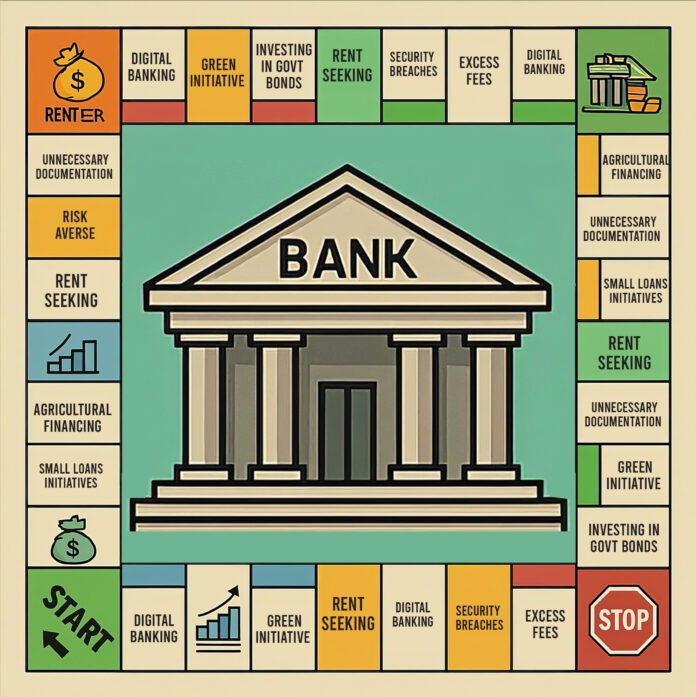

There are six main criticisms that I will address:

- The banking sector actively lobbies the government against its own taxation;

- The banks lend entirely to the government and do not lend to the private sector;

- The banks offer little by way of lending to small businesses and to agriculture;

- The banks have not made adequate efforts to improve financial inclusion;

- That we do not contribute to the country’s economic dynamism;

- And that we have been slow to adopt the conversion towards Islamic finance.

Let us address each of these. We will present not just our perspective, but also some data and analysis to back up our perspective. The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account. Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.To read the full article, subscribe and support independent business journalism in Pakistan

One major issue that continues to stand out is the lack of basic customer service—something that is fairly decent in most other industries when it comes to company-client interactions.

Banks, unfortunately, still operate with an attitude of superiority, even when it comes to simple transactions or routine security checks.

Take my recent experience with Standard Chartered Bank (SCB) as an example. My SCB credit card was fraudulently used in Thailand for around USD 2,500, despite the fact that I was physically in Pakistan at the time. It’s now been four months since the incident. I’ve already paid the amount in full, yet I am still waiting for a formal written response from the bank. Ive taken it up with the Mohtasib as well.