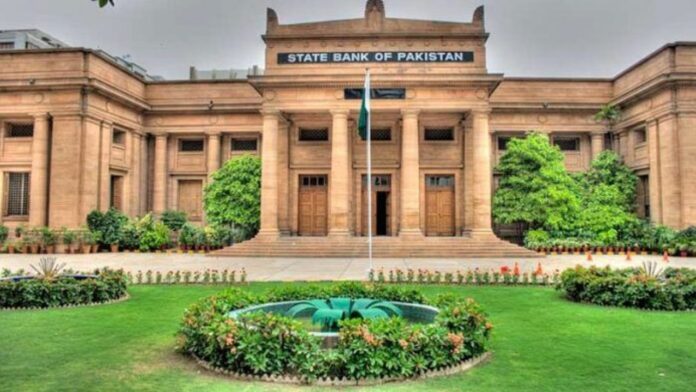

KARACHI: Governors of the State Bank of Pakistan (SBP) along with OICCI officials on Tuesday pre-approval procedure of LCs for import of machinery and spare parts, timely remittance payments, approval exemptions of shipping values being too low, and other operational issues.

In this regard, SBP Acting Governor Dr. Murtaza Syed with two deputy governor’s visited Overseas Investors Chamber of Commerce and Industry (OICCI) here to discuss urgent fiscal and monetary policy measures needed to help stabilise the country’s economy. Deputy Governors Dr. Inayat Hussain and Sima Kamil also responded to queries from the top business hierarchy.

President OICCI Ghias Khan and its Secretary General Abdul Aleem led the discussions and emphasized that SBP leadership to set timelines so that industry supply chain was not compromised.

The SBP team gave a comprehensive overview of the current economic situation and the planned strategy to tackle issues in 2023. Pakistan was primarily a consumer-driven economy with consumption driving up to 95% of GDP, they said.

The SBP team expressed confidence that Pakistan’s problems were temporary and urged the OICCI members to work on improving exports to help balance the exchange rate fluctuations and currency depreciation.

“It was imperative that we implement cogent measures to halt our pattern of circular debt,” Ghias Khan said.

SBP’s Acting Governor Dr. Murtaza Syed said SBP was taking tough measures and making difficult decisions to help avert the economic crisis. Global inflationary pressures coupled with a procyclical expansionary fiscal policy during a pro-cyclical period was one of the main reasons Pakistan was at this crossroads today.

Once these measures were implemented and the IMF loan was received, the pressures on the economy would ease, specifically on the depreciating Rupee.