KARACHI – The Pakistan Stock Exchange (PSX) witnessed a steep sell-off on Friday, with the benchmark KSE-100 Index plunging by 1,949.56 points, or 1.57%, to close at 122,143.56 amid heightened geopolitical uncertainty after Israel launched a military strike on Iran.

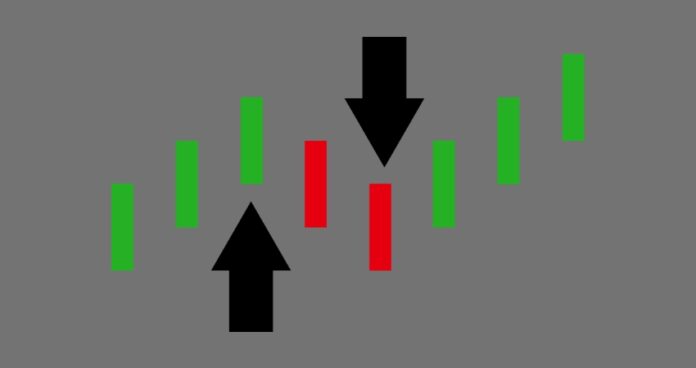

The market opened under pressure and remained in negative territory throughout the session, hitting an intra-day low of 121,604.59. At its lowest point, the index had dropped over 2,400 points. Broad-based selling was observed across key sectors including automobile assemblers, cement, commercial banks, oil and gas exploration companies, OMCs, power producers, and refineries.

Heavyweight stocks such as Oil and Gas Development Company (OGDC), Pakistan Petroleum Limited (PPL), Pakistan State Oil (PSO), Mari Petroleum (MARI), and Hub Power Company (HUBCO) were among the major laggards, trading deep in the red.

The rout followed news of Israeli airstrikes in Iran early Friday, escalating regional tensions and roiling financial markets globally. Explosions were reported northeast of Tehran, and Israel declared a state of emergency in anticipation of potential retaliatory attacks from Iran, citing a preemptive strike over nuclear concerns.

The geopolitical shockwaves reverberated across global markets. US S&P E-mini futures and Nasdaq futures dropped by 1.5% and 1.7% respectively in early Asian trading, while Japan’s Nikkei and South Korea’s KOSPI declined 1.4% and 1.2%. Commodities surged, with Brent crude oil spiking over 6% to $73.56 per barrel and gold rising 1% to $3,419 an ounce, as investors sought refuge in traditional safe-haven assets.

The slide at the PSX comes after a brief period of optimism earlier in the week, driven by expectations surrounding Pakistan’s federal budget. However, that rally faltered on Thursday with a modest correction, when the index fell by 259.56 points.

Analysts say the intensifying geopolitical risk has dampened sentiment, and investor caution may persist in the coming sessions, particularly if regional tensions escalate further or disrupt energy markets.