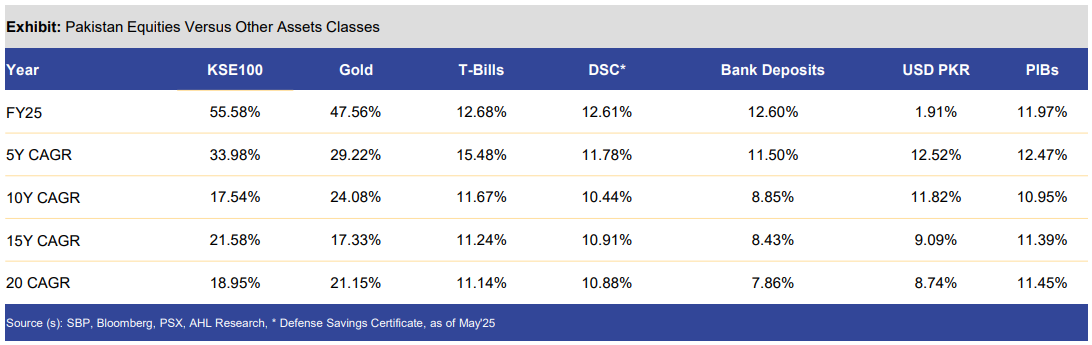

Stocks outperformed all other asset classes in FY25, posting a return of over 55%, significantly outpacing gold at 47.56%, T-Bills at 12.68%, DSC at 12.61%, bank deposits at 12.60%, PIBs at 11.97%, and USD/PKR at 1.91%.

According to Arif Habib Limited (AHL), this remarkable rally was driven by aggressive monetary easing, improved market liquidity, and the unlocking of fundamental value across key sectors.

“The benchmark index’s returns consistently outshine those of other major asset categories. Even the historical gains from Gold and T-Bills in recent times have been unable to match the impressive surge of the equity market,” the brokerage house said in its report.

It added that the KSE-100’s Compound Annual Growth Rate (CAGR) was higher than all other asset classes in every long-term benchmark, from a 5-year holding period to a 20-year holding period. This performance suggests that the KSE-100, particularly the equity market, is the most lucrative asset class for investors with a long-term horizon in Pakistan.

The KSE-100 Index delivered a stellar performance in FY25, rising by 58.6% in PKR terms and 55.5% in USD terms, closing at 124,379, up from 78,445 at the end of FY24.

FY25 also witnessed record market participation, with the highest-ever trading volumes and the highest traded value since FY21.

Volume leaders during FY25

The sectors that saw the highest activity during the fiscal year were Technology, Banks, Cement, Power, and Refineries, with average volumes of 101 million, 57 million, 54 million, 47 million, and 44 million, respectively.

On a scrip-wise basis, the highest volumes were led by WTL with 50.9 million, KEL with 30.6 million, CNERGY with 29.5 million, BOP with 22.5 million, and KOSM with 18.4 million.

Value leaders

Sector-wise, the highest activity during the period was observed in E&P, Cement, OGMCs, Banks, and Automobile Assemblers, with trade values of USD 12 million, USD 11 million, USD 10 million, USD 9 million, and USD 9 million, respectively.

On a scrip-wise basis, the highest trading values were dominated by PSO at USD 4.8 million, followed by OGDC at USD 4.1 million, MARI at USD 4.0 million, HUBC at USD 3.9 million, and PPL at USD 3.4 million.

Major gainers and losers

In terms of sectors, the major gainers during FY25 were Leasing (224%), Woollen (196%), Investment Banks (130%), OMCs (109%), and Fertilizer (106%). Conversely, the major losers included Automobile Parts (-20%), Vanaspati (-18%), Synthetics (-17%), and Engineering (-8%).

Scrip-wise, the major gainers during FY25 were PGLC, NBP, BNWM, GLAXO, and FFC, with returns of 224%, 222%, 196%, 177%, and 169%, respectively. On the other hand, the major losers during the period were MEHT, EPCL, MUGHAL, THALL, and UNITY, each posting returns of -46%, -30%, -22%, -20%, and -18%.