Global arms sales by the 100 largest companies reached $632 billion in 2023, marking a 4.2% real-terms increase compared to 2022, according to data released by the Stockholm International Peace Research Institute (SIPRI).

Arms revenue rose across all regions, with notable growth among companies in Russia and the Middle East. Smaller arms producers were particularly effective in responding to rising global demand, driven by conflicts in Gaza and Ukraine, escalating tensions in East Asia, and rearmament programs elsewhere.

The SIPRI Top 100 companies saw production ramp up significantly in 2023, reversing a decline experienced in 2022. Nearly three-quarters of the companies on the list recorded year-on-year revenue growth, with the majority of these gains coming from firms in the lower half of the rankings.

“There was a marked rise in arms revenues in 2023, and this is likely to continue in 2024,” said Lorenzo Scarazzato, a SIPRI researcher. He added that the current revenue figures still do not fully reflect the scale of global demand, and the initiation of recruitment drives by many firms indicates optimism for continued growth.

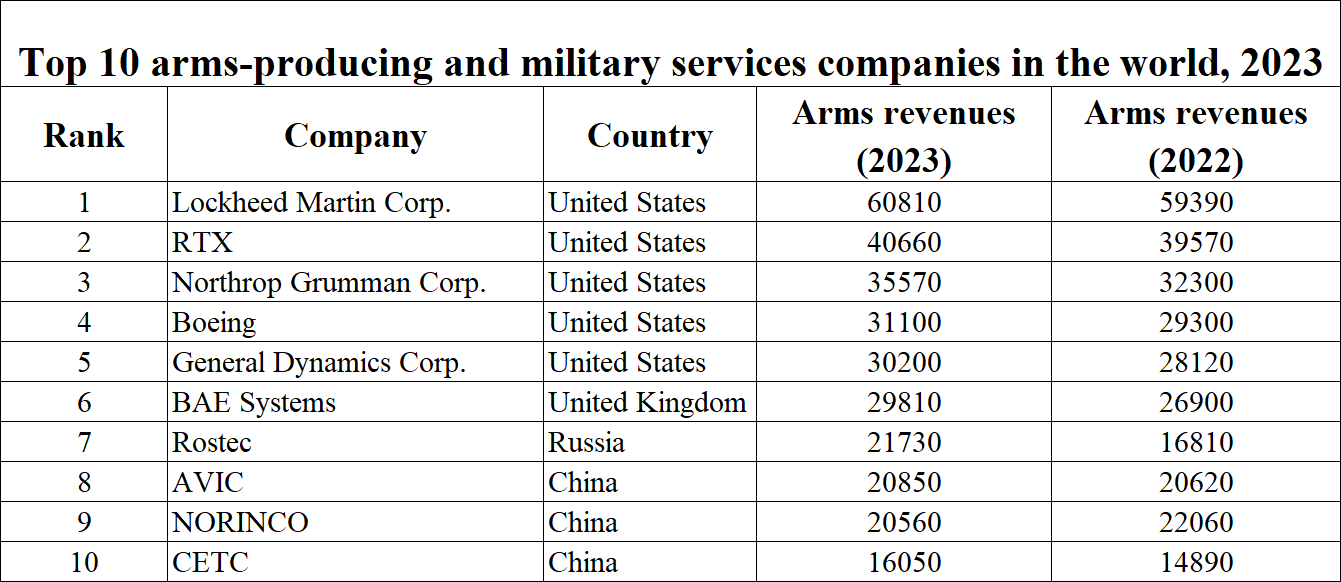

The United States continued to dominate global arms sales, with its 41 companies in the Top 100 generating $317 billion in revenues, representing 50% of the total and a 2.5% increase from 2022. The top five arms companies globally, including Lockheed Martin and RTX, are all based in the United States.

However, while 30 of the US firms recorded growth, Lockheed Martin and RTX saw declines in revenue due to supply chain disruptions, particularly in aeronautics and missile production. Dr. Nan Tian, Director of SIPRI’s Military Expenditure and Arms Production Programme, attributed the challenges to the complexity of multi-tiered supply chains, which left these larger firms vulnerable.

European companies in the Top 100, excluding Russia, recorded $133 billion in combined revenues, an increase of just 0.2% compared to 2022. This was the smallest regional growth worldwide.

Companies producing complex weapon systems often worked on older contracts, delaying their ability to benefit from surging demand. Despite this, firms focused on ammunition and artillery production, especially those in Germany, Sweden, and Poland, experienced substantial growth.

Germany’s Rheinmetall, for example, expanded its production of 155-mm ammunition and increased revenue through Leopard tank deliveries and war-related “ring-exchange” programs.

Russian companies recorded one of the largest regional increases in arms revenues, with the two firms in the Top 100 seeing a 40% rise to $25.5 billion. Rostec, a state-owned holding company, reported a 49% revenue increase, driven by the production of combat aircraft, UAVs, and munitions as the war in Ukraine intensified.

Although official Russian data remains scarce, analysts widely agree that production expanded significantly in 2023.

In Asia and Oceania, the 23 companies in the Top 100 saw their arms revenues grow by 5.7% year-on-year, reaching $136 billion. South Korea’s four companies recorded a combined revenue increase of 39% to $11 billion, while the five Japanese firms reported a 35% rise to $10 billion.

Japan’s military build-up since 2022 resulted in a surge of domestic orders, with some companies reporting new orders increasing by over 300%. South Korean firms are also expanding into global markets, particularly Europe, as demand linked to the Ukraine war grows.

The Middle East saw significant growth in arms revenues, with six companies in the Top 100 generating $19.6 billion in 2023, an 18% increase. Israeli companies reached $13.6 billion in revenues, the highest ever recorded by Israeli firms in the SIPRI Top 100.

Meanwhile, Turkish companies recorded a 24% increase, with revenues reaching $6 billion, bolstered by exports and government initiatives promoting self-reliance in arms production.

Other notable developments include a 0.7% increase in revenues for China’s nine companies in the Top 100, the smallest growth since 2019. Combined arms revenues for India’s three companies rose by 5.8% to $6.7 billion.

Taiwan’s NCSIST recorded a 27% increase in arms revenues, reaching $3.2 billion. Türkiye’s Baykar, a key producer of UAVs widely used in Ukraine, reported a 25% revenue increase to $1.9 billion, with exports accounting for 90% of its revenue.

In the United Kingdom, the Atomic Weapons Establishment reported the largest year-on-year percentage increase among UK firms in the Top 100, with revenues rising 16% to $2.2 billion.

The SIPRI Arms Industry Database, established in 1989, now includes data for companies from 2002 to 2023, incorporating information on firms in China and Russia. Revenues in this dataset are based on military sales and services to domestic and international customers, expressed in constant 2023 US dollars.

This report is part of SIPRI’s lead-up to its flagship Yearbook, set to be published in 2025.