LAHORE: Hi-Tech Lubricants on Tuesday released their half yearly earnings to the Pakistan Stock Exchange (PSX), showing that the company’s standalone earnings stand at Rs 106.5 million and Rs 5.7 million for Q2FY23 and HFY23, respectively.

However, the company’s consolidated earnings stand at losses of Rs 89 million and Rs 369.3 million for Q2FY23 and HFY23, respectively.

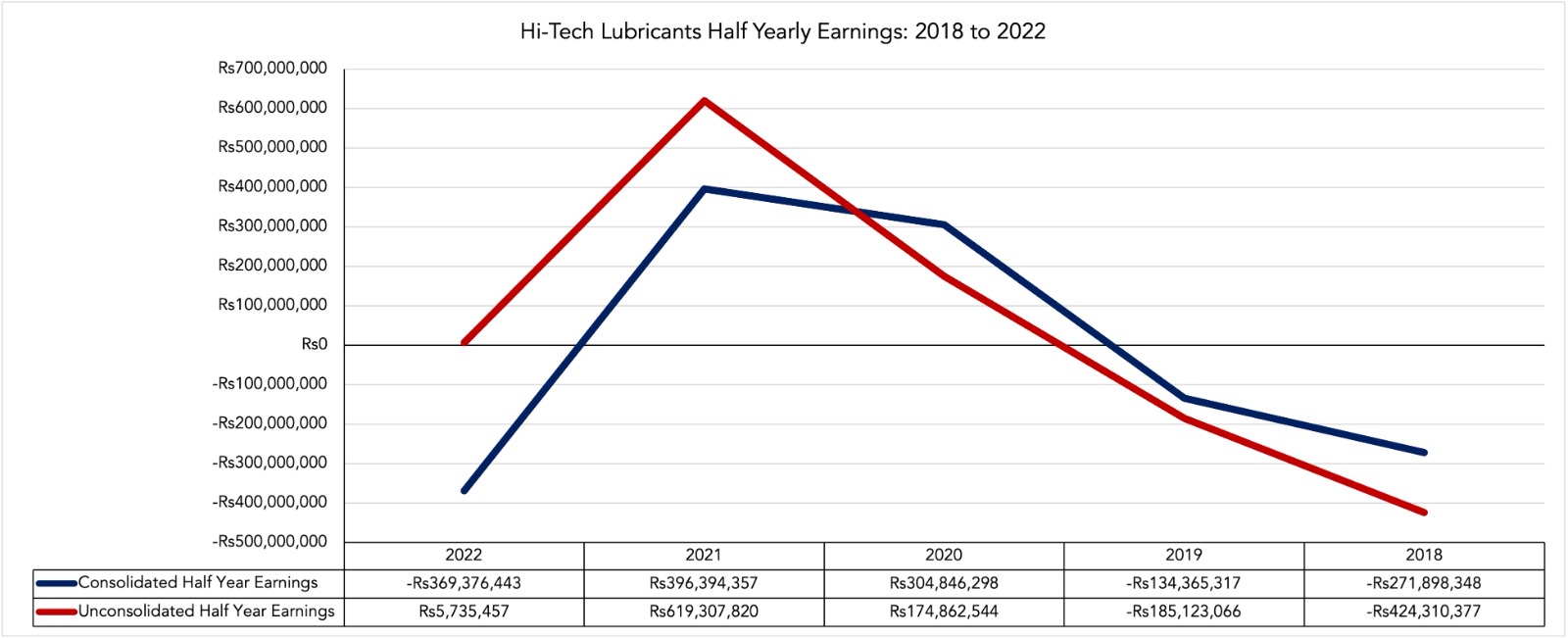

The Rs 369.3 million HFY23 loss is the highest consolidated loss that Hi-Tech Lubricants has had in the past five years, with the unconsolidated HFY23 earning of Rs 5.7 million is the third lowest the company has had over the same time period.

Company Profile

Hi-Tech Lubricants Limited (HTL) has operated in the Pakistani lubricant market for the past 25 years, with the company catering to clients in the automotive, industrial, and marine sectors. The company launched a one-stop vehicle maintenance solution under the brand name of HTL Express Centers in 2017, and launched HTL Fuel Stations across Punjab in 2020.

The company also operates Hi-Tech Blending (Private) Limited which is a wholly owned subsidiary.

Unconsolidated Q2FY23 Earnings

Hi-Tech Lubricants recorded a sales revenue of Rs 3.847 billion in Q2FY23. This was a quarter-on-quarter (QoQ) increase of 11.08% from its Rs 4.326 billion in Q1FY23, but a 23.3% year-on-year (YoY) decline from the Rs 5.06 billion it reached in Q2FY22. The company did manage to reduce its cost of goods sold by 11.86% QoQ, and 2.47% YoY. This, however, was not enough as the company’s gross profit contracted by 25.14% QoQ and 64.72% YoY to Rs 259.8 million. The company’s gross profit margin (GPM) subsequently shrank to 6.75% from 8.02% in Q1FY23, and 14.68% in Q2FY22.

The company’s other income rose by 997.06% to Rs 303.669 million. This was also a 1966.92% YoY increase as well. The other income edged Hi-Tech Lubricants over the edge to record an operating profit of Rs 213.6 million compared to the Rs 34 million loss it recorded in the previous quarter. The company’s cost of finance, however, rose to 132 million. This was a 45.74% QoQ increase, and a 20.7.2% YoY increase from its previous interest expenses. The company recorded a negative effective tax rate of 32.13% due to the Rs 25.9 million rebate it received. This is a 3.69% QoQ increase on its previous rebate of Rs 24.9 million, and a 132.09% YoY reduction on its tax expense of Rs 80.7 million in Q2FY22.

Finally, Hi-Tech Lubricants ended the quarter with a final profit of Rs 106.5 million. This is a 205.69% QoQ improvement on its previous loss of Rs 100.797 million, but a 61/57% YoY reduction on the Rs 277 million it earnt in Q2FY22.

Unconsolidated HFY23 Earnings

Hi-Tech Lubricants’ total revenue fell 5.95% YoY to Rs 8.17 billion, however, its net revenue rose by 4.31% YoY to Rs 7.3 billion. The company also saw its cost of goods sold rise by 17.12% YoY to 6.76 billion for a gross profit of Rs 606.8 million. This is a 53% YoY contraction from HFY22 gross profit of Rs 1.29 billion. The company’s GPM also contracted from 14.85% to 7.42%.

The company’s other income rose by 14.89% YoY to Rs 331 million, whilst its interest expense rose by a whopping 223.28% YoY to Rs 224 million. The company’s tax expense also reduced by 142.95% YoY due to the Rs 50.8 million tax rebate it received. The company ended HFY23 with a total earning of Rs 5.7 million. This is in contrast to the Rs 619 million it earnt in HFY22.

Consolidated Q2FY23 Earnings

The company’s revenue shrank by 15.23% QoQ and 28.35% YoY to Rs 3.99 billion. Its net revenue also contracted by 13.03% QoQ and 13.97% YoY to Rs 3.42 billion. The company, however, recorded a gross profit of Rs 419 million, a 19.18% QoQ increase but a massive 50.06% YoY decrease. Subsequently, its GPM improved from Q1FY23’s 7.47% to 10.5%, but lagged behind Q2FY22’s 15.06%.

Other income rose by 27.16% QoQ, and 104.29% YoY to Rs 35.19 million. Interest expense also similarly rose by 22.25% QoQ, and 198.52% YoY to Rs 178.9 million. The company continued to benefit from a tax rebate, similar to the previous quarter. The rebate, at Rs 47.5 million, however, was 37.74% lower QoQ. This did reduce the company’s tax expense by 167.05% YoY from its previous Rs 70.9 million. The company ended the quarter with a loss of Rs 89 million. This was a 68.23% QoQ improvement from its previous loss of Rs 280.3 million, and a 130.5% YoY deterioration from its profit of Rs 290 million last year.

Consolidated HFY23 Earnings

Overall revenue fell by 7.46% YoY to Rs 8.7 billion, whilst net revenue rose by 4.31% YoY to Rs 7.37 billion. Cost of goods sold rose by 19% YoY to Rs 6.59 billion, despite the reduced revenue to culminate in a gross profit of Rs 770.9 million. Gross profit contracted by 49.28% YoY, whilst GPM also deteriorated YoY from 16.16% to 8.86%.

Other income rose by 80.17% YoY to Rs 62.87 million, and interest expense similarly rose by an astounding 236.15% YoY to Rs 325 million. The company’s effective tax rate stood at 25.13% despite a Rs 123.9 million tax rebate due to it incurring a pre-tax loss of Rs 493 million. This is compared to its previous effective tax rate of 23.01% , and pre-tax profit of Rs 514.86 million. The tax expense was reduced by 204.63% YoY.

The company finally ended its HFY23 earnings with a loss of Rs 369.376 million. This is a 193.18% YoY decline from the Rs 396.39 million profit it recorded in HFY22.