Imagine we are back in 2018. The country is seeing economic growth and development. There is sustained expansion in economic activity as the GDP is growing at a steady rate. 2018 has seen year-on-year growth of 6.15%. There is infrastructure development taking place under the Public Sector Development Program (PSDP) coupled with international investment in the form of CPEC related projects.

Just like macro level development is being carried out, private sector and housing schemes are also seeing a boom. Who benefits from this? The spillover effect of these developments falls into the construction sectors. Mainly cement, steel and other allied industries related to it. In the context of Pakistan, many of the cement manufacturers were operating at capacity and the next move was to expand their capacity.

This would prove detrimental in retrospect.

Since then, Covid-19 pandemic and an economic downturn has had a huge impact. Manufacturing, which was operating at near capacity, has fallen due to lower demand. This has been coupled with the fact that the cost of the expansion is still weighing down on many of the manufacturers. As sales fall and costs increase, what is next for the manufacturers?

Expansion bonanza

In order to understand the expansion frenzy seen by the industry, it has to be considered that the country had gone through a prolonged period of economic stability and certainty. The GDP recorded a healthy growth in successive years and the trajectory was expected to continue. Even when the government changed hands in 2018, an amnesty scheme was provided to investors and builders working in the real estate sector. This only made the situation even more conducive to expansion being carried out and justified.

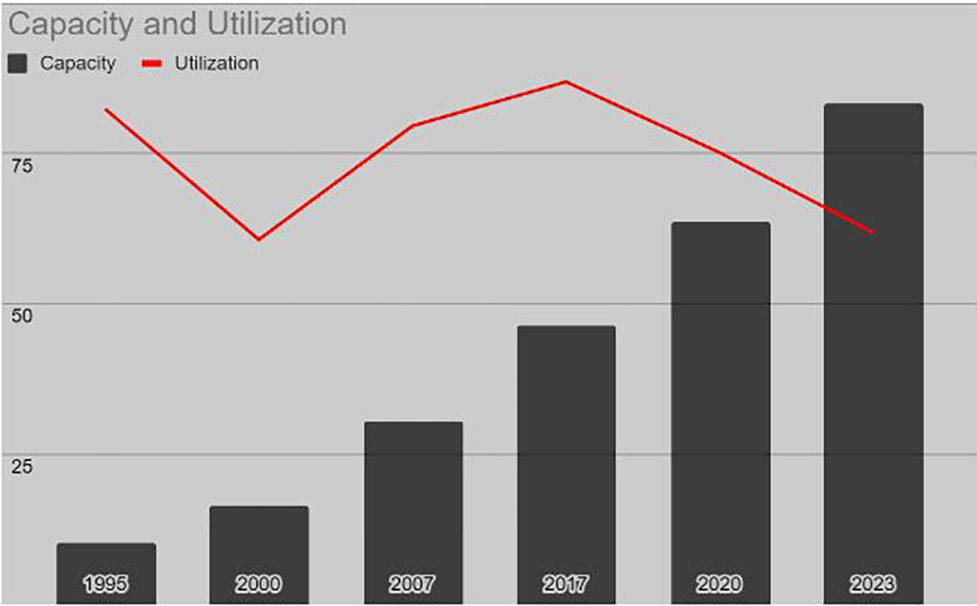

The cement industry earns healthy margins and when demand rises, the logical next step is to expand capacity in order to absorb the excess demand. The recent wave of expansion has come in a series of expansions that have taken place in the past. In 1995, the total capacity of the industry was 10 million tons. Since then, there have been three significant waves of capacity upgrades. These are due to the fact that as time passes, the demand catches up to the supply and a step forward is required in order to meet the market demand.

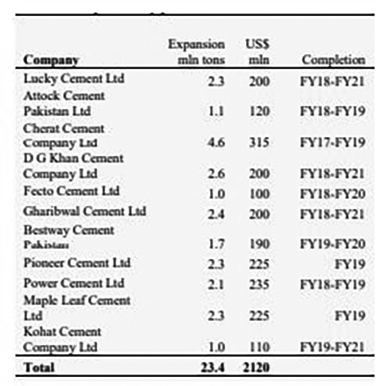

The jumps in the production capacity increased in steps from 1995 to 2023 as the capacity increased by more than 8 folds. This is an organic process and the manufacturers make sure they have demand before they expand their capacity. The recent episode of this was carried out after 2018 when the economy was firing on all cylinders. The industry was producing nearly 49 million tons and it was expected that the capacity would increase to 73 million tons by the end of 2021. This figure was based on the expansion that had been announced by some of the large manufacturers. As time passed, some of the small companies also expanded their capacities.

Cement industry as a whole

The cement industry is considered one of the integral parts of the large-scale manufacturing of the country and contributes around 7-8 percent. It is also connected to other industries like steel and construction. In 2018, many of the larger manufacturers decided that they were looking to expand their production capacity.

Initially, a total of eleven companies announced plans to expand which would have cost more than $2 billion and would have added 23 million tons of production in the industry. This was almost an addition of half of the existing production capacity. In reality, other competitors also joined in and currently the production capacity of the sector stands at 83 million tons.

The reason for the optimism

The key players in the industry hinged their demand estimates on the development of infrastructure projects under CPEC. The industry was already performing at capacity and expansion was deemed necessary.

There was also an expectation that the government would expand their own spending with mega projects like Dasu and Diamer Bhasha dam being announced which would have contributed to the demand. The government was also planning expansion of power stations and building highways and motorways which would have stimulated demand further.

Lastly, the private sector was also seeing sustained growth and demand would also increase in relation to new housing societies being set up. This factor was based on the notion that as there is a huge housing divide in the country, new houses will be built in order to close this gap.

All these factors would come together and the demand will be stimulated to new highs. This was reason enough for the cement industry to commit to large scale infrastructure development and even setting up new plants.

Business sense for expansion

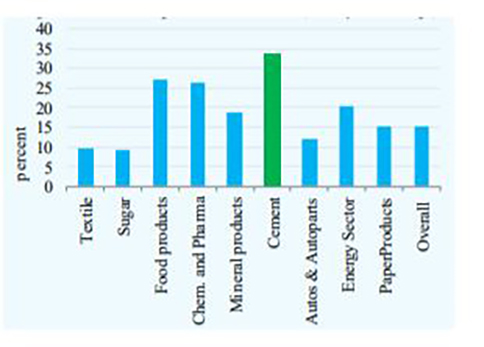

It is a well known fact that the cement industry operates on healthy and high margins. The industry is one that has one of the best gross profit margins in the economy topping at nearly 35 percent. A close second is food products at 27 percent and chemicals and pharmaceutical earning around 25 percent as gross profit.

Due to such healthy profit margins, it is felt that the capacity expansion can be funded by the margins earned. The manufacturing sector, on the whole, earns an average of 16 percent in its gross profit while the cement industry is doubling their gross profit margin. The industry was also helped by the fact that the country was seeing low coal and oil prices and lowest interest rates in the lead up to 2018. The industry is also able to pass on costs to its customers by increasing their prices in the market which protects the gross profit margin at these high levels.

Due to such healthy profit margins, it is felt that the capacity expansion can be funded by the margins earned. The manufacturing sector, on the whole, earns an average of 16 percent in its gross profit while the cement industry is doubling their gross profit margin. The industry was also helped by the fact that the country was seeing low coal and oil prices and lowest interest rates in the lead up to 2018. The industry is also able to pass on costs to its customers by increasing their prices in the market which protects the gross profit margin at these high levels.

The companies had decided to fund much of these financing needs by taking on more debt and using their own cash reserves. Interest rates from 2016 to 2018 were at record low levels of 5.75 percent which was seen as manageable at that time.

As the expansion would take 3 to 4 years to complete, the increase of capacity of 50 percent needed to see annual growth in demand or sales to increase by 11 percent. The past increase in demand had increased at 12.6 percent in FY 16-17 and it was felt that the capacity will be absorbed by the demand. Even if local dispatches were considered, increasing income, boom in real estate and government spending would have increased demand justifying the expansion alone.

In addition to demand, expansion would allow for economies of scale which would have reduced cost and the export market could also be considered as an important avenue which can be looked into for future revenue generation.

What has happened since then

Since these plans were announced and carried out, there have been different shocks which have directly impacted the cement sector. First of all, the pandemic and then an economic downturn has meant that demand has not grown by the same rate as it was expected to. In addition to that, as the currency has depreciated, the import cost of raw materials has increased which has impacted the gross profits of the company. Lastly, the interest rates are at record high levels now of 22 percent which has meant that the debt which was used to finance the capacity expansion has now become much more expensive for the companies.

The impact of each of these shocks can be seen in different metrics.

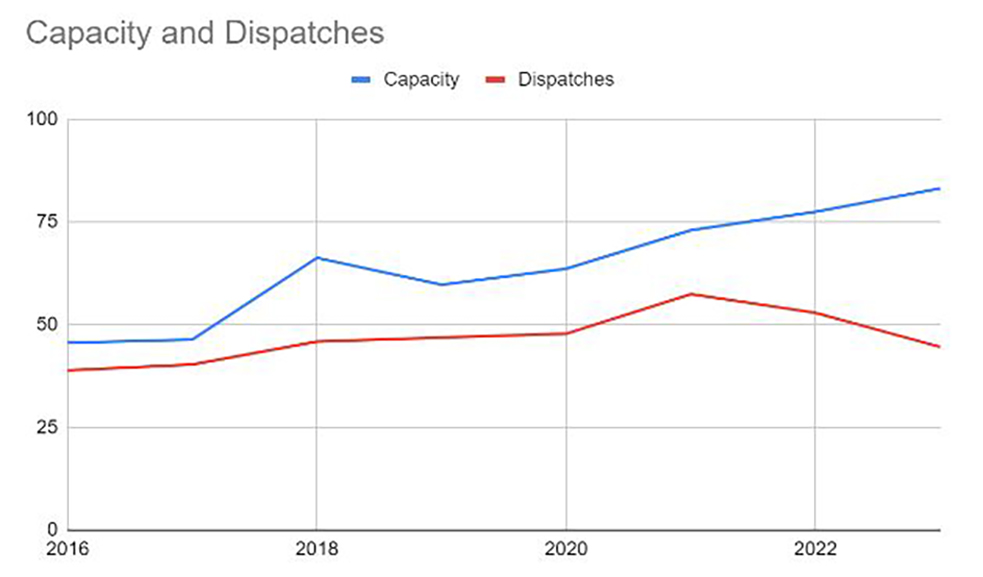

The cement industry was able to produce at capacity and sell most of their production in the market in 2017. This can be seen as a justification for the expansion to be carried out. However, the misalignment started during the pandemic and then got worse in 2022 and 2023 due to falling demand while more capacity came online. It was expected that demand would sustain and grow at a steady rate, however, in the last two years, demand has actually shrunk as the industry saw falling demand.

As demand falls, the companies cut down on their production which impacts their capacity utilization. Historically, companies were seeing capacity utilization in excess of 80 percent consistently. Once the new capacity became available, their capacity utilization fell from a high of 90.42 percent to 62 percent in 2023. This shows that on average, only two-thirds of production capacity is being used while the companies bear the brunt of higher costs.

In order to understand the impact of rising raw material costs due to currency depreciation and international price movements, it is vital to take an average of the companies operating in the industry. Based on that, it can be seen that the gross profit margins were around 40 percent in 2016 which fell to 2 percent during the pandemic and have only recovered to 22 percent in 2023. This shows how the fall in the Pak Rupee and an increase in price of coal in the international market was detrimental to the profitability of the whole industry.

Similarly, the operating margin was around 33 percent in 2016 for the industry which has fallen to 18 percent in 2023 which shows how the costing has impacted the profitability for the whole sector.

The last shock that was felt by the industry was based on the fact that they had increased their debt in order to finance the expansion which had an impact on their profitability and debt to equity ratios.

In order to fund the investment, the cement industry saw its debt to equity ratio expand from 0.17 in 2017 to almost triple its size in 2023 at 0.46. This shows that the companies looked towards debt financing in order to fund these expansions. In case the demand had remained stable, this increase in liabilities and subsequent finance cost would have funded itself in the form of increased profits, however, as sales fell, this liability became a burden on the companies which ate into their profit margin.

In order to understand the magnitude of debt taken on by the companies, it can be seen that net profit margin for the industry on average was around 23 percent in 2016 which fell to 7 percent in 2023 due to decrease in sales, increase in costs and the impact of finance cost on the net profits.

The interest expense as a percentage of sales increased from being 1.5 percent of sales to 5 percent for the whole industry. To put it into context, for every 100 rupees earned, the company was paying 5 rupees of it just to service the debt in terms of its interest payments. The last nail in the coffin comes from the fact that interest expense used to make up only 6 percent of the net profit in 2016. Now it makes up around 76 percent of it. This shows how badly the debt and the increase in the interest rates has impacted the cement industry on the whole.

At this point in time, the manufacturers are looking towards increasing their efficiency.

The effective tax rate on the cement sector also comes to around 50 percent which is taking away much of the profit for the manufacturers as well.

So what is next for the cement industry?

Exports

With the local economy being under pressure, one avenue that can be considered by the cement manufacturers is to look to produce above and beyond the local demand and look to export it. Recent trends do point towards the fact that export sales have increased in terms of the dispatch mix that is being offered in the market. Exports which were not existent in the 1990s have started to ramp upwards. The country made its first exports in 2002 and exports steadily increased from 2002 to 2010 reaching a high of 11 million tons exported. Since then the trend has been mixed with exports floundering. This is an avenue that many manufacturers feel has potential going into the future.

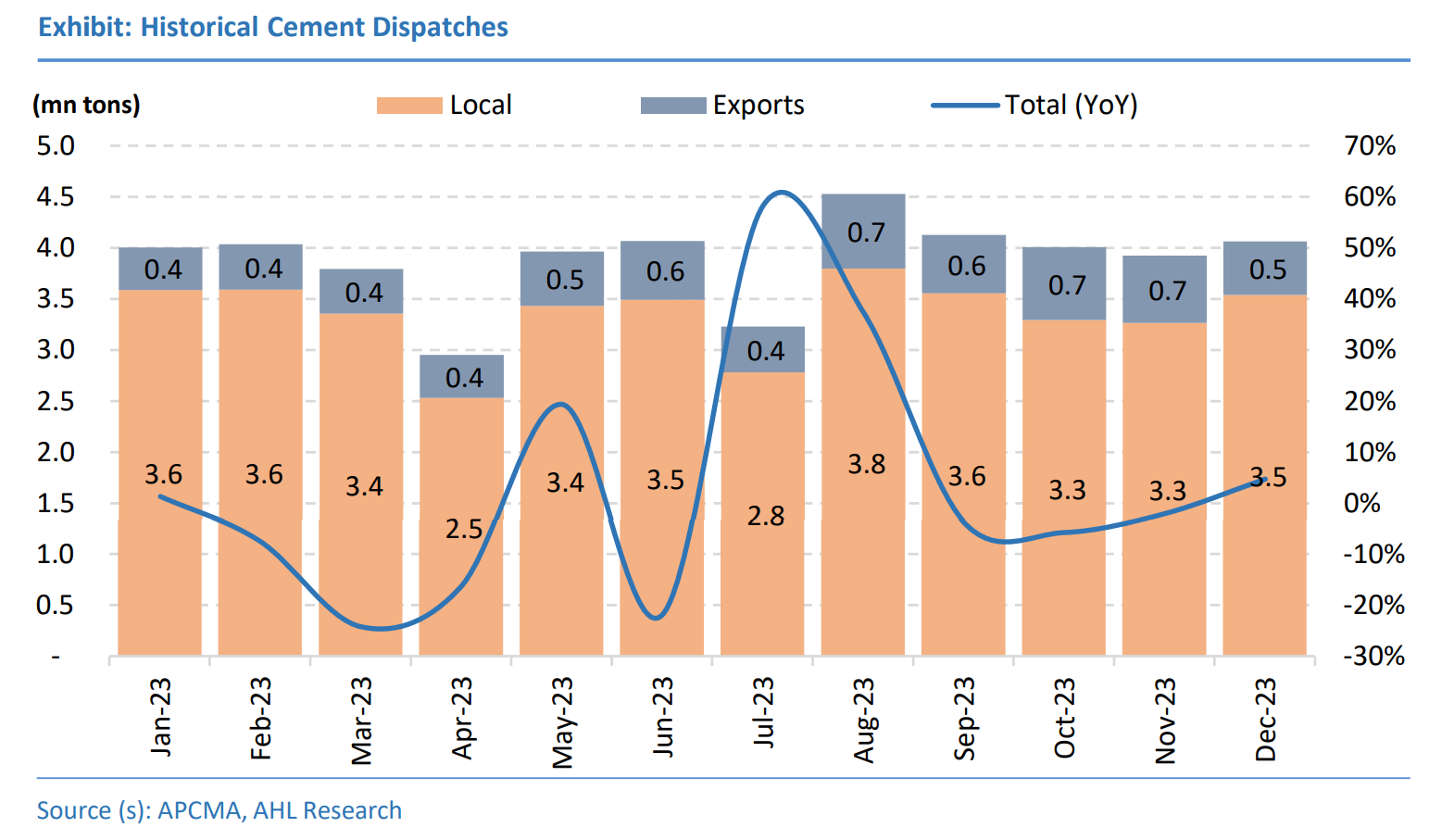

Recent trends show that in the first half of FY 2024, exports increased by more than 110.66 percent compared to last year as the industry exported 3.65 million tons compared to 1.734 in HFY 2022. This trend can mean that exports for the year can be around 9.6 million tons which will be equal to the last two years worth of exports combined. Industry analysts also point towards the fact that as costs cannot be changed in the near future, the best course of action would be to stimulate demand.

Operational Efficiencies

One of the main reasons behind the high gross profit margins seen in the cement sector is due to the fact that they are able to maintain their customer base while being able to increase their prices by passing any cost addition to their customers. There is a strict pricing discipline in the sector and it is easy for them to pass on additional costs to their customers. The challenge is to be able to sustain high levels of debt and fixed costs which still have to be borne by the manufacturers themselves. In the future, it can be expected that prices will be maintained or even increased to maintain the margins that these companies have seen in the past.

The cement industry is also looking to improve the retention of its customers where north based manufacturers are trying to sell closer to their plants while south region ones are able to use the port in order to export most of their production.

“South exports increased by 147% in 1HFY24 compared to the same period last year. This strategy is expected to continue until local demand improves.” states Saleem Sami, Investment Analyst with a specialized focus on cement sector at Providus Capital.

“South exports increased by 147% in 1HFY24 compared to the same period last year. This strategy is expected to continue until local demand improves.” states Saleem Sami, Investment Analyst with a specialized focus on cement sector at Providus Capital.

Analysts also believed that demand will improve at the end of FY 24 as inflation and interest rates decrease which can provide a boost to the construction sector. As elections take place, PSDP related programs will also be funded which are currently on hold due to budget constraints. Optimistic view points see positive development tied to future government spending, however, recent news in relation to Pakistan Development Fund Limited might dampen some of this optimism.

Well, a great article on the cement industry and its future.