Hub Power Company (HUBC) disclosed its financial results for the second quarter of fiscal year 2024, reporting a profit after tax (PAT) of Rs 17 billion, which represents a 17% year-over-year increase but reflects an 6% decline quarter-over-quarter.

The company declared an interim cash dividend of Rs 4 per share, culminating in a cumulative dividend of Rs 9 per share for the first half of FY24.

Topline Securities suggests, “finance cost increased by 46% YoY to Rs 7 billion in 2QFY24. This is likely on the back of higher borrowings to finance the newly operational ThalNova plant and Thal Energy alongside higher short term borrowings and higher interest rates.”

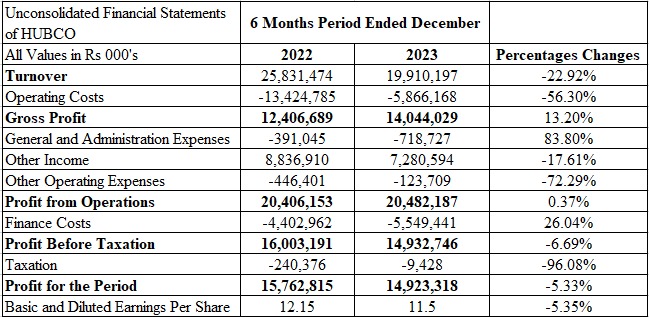

The company’s unconsolidated financial results for the first six months of 2023 show a turnover decrease of 22.92% from the same period in 2022. Operating costs fell by 56.3%, and gross profit rose by 13.20%, reflecting a higher gross margin despite lower turnover.

General and administration expenses increased by 83.80%, and other income decreased by 17.61%. Finance costs rose by 26.04%, likely due to increased borrowing or higher interest rates, affecting net profitability.

Profit for the period fell by 5.33% in the first six months ending December 2023 compared to the same period in 2022, leading to a decrease in EPS for 2023.

Guys, join me and thank “HACKWEST AT WRITEME DOT COM” for helping me recover my money from this scam artist who poses as crypto traders and promises huge return on investment but ends up stealing money. I invested about €89,700 in a Telegram trading group believing I will be getting 30% interest rate every month, but in the end they kept asking me to invest more money before I was able to withdraw my money from their platform. I had to research and contacted Hack West who then helped recover all my money and also traced their identity. I can strongly recommend West for your quick and reliable crypto recovery.