The cement sector in Pakistan has been facing challenges in recent times. As costs increase and demand falls, there is pressure on the bottom line. It seems there is some light at the end of the tunnel. Coal prices in the international market have been decreasing steadily since March 2022 and it seems the future outlook is still bearish in this regard. The January future contracts for coal is trading currently at around $95 for a contract of 1,000 metric tons while June future contracts are barely able to touch $93.

Read More: The cement sector’s Goldilocks conundrum

The last time prices were this low was in April 2021 as the world economy was still reeling from the impacts of the pandemic. Production and manufacturing was low leading to lower demand. This was still higher than an all time low in April of 2020 when coal had touched $50 per contract.

After the world economy finally rebounded, prices were seen stable at around an equilibrium range of $100 and $200. A huge spike was seen in February 2022 when Russia invaded Ukraine which led to prices increasing to eye-watering levels of more than $400 per contract. Now it seems the prices are finally decreasing as supply catches up to demand.

The reaction of the industry

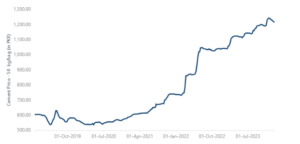

One of the biggest advantages that the cement industry enjoys is the fact that the demand for its product is income inelastic. This means that cement producers can keep increasing their prices and the customer is able to pay for any increase. This means that when the cost of production for the producer rises, they are able to transfer this cost increase into the price and maintain their margin while the customer ends up paying a higher price. This is why, since April 2021, as the cost of coal has increased, the cement producers have been able to increase their prices in lock step. Prices prevailing from 2019 to 2021 were fluctuating around Rs 600 for a 50 kg bag.

After coal prices started to rise, cement prices increased as well. Even though coal touched a high in 2022, it seems the cement industry has still been able to increase their prices while the cost of their raw materials has fallen. The increase from 2021 to 2023 was staggering and drastic as the price of a 50 kg bag went doubled. Currently it is around Rs 1200.

Where to from here?

At this juncture, the cement sector seems to be standing at a crossroads. The coal prices are again hovering around the pre-pandemic levels and it seems going forward, the market expects the coal prices to fall further based on future contracts trading.

As coal prices are expected to be stable, the cement sector can either chose to maintain their margins and prices and look to earn high returns or decrease prices in order to stimulate demand.

The first option available to the sector is to keep prices stable at this level. As their direct costs have decreased, they can earn a healthy margin above and beyond what they were earning and look to increase their bottom line. This strategy can work as the demand is inelastic and there is an opportunity to earn at this higher price.

The second option available to the company could be to decrease prices in order to stimulate demand. In recent years, the downturn in the economy has seen falling demand for the sector. The industry has been looking to export in order to generate more revenues. In such a situation, decreasing prices can lead to some recovery in demand in the domestic market. Similarly, a decrease in international prices can also look to give a competitive advantage over other countries as the benefit of lower prices can be passed onto the consumers as well.

Industry experts feel that reduced cost will be reflected in the third quarter results and margins of the companies themselves. Currently, South African coal is seeing a decrease in demand in the region and prefers to use Afghan coal which is trading at between 50,000 and 55,000 per ton. South African coal is cheaper, however, the carriage and shipping costs on them are higher. As international prices fall, it is expected that Afghan coal prices will converge to South African coal levels.

“Doing rough calculations, a ~USD 5/ton decrease in coal prices may result in ~PKR 9-10/bag savings on average. Cement prices in the North have also reduced by ~PKR 30/bag in recent weeks due to lower fuel costs” says Saleem Sami an investment analyst at Providus Capital.

Nice Article.I gained Many Knowledge From Your Website.

nice article

Saleem you are bestttt.

greed drives pakistani businesses, ofcourse district administrations claim to be busy monitoring but no effect is seen.

Balochistan coal excepted price in future ??