ISLAMABAD: While the construction industry is represented by the Association of Builders and Developers of Pakistan (ABAD) asks government to take action against cement manufacturers and steel makers for increasing prices of their products, the steel industry has rejected the claims saying it was builders who have increased prices of apartments and homes manifolds during the past few years.

ABAD in a recent stamen had claimed that stern action should be taken against the cement manufacturers who had formed a cartel to control the price of the input. Besides, it said the continuous increase in prices of cement and steel bars would badly damage the construction industry and jeopardise progress on the Naya Pakistan Housing Scheme.

However, rejecting the association’s claims, the Pakistan Association of Large Steel Producers (PALSP) said on Monday that the statement regarding the increase in the prices of rebars in the country was irresponsible and a conspiracy against PM’s Naya Pakistan Housing Project.

Officials of PALSP claim that the Naya Pakistan Housing Scheme (NPHS) and the set of incentives given to the construction industry were visionary initiatives taken by the honourable PM to provide affordable housing and churn the economy. However, the biggest barrier to affordable housing is the real estate builders and developers themselves. Prices of homes, apartments and office spaces – particularly in urban areas, have increased significantly over the past few years due to an increasing appetite of real estate developers for high margins. With some of the highest net profit and return on equity margins across industries, the need of the hour is government regulation to fix the pricing of various categories of real estate projects whether it be residential or commercial development. “Since there is very little transparency in the real estate development sector, the government needs to audit the income tax contribution of such lucrative ventures. After a huge amnesty given to the builders and developers to whiten the black money, further oversight from the government needs to ensure that un-accounted and un-declared wealth (black money) is not being used moving forward,” the steel manufacturers said.

According to a statement issued by PALSP on Monday the year, 2021 witnessed an extraordinary increase in the price of rebars worldwide which has been as a result of a shortage of raw material/ scrap due to Covid 19 related factors as well as due to increasing in demand of steel globally. However, even though the cost of input increased drastically, still, the steel sector of Pakistan has been providing rebars at a price that is less or in some cases equal to countries like China, Turkey, the US, UK and the CIS states who are leading steel producers. The steel sector has been absorbing the increasing cost of inputs by reducing its net margins that hover around 4 to 5 per cent recently. In the FYs 2018-2020, major players declared losses and many smaller ones went out of business. The year 2021 provided a little bit of relief due to an increase in demand for steel; however, the steel sector is fighting for survival.

PALSP represents the documented & transparent steel sector comprising the most credible players of the steel sector. Over the period ranging from August 2020 to August 2021, scrap prices (C&F Karachi) had shot up from $ 299 to $ 530, accounting for a 79pc increase in raw material cost. Electricity cost, a major input for steel producers, over the same period also jumped 37pc from PKR 13 to PKR 20. Similarly, RLNG has increased by 90pc over the past year and ferroalloys, also a raw material used for steel making, have jumped up by 58pc. All such factors have forced steel manufacturers the world over to increase prices while absorbing some of the impacts that are apparent in the meagre industry margins of 4-5pc.

“However, the good news is that the sudden hike of raw material prices is a sort of bubble, created by supply chain disruptions that create a shortage of metal scrap in the global market. As global trade starts to recover and make its way back to a normal level of efficiency, the supply side of the raw material could once again come back to pre-Covid levels, resulting in a normalization of prices. Due to the fragmented and highly competitive nature of the steel industry in Pakistan, having over 400 steel units re-rolling primarily steel bars, the normalization of raw material prices will automatically be translated and domestic steel prices will come down,” PALSP said.

According to the association, looking to the future, if steel demand is to grow at 8pc per year, Pakistan will need to double steel production in the next 10 years to keep pace with a growing economy. However, with such meagre profitability and an array of tariff and tax anomalies, who would like to invest in the steel sector? The government must create a long-term roadmap that provides a facilitating and progressive environment for investment in the steel sector which is the backbone of our country’s economy.

Earlier ABAD had claimed that cement and steel manufacturers have begun raising prices of inputs as soon as construction activities took off following the announcement of incentives for the sector by Prime Minister Imran Khan last year.

Chairman ABAD Fayyaz Ilyas had termed the increase in cement and steel prices a conspiracy against the construction industry. Citing figures, Ilyas said that steel bars were sold for Rs110,000 per ton in November 2020, however, the price now soared to Rs178,500, which depicted an increase of more than Rs68,000. On the other hand, cement manufacturers also hiked prices to Rs680 per 50kg bag, he said, adding that the two commodities constituted 60pc of the total cost of a high-rise building while the proportion amounted to 30-40pc for residential houses.

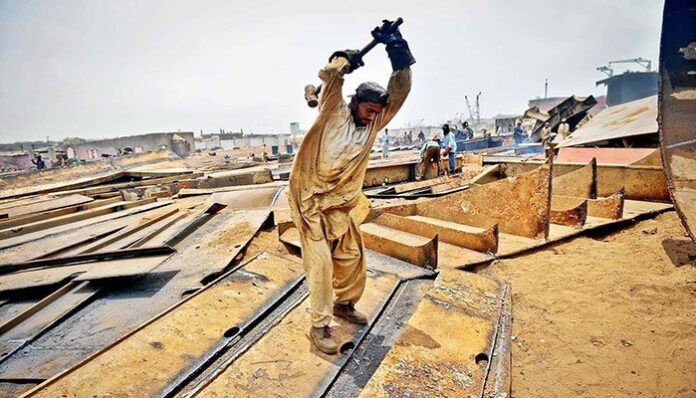

Yeah steel bars are important for all construction projects.