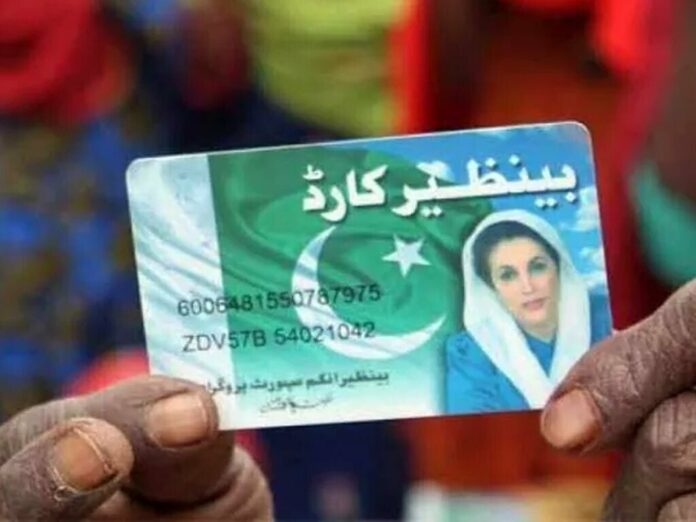

More than 10 million of Pakistan’s poorest women have, for the first time, become bank account holders under the Benazir Income Support Programme (BISP), ending 16 years of dependence on agents and manual cash distribution.

The new digital wallet accounts, linked to beneficiaries’ CNICs, allow funds to be accessed through mobile phones. To eliminate middlemen, stipends can only be withdrawn through biometric verification; debit cards will not be issued.

HBL has opened 3.1 million accounts, Bank Alfalah three million, Bank of Punjab two million, JazzCash 1.2 million and Easypaisa about 700,000.

The government has distributed 1.7 million SIM cards so far, with targets of 30% coverage by next month and 80% by March. Free SIMs are being provided by all telecom operators.

According to BISP Secretary Amir Ali Ahmed, the beneficiaries previously operated through limited-liability accounts controlled by banks, which charged fees and often used their funds without paying interest. Despite the programme’s launch in 2008, banks resisted opening standard accounts for the poorest recipients.

Minister of State for Finance Bilal Azhar Kayani said Prime Minister Shehbaz Sharif aims for 100% digital payments to BISP beneficiaries by June 2026. SIM distribution targets include 5.1 million for Punjab, 2.6 million for Sindh, 2.2 million for KP, 485,000 for Balochistan, 167,360 for AJK, 115,000 for Gilgit-Baltistan and 21,000 for Islamabad.

The stipend is expected to rise from Rs13,500 to Rs14,500 per quarter from January under IMF requirements. The government has allocated Rs716 billion to BISP this year.

Major agencies, including the Ministry of IT, PTA and NADRA, are coordinating the rollout. A challenge remains: many beneficiaries, especially in rural areas, do not own mobile phones.

Of 16,000 ATMs nationwide, fewer than 6,000 are biometric, prompting authorities to rely on local biometric-enabled shops for withdrawals.