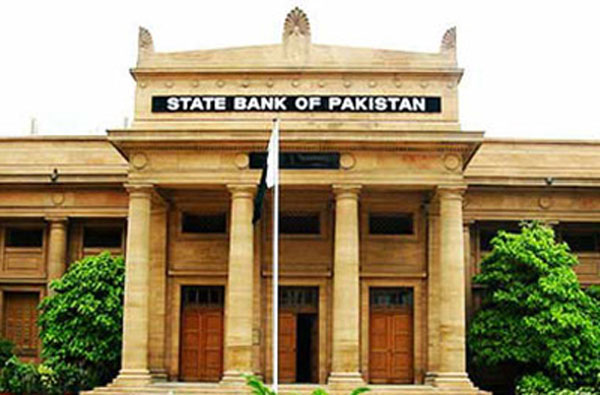

Karachi: Chief Spokesman, Abid Qamar of the State Bank of Pakistan (SBP) on Friday said that the central bank is working on establishing a National Financial Stability Council (NFSC).

The purpose of NFSC’s establishment is to ensure compliance with international best practices on regulatory and supervisory measures which are meant to secure the financial stability of the country.

An IMF report had felicitated SBP for carrying out financial reforms and said, “Staff welcomed progress in strengthening the regulatory framework, including the ongoing phased implementation of Basel III liquidity and capital standards, to be finalised by end-2017 and end-2019, respectively.”

This move is being made to make the central bank more autonomous and a former governor of SBP lamented that the independence gained by the institution during 1993-97 was diminishing as now the finance ministry was taking decisions in regard to monetary and exchange rate policy which was the formers domain.

NFSC’s setting up is meant to promote the autonomous nature of the central banks, which globally are independent of government meddling and have their own decision-making body.

This is reflected from the fact, that last month’s depreciation of the Pakistan Rupee (PKR) had created a chaos in the inter-bank and open-markets. It led to the appreciation of the rupee against the US dollar by Rs3 to reach Rs108 and caused mayhem at the stock market on the 5th of July.

As a result of it, this led to a tussle between the Finance Minister Ishaq Dar and the then Acting Governor of SBP, Riaz Riazuddin which paved the way for the appointment of Tariq Bajwa as permanent governor of the central bank.

Earlier this Wednesday in front of a parliamentary panel, Deputy governor State Bank of Pakistan (SBP), Riaz Riazuddin had admitted that the decision to depreciate the rupee on the 5th of July was taken on his own.

In a briefing to the Senate Standing Committee on Finance, Riazuddin had defended his action of not taking the finance ministry into confidence before taking such a momentous decision.

Riazuddin reiterated that he took this decision in capacity of his position as acting governor of the central bank under the SBP Act of 1956 which allowed him to act independently without consulting the finance ministry.