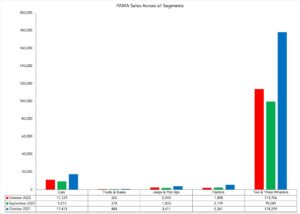

LAHORE: The Pakistan Automotive Manufacturers Association (PAMA) has released its members’ sales data for the month of October. Overall sales have risen by 14% on a month-on-month (MoM) basis with increases seen in the passenger cars, jeeps and pickups, and two- and three-wheeler segments. However, despite the rally, sales are still down 37% year-on-year (YoY) in comparison to October 2021.

The largest nominal increase was seen in the two and three-wheeler segments. The segment rose to 113,706 units in October, against September’s 99,581. However, sales still fall short by 36% YoY in comparison to the 178,229 units sold in October 2021. Jeeps and pickups saw the largest relative increase with 2,240 units sold in October in comparison to September’s 1,833. YoY sales are down 38% when compared to October 2021’s 3,611 units sold. Finally, passenger cars saw 11,129 units sold in October against 9,213 units sold in September. YoY sales are down 36% when compared to the 17,413 units sold last year.

On the other hand, the trucks and buses segments saw a decline in MoM sales. The former saw sales decline to 326 units in October against September’s 378 and last year’s 484. The latter saw sales decline to its lowest point this financial year with only 1,890 units sold in October. This is compared to September’s 2,149 units sold and October’s 2021’s 5,361.

Only four of PAMA’s members saw a MoM reduction in their sales figures with everyone else averaging a MoM increase of 40%.

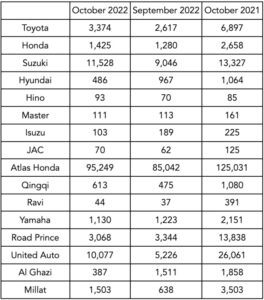

Looking at companies strictly in the four wheel passenger and commercial car business, Toyota and Honda Cars saw increases in their MoM sales, whilst Hyundai did not. Toyota saw its MoM sales rise 3,374 units sold in comparison to September’s 2,617 units. Similarly, Honda saw sales rise 1,425 units sold in comparison to the previous month’s 1,280 units. Hyundai conversely saw sales dip to 486 units compared to the previous month’s 967 units.

Looking at the company’s strictly in the two- and three-wheeler markets, there were mixed results abound. Atlas Honda, the leader of the pack, saw its sales rise to 95,249 units sold in comparison to the previous month’s 85,042 units. Atlas Honda’s sales also place it in first position in terms of sales across all companies. Ravi, Qingqi, and United Autos also saw their sales increase to 44 units sold, 613 units sold, and 10,077 units sold in comparison to the previous month’s 37 units, 475 units, and 5,226 units sold respectively. Yamaha and Road Prince are the only two companies in this segment that saw their sales decline on a MoM basis in the segment. Yamaha recorded 1,130 units in comparison to the previous month’s 1,223 units, whereas Road Prince saw its volume decline to 3,068 units compared to the previous month’s 3,344.

Looking at companies providing strictly commercial vehicles. Hino and JAC saw their sales rise to 93 and 70 units compared to the previous months 70 and 62 units sold. Master and Isuzu, in contrast, saw their sales dip to 111 and 103 units sold when compared to the previous month’s 113 and 189 units sold. The tractor segment saw Millat regain its top position against Al-Ghazi. Its sales rose 1,503 units compared to the previous month’s low of 638. Conversely, Al-Ghazi saw its sales dip to 387 units compared to the high it saw with 1,511 units in the previous month.

Finally, operating across multiple segments, Suzuki saw its sales rise to 11,528 compared to the previous month’s 9,046 units. With the exception of Hino, all of PAMA’s member’s saw a YoY decline when their figures are compared to October 2021. Hino, in contrast, saw it’s YoY sales in October rise by 9% whereby it recorded 93 sales compared to October 2021’s 85 units.

Companies are likely to have breathed a sigh of relief when looking at their October figures in comparison to the lows they saw in September. However, there is still no guarantee if the rebound carries over into November and if the industry subsequently stabilises. “The situation is unprecedented so no one can comment on the matter right now.” Abdul Waheed Khan, Director General of PAMA, told Profit.

“The quota system, freight charges, the non-availability of computer chips, and the prices of raw materials have reduced sales. Furthermore, there has also been a reduction in demand as well.” Khan stated when asked by Profit why sales were down 37% YoY. However, Khan stated that the situation would improve beyond the immediate future due to the sector’s continued engagement with the Government for a redressal of the aforementioned complaints.