In February 2021, the KIA Sorento had some big shoes to fill. The seven-seater SUV was following on stage the KIA Sportage, which in the two years since its launch in 2021 had put KIA on the map in Pakistan and solidly placed them as a significant player in the country’s automobile industry.

All indications pointed towards the Sorento being a great success too. By the time it was launched, KIA already had brand equity because of the Sportage, and on top of that the Sorento beat other cars in its category like the Toyota Fortuner in terms of price – Rs 1.1 million on average in fact.

Today, the KIA Sorento is languishing in KIA’s showrooms. You see very few of them on the road, and it is not even part of drawing room discussions. In fact, in Pakistan the sign of a vehicle selling well is high ‘on-money’ and unavailability. The KIA Sorento is actually selling at large discounts of up to Rs 100,000, that KIA dealers are giving customers to get the car off their hands.

So what exactly happened with the Sorento? To a large extent, the Sorento is definitely a victim of how the market is structured in Pakistan and the peculiarities of customer demands, preferences, and priorities in the country. It is also a victim of investor greed. To another extent, it is also a major miscalculation on the part of Lucky Motors – and perhaps just a bit of greed and brashness. They believed that they could easily replicate the success of the Sportage with an older version of the Sorento with an above-standard profit margin.

All of this has contributed to the Sorento never managing to take flight. A lot has happened since the launch in February 2021, and a lot more is yet to go down. But our story begins with the Sportage, and how KIA struck gold in its pricing of the KIA, which has served it so well.

The beginnings – Sportage meet Sorento

Here’s a bold statement for you – the KIA Sportage changed the history of cars in Pakistan. In 2019, KIA was trying to break into the Pakistani market for the third time, this time in association with the Lucky Group. While it is hard to remember given the huge strides the car market has made in the past three or four years, at this point Pakistan was still very firmly under the thumb of the ‘Big Three’ triopoly of Honda, Suzuki, and Toyota.

KIA, and all other new entrants, had the challenge of breaking into this triopoly. In Pakistan, the car market lives in a strange conundrum. Automobiles are almost entirely imported products in Pakistan, in one form or another. Thus, their prices are closely tied to the US dollar. This characteristic in particular allows them to act as a hedge against inflation. If you keep your car in good condition, don’t have it repainted, and sell it a few years after you buy it, you will most likely get the rupee value of what you bought it for back or even a little more than that.

This means cars in Pakistan are an asset class, and since Honda, Toyota, and Suzuki are considered to have ‘good resale value’ – most consumers do not want to buy outside of these three. So what did KIA do?They made an offer that Pakistani consumers could not refuse

KIA came in on a model that was completely different from the Big Three. Up until this point, Toyota, Suzuki, and Honda had been operating on a just-in-time model (JIT) for assembling automobiles. This is to say they first absorbed orders to ascertain demand and then assembled automobiles to satiate it accordingly. This is why the industry is characterised with artificial shortages, and subsequently, long wait times. Lucky Motors flipped the model upside down by ordering CKDs en-masse and then trying to sell them.

Suddenly there was a car in the market that was readily available. Not only that, but it was a crossover SUV in the same price range as sedans like the Honda Civic and the Toyota Corolla. Secondly, and most importantly, they single-handedly created a resale market by changing the way automobile manufacturers delivered vehicles.

These factors acted in unison led to customers flocking to the Sportage to both satiate their Chaudhry Sb urges but also because they were unlikely to ever get any other automobile in time.

Suddenly, there was a new option available in the market, and it offered a larger car in a different category in the same price range. The rest is history. KIA started selling more than a thousand Sportages a month, and while the Big Three resisted, KIA not only became entrenched as a ‘resellable’ brand but also helped pave inroads for other manufacturers like Hyundai, Changan, and MG.

Read more: Can KIA be King, or do the Big 3 have another trick up their sleeve?

This is where the Sorento comes in. Between 2019 and 2021 KIA sold a lot of Sportages, and we mean a lot. Their hatchback, the Picanto, did good business too. In 2021, perhaps galvanised by their success, KIA Lucky Motors decided to launch the KIA Sorento. This was going to do to the high-end SUV segment what the KIA Sportage did to sedans like the Civic and Corolla.

The Sorento equation

This is the market the Sorento came into. After the massive success of the Sportage, KIA announced pretty quickly that they would be launching this car. Another peculiarity of the car market in Pakistan is that initial buyers are investors and not end-consumers. These are dealers that buy cars before they are even launched. Often, when investors expect the car to sell a lot, they agree to buy them without knowing either the price or the generation of car being imported. KIA chose to use their winning strategy with the Sportage on the Sorento as well – importing CKD models en masse. And it worked with investors.

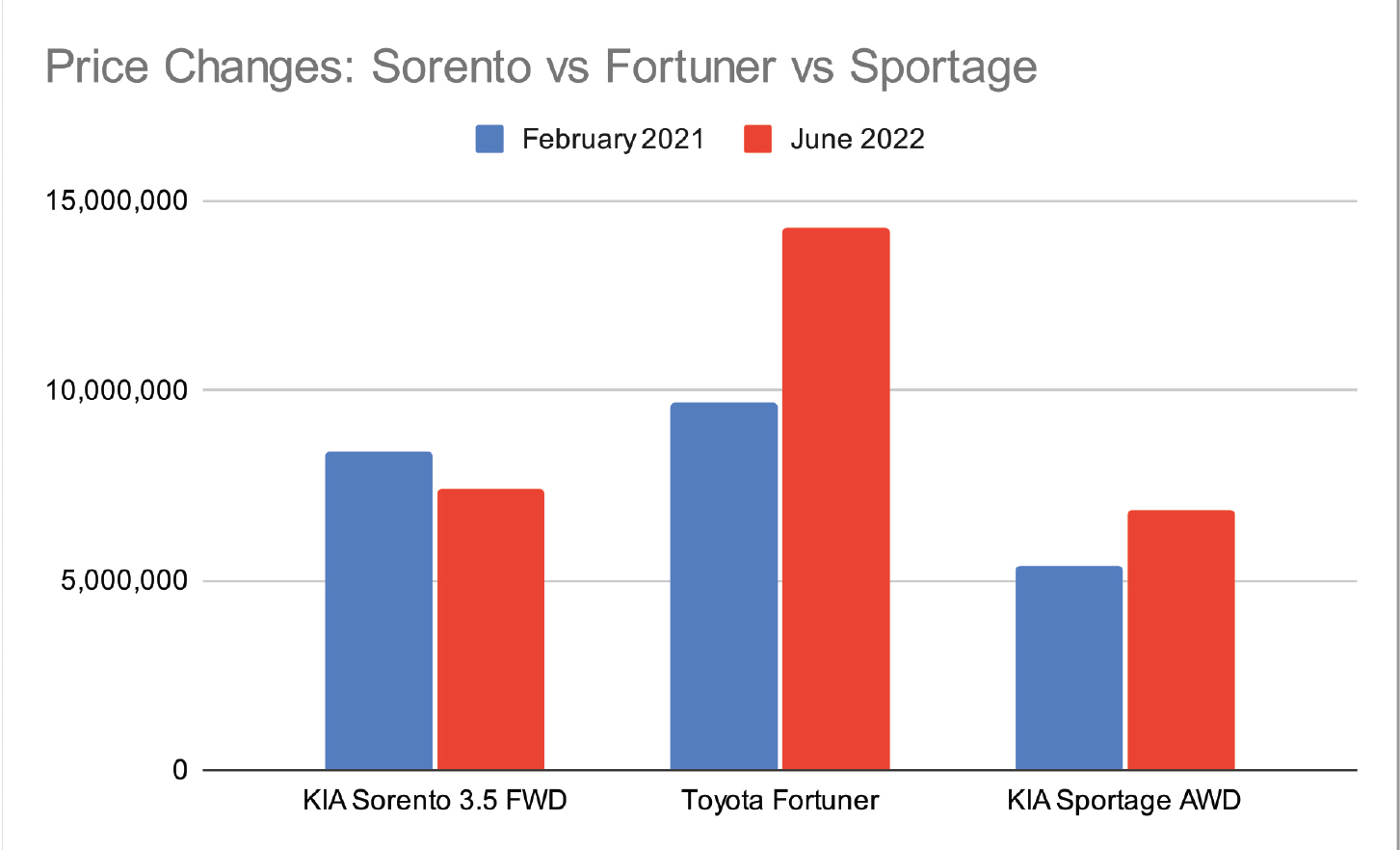

The initial price of a top-variant KIA Sorento was around Rs 8.4 million. The Sorento, unlike the Sportage, was a larger car and its top-variant came with a 3500cc engine and a 7 seat configuration, which meant its main competitor was the Toyota Fortuner. Compared to the Fortuner the Sorento at this point was around Rs 1.1 million cheaper and came fully loaded with a host of features that Fortuner lacked.

On paper, it was a good car and KIA Lucky Motors were confident that they would be able to sell it the same way they sold the Sportage. And the initial response especially during the pre launch period was favourable. Muhammad Ali Tabba, Chairman Lucky Motors, even took to Twitter to thank people for the response. This is where our problems with the Sorento start.

The Sorento was plagued with problems from the onset. Lucky Motors opened pre-bookings for the KIA Sorento to test the waters and gauge demand, and investors piled into it like wedding guests onto a buffet because they thought Lucky Motors was about to lay another egg.

Now investors making pre-bookings for automobiles in Pakistan is a perfectly normal matter. They do so in an attempt to create artificial shortages and then resell automobiles on on-money. This was also the likely fate of the KIA Sorento, until it wasn’t. The problem was that like the parents of a couple bound for an arranged marriage, Lucky Motors did not disclose the price nor introduce the investors to which generation of the KIA Sorento they were launching. Investors, however, completely trusted Lucky Motors. They had launched the latest Sportage at a good price point, and they’d do the same with Sorento is what they thought.

Any doubts Lucky Motors may have had about the KIA Sorento were never brought up due to the pre-bookings. And in February 2021, Lucky Motors unveiled the KIA Sorento at their Power Play event. They proceeded to launch the Sorento in a matter of days afterwards. Let’s just say Lucky Motors went from the Muh Dikhai to marriage counselling immediately.

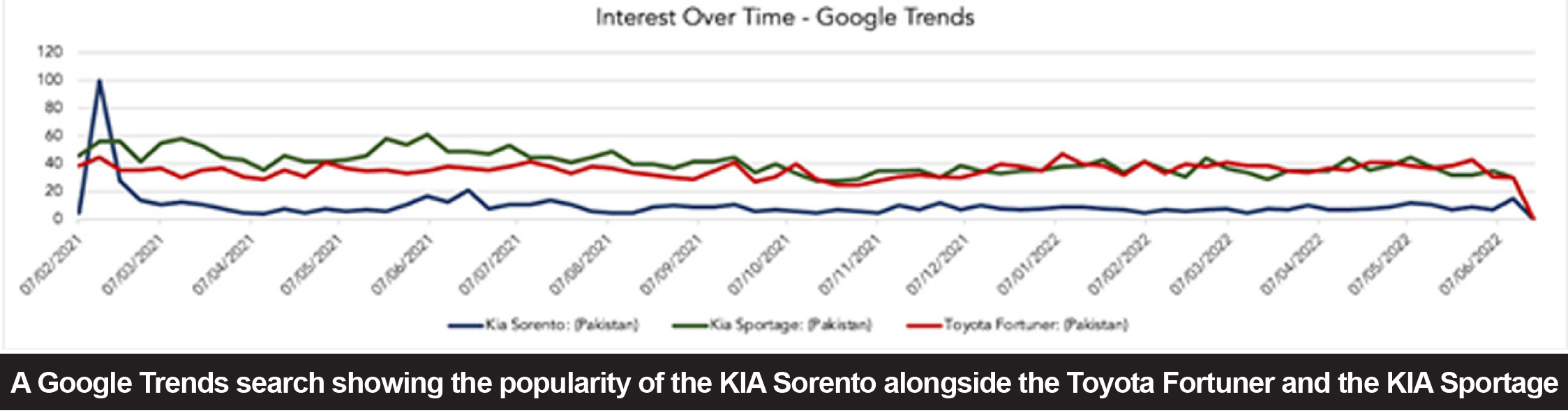

The KIA Sorento’s interest peaked around its launch and has subsided in the months to follow. According to a sales manager at one of the KIA dealerships, the explanation for this is that Lucky Motors did not advertise the Sorento as much as they should have, relying instead on word-of-mouth and the brand equity they had gained through the Sportage.

Profit ran a simple Google Trends search to see the popularity of the Sorento next to its younger brother and the Toyota Fortuner. The results were not pretty.

It became clear very quickly that the car had not made the kind of splash KIA was expecting. Once the excitement of the early days passed, not a lot of people were coming in to buy, let alone have a look at, the Sorento. There was always going to be lesser demand than the Sportage since there are fewer customers for more expensive cars like the Sorento, but even by those standard buyers just weren’t coming in.

The days passed into months and the investors started becoming jittery about the car. They started selling it on a discount, up until the point that Lucky Motors themselves slashed the car’s price by around Rs 700,000. This, of course, was a cardinal sin in Pakistan’s car market. For a market that treats cars as an asset class rather than a utility item, the manufacturer reducing the price says only one thing – there is little demand and hence resale price will not be good.

It doesn’t matter at that point how good the car is (and the KIA Sorento is a good car) or what a good deal you’re getting on it (and now you are getting a great deal). All that matters is that the car may not have great resale value and hence is shunned by the market.

Of course, there were also reasons for why customers were not coming in the first place – because KIA had cut some very important corners. For starters, they had chosen to bring in the third generation Sorento even though the fourth generation was available. The fourth generation Sorento, with a design concept close to the Range Rover, is significantly more modern looking and would have been successful in Pakistan.

The other corner was that they kept their price margins quite high – as high as 26% compared to the usual 15% as per Profit’s analysis. This, of course, was because Sonerto was still cheaper compared to the Fortuner. Under their Sportage model, they thought this would be enough to break a chunk of the market. Besides, if they had reduced their price further, the Sorento might have been uncomfortably close to the price of the Sportage. Unfortunately for them, it did not work out this time and that is what led them down the path of readjusting their prices.

Was the Sorento overpriced?

“The market felt the KIA Sorento was overpriced at its initial price” conceded Muhammad Faisal, President of the Automotive Division at Lucky Motors Corporation, in an interview with Profit. The initial price was the aforementioned near Rs 8.4 million.

According to one senior executive at a rival automobile manufacturer, one of the mistakes made by KIA was keeping higher profit margins than usual. “We set our prices to achieve, on-average, a gross profit margin of 15% above the cost of assembly and import for completely knocked down (CKD) and completely built up (CBU) units respectively,” they said.

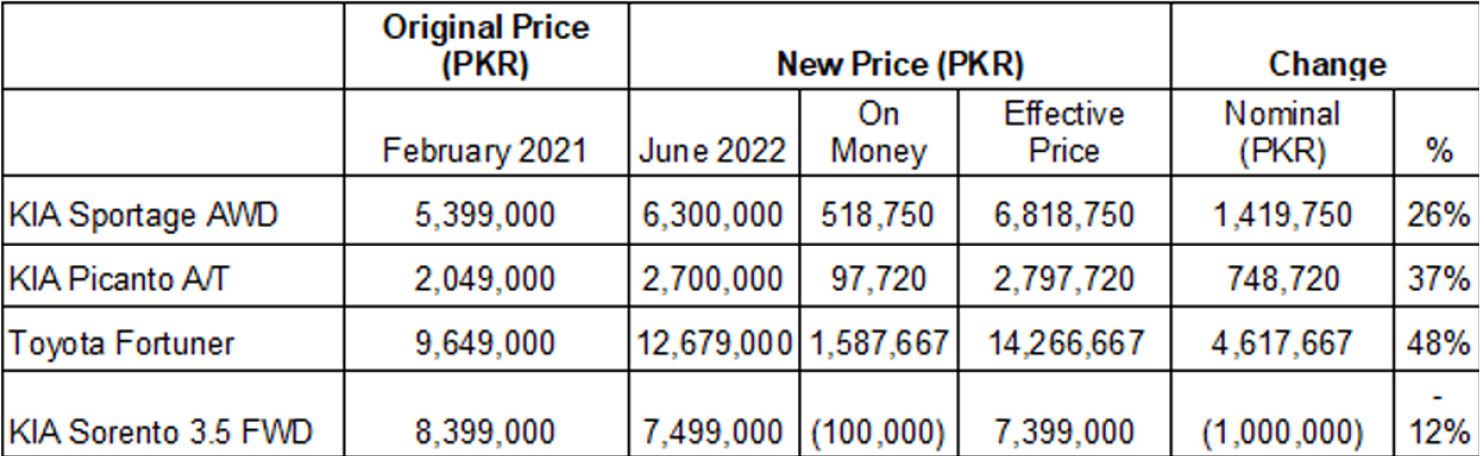

Profit ran the numbers to figure out just how much the margin on the Sorento was. Profit did the maths behind the Sorento’s profit margins and the results were not flattering. The 3,500 cc variant currently retails for Rs 7.5 million If we were to assume that this includes the on-average profit margin of 15% then the initial price of 8.4 million had a margin of 26%.

“In response to our questions, Muhammad Faisal said that while he could not share the specifics, the 26% margin was very hefty and that even the 15% margin sounded hefty to him.”

So why did customers believe the Sorento was overpriced? Both the nature of the strategy for product selection and promoting it failed in unison. As a product itself, the KIA Sorento is probably a very good car. The problem is that combating the Fortuner was always going to be an uphill battle.

The Toyota Fortuner was both the incumbent and the progenitor of the affordable luxury segment. KIA had admittedly dislodged the Big Three before but on this occasion they overshot their mark. The fact that the Sorento was not the latest generation and was overpriced by that standard led to it launching with a whimper rather than a bang. Also, in a segment where a buyer is paying Rs 8 million and more for a car, being able to pay an additional Rs 1.1 million is not that rare.

Of course, KIA felt at the time that they had to bring in an older generation of the Sorento to keep its price lower than the Fortuner, but the strategy clearly didn’t work. It was possible that the Sorento may have still carved a niche in the market had Toyota Indus not introduced the Fortuner’s facelift in May 2021. The Fortuner’s facelift was universally well-received and was perhaps the final nail in the coffin for the KIA Sorento.

Damage control – slashing prices

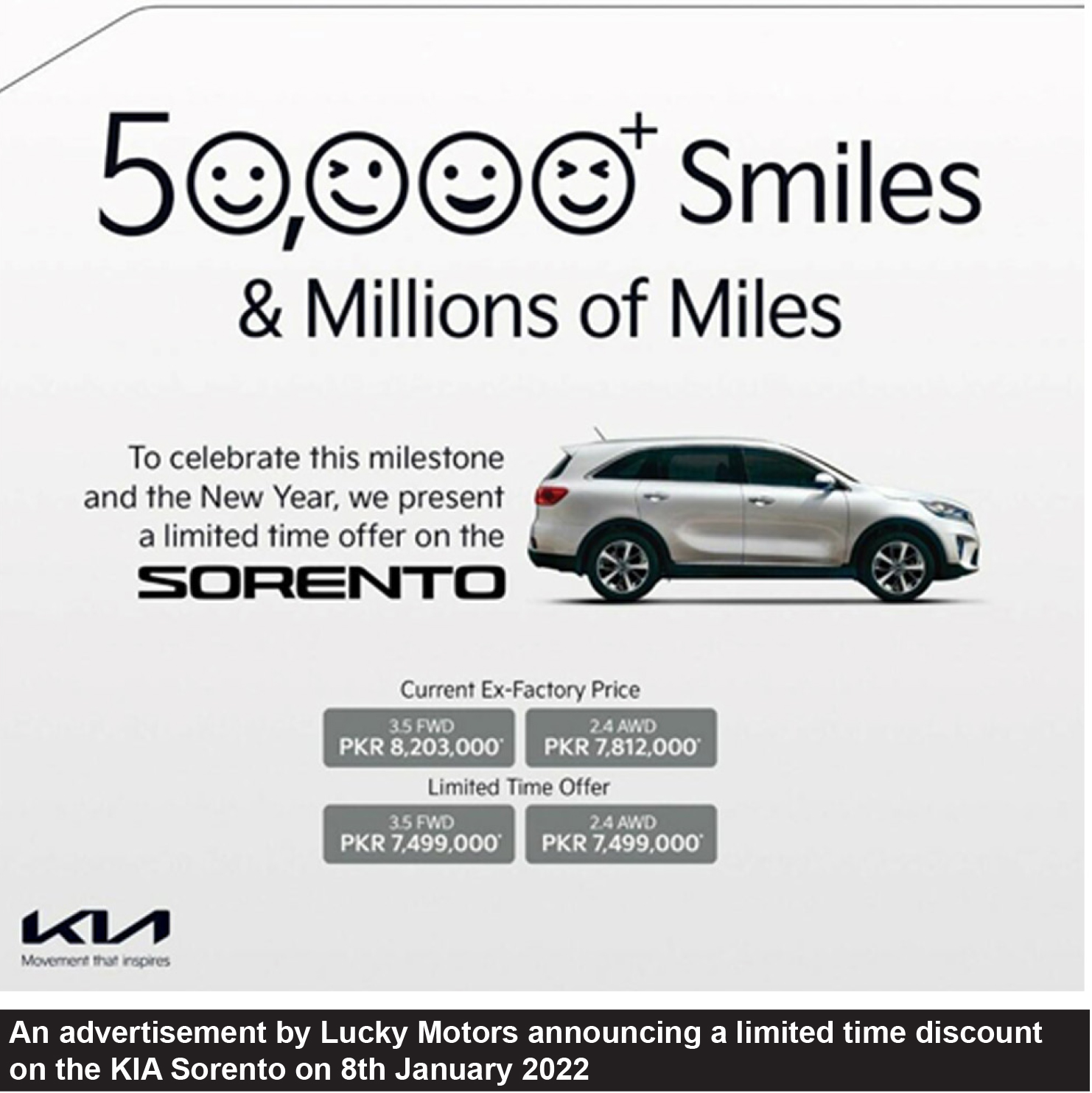

Here is the situation we have. KIA is stuck with a product, the Sorento, that has proven itself difficult to sell. The company has itself admitted that the market felt the product was overpriced, and they put their money where their mouth was by offering a limited time discount of upto Rs 700,000.

A price reduction on a product that is not selling well would have been hailed in almost any market, other than the Pakistani automobile market. As we have discussed earlier, cars are an asset class in Pakistan and hence any drop in their price is received as a warning sign rather than an opportunity.

In a country as starved for investment avenues as Pakistan, the automobile sector provides a means to accrue wealth. However, this relationship is contingent upon the price of the car increasing. The KIA Sorento’s discount harmed the relationship and sent a signal to both investors and regular customers that the Sorento was not a safe investment.

However, the well was not yet completely poisoned. Lucky Motors did not disclose when this limited time discount would lapse. Some buyers bought the Sorento assuming the discount was temporary, but Lucky Motors had other plans.

Automobile manufacturers increased prices in March and May this year due to the Pakistani rupee’s devaluation against the US dollar. Lucky Motors did so as well, for all of its portfolio except the KIA Sorento. The Sorento retained its discounted price, and automobile buyers were now certain that they had been handed the short end of the stick.

This meant that where the Sorento’s rival, the Fortuner, had a price hike that took it up to as much as Rs 12.6 million, the Sorento’s price actually decreased – making the gap between the two cars swell to more than Rs 5 million.

Let us recap here. Lucky Motors reduced the price of the KIA Sorento because customers felt it was overpriced and Lucky had excess inventory. The price reduction was met with even fewer sales due to shattered demand that could only be ameliorated with a price increase. However, if Lucky increases the price then the market will deem it overpriced again which will stagnate sales. And on top of all this, this self-fulfilling prophecy was made worse by another issue – KIA badly bungled the car’s marketing.

Could a comeback be on the cards?

In facing the ghosts of pricing decisions past and providing arguably one of the best bargains ever, Lucky Motors may have found a way out. Albeit, not of their own doing.

The KIA Sorento’s discount price is now the official ex-factory price. When asked about the matter Muhammad Faisal told Profit “We have had a favourable response at this price and the Sorento is now doing well. I see more of them on the road everyday.”

The KIA Sorento for all we know may actually be doing very well (Lucky Motors is not a member of the Pakistan Automotive Manufacturers Association and therefore does not disclose its sales numbers like the other big car assemblers). It is one of the very few automobiles that can still be bought from an official dealership at a time when automobile manufacturers have suspended bookings.

Furthermore, the Sorento may have also benefited from Toyota Indus’ pricing decisions. The Toyota Fortuner on average retails for Rs 4.2 million more than the KIA Sorento. Pricing-wise, the two are incomparable with the KIA now more comparable to the Chery Tigo 8 Pro, which provides far less of an uphill battle in comparison to the Fortuner.

However, these are assumptions. However, this writer did inquire about the availability of a KIA Sorento at his nearest official dealership earlier in the month. The experience was quite pleasant. The sales team not only promised to deliver the Sorento within 7 days but also a further discount on the already discounted price of approximately Rs 100,000.

These are not the signs of an automobile that is highly in-demand by any means. However, Lucky Motors may have solved some of their issues. “We gave discounts from Rs 80,000 to 1 lac last month to sell the Sorento, but we’ve stopped for now as it’s rumoured that Sorento might actually see a price increase in the next two weeks” said the owner of a KIA dealership to this writer.

Muhammad Faisal also confirmed the same to Profit. “It’s price will definitely increase. Jub iski price correction aye gi upwards tou automatically consumer confidence barhay ga aur ye gaari apni, is tarah samaj lein is gaari ko uski value sai hum kum baich rahay hain”, he claimed.

The company’s recent decision to suspend further bookings of Sportage is also helping Sorento’s cause.

A price increase may seem plausible given that the KIA Sorento absorbed the shocks in the previous two price hikes its siblings enjoyed. A price hike within the range of 10-19% would be in-line with the ones witnessed by the rest of KIA’s offerings. It would also reset the price upwards of its original retail price for the top two variants.

While the KIA Sorento may be on the precipice of burying its troubled past, it could also easily continue down the rabbit hole it’s found itself in. Any prediction would be premature given the irrationality that the Sorento has displayed, and because of Lucky Motors’ handling of one of the Sorento’s newest Pakistani cousins, the Peugeot 2008.

One thing for sure is, the KIA Sorento currently oscillates between arguably one of the most expensive enthusiast products and one of the best bargains one can buy. This juxtaposition may not be the market position Lucky Motors envisioned for the Sorento, but hey, home is wherever the customer is willing to take your excess, possibly very excess, amounts of inventory off your hands.

It cannot be compared to Toyota Fortuner because that is a proper SUV while this is just a glorified MPV.

nice article

Excellent paper. KIA should forgo 2.4 lit option and add AWD with 3.5 lit engine. I think it would give them a boost

True. In fact 3.5 litre engine with AWD would have been an attraction. Already it lacks so may goodies like 360 camera. Lane assist / lane depature and adaptive cruise control.

Very well written. Good article.

Today, the KIA Sorento is languishing in KIA’s showrooms. You see very few of them on the road, and it is not even part of drawing room discussions. In fact, in Pakistan the sign of a vehicle selling well is high ‘on-money’ and unavailability. The KIA Sorento is actually selling at large discounts of up to Rs 100,000, that KIA dealers are giving customers to get the car off their hands.

Good unbiased article.

It’s a very well written article.

I think the reason of poor response was because of their decision to launch 3rd generation product while 4th generation was internationally available. Pakistan is no more a market where older generation products can be dumped. Sorento 3rd generation cannot be compared with Fortuner, as someone mentioned, this version of Sorento looks like a MPV rather than SUV.

the Sorento is definitely a victim

The article Comprehensively covered by in large all the market angles . Nice effort though . The consumer still wanted more confident words either to go for it or leave it for good to Cherry Pro 8 ?

Excellent article! I think this Sorento, though an excellent cad is water under the bridge. KIA should launch the next generation and that would propel the 7 seater market the way they capitalised the compact SUV crossover segment with Sportage!

I actually drive a sorento 2.4 awd. My father drives a fortuner. Sorento has a much better comfortable drive than fortuner. More feature and really good value for money i thought.

Excellent analysis. In my opinion there is no comparison with fortuner being only awd.

Kia should reduce the price further to dispose the stock as Suzuki did to Vitara.

A very well written article with handfuls of good analysis.

However, our local automotive industry is striding like crazy and no regulations in terms of price control mechanism by the government.

All foreign investments are restricted, therefore all black money investment options rest with Car purchase and property purchases. Nobody wants to keep cash such a volatile currency parity. All these conditions makes the overall situation fertile harvest for these automotive companies. Please write something on this issues as well as government is sleeping on it. Must be challenged at Competition commission of Pakistan. Local industry charging a lot of premium on Cars. Government Not giving us a chance to buy cars from imported source ending up in monopolizing the industry.

Toyota Fortuner is way too Amazing.

I own a Sportage AWD and was really impressed by this SUV , visited skardu and Hunza,never got tired while driving at one stretch 400 km.so now I bought a 3.5 Sorento,and found more comfortable.

I own a toyota corola and i belive it’s the best car in the world. lol

very interesting to read

Thats Great Information . Really i like it

I dеfinitely loved every little bit of it and I have you book marked too check .

온라인 카지노

j9korea.com

when will Pakistan wil start its own automobile

Amazing Knowledge, i like it, thank you

A luxury car but we have many other options on this price range. So No to Sorento