The federal government has decided to approach the Supreme Court to vacate a stay order issued by the Islamabad High Court (IHC), which temporarily halted the collection of a 15% additional income tax from banks on excessive lending to the finance ministry.

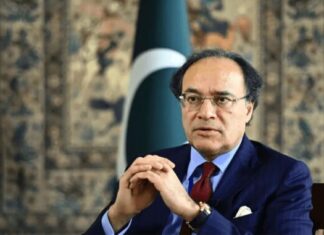

According to a news report, in a meeting with Finance Minister Muhammad Aurangzeb, the Federal Board of Revenue (FBR) announced that it would file a Civil Petition for Leave to Appeal (CPLA) with the Supreme Court this week. The CPLA seeks permission to challenge the lower court’s decision.

This decision comes as the FBR faces pressure to meet its November revenue target of Rs1.03 trillion, following a Rs190 billion shortfall in the first four months of the fiscal year.

The IHC stay order, granted to Askari Bank Limited earlier this month, has further complicated the FBR’s efforts. Other banks are reportedly planning to follow suit.

The additional income tax, expected to generate Rs100 billion to Rs197 billion, aims to incentivize banks to lend more to industries rather than primarily to the government. However, recent reports indicate banks have begun imposing fees on depositors to reduce deposits and, consequently, their tax liabilities before the December 31 calculation deadline.

The IHC, in its interim order, barred the FBR from enforcing the additional tax on Askari Bank and directed the government to file a report by December 3.

FBR spokesperson Muhammad Bakhtiar confirmed that the agency has engaged legal counsel to challenge the stay in court but said estimating revenue losses at this stage was not possible.

The additional income tax, first introduced in 2022, was temporarily suspended in 2023 under pressure from banks but reinstated in January 2024. Under current laws, banks with a gross advance-to-deposit ratio (ADR) below 40% face a 55% income tax rate on profits earned from government debt investments, compared to the normal 39% tax rate.

The petitioner bank argued that the FBR’s taxation based on ADR aimed to regulate banking business, a mandate outside the scope of a Money Bill and in violation of Article 73 of the Constitution. It also contended that loans to the federal government, which had not matured, could not be retroactively taxed.